December salary payment deadline: options

Employers can choose different options for paying the second part of their December 2021 earnings. So, let’s say, you can pay the second part of your salary ahead of schedule - in December 2021. However, this payment may take place in January 2021. The solution to this issue depends, among other things:

- on the content of employment contracts and internal labor regulations regarding the timing of salary payments;

- from the employer’s desire to pay wages for December 2021 ahead of schedule.

Please note that December 31, 2021 is Sunday, which is a day off in a five-day work week. After this weekend, the New Year holidays will begin. The first working day in 2018 is January 9 (Tuesday). Also see “Salary payment deadlines for December 2021“.

What the Labor Code says about wages for December

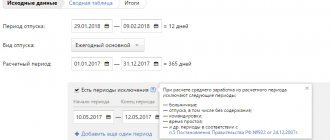

If the deadline for paying wages for the second half of December is set from January 1 to January 8, 2021, then the employer is obliged to pay employees for December no later than December 29 (Part 8 of Article 136 of the Labor Code of the Russian Federation). It is simply impossible to issue salaries in January 2021 in such a situation, so as not to violate the requirements of the Labor Code of the Russian Federation.

Note that before paying wages, the employer must first close the time sheet and only then calculate wages. This logic follows from Part 4 of Article 91 of the Labor Code of the Russian Federation. If so, then it would be correct to accrue December salaries only in January 2021.

But, as we have already said, employees may need to pay wages in advance, since the payment deadline falls on weekends and holidays (Part 8 of Article 136 of the Labor Code of the Russian Federation). If you pay the second part of the salary for December later, the employer faces an administrative fine of up to 50,000 rubles. (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Thus, there is some uncertainty in labor legislation. On the one hand, you need to wait until the end of the month and close the timesheet, and on the other hand, you need to make the payment before the end of the month.

In our opinion, if the payment deadline falls from January 1 to January 8, 2021, then the salary for December 2017 must be calculated and paid in December. Moreover, you don’t need to wait until December 29, 2021. Of course, it is possible that in the last days of December workers may get sick or even miss work. And then an overpayment occurs. However, accruing and paying wages before the end of December will be better than being subject to the above-mentioned administrative fine of 50,000 rubles. Moreover, for late payment, the employer may be required to pay monetary compensation to the employees.

We also note that, at the initiative of the employer, it is possible to pay wages for December 2021 ahead of schedule. However, in this case, it will be necessary to issue an order for early payment and familiarize employees with it. See “Order on early payment of salaries for December 2021.”

Severance pay upon dismissal

But is it necessary to pay personal income tax for severance pay? Such a need arises only when the amount of the payment exceeds more than three times the average monthly salary. Otherwise, there is no need to calculate tax on the benefit.

In order to calculate the full amount of tax that must be paid to the state treasury upon dismissal of an employee, you must first identify the full amount of payments. You need to add up wages, compensation for unused vacation and severance pay (in some cases). The resulting amount must be multiplied by a correction factor taking into account the taxation of personal income at 13%.

The resulting figure is equal to the amount of funds that must be transferred to the state at the appointed time.

Some categories of employees are entitled to a special tax deduction, which helps reduce the burden. These categories include parents who provide for the child. Amounts of tax deductions for children:

- 1,400 rubles for the first and second child;

- 3,000 rubles for the third child and subsequent ones.

A complete list of persons who can count on deductions can be seen on the official website of the Federal Tax Service.

When the Tax Code of the Russian Federation requires withholding personal income tax

The Tax Code of the Russian Federation provides that the tax agent (employer) is obliged to:

- calculate personal income tax on the date of receipt of income (clause 3 of article 226 of the Tax Code of the Russian Federation);

- withhold on the day of payment of income (clause 4 of article 226 of the Tax Code of the Russian Federation).

It turns out that the date of receipt of income in the form of salary for December is December 31, 2021 (Clause 2 of Article 223 of the Tax Code of the Russian Federation). But how to apply this rule if the salary was transferred on the last working day of 2017 - December 29? After all, it turns out that on December 29, 2021, the employee has not yet received income in the form of a salary, but the employer has actually already paid him the money.

Based on the results of the analysis of the above norms of labor and tax legislation, it can be concluded that they cannot be “adequately” applied to wages for December. If we talk about other months, then there are no problems: the month is over, the accountant took information from the working time sheet, calculated and issued wages, and withheld personal income tax. But you won’t be able to do this with December salaries, since they may need to be paid out before the end of December. But what then? We offer a solution.

