Any citizen who is a tax resident of the Russian Federation is obliged to pay all necessary taxes in accordance with the Tax Code of the Russian Federation. The most common tax for individuals is personal income tax. Personal income tax involves various categories of profit, including profit from sales.

We will talk about this type of tax in more detail in this article. Let's look at the amount of tax to be paid on the sale of real estate to individuals. Let's find out whether the rate is fixed or depends on certain nuances. We will also describe exceptions to the payment of tax on the sale of real estate that was owned by the owner for less than 3 (or 5) years.

What is a tax deduction

The Tax Code of the Russian Federation contains rules defining property tax deductions. In other words, a tax deduction (TD) is a reimbursement of 13% of the amount spent on the purchase of housing.

It is worth noting that real estate must be purchased with one’s own funds and only from one’s own account, and the parties to the transaction must not be related persons (Article 105.1 of the Tax Code of the Russian Federation).

In this article, we will look in detail at who is entitled to IC, what is the amount of the refund, where you can apply for compensation, which includes a list of documents and other features of IC when buying a house.

You may be interested in: how to get a tax deduction when building a house?

Laws

Calculations and payment of taxes on the sale of land plots with a house must be made in accordance with the laws of the Russian Federation.

In particular, Chapter 23 of the Tax Code is devoted to general tax issues.

At the same time, Articles 217 and 217.1 clarify the issues of tax exemption for income received in real estate transactions, which include land plots with a house, and Art. 220 considers tax deductions for both sellers and buyers of real estate.

The letter from the Federal Tax Service clarifies issues related to the status of tax resident for citizens of the Russian Federation. This status is important when determining the amount of personal income tax.

Who can claim a tax refund when buying a home?

Not everyone can receive compensation from the purchase of a house, and the legislation clearly defines the requirements for applicants for receiving NV. To receive a refund, a citizen must be:

- taxpayer;

- tax resident of the Russian Federation (clause 2 of Article 207 of the Tax Code of the Russian Federation);

Important! If a non-resident person has a source of income in the territory of the Russian Federation, he pays income tax, but cannot claim a deduction (clause 4 of Article 210 of the Tax Code of the Russian Federation).

- the owner of the purchased house;

The only exception is when the house is purchased by parents or guardians (guardians) for minor children.

- a person who has not previously received such compensation in full.

They are not entitled to a tax deduction

Despite the fact that any citizen can exercise the right to receive NV, there are categories of persons who are denied this opportunity.

The following cannot receive a tax deduction:

- persons who have already received NV;

- close relatives in relation to the seller;

- non-residents of the Russian Federation;

- persons who have not had official income for the last 3 years before submitting the application, including pensioners;

- individual entrepreneurs;

- persons who received a house at the expense of the federal budget.

The latter include military personnel, orphans and those who paid for the purchase of a house with maternity capital.

The amount of tax for the purchase and sale of land plots with a house

When calculating the tax on the sale of land plots with a house, it is first necessary to determine whether the seller has resident status.

A resident, regardless of citizenship, can be a person who stays in the country for > 183 days during the year.

In this case, departure abroad of the Russian Federation due to illness, study or to work in offshore fields for a period of less than six months is not taken into account. Military personnel and government employees sent abroad are also considered residents.

The remaining persons are not residents.

It is necessary to take into account the clarification expressed in the letter of the Federal Tax Service No. OA-3-17/4698.

In accordance with it, the absence of a citizen of the Russian Federation in the country for more than a specified period is not grounds for considering him a non-resident.

This is due to some international treaties, according to which an individual is considered a resident of the Russian Federation if he has a permanent home there.

In such cases, the issue of resident status is decided individually.

The tax rate on the sale of land plots with a house is set at the rate (Article 224 of the Tax Code):

- 13% - for residents of the Russian Federation;

- 30% - for non-residents of the Russian Federation.

For example, a seller who is a resident is not entitled to deductions.

When selling a plot with a house for 5 million rubles. he must pay tax N1=5000000*13%=650000 rub. In such a case, a non-resident person will pay tax H2 = 5,000,000 * 30% = 1,500,000 rubles.

