Financial assistance in connection with the death of a close relative is one of the types of social support provided at the state level. Anyone can apply for this type of financial compensation, subject to certain conditions.

However, as practice shows, not all citizens are aware of such social support, and therefore do not know where to turn for help.

Download for viewing and printing:

Federal Law of January 12, 1996 N 8-FZ _On burial

Payments upon death of a close relative

When a loved one passes away, relatives rarely think about the fact that they are entitled to certain monetary compensation, which is guaranteed by law. This kind of support is intended to reduce the costs of organizing a funeral or providing funeral services and, to a certain extent, alleviate the financial situation of the mourners. Payments can be conditionally divided into two groups:

- general benefits;

- specialized compensation, which can be claimed subject to certain conditions.

Are common

In days of grief, financial support for family members of the deceased is simply necessary in order to honorably see off a loved one into another world and reimburse the costs associated with organizing the funeral. In addition to this, relatives of the deceased can receive constant assistance from the state if the deceased was the only breadwinner in the family. To assign general compensation, you must contact the competent authorities, providing a certain list of documents, which will be discussed below.

If we talk about specific assistance from the state, it includes the following types:

- funeral benefit;

- one-time payments;

- survivor's pension.

Specialized

In addition to funds allocated directly from the state, relatives of the deceased have every right to claim other compensation. Their list is determined in each case individually and is of a specific nature. Payments are:

- life insurance (including those due under compulsory motor liability insurance in the event of an accident);

- for deposits in Sberbank opened before June 20, 1991;

- within the framework of criminal proceedings, if the death occurred due to the fault of a third party;

- in the form of unpaid pensions, salaries, alimony.

Taxation issues

For the employer, the issues of taxation of lump sum payments to their employees and family members remain important. As of 2021, the following rules apply:

- The amount of one-time financial assistance that is paid to an employee upon the death of his family members is not subject to income tax or personal income tax .

- The paid amount of financial assistance is not subject to insurance premiums for insurance premium payers.

It is important to know! If financial assistance is paid in the amount of more than 4,000 rubles (non-taxable amount of financial assistance), then the amount exceeding this amount is subject to personal income tax. Tax legislation also provides for taxation of amounts paid by an employer to a former employee of the enterprise or to the relatives of such an employee. Thus, in order to avoid taxation, it is necessary that the employee be in an active employment relationship with the employer at the time of payment.

Social benefit for funeral

In connection with the death of a person, his relatives are entitled to assistance in organizing funerals and funeral services. According to Law 8-FZ (01/12/1996), the benefit has a fixed value, and the exact amount is revised annually from February 1 and indexed to last year’s inflation level. For 2021, the amount of social benefits for funerals is 5,701 rubles 31 kopecks. In those regions of Russia where a regional coefficient is applied to salaries, the amount increases in accordance with this indicator.

Who can apply

In most cases, the recipient of the funeral benefit is a close relative of the deceased, but according to the law, any person who has undertaken the organization of the funeral has the right to seek help. By providing the necessary documents, the applicant can cover the costs of:

- preparation of the necessary documentation;

- delivery and issuance of items needed for the funeral;

- transporting the body of the deceased to the burial place;

- carrying out the direct funeral process.

Where to contact

The person who takes upon himself all the issues related to organizing the funeral should know that, depending on the social status of the deceased, you need to apply for funeral benefits to different authorities:

- Pension Fund. Considers applications if the deceased was not employed at the time of death, but was accrued a pension.

- Military registration and enlistment office. Papers are submitted to the local office, provided that the deceased was a military serviceman, a veteran or disabled person of the Great Patriotic War and (or) other military operations, an employee of internal affairs bodies, the Ministry of Defense, an employee of institutions of the penal system or the State Fire Service.

- At the place of work. Documents are submitted in the event of the death of an employee, a pensioner who continued to work, and in the event of the death of a minor child of an officially employed citizen.

- Social security authorities. The application is submitted by relatives of the deceased who was unemployed at the time of death or the deceased was a minor child of unemployed parents or student parents. The SZN authorities are also contacted in case of a stillborn child with a gestation period of more than 154 days.

List of required documents

To receive payment in connection with the death of a close relative, the applicant must prepare a certain package of documents. Among this list are:

- applicant's passport;

- death certificate issued by the civil registry office;

- a completed application for funeral benefits;

- work book to confirm the fact that the deceased was not officially employed.