Innovation No. 3. Introduction of new codes for the 2-NDFL certificate

In the coming year, two codes will appear designed to reflect certain types of employee income. This means changes to 2-NDFL from 2021. The new designations are:

- 2002 – bonuses that are related to the employee’s performance and become part of the specialist’s salary.

- 2003 – bonuses paid from the organization’s net profit.

Previously, for the two types of payments given, the code “2000” was used - remuneration received for the performance of official duties.

An issue that will undergo significant adjustments from January 1 is personal income tax deductions in 2021. What changes is the legislator preparing?

Changes affect standard deductions. New codes have been introduced for them:

- 127 – for the first child to parents (adoptive parents);

- 127 – for the second parents (adoptive parents);

- 128 – for the third and other parents (adoptive parents);

- 129 – for a child with a disability of group I or II to parents (adoptive parents).

Additionally, codes 130-133 are used. They are used to reflect tax benefits provided to guardians and adoptive parents. The principle of using values is similar to the one above.

Changes to 2-NDFL 2021 did not affect the rules for providing deductions. As before, before the child reaches adulthood, they are provided in all cases, after - depending on the fact of continuing education. If the child continues his studies at a university, his parents will enjoy the benefit until he turns 24.

The salary “ceiling” for receiving a standard deduction in 2021 is 350,000 rubles. If the parent's income exceeds this amount, he loses the right to the benefit. It disappears when the child dies, turns 18, and graduates from college. In all of the above situations, the deduction ends on January 1 of the following year.

How to determine the date of personal income tax transfer

When should personal income tax be transferred to the budget if salaries were paid to employees in the same month for which they were accrued (for example, for December in December)? It all depends on what was given: an advance or the final salary for the month. But how to distinguish an advance from a salary? You can issue wages for settlement no earlier than the last day of the month, since in order to accrue earnings, you must have a closed time sheet. And it is closed only on the last day of the month. Therefore, consider payments until the last day of the month as an advance.

If the organization issues wages, then transfer the personal income tax no later than the day following the day when the employees received the money (clause 6 of Article 226 of the Tax Code of the Russian Federation). Apply it also if the salary for the current month was paid on the last day of the month. For example, for December they paid on December 31st. Then transfer personal income tax on the first working day of January.

If you give an advance, then you do not need to withhold personal income tax from it. Do this on the last day of the month when income in the form of wages arose (clause 2 of Article 223 of the Tax Code of the Russian Federation). And transfer the tax to the budget no later than the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation). In the case of December salaries, the deadline for paying personal income tax is again the first working day of January.

Salary for December 2021, paid in December

Stella LLC accrued salaries for December 2021 in the amount of RUB 1,300,000. The amount of calculated personal income tax was 169,000 rubles. Salaries were issued on December 29, 2021.

The date when income in the form of wages arises is the last day of the month (Clause 2 of Article 223 of the Tax Code of the Russian Federation). Thus, the employee receives income in the form of salary for December on December 31, 2021. Since the salary was paid earlier than this date (December 29), this is an advance.

Please transfer your salary minus tax. However, according to the law, personal income tax must be withheld not on December 29, but on December 31 - the day when the income actually arose. The tax must be transferred to the budget the next day after the tax was withheld. That is, on the first working day after December 31, 2021 – January 9, 2021.

The maximum amount of advance payments to employees is not limited - a 100% advance can also be issued. Therefore, if an organization issues salaries for December on the 20th, then establish in the organization’s local documents that due to holidays, the amount of the advance payment can be increased to 100 percent. The main thing is that this order is enshrined in documents.

If the employer transfers wages for December to employees before the 29th day (for example, December 25, 26, 27 or 28, 2017). There should be no problems or ambiguities with the transfer of personal income tax. If, for example, the payment is made on December 25, then nothing will change. The tax must be transferred to the budget the next day after the tax was withheld. That is, on the first working day after December 31, 2021 – January 9, 2021.

