When to pay payments under the simplified tax system in 2018

Payers of the simplified tax system in 2021 must quarterly calculate and pay advance payments for the “simplified” tax no later than the 25th day of the month following the quarter, as well as the tax for the year no later than March 31 (for organizations) and April 30 (for individual entrepreneurs). When paying the simplified tax system, you must indicate in the payment slip the budget classification code (BCC) to which the tax is transferred according to the simplified tax system. Budget classification codes according to the simplified tax system in 2021 must be indicated in field 104 of the payment order (according to the order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n, as amended by order No. 90n dated June 20, 2021). For legal entities (organizations) and individual entrepreneurs (IP) on the simplified tax system, the indicators depend on:

- from the object of taxation;

- from the purpose of payment.

rekvizity.jpg

Related publications

Each simplified tax system payer, be it a company or a businessman, pays a single tax based on the requirements determined for the chosen taxation regime. Despite the difference in the forms of ownership of enterprises and in the calculation of simplified tax, its transfer is formalized by a standard payment order, the perfect completion of all the necessary attributes of which becomes a guarantor of timely transfer to the budget. Let's talk about the features of processing such payments by enterprises and entrepreneurs using the simplified tax system.

KBK according to the simplified tax system “income” in 2021 (6%)

The BCC for the simplified tax system for 2021 with the object “income” is single – 182 1 05 01011 01 1000 110. Advance payments and a single tax at the end of the year are transferred using this code (182 1 0500 110).

The BCC for penalties of the simplified tax system 2021 and the code for paying the fine differs in the 14th and 15th digits (21 and 30 instead of 10). Let us summarize the BCC according to the simplified tax system “income” for 2018 in the table. It is relevant for organizations and individual entrepreneurs:

| Purpose of payment | Field 104 in the payment slip |

| KBK 2021 simplified taxation system income: advance payment; single tax. | 182 1 0500 110 |

| KBK penalties under the simplified tax system with the object's income in 2021 | 182 1 0500 110 |

| Penalty code for simplification with the income object | 182 1 0500 110 |

Here is an example of filling out a payment order for payment of the simplified tax system “income” (6 percent) in 2021:

Taxpayers

This code is not suitable for all taxpayers, since the single fee itself under the simplified system is paid only by entities that have officially switched to using it. This system can be chosen by legal entities or individual entrepreneurs subject to the conditions established by the Tax Code. A corresponding notification is sent to the Federal Tax Service about the transition to it. By choosing such a tax system, the taxpayer has the opportunity to pay only one tax, based on the amount of income.

The KBK “Single tax simplified tax system 2021 “Income”” should be used by those who have chosen income as an object of taxation. For them, the general collection rate is 6%, but regional authorities can reduce it to 1% for some categories of payers. Separate codes have also been established for taxpayers who have chosen a version of the “Income minus expenses” system, when the tax is paid on the difference between what is earned and what is spent (the rate is 15%, but it can be reduced by constituent entities of the Russian Federation). But other KBKs are installed for them, be careful.

Thus, the simplified tax system is an income tax; Individual entrepreneurs under the simplified tax system “6” in 2019 use BCCs the same as legal entities. Individual entrepreneurs are also taxpayers under the simplified tax system, but only if the conditions and procedure for switching to using this simplified taxation regime are met.

KBK USN “6” in 2021 is used the same as in previous years. Although the Order on approval of budget classification codes is issued by the Ministry of Finance annually, the values themselves may not change with such frequency. For 2021, the list of indicators was approved by Order of the Ministry of Finance dated 06/08/2018 No. 132n.

BCC under the simplified tax system “income minus expenses” in 2018 (15%)

For organizations and individual entrepreneurs on the simplified tax system “income minus expenses”, 19 out of 20 KBK digits coincide. Check that in the KBK simplified tax system for 15 percent in 2018, in place of the 10th digit there is “2” and not “1”. This will be the main difference compared to the “income” object.

If “income minus expenses” is chosen as the object of taxation, then the KBK simplified tax system in 2021 for organizations and individual entrepreneurs is as follows:

| Purpose of payment | Field 104 in the payment slip |

KBK 2021 simplified tax system income minus expenses:

| 182 1 0500 110 |

| KBK penalties under the simplified tax system income minus expenses 2018 | 182 1 0500 110 |

| KBK simplified tax system 15%: value for fine | 182 1 0500 110 |

Here is an example of filling out a payment order for payment of the simplified tax system “income minus expenses” (15 percent) in 2021:

The BCC of the minimum tax according to the simplified tax system is the same as the code for the single tax and advance payments for the object “income minus expenses”. Therefore, the minimum tax under the simplified tax system for income minus expenses in 2021 is paid at KBK 182 1 0500 110.