Application and payment terms

Funeral assistance is provided only once, and can be received directly on the day of the funeral or no later than six months from the date of the person’s death. If the last day on which you can submit an application falls on a weekend or is a holiday, you can submit documents on the next working day. Assistance is paid in cash, and if the applicant wishes, it can be transferred to a bank account with a credit institution, but for this it is necessary to provide details.

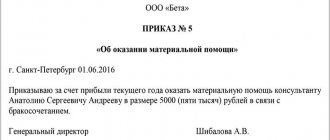

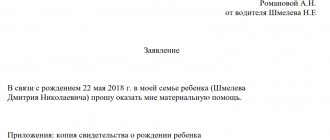

Drawing up an application

To receive support, you must write an application. It contains the following data :

- in the top center - the title of the document;

- reference to the legislative framework that is the basis for receiving the payment;

- the petition part with the text: “I ask you to provide me with one-time financial assistance in connection with ...”;

- indication of length of service and lack of penalties (preferably);

- list of applications;

- date of;

- initials, signature.

Sample application for financial assistance

How to get funeral money for a deceased pensioner

If a pensioner died without receiving the allowance due to him in the current month, his relatives who lived together with the deceased have the right to receive this money. Provided that several citizens simultaneously apply for a pension payment, the amount is distributed in equal shares among all applicants. If after six months the amount has not been claimed, it is subject to inheritance on the general basis determined by law.

To receive payments in connection with the death of a close relative, the following documents must be submitted to the Pension Fund:

- application in the prescribed form;

- passport of the applicant(s);

- death certificate of the pensioner;

- a certificate confirming the fact of registration and residence in the same living space as the deceased;

- documents that can be used to establish family ties (marriage certificate, birth certificate, etc.).

Is refusal possible?

This practice does exist, and not always a citizen can count on financial compensation.

Here, a lot depends on where exactly the person turns for help. If we are talking about the management of an enterprise, then the organization is not at all obliged to provide financial support in such cases. Therefore, if the organization is in a difficult financial situation, the employee may well be refused. At the same time, the employee retains the right to receive 5 days of unpaid leave in connection with the death of a family member.

If we are talking about the death of an employee, the employer does not have the right to refuse relatives to receive financial compensation. Here, the financial position of the enterprise and other factors do not play a role: transfers are made from the social insurance fund (clauses 1, 2, article 10 of Law No. 8-FZ).

Attention! When contacting social support authorities, payments may be denied only if the person has not provided the documents necessary to receive payments. If we are talking about an unfounded refusal, such decisions can be appealed in court.

What assistance is available for the death of a military personnel and law enforcement officers?

The legislation defines cases when the amount of funeral benefits may differ from the established one. This is possible if compensation is paid from the funds of individual federal departments and executive authorities. They can be obtained if the deceased was:

- military personnel;

- participant in hostilities;

- an employee of the State Fire Service;

- veteran of the Great Patriotic War;

- employee of law enforcement agencies (Ministry of Internal Affairs, Ministry of Defense, penal authorities, etc.);

- blockade runner;

- home front worker.

Financial assistance to the relatives of a deceased law enforcement officer or military serviceman can be of three types, and applicants can only apply for one of them and provided that the funeral was organized at their own expense and not at public expense:

- social benefit for funeral;

- compensation payments for funeral expenses incurred;

- funeral benefit in the amount of three times the pension/salary.

Compensation for actual funeral costs

Close relatives can receive funeral payments in the amount of the established social benefit, the amount of which in 2019 is 5,701.31 rubles. If the funeral was carried out at his own expense, the applicant has the right to apply for reimbursement of expenses incurred by presenting documentary evidence. The refund amount will depend on the actual waste, but no more than 18,980 rubles (for Moscow and St. Petersburg - 26,280 rubles). If the deceased was a WWII veteran, the maximum is set at 32,803 rubles.

