What taxes are imposed on compensation for unused vacation upon dismissal? This question interests not only employers, but also employees. Citizens who officially work at enterprises have the right to go on paid leave every year. Its duration depends on the specialty and type of work.

When an employee is dismissed, the organization’s accounting department is obliged to assign compensation in the form of a sum of money for unused vacation days or send him on vacation with subsequent dismissal, in accordance with Article 127 of the Labor Code of the Russian Federation, having paid all the necessary contributions and taxes.

The procedure for calculating personal income tax on dismissal payments

The amounts that are paid to an employee in the event of dismissal can be divided into taxable and non-taxable with income tax (NDFL).

Taxable include :

- all accruals to the employee for time worked and work performed;

- payment of unused vacation days.

There is no need to charge personal income tax on severance pay within the established limit and some types of compensation payments (Article 217 of the Labor Code of the Russian Federation).

The process of determining the tax base includes:

- Identification of taxable and non-taxable charges.

- Summation of only taxable accruals.

- Application of deductions to the amount of taxable charges.

The tax is calculated using the formula:

Tax base × 13% (for non-residents 30%) |

Basic principles

The duration of leave is determined on the basis of current legislation and the terms of the concluded employment contract. Most often, vacation lasts 28 calendar days. The employer can also provide additional days of rest to an employee working in a certain position, in proportion to the time worked under certain conditions.

The calculation of the compensation amount for vacation not taken is carried out similarly to the calculation of vacation pay. It is based on unused vacation days and the average salary of the resigning employee. Compensation is the income of an individual and is therefore subject to taxes. The transfer of personal income tax to the budget is carried out by the employer.

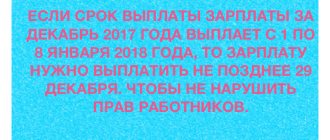

Deadline for paying personal income tax on salary upon dismissal

All tax accrued on payments upon termination of an employment contract must be paid no later than the day following the date of their actual transfer to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation). When the deadline for transferring tax upon dismissal coincides with a day off, settlements with the budget for personal income tax are made on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Important

Although now almost all companies pay salaries by bank transfer, and making payments on the day of dismissal is not a problem, there are situations when the date of separation and receipt of money do not coincide. For example, small organizations may issue wages through a cash register, but the employee does not show up to collect the money on the last working day. Then the company is obliged to make payments no later than the next day after the date the dismissed person applied for the debt (Article 140 of the Labor Code of the Russian Federation).

Example 1

The company pays employees wages through a cash register. The employee resigns on 08/20/20__. However, he did not show up for the payment and brought a statement demanding its issuance only on 09/02/20__. The company, in compliance with the law, made a full settlement with him on 09/03/20__. When should she remit personal income tax?

Decision: based on the above provisions of paragraph 6 of Art. 226 of the Tax Code of the Russian Federation - no later than 09/04/20__.

Algorithm of actions for processing and receiving compensation for vacation

To receive money in exchange for part of the vacation, the employee must write a corresponding application. You can use the sample.

Having received an application from the employee, the employer issues an order to replace part of the vacation with monetary compensation, drawn up in any form.

The order must indicate:

- Full name and position of the employee;

- the number of vacation days that must be replaced by monetary compensation, the billing period;

- the basis for issuing the order;

- details of the employee's application.

The employee reads the order and signs it. After this, the employer enters into the employee’s personal card (unified form T-2) in section 8 “Vacation” information about the replacement of part of the annual paid leave with monetary compensation.

How are the remaining columns filled in?

Column 1 “Type of leave” specifies which leave is replaced by monetary compensation (main, additional).

There are no specific comments for filling out columns 2 and 3 “Working periods” - they are filled out according to general rules.

The number of vacation days that are subject to replacement with compensation is indicated in column 4 “Number of calendar days of vacation.”

In columns 5 and 6, the corresponding entry “Replacement of vacation with monetary compensation” is made.

Column 7 “Grounds” reflects the details of the order. The same information should be recorded in the vacation schedule - in column 10 “Note”. Just make a note that part of the annual leave has been replaced by money, indicating the number of compensated days.

The procedure for calculating insurance premiums upon dismissal

When deciding what taxes to pay when dismissing an employee, you should not forget about insurance premiums, as well as contributions in connection with accidents at work. The composition of payments subject to taxation includes almost all accruals under an employment or civil law contract. The list of non-taxable amounts is clearly stated in Art. 422 of the Tax Code of the Russian Federation.

The procedure for determining the taxable base for contributions upon dismissal is as follows:

- Accounting for all amounts due to the employee in connection with termination of cooperation.