Sample of a simplified payment order

In the payment slip, which is filled out when depositing funds into the tax budget, there is field 104, intended to indicate the budget code. The form is regulated by Bank of Russia Regulation No. 383-P dated June 19, 2012 (October 11, 2018). In the updated payment form, the “KBK” field has changed to “Type of payment”; now the codes are indicated in this cell.

Correctly filling out the form ensures timely transfer of money to the correct account. To avoid mistakes when filling it out, it is recommended to study the sample:

When filling out a payment order, you should carefully fill out each cell. If you specify the budget codes incorrectly, then even with other correct indicators, the payment for the operation will not go through. For example, a businessman pays a fine, but indicated a code for interest. In this case, the funds will go to the tax budget, but automatically to the wrong account, and the entrepreneur will be in debt. For non-payment of debt, tax authorities are punished by charging a penalty.

Taxpayers

This code is not suitable for all taxpayers, since the single fee itself under the simplified system is paid only by entities that have officially switched to using it. This system can be chosen by legal entities or individual entrepreneurs subject to the conditions established by the Tax Code. A corresponding notification is sent to the Federal Tax Service about the transition to it. By choosing such a tax system, the taxpayer has the opportunity to pay only one tax, based on the amount of income.

The KBK “Single tax simplified tax system 2021 “Income”” should be used by those who have chosen income as an object of taxation. For them, the general collection rate is 6%, but regional authorities can reduce it to 1% for some categories of payers. Separate codes have also been established for taxpayers who have chosen a version of the “Income minus expenses” system, when the tax is paid on the difference between what is earned and what is spent (the rate is 15%, but it can be reduced by constituent entities of the Russian Federation). But other KBKs are installed for them, be careful.

Thus, the simplified tax system is an income tax; Individual entrepreneurs under the simplified tax system “6” in 2019 use BCCs the same as legal entities. Individual entrepreneurs are also taxpayers under the simplified tax system, but only if the conditions and procedure for switching to using this simplified taxation regime are met.

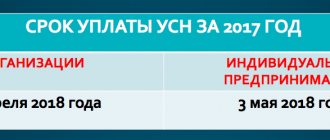

Deadlines for payment of tax advances

The procedure is regulated by the Tax Code of the Russian Federation. At the end of the year, entrepreneurs make the final calculation of the single tax. Payments to the budget must be completed by April 30 next year.

Payments on other dates are made upon the occurrence of one of the following cases:

- when closing an individual entrepreneur, the tax is paid no later than the 25th day of the month following the month indicated by the tax notice as the date of termination of activity. The reason for termination of work may be the personal desire of the entrepreneur or an order from government authorities;

- If the right to use the simplified system has been lost by the taxpayer, then the tax must be paid by the 25th day of the month following the quarter during which the right was lost. You can lose the right to use the simplified tax system due to non-compliance with the criteria (amount of revenue, number of personnel). The entrepreneur is automatically transferred to the use of OSN.

Below is a table with payment deadlines in 2019.

| Reporting period | Deadline (until) |

| 2017 | 03.05.2018 |

| 1st quarter 2021 | 25.04.2018 |

| 1st half of 2021 | 25.07.2018 |

| 9 months 2021 | 25.10.2018 |

If the payment date falls on a weekend or non-working day, then payment is allowed no later than the next working day.

The advent of 2021 has made changes to the calculation of fixed payments paid by individual entrepreneurs. Previously, the calculation used a formula linking the size of the contribution to the size of the minimum wage and the tariff rate. Since 2019, the formula has been discontinued, the amount of payments has been fixed, and the dependence on the minimum wage and other indicators has been abolished.

The new contribution amount is:

- Pension Fund (income less than 300 rubles) – 26,545 rubles;

- maximum contribution (PFR) – 212,360 rubles;

- Compulsory health insurance fund - 5,840 rubles.

| Pension Fund | Health insurance |

| 18210202140061110160 | 18210202103081013160 |

| Penalty | |

| 1821020214006 2110160 | 18210202103082013160 |

| Fines | |

| 18210202140063010160 | 18210202103083013160 |

If an incorrect code was specified when generating the payment order, you must write an application to transfer the BCC to the Federal Tax Service or Pension Fund.

