In the 1C: Accounting 8 program, starting with version 1.6, it became possible to reflect settlements with retail customers not only for cash payments, but also for payments with payment cards and using a bank loan. This article, prepared by methodologists, examines the procedure for reflecting non-cash payments in retail in the program using the example of customer payments with plastic cards.

Retail sales in the 1C: Accounting 8 program are reflected in the document “Retail Sales Report”.

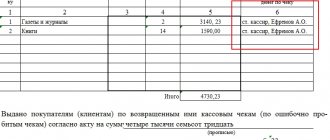

In the report on retail sales of cash register machines of the trading floor for a certain date, on the “Products” tab, you should indicate the product composition, quantity, price and amount of goods sold per day.

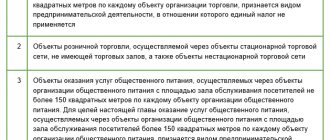

If, in addition to cash payments, payments were made with payment cards during the day, you must fill out the “Payment cards and bank loans” tab. The payment type is selected from the directory of the same name, the elements of which contain the following data:

- payment type - payment card or bank loan;

- organization - a sales organization that prepares a report on retail sales;

- counterparty (for payment cards) - a bank with which an acquiring agreement has been concluded for servicing plastic card holders;

- counterparty agreement (for payment cards) - acquiring agreement for servicing plastic card holders;

- settlement account - account of settlements with the bank under the acquiring agreement;

- % bank commission - the percentage charged by the bank as a commission under the acquiring agreement.

When conducting a report on retail sales, the corresponding transactions are generated.

If there are several payment options, revenue is reflected in the intermediate account 62.Р “Settlements with retail customers”, after which it is distributed according to payment methods.

The difference between retail and wholesale

First, let's figure out what kind of trade is considered retail. It seems that everything is simple: when a lot of goods are sold at once, then this is wholesale trade, and when individually or in small quantities, then this is retail. However, this is not really the difference between retail and wholesale By law, you are considered to be selling goods at retail if the buyer uses them for personal rather than business purposes. But as a seller, you are not obligated to control what the person who bought it from you does with the product. At the same time, you cannot sell at retail, for example, commercial or cash register equipment, that is, goods that cannot be used for personal purposes.

Retail trade differs from wholesale trade and the documentation that accompanies it. When selling goods at retail, you should not issue an invoice for the goods to the purchasing organization, otherwise the transaction may be considered wholesale.

How to arrange a retail sale without consequences

One of the main rules is issuing a payment document to the buyer. This may be a written purchase and sale agreement, a cash or sales receipt, or another document confirming payment (for example, a strict reporting form or a cash receipt order). In very rare cases, no documents are needed. Let's try to figure out how to arrange a retail sale without consequences. Let's consider all possible options.

Retail sales agreement

In fact, this agreement is mandatory for any retail sale transaction. But most often it does not have to be concluded in writing. For example, with a simple purchase in a store, this is done orally. The condition for the oral conclusion of a purchase and sale agreement is the coincidence of the moments of transfer of the goods to the buyer and its payment. As soon as a cash receipt or sales receipt is issued, the contract is considered concluded, and these documents, in turn, legally confirm it.

A written purchase and sale agreement is necessary when goods are purchased, for example, in installments, that is, the moments of transfer of goods and payment for them do not coincide. A contract fixed on paper is also mandatory when selling goods by sample or remotely.

Cash receipt

When selling goods at retail for cash or using payment cards, the seller is obliged to issue the buyer a cash receipt. Since 2020, new mandatory details have been added to the check.

The list of details should also include the OFD data to which the online cash register is connected - almost all entrepreneurs should install it. Even if you have a very small retail outlet, you can quickly and inexpensively organize a workplace for a cashier-seller. The MoySklad service offers a convenient modern solution for store automation. Just connect the fiscal recorder to your laptop - now you can punch out cash receipts!

Sales receipt

A sales receipt may also serve as confirmation of the conclusion of a retail purchase and sale agreement. With some exceptions, in most cases it may not be required. You are required to issue a sales receipt to the buyer if you peddle non-food items, as well as when selling furniture, weapons and ammunition, cars, motorcycles, trailers and numbered units. If the cash register receipt does not contain such information about the product as name, article number, grade, type and other characteristics, then the sales receipt is also required when selling:

- textile, sewing, knitted, fur products,

- technically complex household goods (communications, musical equipment, electrical appliances, etc.),

- precious metals and precious stones,

- animals and plants,

- building materials.

In addition, a sales receipt is issued upon the buyer's request.

This document is drawn up in any form. On our website you can also clarify the mandatory details that it must contain.

If money with VAT is received in the individual entrepreneur’s current account on UTII

Receipt of funds to the current account of an individual entrepreneur with UTII with an allocated VAT amount is possible in 2 cases:

- The buyer made a mistake by allocating VAT. It is safer to request a clarification letter from the buyer (about payment without VAT). The allocated amount in the payment order is not the reason for charging VAT, but it will attract extra attention from the regulatory authorities.

- Agreement of the parties to include VAT in the sales amount. The supplier carries out sales including VAT, issues an invoice and pays the allocated amount to the budget.

Trading without a cash register

Companies that pay a single tax on imputed income (UTII), as well as individual entrepreneurs using a patent taxation system, are allowed to trade without a cash register until July 2021.

Until July 1, 2021, only individual entrepreneurs without employees on employment contracts can trade without a cash register, who:

- sell products of their own production,

- perform work,

- provide services.

All others, including UTII and patent, were required to supply the cash register by July 1, 2021.

But the law still allows some entrepreneurs to work without a cash register at all. This does not depend on the taxation regime, but on the type of activity.