- Identification in the list of charges that fall under those given in Art. 422 of the Tax Code of the Russian Federation, benefits.

- Deduction from the total amount of accruals of non-taxable amounts - according to Art. 422 of the Tax Code of the Russian Federation.

The calculation of the amount of contributions upon dismissal is carried out according to the formula:

Taxable base × Percentage of contributions to the relevant fund |

Accounting

The procedure for reflecting in accounting the amounts of compensation for unused vacation upon dismissal depends on whether the organization is a small business or not.

Situation: in accounting, should the accrual of compensation for unused vacation upon dismissal be written off as a reduction in the reserve for vacation pay? The organization is not a small business entity.

Yes need.

Organizations that are not small businesses are required to create a reserve for vacation pay in accounting, that is, recognize estimated liabilities in the form of vacation pay (subparagraph “a”, clause 2, clause 5 of PBU 8/2010, letter of the Ministry of Finance of Russia dated April 19 2012 No. 07-02-06/110).

Compensation for unused vacation should be accrued against a previously recognized provision (previously created reserve). This is explained as follows.

By creating a reserve for vacation pay, the organization recognizes its future obligations with an indefinite period of fulfillment to employees regarding the payment of vacation pay (subclause 4, 8 of PBU 8/2010). In this case, the liability for each employee is calculated based on the number of vacation days to which he is entitled at the time the reserve is created.

Compensation for unused vacation is also calculated based on the number of vacation days to which the employee is entitled at the time of dismissal (Article 127 of the Labor Code of the Russian Federation). Therefore, the amount of expenses for its payment is taken into account when determining the amount of the estimated liability, that is, when forming a reserve for vacation pay.

Thus, the accrual of compensation to an employee for unused vacation is not recognized as an expense of the current period, but is the fulfillment of a previously recognized estimated liability (clause 21 of PBU 8/2010). Consequently, the amount of the estimated liability for vacation pay (reserve) is reduced by the amount of accrued compensation for unused vacation.

Small businesses may not create a reserve for vacation pay (clause 3 of PBU 8/2010, part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ).

If the organization is a small enterprise and decides not to create a reserve for vacation pay, in accounting, include compensation for unused vacation associated with dismissal as part of the expenses for ordinary activities, namely in labor costs (clause 8 of PBU 10/99 ). Reflect the accrual and payment of compensation for unused vacation associated with dismissal with the following entries:

Debit 20 (23, 25, 26, 29, 44...) Credit 70

– compensation has been accrued for unused vacation related to dismissal;

Debit 70 Credit 50 (51)

– compensation for unused vacation related to dismissal was issued from the cash register (transferred to the employee’s bank account).

Deadline for transferring contributions from the salary of the dismissed person

All contributions must be transferred no later than the 15th day of the month following the month of payment of income (clause 1 and clause 3 of Article 431 of the Tax Code of the Russian Federation). This rule also applies when dismissing an employee.

However, for the purpose of paying contributions, the date of payment is the day of actual delivery of the amounts to the employee (clause 1 of Article 424 of the Tax Code of the Russian Federation). If this date falls on a weekend, then payments should be made no later than on the next working day.

Example 1

The employee resigned on 9/20/20__. On the same day, full payment was made to him. The due date for payment of contributions is no later than 10/15/20__.

Example 2

The employee quit on 09/20/20__, but did not show up for the payment, and only requested it on 10/01/20__. The accounting department carried out the calculation and payment of the debt on 10/02/20__. The due date for payment of contributions in this case should be 11/15/20__. But this day falls on a weekend, so the deadline is until 11/16/20__.

Read also

23.10.2020

Example of calculating compensable days

The employee was employed by the organization on July 10, 2015. Resigns effective August 13, 2021. The duration of the vacation is 28 days. In the first year of work, 21 days were used, in the second - 28, in the third - 14.

Thus, when dismissing for unused vacation, the company must calculate the amount of compensation.

| Index | Calculation procedure | Result |

| total length of service in the organization | 3 years, 1 month | |

| the total number of days of entitlement leave for all years of work | 28 * 3 years + 28 / 12 * 1 month. | 86.33 days |

| number of holidays used | 21 + 28 + 14 | 63 days |

| differences between granted and used vacation | 86,33 – 63 | 23.33 days |

Compensation must be accrued in 23.33 days.

Income tax: accrual method

If the organization uses the accrual method, include the amount of compensation as part of direct or indirect expenses.