Fixed contributions for entrepreneurs without hired personnel had to be paid before 01/09/2018, and the percentage of excess income - before 07/02/2018. Contributions for 2021 must be paid before 01/09/2019 (Compulsory medical insurance and mandatory pension insurance for individual entrepreneurs without employees) , until 07/01/2019 (“pension” contribution if income exceeds).

KBK simplified tax system 6 percent 2021 is used on a simplified taxation system with the object “income”. See the current codes for taxes, penalties and fines in the table, as well as a sample payment order.

The simplified tax system rate is 6 percent - the rate at which the entire income of an organization applying a special regime is taxed (Article 346.20 of the Tax Code of the Russian Federation).

The use of the simplified tax system of 6 percent among small business owners is considered the simplest accounting system. And this tax is transferred to individual KBKs.

Despite the latest changes in budget classification codes starting this year, KBK STS income 2021 has not changed. At the same time, the code for taxes, penalties and fines is different (see table).

Payment type KBK

| Income tax 6 percent | 18210501011011000110 |

| Penalty | 18210501011012100110 |

| Fines | 18210501011013000110 |

KBK simplified tax system income for 2021 consists of 20 digits, where

- 182 - payment administrator code - Federal Tax Service;

- 105 - simplified tax system;

- 0101101 - budget type (federal), subgroups, code, income subitem;

- 1000 - tax;

- 110 - tax revenues.

In the payment order of the simplified tax system, income must be indicated exactly KBK18210501011011000110, both when paying tax in the current year and for previous periods.

Good afternoon, dear individual entrepreneurs!

A short article for newbie entrepreneurs who work in simplified language. As spring begins, the number of questions on the simplified tax system grows exponentially =) And in order not to explain to each individual commentator what and how, I decided to write a short summary article for 2021 in advance.

Despite the apparent simplicity of this topic, entrepreneurs often make mistakes. For example, very often starting individual entrepreneurs miss the deadline for paying an advance under the simplified tax system, which must be done strictly within certain deadlines. They also often confuse an advance payment under the simplified tax system with mandatory insurance contributions “for oneself”... They try to deduct tax under the simplified tax system from insurance premiums.

Or those individual entrepreneurs often write to the simplified tax system who are sure that quarterly payments under the simplified tax system can be paid once a year. For example, at the very end of the year. And they are very surprised when they receive a demand from the Federal Tax Service to pay a fine or penalties.

I think that everyone stepped on such a rake at the very beginning. Including me =)

This is why I constantly write that it is necessary to use accounting programs or services in order to avoid making such basic mistakes. I won’t repeat myself, let’s move on to the topic of the article.

There are strictly designated deadlines for paying an advance under the simplified tax system:

- for the 1st quarter of 2021: from April 1 to April 25;

- for 6 months of 2021: from July 1 to July 25;

- for 9 months of 2021: from October 1 to October 25;

Yes, the last day is also included in the deadline, but I always recommend not to wait until the very last day, as there are incidents with suspended payments in banks. Also, if the last day falls on a weekend, the date is moved to the next working day.

I answer: it must be paid no later than April 30, 2021, when you prepare a declaration under the simplified tax system.

No later than April 30, 2021. Since April 30, 2021 falls on a holiday weekend, the last day of payment is moved to May 3, 2021.

I repeat once again that I strongly do not recommend postponing the payment of any fees or taxes until the very last day, since the payment can easily “get stuck” in the bank at the control stage. And you will not make the required payment at the required time. Therefore, it is better to pay everything at least 7-10 days before the expiration date.

Of course, do not forget to also submit a declaration under the simplified tax system for 2017.

There are no changes in the BCC for tax under the simplified tax system compared to last year.

- BCC has not changed in 2021: 182 1 0500 110

- KBK in 2021 182 1 0500 110

- The BCC for the minimum tax for 2021 coincides with the previous BCC 182 1 0500 110 (Order of the Ministry of Finance dated June 20, 2016 No. 90n)

But please note that the minimum tax for individual entrepreneurs on the simplified tax system “income minus expenses” is paid at the end of the year, and not quarterly.

How to pay?

I recommend paying taxes and contributions only from the individual entrepreneur’s bank account (if you have one, of course). Now banks are closely monitoring payments of taxes and contributions. And they can block the account of those individual entrepreneurs whose payments for taxes and contributions are less than 0.9% of the debit turnover on the individual entrepreneur’s account. As a rule, they look at turnover for the quarter.

If the individual entrepreneur does not have a bank account, then you can pay in cash. Just don't lose your receipts =)

Every day, the budget receives a huge amount of funds contributed by payers to pay all kinds of taxes, fines, fees, and penalties. And with each one there are still the same number of payment orders.