Compensation amount

The refund amount is 13% of the price of the house, but not more than 260,000 rubles. In other words, the cost of the house cannot exceed 2,000,000 rubles. (Clause 1, Clause 3, Article 220 of the Tax Code of the Russian Federation). For example, the cost of a house is 1,650,500 rubles, compensation will be 214,565 rubles.

The remainder, RUB 45,435, can be returned when purchasing another home in the future.

But if the cost of the house is 5,370,000 rubles, then the deduction will be only 260 thousand rubles.

Until 2014, the limit was 1 million rubles. Therefore, if the house was bought before 2014, you can get no more than 130 thousand rubles.

The situation is interesting when spouses buy a house. Previously, NV was divided between husband and wife in equity terms. Since 2014, everyone has the right to receive full compensation.

Example 1

The cost of the house is 5,575,300 rubles.

Deduction for each spouse of 2,000,000 rubles.

As a result, the spouses will receive compensation of 260 thousand rubles. every.

Example 2

In 2013, the couple purchased a house as joint property. Purchase amount – 1,375,000 rubles. In 2021, a tax deduction was issued for the purchase of a house, and the shares in the application were distributed by 1⁄2. At the time of purchase, there was a limit on the amount for deduction - 13% of RUB 1,000,000.

Thus, the deduction will be divided into 75 thousand rubles. to each.

In some cases, the amount of compensation may decrease or increase.

The refund amount is reduced due to payment by maternity capital and other subsidies. Also, the amount of payments will decrease if there is shared ownership.

Example 3

In 2021, we purchased a house for 1,975,000.

350,000 was paid from maternity capital funds.

In 2021, you can submit documents for compensation from the amount of 1,625,500.

The amount of compensation is 211,315 rubles.

Example 4

In 2021, a house was purchased as joint property.

The cost of the house is 2,000,000 rubles.

Number of participants – 2.

The share of participants is 1⁄2 each.

The amount of payments is 260,000 rubles. (13%).

Each participant will receive 130,000 rubles.

You can increase the amount by buying a house with a mortgage - through compensation from the interest paid to the bank. But we'll talk about this later.

Legal ways to reduce personal income tax

- Personal income tax can be legally reduced by tax deduction.

A tax deduction is the amount by which the tax base for paying taxes is reduced.The Tax System of the Russian Federation provides for standard (Article No. 218 of the Tax Code of the Russian Federation), property (Article No. 220 of the Tax Code of the Russian Federation), social (Article No. 219 of the Tax Code of the Russian Federation) and other tax deductions.

The amount of tax deduction when selling property may vary:

- Equal to 1 million rubles - for the sale of residential real estate and land plots. For example, a residential building with a land plot was purchased by a resident of the Russian Federation in 2013. And sold in 2015. Accordingly, when paying tax, the former owner of the house can reduce the tax base by 1 million rubles, using the right to a tax deduction. In this case, the tax will be calculated as follows: (sales cost. rub. - 1,000,000 rub.) * 13%.

250 thousand rubles when selling other property (non-residential premises, cars). It is calculated similarly to the first example (with 1 million rubles).

- According to statistics from legal consultations, many citizens try to “get around” paying taxes when selling a property that they have owned for less than 3 (or 5) years.

In fact, such a method exists - it is donation. However, in this case, the “donor” risks being left without money, because after signing the agreement at the notary’s office, the recipient of the property may simply refuse to transfer the funds. Everyone knows that deliberate violation of the Laws of the country is a criminal offense. And, trying to save on paying taxes, an unscrupulous citizen risks not only receiving legal punishment, but also losing his property irrevocably. - Reduce the tax base for expenses incurred by the owner when purchasing real estate. In this case, the tax will be calculated from the difference between the income from the sale of the apartment and its original cost. For example, the owner of the property being sold once bought it for 5 million rubles , and sells it for 7 million rubles . Then the tax will be calculated as follows: (7-5) million rubles * 13% = 260,000 rubles.