Early transfer of personal income tax in December 2021

If the salary for December 2021 was paid in December 2017, then it is not necessary to wait until January 9, 2021 (the deadline for paying personal income tax) to transfer personal income tax. January 9, 2018 is the payment deadline. At the same time, there is no prohibition in the Tax Code of the Russian Federation on the transfer of withheld personal income tax before this date. Therefore, you can transfer personal income tax until the end of December 2021. It is impossible to fine a tax agent under Article 123 of the Tax Code of the Russian Federation for early transfer of personal income tax. After all, there is no offense for which liability is provided for in this article. The tax amount has been received by the budget and there is no arrears due to the tax agent. The Federal Tax Service of Russia does not object: it is illegal to fine organizations that pay personal income tax ahead of schedule (letter dated September 29, 2014 No. BS-4-11/19716).

Innovation No. 2. New deadlines for filing income tax reports

Important changes in personal income tax from 2021 are related to the timing of reporting to the Federal Tax Service. The deadline is determined by whether the tax for an individual is fully withheld or not. In the first case, the value “1” is entered in the “Sign” field of the 2-NDFL certificate, in the second - “2”.

Novice accounting professionals often ask how code “2” can appear. Let's look at examples of this situation:

- An employee of the company works in its foreign representative office and spends more than 183 days a year outside the Russian Federation. Initially, his income is taxed at a rate of 13%, but by the end of the year it becomes clear that based on the sum of days of business travel, the specialist must be classified as “non-resident”, which implies the use of a rate of 30%. The law prohibits an accountant from withholding more than half of an employee's income, and therefore part of the income tax may remain unpaid during the year.

- The organization gives a gift, the price tag of which exceeds 4,000 rubles, to a citizen who is not registered in its state. Income tax cannot be withheld; status “2” appears in the certificate.

What is new in fiscal legislation is the deadline for submitting the 2-NDFL certificate. There are two possible options. If the status is “1”, the deadline is 04/03/2017. If the status is “2”, the deadline is 03/01/2017.

6 Personal income tax and civil law agreement

Starting from 2021, personal income tax reporting is submitted in the same order as in 2016. Companies with up to 25 employees can submit it to the Federal Tax Service on paper, the rest - exclusively electronically.

Fines for failure to present a document remain the same – 200 rubles. for one employee. For an error in each document, the company will have to pay 500 rubles.

Salaries issued in January 2017

Perhaps the organization's salary payment deadline falls on the period from the 9th to the 15th of the next month. In this case, you are not required to pay your December salary until the beginning of 2021. But if you want to give employees their salaries ahead of schedule, then you need to issue an order for early payment. See “Order for early payment of wages for December 2021: sample.”

If in January 2021 you pay your salary for December 2017, then personal income tax will be withheld when paying the salary. Income tax must be transferred to the budget no later than the day following the day on which the salary was transferred (clause 6 of Article 226 of the Tax Code of the Russian Federation). Therefore, if the salary for December 2021 was paid on January 9, 2021, the tax must be transferred to the budget no later than January 10, 2021.

Contribution violations and enforcement measures

Failure to meet deadlines and incomplete payment of personal income tax fees are common deviations from the law.

The Tax Code of the Russian Federation provides for sanctions for such violations. The size of the penalty is differentiated by its severity: failure to pay tax entails a fine of 20–40% of the debt amount. In case of deliberate evasion, the upper limit applies. An additional sanction for the offending organization or individual entrepreneur is a fine for each day of delay during the entire period of non-payment. You can appeal fines to the tax office, citing mitigating circumstances. These could be:

- a sincere admission of guilt with the justification of manslaughter;

- technical accounting errors;

- personnel changes in the management apparatus, which occurred at the time of payment of the tax.

The decision of the fiscal service will be influenced by the overall positive reputation of the enterprise in relation to the timely payment of fees and the absence of debts from previous periods. The issues of calculating and withholding personal income tax from resigning employees are not easy, but improving legislation allows them to be successfully resolved.

Conclusion

Next, we summarize the conclusions about the timing of personal income tax transfers from the December salary in the table.

| December salary paid in December | December salary paid in January |

| Transfer personal income tax to the budget on January 9 (the first working day after December 30), 2021. The fact is that personal income tax cannot be withheld until the end of the month. The date of receipt of income in the form of salary is considered to be the last day of the month, even if the entire salary was paid in advance on December 29 | Transfer personal income tax to the budget no later than the day following the day the salary is issued. For example, if employees were paid money on January 9, 2021, the tax must be transferred to the budget no later than January 10, 2021. |