To make it easier to distribute them between funds and organizations, unique budget classification codes have been invented. The fate of your funds depends on the correctness of their writing in payment slips - whether they reach their destination or not.

Let's consider the KBK according to the simplified tax system of 6 percent in 2021 for individual entrepreneurs and the income for the object, taking into account expenses.

Taxes on the simplified tax system

The simplified taxation system is the simplest regime. It replaces several unpleasant duties - personal income tax, VAT, and property taxes. And it involves paying only one payment - a single one. This is simple, economical, and less painful for individual entrepreneurs who do not get along with reporting. The declaration is submitted only once, when payments are made at the end of the year.

In each quarter, the entrepreneur pays an advance (approximate) payment, calculated by him personally. There is no need to provide examples and calculation results to the tax office to confirm their feasibility. They will check everything at the end of the year, after filing the declaration.

The amount of deductions for simplified taxation depends on the chosen base on which the tax is assessed. As soon as an individual entrepreneur decides to switch to a simplified system, he will be offered 2 options:

- Income – only income and the 6% rate appear in the calculation formula;

- Income/expenses – 15% and profit minus company expenses.

These are standard numbers. In some regions, rates for certain types of work are lower. For example, in Moscow, individual entrepreneurs using the profit/cost system multiply their profits by only 10% if they are engaged in scientific research.

There is also a zero rate, which individual entrepreneurs can rest on during tax holidays. Not everyone is sent on vacation; one of the conditions is that the businessman must be engaged in the type of work that is most important for the development of the region.

And finally, the last nuance of the regime - with a base of income minus expenses, the payer is obliged to pay to the budget 1% of the entire income part, if this figure turns out to be higher than that obtained when calculating using the usual formula of 15% x tax base.

How to calculate

Let's look at how the calculation occurs using clear, visual examples.

Example No. 1

Individual Entrepreneur Thin sells kitchen utensils at a simplified rate of 6%. He has no employees. During the quarter he earned 50,000 rubles. and paid dues in the amount of 4,000.

Advance = 6% x 35,000 – 2,000 = 1,000 rub.

Example No. 2

Individual entrepreneur Margantsev sells underwear at a simplified rate of 15% without staff. During the quarter, he earned 56,000 rubles. and paid contributions in the amount of 4,000. The company's expenses, which are allowed to be deducted from the duty, amounted to 2,000.

Advance = 15% x 56,000 – 4,000 – 15,000 = 2,400.

An entrepreneur without staff deducts contributions for himself from the tax base 100 percent. With employees - both for yourself and for them, but only half of the original amount.

Deadlines for payment of the simplified tax system

Details for filling out reports and settlement documents

Payments under the simplified tax system made in — years. What are the details for paying the simplified tax system for years? Are there any differences between them and how do these details depend on the category of the payer and the object of taxation? Let's watch.

WATCH THE VIDEO ON THE TOPIC: Important: from February 4, 2021, the details for paying taxes and contributions in 26 regions of the Russian Federation will change

The information below depends on your region 77 Moscow. The obligation to pay tax is not considered fulfilled if the taxpayer incorrectly indicates in the order to transfer tax the account number of the Federal Treasury for the relevant constituent entity of the Russian Federation and the name of the recipient's bank. Details of the state duty for state registration, fees for providing information and documents contained in the Unified State Register of Legal Entities and in the Unified State Register of Individual Entrepreneurs; Details for providing information from the register of disqualified persons; Details for payment of state duty in cases considered in arbitration courts located in the city. Details for payment of state duty in cases considered by the Supreme Court of the Russian Federation;. Details for paying the state fee for performing actions related to licensing;

Punishments

If you transfer money with identification or do not send a tax return on time, the company cannot avoid penalties from the Federal Tax Service. Let's determine what threatens violators:

- If the advance payment is late, only penalties will be charged, in accordance with Article 75 of the Tax Code of the Russian Federation.

- If you are late with the final calculation, the tax authorities will charge penalties, as well as a fine of 20% to 40% of the unpaid amount of the tax liability.

- If you are late in submitting your tax return under the simplified tax system - at least 1000 rubles, maximum - 30% of the amount in the declaration. In general, 5% of the amount of the tax liability from overdue reporting (line “to be paid to the budget”) for each full and partial month of delay.

The amount of fines can be reduced if the institution has good reasons for doing so. For example, a break in the communication line when submitting reports via secure communication channels.