Attention! The taxpayer has the right to use only one option to reduce the tax base and only for one object being sold! - Selling an apartment at a reduced price.

This method is very common among residents of the country, but over the years it has lost all meaning, since real estate has a cadastral value. Cadastral value is the value of real estate, which is determined by specialized organizations - independent appraisers. The cadastral value is close to the market value of housing. Therefore, now, if the real value of the apartment under the purchase and sale agreement is less than 70% of the cadastral value, then the tax will be calculated according to the full standard program. The cadastral value of the real estate being sold is determined as of January 1, 2021. - To avoid paying tax when donating real estate between non-close relatives, many use this completely legal scheme.

For example, a niece’s uncle wants to give her an apartment when she comes of age. However, when carrying out a direct gift transaction, the niece will have to pay the appropriate tax. To avoid this, an uncle can first give this apartment to his sister, and then his sister will give the property she accepted as a gift to her daughter. However, we should not forget the fact that such transactions are monitored by law, and if 2 gift agreements are made within a week, the transactions will be considered officially illegal.

Tax or property deduction is available exclusively to residents of the Russian Federation.

List of documents for obtaining a tax deduction

To process a refund from the purchase of a home, you must collect the relevant documents from the list and submit them to the tax authority.

When purchasing a house with a mortgage, the package of documents additionally includes:

- mortgage agreement, repayment schedule, interest payment certificates.

When buying a house in common or shared ownership:

- a copy of the marriage certificate;

- application for distribution of compensation.

There are cases when the plot with the house being purchased on it is not officially registered or is leased (read more about renting a land plot), therefore, when buying a house with land, you need to provide documents confirming the rights to this land.

Tax exemption

In some cases, income received from the sale of a lease with a house is not subject to taxation.

The sale of a land plot with a house is subject to tax exemption if the seller

owned this property for more than the maximum period.

Currently this period is 5 years. A period of 3 years remains for sellers of land plots with a house who received their property as a result of the following transactions:

- gifts from close relatives or inheritance;

- privatization;

- transfer of real estate under a lifelong maintenance agreement.

At the same time, constituent entities of the Russian Federation can reduce the deadline down to zero.

Ways to receive a tax deduction

Through the tax authority

- Documents for a tax refund when purchasing a house can only be submitted in the year following the year of purchase.

- All documents from the list are required.

- The verification takes 3 months, and the results will be sent to the applicant within 10 working days.

- The amount is paid in full at a time.

- Return period is 1 month.

Through the employer

- You can apply immediately after purchasing a home.

- A declaration in form 3-NDFL is not required.

- Document verification – 1 month.

- Payment is made in part, in the amount of withheld salary tax, until the amount is paid in full.

- Refunds start from the first salary after the application is approved.

In order to issue an IR in the second way, you need, in addition to the general list of documents, to provide the employer with an application requesting an IR due to the purchase of a house and a notification to the tax office about the right to receive a refund.

Characteristics of personal income tax in the Russian Federation

The abbreviation “NDFL” stands for “personal income tax.” In abbreviated form it is also called income tax. Tax payers are both citizens of Russia and foreign citizens - tax residents of the Russian Federation.

In 2021, Russians are required to pay taxes on the following income:

- from wages;

- from the sale of property owned for less than 3 (or 5) years;

- from the profit received from renting out real estate;

- from various kinds of winnings;

- from accepting an inheritance (in some cases).

In the case of a gift, personal income tax is paid not by the subject of the alienated property, but by the subject receiving the donation. The law explains this by the fact that the recipient receives income in kind - in the form of an apartment. The donee, in this case, is obliged to pay a fixed rate for personal tax, namely: 13%. By the way, for non-residents this rate is 30%.

An exception to the payment of taxes on a gift transaction is a transaction between close relatives:

- Between spouses

- Between parents and children (including legally adopted children)

- Grandparents and grandchildren

- Brothers and sisters (including half-siblings, that is, with one common parent).