Funeral benefit in the amount of three months' pension or salary

If you refer to Government Decree No. 941 (09/22/1993), you can see that the death benefit for a relative from among the military, employees of internal affairs bodies, the State Fire Service and the penal system can be three times the monthly allowance (pension) on the date of death citizen. In total, this amount cannot be less than the amount of the social funeral benefit (in 2019 - 5,701.31 rubles)

Installation of a monument at the grave at the expense of the federal budget

In some cases, close relatives are entitled to reimbursement of expenses in connection with the installation of gravestones. Funds are allocated from local budgets and provided with documentary evidence of expenses incurred. Money allocated from the federal executive authorities where the deceased served cannot exceed 20% of the amounts established by law. Government Decree No. 460 (06.05.1994) sets out the following maximum amounts of compensation:

| Deceased status | Amount, rubles |

| Military personnel and other law enforcement officers | 32 803 |

| Veterans of military service and combat operations | |

| Participants and disabled people of the Second World War | |

| Conscripts, cadets | 26280 |

| Participants and disabled people of the Second World War (who did not serve as military personnel in the active army) |

What payments are required from the employer?

The employer can issue additional financial assistance at his own discretion. This is not a legal requirement, it is purely voluntary.

But, if a person died due to an accident at work, or it was a fatality due to an illness caused by harmful working conditions, then relatives have the right to receive from the employer:

- one-time payment of up to one million rubles;

- monthly benefit in the amount of the average salary of the deceased.

The state also provides compensation in the amount of 50 times the average salary of the deceased.

One-time payments to relatives of the deceased

In addition to compensation for the costs that the relatives of the deceased incur when organizing a funeral and installing a monument, they may qualify for other types of support not regulated by federal law:

- assistance provided at the applicant’s place of work;

- accruals made by the employer for whom the deceased worked until death;

- compensation provided for by local legislation from the regional budget.

Financial assistance from the employer

Financial assistance in connection with the death of a relative may be paid by the employer. In the first case, this is compensation at the deceased’s previous place of work. Relatives of the deceased can apply to receive it by writing a statement. In the second, the applicant can receive it at his place of work, if this is provided for by local regulations. The husband, wife, children and parents of the deceased can apply for benefits. The list can be expanded at the initiative of the employer (for example, siblings, grandparents, guardian and trustee).

The amount is determined by the head of the enterprise or may have a fixed value and be prescribed, for example, in a Collective Agreement or contract. To receive funds, the applicant must write a free-form application for financial assistance and attach a copy of the death certificate of a relative. Money is issued in cash from the company's cash desk or transferred to a card account. They are not subject to taxation (personal income tax is not charged) and they do not need to pay insurance premiums.

One-time regional compensation

Local authorities do not have the right to cancel compensation provided for by federal law, but can assign additional payments in connection with the death of a close relative. The value will vary depending on the subject. It depends on the capabilities of the local budget and adopted legislative or regulatory acts. For example, in Moscow the following sizes are established:

- for a military serviceman or law enforcement officer - 22,511 rubles;

- for disabled people, veterans and participants of the Second World War – 38,400 rubles;

- for the liquidators of the accident at the Chernobyl nuclear power plant and the Mayak production association - 11,456.14 rubles;

- for the unemployed, non-working pensioners and a stillborn child during pregnancy more than 154 days - 16,701.31 rubles.

- What pills to take to get rid of headaches

- Red sea bass baked in the oven with vegetables

- Homemade beef liver pate

What does the Labor Code of the Russian Federation say?

The Labor Code of the Russian Federation establishes that financial assistance for a funeral can be provided to an employee by an employer if its internal local regulations provide for this.

For example, there is a provision regarding this in the Collective Agreement. If such a rule exists at the enterprise, then upon the occurrence of an event that is the basis for its implementation (the death of a close relative), payment of financial assistance must be made.

However, if the enterprise does not have the financial capacity, and there is no such provision in local regulations, the employer is not obliged to provide financial assistance in the event of the death of its employee.

Survivor's pension

The assistance provided is not limited to the above options. In some cases, a citizen may be awarded a monthly compensation - a survivor's pension. According to the law, there are three types:

- insurance;

- state;

- social.

Who is entitled to

In accordance with the information provided on the official website of the Pension Fund, the categories of citizens who are entitled to monthly payments in connection with the death of a close relative are determined depending on the type of pension:

| Type of pension | To whom is it credited? |

| Insurance |

|

| State |

|

| Social |

|

What documents need to be provided

To assign payments, it is necessary to collect a certain package of documents (originals and copies), which, together with the application, are submitted to the local branch of the Pension Fund. Additionally, you can apply for a pension in connection with the loss of a breadwinner through your personal account on the Pension Fund website, the Multifunctional Center, or send documents by registered mail with notification. The list of required papers looks like this:

- identification document of the applicant (passport, residence permit, birth certificate, etc.);

- death certificate;

- a document capable of confirming family ties with the deceased;

- other papers regarding the deceased that will be required to confirm additional circumstances (for example, a work book to calculate work experience).

