Briefly about the essence of PSN

By purchasing a patent, you get the right to engage in certain activities and not pay tax on income from this activity. The cost of the patent is the tax. There is no need to report income or submit a declaration .

Let's say you have a retail store. You bought a patent for a year, paid for it, and don’t pay anything else from your income. It doesn't matter how much you actually earn. The main thing is that income does not exceed 60 million rubles , because you cannot earn more than this amount from a patent, otherwise you will have to switch to another regime and pay additional taxes.

If you open another store, you will have to buy another patent, because the cost of the first patent was initially calculated for only one store. At the same time, you can take out one patent for several retail outlets at once.

If, in parallel with the store, you have some other activity that is not indicated in the patent, taxes on income from it must be paid separately. For example, in addition to trading in a store, you also supply equipment to someone - this is no longer an activity that falls under the PSN.

When the patent expires, you can either stop operating, buy another patent and continue, or conduct the same activity under a different tax regime. If, after the expiration of the patent, you do not immediately buy a new one, income from this type of activity will be taxed as under the simplified tax system or OSNO, depending on which regime you have as your main one other than the patent.

How to switch from UTII to another tax regime in 2 clicks Find out more

Applying Patents to a Car Wash

The use of a patent taxation system at a car wash is possible, provided that the car is not washed by the client himself.

In Russia, as in Europe, so-called “self-service car washes” are becoming popular.

In Russia, as in Europe, so-called “self-service car washes” are becoming popular. They are boxes in which, having put money or a token into the coin acceptor, the client takes a gun and washes his car himself.

The Ministry of Finance in its letter dated September 3, 2015 No. 03-11-11/50699 indicated that the activities of self-service car washes cannot be transferred to PSN:

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

LETTER

dated September 3, 2015 N 03-11-11/50699

Question:

The individual entrepreneur applies a patent taxation system for the position of Maintenance and repair of motor vehicles and motor vehicles, machinery and equipment. The individual entrepreneur provides vehicle washing services, which, according to OKUN, fall under the position “017103 Cleaning and washing work”, which is included in the type of activity “Maintenance of passenger cars”.

In August 2015, the individual entrepreneur plans to purchase and place automatic means on half the area of the wash hall, allowing car wash clients to wash their cars themselves.

Will such activities of an individual entrepreneur fall under the position “017103 Cleaning and washing work” and be included in the type of activity “Maintenance of passenger cars”? Can an individual entrepreneur continue to apply the patent tax system? If not, what taxation system should he apply: UTII or OSNO?

Answer:

The Department of Tax and Customs Tariff Policy has considered the appeal on the issue of applying the patent tax system and, based on the information received, reports the following.

According to paragraph 1 of Article 346.43 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the patent taxation system is put into effect in accordance with the Code by the laws of the constituent entities of the Russian Federation and is applied in the territories of these constituent entities of the Russian Federation.

Paragraph 2 of Article 346.43 of the Code contains a list of types of activities in respect of which the patent tax system is applied.

In accordance with subparagraph 9 of paragraph 2 of Article 346.43 of the Code, the patent taxation system can be applied by individual entrepreneurs in relation to business activities in the field of maintenance and repair of motor vehicles and motor vehicles, machinery and equipment.

Subparagraph 2 of paragraph 8 of Article 346.43 of the Code provides that subjects of the Russian Federation have the right to establish an additional list of types of business activities related to household services in accordance with the All-Russian Classification of Services to the Population (hereinafter referred to as OKUN), not specified in paragraph 2 of Article 346.43 of the Code, in respect of which A patent taxation system is used.

According to Rosstandart, given that the object of classification in OKUN are individual services to the population, car wash services, depending on the type of vehicle, can be classified under the position “017103 Cleaning and washing work”, included in the type “017100 Maintenance of passenger cars” or to the position “017303 Cleaning and washing work”, included in the type “017300 Maintenance of trucks and buses”.

The OKUN list does not include services for the provision of specialized machines for temporary use to individuals for self-washing of their cars. Thus, an individual entrepreneur who plans to carry out business activities of providing automatic means for temporary use at a car wash to individuals so that they can independently wash their cars does not have the right to use the patent taxation system.

Income received from the use of these automatic funds by individuals must be taxed in accordance with other taxation regimes.

Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation R.A. SAHAKYAN

PSN and its features

To reduce the payment burden of entrepreneurs, in 2013 the state introduced a new tax system - a patent. The tax on it is 6% of potential income. The latter is calculated by the authorities based on the characteristics of the region. Activities in the patent system are regulated by the Tax Code (Chapter 26.5).