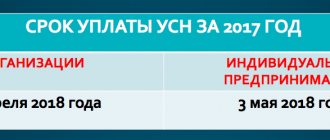

Citizens who received income from the sale of real estate must submit a declaration in form 3-NDFL no later than April 30 of the following year. That is, if a transaction for the sale of property occurred on March 17, 2021, then the citizen who received profit from the sale is required to declare his income by April 30, 2021.

And you will need to pay personal income tax no later than July 15 of the year following the one in which the income from the property sale transaction was received.

You should know! Individuals must declare their income from the sale of property themselves. There is no need to wait for any notifications from the tax office. Ignorance of this rule does not relieve the taxpayer from liability.

Ways to submit an application to the tax office

Having prepared the necessary documents, you can personally visit the tax office and provide the entire package of documents, or you can choose one of the alternative methods: MFC and the State Services portal.

MFC

To issue a refund through the MFC, you need to submit a package of documents at the center’s office and arrive at the tax authority at a certain time.

State Services Portal

It is also possible to apply for a refund through the State Services portal. To do this, you need to log in to the site. In the “Taxes and Finance” section, select “Acceptance of declarations” and “Provide form 3-NDFL”. Next, selecting “Online declaration generation”, enter information and fill out the data for 3-NDFL. After sending the application, you can make an appointment with the tax authority also through the State Services portal.

Land tax amount in 2021

The payers of this tax are the owners of land plots who have ownership rights to them, or the right of perpetual use, confirmed by the relevant legal document or an extract from the cadastre.

In the case of joint ownership of a plot by two or more persons, each of them pays tax in proportion to the value of their share.

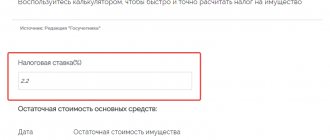

The tax is calculated as follows:

ZN = KS x C

, Where

- ZN - land tax;

- KS – cadastral value of the site;

- C is the tax rate.

The cadastral value reflects the real market valuation of land plots made at the beginning of the current year. Data about it can be found on the Rosreestr website using the cadastral number of the plot. In addition, owners can make a request in writing and receive an official statement of the value of the site.

On what basis is real estate tax calculated in 2018?

Let us remind you that recently the property tax for individuals began to be calculated in a new way, and those Russians who are required to pay this tax have already encountered the new rules more than once.

For a very long time we paid almost a penny tax on our apartments and houses. It was calculated on the basis of the inventory value of the property, and it is several times, if not tens of times, lower than the market price. At some point, the state, faced with an economic crisis, got tired of this, and it abruptly changed the principle of calculating the tax from citizens on their apartments in order to further replenish the budget. The basis was the cadastral value, which theoretically should be close to the market price of housing. This means that the tax has increased sharply.

This could still be considered fair if it were not for such a piquant detail as the inflated cadastral value charged to Russians in many cases.

The fact is that the cadastral value was determined by a relatively small number of experts who, of course, did not go and evaluate with their own eyes what was happening to the apartment and the house in which it is located, how much such housing could cost on the market. Very rough estimates and almost advertisements for the sale of housing on the Internet were used. As a result, sometimes the cost was inflated relative to the original market price. It is also worth considering that the assessment was carried out before the fall in prices on the real estate market, so when prices on the market became noticeably lower, against this background the cadastral value turned out to be even more insane.

It is clear that the majority of Russians were shocked by the new principle of tax calculation, since everyone was used to paying a small amount, but it increased sharply. The injustice in calculating the cadastral value further outraged people. To the credit of the tax authorities, they were cooperative in controversial situations, and the cadastral value was reduced.

Who has benefits for paying property taxes in 2021?

The list of beneficiaries has not changed in any way compared to previous years. The housing tax does not apply to pensioners, disabled people, children of war, liquidators of the Chernobyl accident, etc. In a word, if you have not paid this tax before, you are unlikely to be forced to do so by taking away the benefit.

The only thing you shouldn’t forget about is that if, for example, a pensioner owns three apartments, then the benefit applies to only one of them. For the remaining two, he will be required to pay taxes.