Conditions of appointment

There are some rules, subject to which a person can qualify for a pension in connection with the loss of a breadwinner:

- Insurance. Possible if the work history of the deceased, during which he paid insurance premiums, is confirmed. Payments will not be accrued to those dependents whose actions resulted in the death of the breadwinner.

- State. It is calculated regardless of the length of service of the deceased and the time of his death (while serving or being retired).

- Social. It is calculated if the deceased did not have an insurance record or it could not be confirmed.

Size and timing

The assignment of an insurance pension depends on the date of application. If the application was submitted within one year from the date of death of the citizen, pension payments will be accrued from the date of death of the breadwinner. If the application was received after 1 year, the calculation will be made for the last 12 months preceding the date of submission of documents. The amount is calculated individually, but in addition, the law defines additional payments to the main part. The following values are set for 2021:

- standard conditions – 2,491.45 rub. (regional coefficient applies);

- orphans – 4,982.90 rub.

State and social pensions are assigned from the first day of the month when the applicant applied for assistance. The amount of payments has the following values:

| Deceased status | Recipient category | Size |

| Military personnel who died due to military trauma | Disabled family members | 200% social pension |

| Military personnel who died as a result of a disease acquired during service | 150% social pension | |

| Victims of man-made and (or) radiation disasters | Children whose both parents have died | 250% social pension |

| Children of a single parent | 250% social pension | |

| Other disabled family members | 125% social pension | |

| Astronauts | All family members of the deceased | 40% of the allowance received by the deceased |

The size of the social pension for persons under the age of 18 or up to 23 years, if they are full-time students in an educational institution, is:

| Recipient category | Size, rubles |

| Children who have lost one parent | 5180,24 |

| Children who have lost two parents | 10360,52 |

For residents of the Far North and other territories equivalent to them, an increasing coefficient (PC) is additionally applied. If pension recipients leave for permanent residence (permanent residence) in another area, payments are assigned in a standard amount or taking into account another value that is applied in the region. For example, if a citizen lived in Vorkuta, payments increased by 1.6. When he leaves for permanent residence in Smolensk, the pension will be calculated without using a PC, but if he goes to live in Severodvinsk, the coefficient will be equal to 1.4.

Payments from life insurance of the deceased

Provided that the deceased has entered into a voluntary life and health insurance agreement, after his death, relatives can contact the insurance company with which the deceased citizen collaborated to receive the payments due. If the policy states that the beneficiary is a specific person, the money is transferred only to him, although in case of disagreement, relatives can appeal the will of the deceased in court.

What are the grounds for demanding money?

A relative of the deceased has one reason - the death of a loved one and the financial need to bury him with dignity. But there is no law in the Labor Code of the Russian Federation obliging managers of enterprises of any form of ownership to provide financial assistance. Federal Law No. 8 contains a clause that every citizen of the Russian Federation has the right to be buried, and the state guarantees financial support to those involved in funerals.

Important! The amount is allocated from the extra-budgetary budget (FSS) and transferred to the account after approval by employees of the social security department. Many enterprises also have a special “fund” from which payments are made specifically for such needs. But they must be confirmed by the charter and local documents of the organization.

Receiving compensation for Sberbank deposits

If the deceased had a deposit in the largest bank in the country, opened before June 20, 1991 and not claimed before December 31, 1991, the heirs have the right to receive compensation for it, but only if the depositor had Russian citizenship at the time of death. The amount of compensation depends on the date of birth of the beneficiary and is:

- up to 1945 (inclusive) – three times the balance;

- 1946–1991 – double the value.

Upon the death of the investor in 2021, his heirs or citizens who organized and paid for the funeral and funeral services are entitled to compensation. Its size depends on the balance of the deceased’s deposit in the bank, but cannot exceed an amount equal to 6 thousand rubles. To receive the above payments, you must submit an application indicating the date and your own signature. It should be accompanied by the necessary package of documents, the exact list of which should be clarified at the department.

Amount of financial assistance

Each enterprise has local regulations that establish not only the employee’s ability to receive financial support in a difficult life situation from the employer, but also a certain amount of such assistance.

The amount of financial assistance depends on several factors:

- the ongoing social policy of the enterprise;

- financial capabilities of the company;

- other circumstances.

Thus, there are no restrictions on one-time financial support for an employee.