PSN exempts an entrepreneur from three tax payments at once:

- On property (except for accrued tax based on cadastral value);

- VAT (sometimes you will have to pay it);

- Personal income tax (except for income from the sale of property).

An important feature is simplified reporting. No need to declare income. It is enough just to keep a book of profits and expenses.

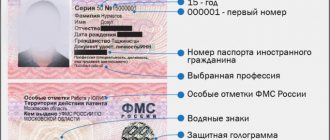

Monthly payment for a patent in 2021 - how much should you pay for a patent in 2021?

Many foreign citizens have already heard about changes in the cost of a patent for 2021, and therefore they are very interested in the question of whether it will change much and how much they need to pay for a patent in 2021.

We answer: the amount of payment for a patent in 2021 will change compared to 2021, since the deflator coefficient for 2021 for a patent has been changed, on the basis of which the monthly patent tax for a foreign citizen is calculated.

Thus, by order of the Ministry of Economic Development, the personal income tax deflator coefficient for 2021 was approved, which amounted to 1,864

.

Let us remind you that in 2021 the personal income tax deflator coefficient was 1.810.

Accordingly, in 2021 the patent amount for foreign citizens has changed, and now the monthly payment for a patent in 2021 will be paid taking into account these changes.

The table below shows the monthly fixed cost of a patent for foreign citizens in 2021 for each region of the Russian Federation, which will need to be paid from January 1, 2021.

How much NFDL should pay for a work patent to a foreign citizen in 2021 is displayed in the last column of this table.

In other words, in the last column of the table you can see the size of the fixed advance payment for a work patent for foreigners in 2021 by region of the Russian Federation from 01/01/2021.

An example of calculating a patent for 2021 in St. Petersburg and the Leningrad region

1200*1.864*1.78827=4000, Where 1200 is the base rate, 1.864 is the fixed personal income tax deflator coefficient for 2021, 1.78827 is the regional coefficient for St. Petersburg for 2021, 4000 is the cost of paying for a patent in St. St. Petersburg in 2021.

Now you know how to correctly calculate the cost of a patent for 2021 yourself and receive the amount of a fixed advance personal income tax payment to pay for a patent for work, taking into account the changes that come into force on January 1, 2021.

Please like if you found our article about changing the amount of the advance personal income tax payment for a work patent in 2021 for foreign citizens useful, or share information on how to correctly calculate the cost of a patent for 2021 and how much to pay for a work patent in 2021 on social media networks:

Calculating tax

To calculate the tax contribution for a patent, you need to know the possible income for the year in the chosen direction. These figures are contained in municipal regulations. An amount of 6% is calculated from income, which is paid to the country’s budget.

Each region has the right to offer tax holidays to entrepreneurs. This exempts the business owner from paying tax for the first two years after opening an individual entrepreneur.

This benefit is provided for those types of activities that are socially significant in a particular region. Tax holidays are currently in effect until the end of 2021.

This means that if today you open an individual entrepreneur in one of the significant areas, then in the next two years you will not pay any taxes to the budget, but only insurance premiums.

To calculate the amount of tax payable, it is convenient to use a specially designed calculator, which is located on the tax office website. To do this, we recommend finding the patent tax system on the website. To the right of the section table of contents there is an item “Electronic services”. It contains a calculator.

In the window that appears, select:

- Year;

- Period of use;

- Region of residence (may differ from registration);

- City;

- Type of activity (a list available for your region is indicated (some areas are indicated with an OKVED identification code));

- Number of employees.

After selecting the parameters, click the “Calculate” button. The amount of tax that will need to be transferred to the budget will appear. These payments vary by region. This is due to the population size and income level of residents.

Example. By selecting the city of Kazan and the activity of car repair with two hired workers, you can see the tax amount equal to 72,000 rubles per year. The same parameters for Moscow give the result in the amount of tax - 79,200 rubles. In the first case, the annual income is equal to 1,200,000 rubles, and in the second - to 1,320,000 rubles. Thus, the monthly tax will be 6,000 rubles and 6,600 rubles, respectively.

Cancellation of a patent in case of violation of the deadlines for payment of personal income tax under the patent

Today, the system for recording the payment of fixed advance payments for a patent by foreign citizens is fully automated, so the absence of an advance payment on a specific date leads to the automatic cancellation of a patent for work in the database of the Main Directorate for Migration of the Ministry of Internal Affairs.

Thus, if a fixed advance payment for a work patent in 2021 is made later than the date of receipt of the patent, even by one day, the document will be automatically canceled for late payment of the patent.