If an organization is engaged in the production and sale of products (works, services), determine the list of direct expenses in the accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Attention: when approving the list of direct expenses in the accounting policy, remember that dividing expenses into direct and indirect must be economically justified (letter of the Ministry of Finance of Russia dated January 26, 2006 No. 03-03-04/1/60, Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/2952). Otherwise, tax inspectors may recalculate income taxes.

Thus, compensation accrued to employees directly involved in production should be taken into account as part of direct expenses. Refer to indirect expenses for compensation for unused vacation accrued to the organization's administration.

Compensation that relates to direct expenses should be taken into account when calculating income tax as products are sold, in the cost of which it is taken into account (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation).

Compensation that relates to indirect expenses should be taken into account when calculating income tax on the last day of the month in which it was accrued (clause 2 of Article 318, clause 4 of Article 272 of the Tax Code of the Russian Federation).

If an organization provides services, then direct costs can be taken into account, as well as indirect ones, at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

In trade organizations, compensation for unused vacation is recognized as indirect expenses (paragraph 3 of Article 320 of the Tax Code of the Russian Federation). Therefore, take them into account when calculating income tax in the month in which they were accrued.

An example of how to take into account payment of compensation for unused vacation associated with dismissal. Organization on a general basis (accrual method, does not create a reserve for vacation pay in tax accounting)

LLC "Torgovaya" is engaged in wholesale trade.

Organization manager A.S. Kondratiev resigns on March 11. He is entitled to compensation for unused vacation in the amount of 8,330 rubles.

Kondratiev has no rights to deductions for personal income tax. Personal income tax on compensation amounted to: 8330 rubles. × 13% = 1083 rub.

In March, the Hermes accountant made the following entries:

Debit 96 Credit 70 – 8330 rub. – compensation for unused vacation has been accrued;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1083 rubles. – personal income tax withheld;

Debit 70 Credit 50 – 7247 rub. (8330 rubles - 1083 rubles) - compensation was paid from the cash register (minus personal income tax).

When calculating income tax for March, the accountant included the entire amount of accrued compensation (RUB 8,330) in current expenses.

Previously, when creating a reserve for vacation pay, a deductible temporary difference and a corresponding deferred tax asset arose in accounting. This happened due to the fact that when creating the reserve, the corresponding expenses were reflected in the accounting, but not in the tax account. When calculating compensation, the opposite situation arises: the amount of compensation is included in expenses in tax accounting, but not in accounting, since it is written off against the reserve. Therefore, the accounting should reflect a partial write-off of the deferred tax asset.

The accountant made the following entry:

Debit 68 Credit 09 – 1666 rub. (RUB 8,330 × 20%) – the deferred tax asset is written off (partially).

An example of how to take into account payment of compensation for unused vacation associated with dismissal. Organization on the general mode (accrual method), refers to small enterprises and does not create a reserve for vacation pay

LLC "Torgovaya" is engaged in wholesale trade.

Organization manager A.S. Kondratiev resigns on March 11. He is entitled to compensation for unused vacation in the amount of 8,330 rubles.

Kondratiev has no rights to deductions for personal income tax. Personal income tax on compensation amounted to: 8330 rubles. × 13% = 1083 rub.

In March, the Hermes accountant made the following entries:

Debit 44 Credit 70 – 8330 rub. – compensation for unused vacation has been accrued;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1083 rubles. – personal income tax withheld;

Debit 70 Credit 50 – 7247 rub. (8330 rubles - 1083 rubles) - compensation was paid from the cash register (minus personal income tax).

When calculating income tax for March, the accountant included the entire amount of accrued compensation (RUB 8,330) in current expenses.

Features of collection and transfer of taxes to the budget

The accounting department deals with taxation issues and transfer of payments. The employee only receives his monthly salary - the remainder after all deductions.

Taxes have an amount and payment deadlines. An individual, not an entrepreneur, as a rule, pays only one tax on his own - on property. Any property owned by a citizen is subject to taxation: a garage, apartment or house.

- Transport tax is paid by car owners; these are annual deductions depending on the cost and year of manufacture of the car. You need to fill out declarations yourself and visit the Tax Committee. However, now you can pay all your bills via the Internet; all you need is a bank card or an e-wallet.

- Income tax is paid by entrepreneurs and people with passive income.

- VAT is a mandatory tax for entrepreneurs; they need to tax the price of products and services.

Tax rates may change; the Tax Code is updated every year. A certificate of the amount and deadline for payment, as well as the code of the required tax, can be found in the code or asked from a tax specialist.

Important: taxes must be paid on time; unscrupulous taxpayers face penalties.

You only need to pay in rubles. Pay either directly to the tax office or through a bank by filling out a form. It is important to provide the details correctly, otherwise the amount will go to the wrong place.