If an individual entrepreneur on UTII is engaged in cargo transportation

An individual entrepreneur on UTII has the right to carry out cargo transportation for any persons (both legal entities and individuals). Accordingly, when providing these services, he can work with a current account and receive money from customers non-cash. The only restrictions for the use of UTII:

- in the region, cargo transportation is not subject to UTII;

- the number of cars is more than 20.

That is, in the absence of any specific features in the form of violation of the UTII framework, the individual entrepreneur must report no later than the 20th day and pay the amount by the 25th day of the month following the reporting quarter.

Rules for registration of price tags

In retail trade, it is equally important to follow the rules for designing price tags . If they do not comply with the form approved by the Government, or if any of them have the wrong price, this can also lead to fines.

To draw up a price tag correctly means to place on it information about the name of the product, its type and price per weight or unit (necessarily in rubles). According to the rules that came into force in January 2021, it is allowed to issue price tags both on paper and on any other medium - the main thing is that the information is clearly visible. For example, prices may be indicated on a slate board, electronic or illuminated display. In all cases, the design must be clear and uniform.

On our website you can always find out how to correctly draw up a price tag, free of charge, or fill out and print price tags online.

In a store, this document is considered a public offer, and the seller is obliged to sell the product exactly at the price that is listed in it. Failure to comply with this condition, as well as failure to comply with the rules for issuing price tags, is considered a gross violation of the law. If the price on the price tag and at the checkout do not match, this can lead to administrative sanctions, even if the store simply did not have time to change the labels.

When selling books, as well as when selling books, price tags are not needed. When peddling goods, you must have a price list indicating the names and prices of the goods. The price list is certified by the signature of the person responsible for its preparation and the seal of the seller.

Responsibility for violation of trade rules

If your organization is required to issue a cash receipt for every purchase, and an audit reveals that the seller did not do this, this could result in unpleasant administrative sanctions. Liability for violation of trade rules , in particular, for failure to use cash registers, is regulated by Art. 14.5 Code of Administrative Offenses of the Russian Federation. For officials, the fine will be from 1.5 to 2 thousand rubles, for individual entrepreneurs - from 3 to 4 thousand, for organizations - from 30 to 40 thousand. The same sanctions are provided for failure to issue a sales receipt in cases where the law makes this an obligation.

If the inspection authorities caught you with a discrepancy between price tags and the real cost of the goods, your store may be fined 10-20 thousand rubles, and the employee who did not issue a check will have to pay 1 to 2 thousand to the state treasury. In case of repeated violations, the consequences may be more serious, including the closure of your store.

Employees of regulatory authorities can “catch” a cashier in the wrong order of issuing change and a check. If the cashier first put in the change and then handed over the check, this may become a reason for the checker to find fault. The cash receipt must be handed over to the buyer at the same time as the change, not before or after. Otherwise, it threatens with a fine for non-use of CCP. Another common violation of trading rules that entails serious liability is that cashiers often do not give change to the buyer in change. This can be interpreted as deception of the consumer (Article 14.7 of the Administrative Code). For citizens, the fine in this case will be from 3,000 to 5,000 rubles, for officials - from 10 to 30 thousand rubles, for legal entities - from 20 to 50 thousand.

How you can get caught for trading violations

Representatives of internal affairs bodies and Rospotrebnadzor have the right to conduct a so-called test purchase (officially this operation is called a “test purchase”). Employees of Rospotrebnadzor, under the guise of ordinary visitors, come to the store and buy a certain product. Police officers can do the same, but when checking them, two more people must be present who are also shopping. Rospotrebnadzor checks stores for compliance with trade rules, and the police check them as part of operational search activities. After completing a test purchase, inspectors are required to introduce themselves, present their identification and the order on the basis of which the event is being carried out. This order must mention the inspector himself, otherwise the test purchase can be considered illegal.

Tax officers have the right to make test purchases only together with police officers. Tax inspectors can check the presence of a cash register and the rules for its installation, but not the rules for issuing a check. So, if an inspector made a test purchase without representatives of the internal affairs bodies, this event is illegal.

The reason for a test purchase may be a complaint from any of your customers. Sometimes these methods become methods of competition. You may not even suspect that inspection bodies are coming to your store. And the only recipe for peace that can be here is to follow all laws and rules always, every day, even if it seems that there is no reason to worry. And if something is not clear, be sure to find out.

Can I use a personal bank account?

Is it possible not to open a current account, but to use a personal one for business-related payments? Until 2014, the Tax Code of the Russian Federation obligated entrepreneurs to draw up special accounts for conducting commercial activities. This provision has now lost its force.

It would seem that now individual entrepreneurs have the opportunity to use a personal account for business purposes. However, for non-cash transfers in the interests of business, you will have to open a separate account, even if it is an individual account. he already has a face. There are the following reasons for this:

- Central Bank Instruction No. 153-I is still in effect. It directly prohibits the use of current accounts for individuals. persons for business-related settlements. In fact, the lending institution may simply not make such payments.

- Large amounts deposited into a personal account will lead to questions from the security service and financial monitoring. Under Federal Law No. 115, the bank will first ask to explain the source of income, and then will prefer to refuse service and terminate the contract. There is even a risk of being blacklisted and then facing big problems when opening new accounts.

- Organizations and other entrepreneurs in most cases refuse to pay into the account of individuals. faces. Tax authorities may not accept such expenses as deductions from the tax base or consider such partners as tax agents and require payment to the personal income tax budget.

- Inability to share income. The IRS will try to collect taxes on the entire amount deposited into the account, regardless of the source of income. As a result, you will have to pay additional taxes on income not received from the business.

- Inability to verify expenses. Payments made from a personal account will not be considered by the tax authorities as expenses associated with doing business; as a result, the individual entrepreneur may face an increase in the tax base.