Did you submit 2-NDFL certificates for all your employees to the inspectorate on time, and did the inspection send a request for clarification? Accounting and taxation expert Angelina Volkonskaya told BUKH.1S what they are fined for, what they forgive and how to make corrections to 2-NDFL.

In March and April 2021, all companies were required to send to the INFS income certificates in form 2-NDFL for all their employees, as well as for citizens with whom civil contracts were concluded in 2021. Let us remind you: those who did not submit these certificates or sent them late face a fine of 200 rubles. for each document not submitted (submitted late) (clause 1 of Article 126 of the Tax Code of the Russian Federation). Those who reported the income of their employees on time, of course, will not be fined. But they may face another fine if the tax inspectorate suddenly finds errors in the certificates they receive.

We work on new forms

From 2021, income reporting will be submitted using new forms. The forms are now filled out in two versions: the first is suitable only for the Federal Tax Service of Russia, and the second can be prepared at the request of the employee.

Report forms differ significantly from each other. It is important not to confuse the formats. If you send an outdated or incorrect format to the inspectorate, the tax authorities simply will not accept the report. Penalties will be applied to the violating taxpayer. So pay attention to how to adjust 2-personal income tax for 2021 in accordance with the requirements of the Federal Tax Service.

Current forms are approved by Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 10/02/2018. Fill out the new reporting with information about employee income accrued for 2021. If an organization needs to submit adjustment reports for earlier dates, then fill out the forms corresponding to the reporting periods.

Is it necessary to submit clarifications?

First, the new return with adjustments should not take into account the information in the original return . In other words, the new document must contain only current information; there is no need to make calculations based on the difference between declarations.

You need to submit new papers as if you had not previously submitted any declarations for this reporting period. The only difference between the documents will be the same number - with each new document submitted to the Federal Tax Service, it will increase.

Secondly, making corrections in itself is a necessity if mistakes were made or important details were not taken into account : profitability for the reporting period, the amount of taxes paid and tax deductions, etc. If the initial submission containing factual errors is not corrected during the reporting tax period, the Federal Tax Service may collect a fine or penalty from the entrepreneur.

Thirdly, in most cases, the Federal Tax Service does not require additional clarifications (explanations) to new declarations . As a rule, if there are no significant discrepancies or incorrect calculations in the latest document, the Federal Tax Service simply does not take into account the data in the first declarations. In this case, the last submitted reports are accepted as the main document.

But in a number of situations, providing additional clarification is mandatory or at least desirable:

- If, compared to the initial delivery, the amount of tax deduction has decreased. Even a decrease of 1000-2000 rubles may result in a letter from the Federal Tax Service demanding clarification;

- If the data of the first and final declarations, submitted at approximately the same time, diverge too much - by amounts greater than 10% of the enterprise’s average annual turnover. Clarifications may be required if the initial and final declarations were filed, for example, within one to two months.

Remember that if factual errors are detected, the amount of tax deductions is reduced and other manipulations are made, the head of the enterprise may be fined in accordance with Art. 122 of the Tax Code of the Russian Federation.

Filling Features

To avoid a fine, check the income tax return forms you have already submitted, and if you find any inaccuracies in them, submit a corrected return. Even if there is an inaccuracy in one certificate, it will have to be corrected. Otherwise, the employer faces a fine of 500 rubles.

Consider the specifics of how to submit the 2-NDFL adjustment for 2019 for one employee. If the personal data of employees, for example, last name or passport number and series, has changed after submitting information, clarification is not required (letter of the Federal Tax Service No. GD-4-11 / [email protected] dated March 27, 2018). In addition, the employee is recommended to issue a report on income and income tax with new passport details, and this is not a violation, despite the fact that you reported to the tax authority using old information (letter of the Federal Tax Service No. GD-4-11 / [email protected] dated 03/27/2018).

The updated reporting of the employee's income is submitted in the form that was in force in the period for which the error was discovered. The special adjustment number in the 2-NDFL certificate “99” means that the document submitted for this individual is cancelled. That is, adjustment 99 in the 2-NDFL certificate does not clarify, but completely cancels the data on an individual, for example, in the case of an erroneous filling out of a document for a person who did not receive income in the reporting year. In this case, in the cancellation certificate, the information in sections 1 and 2 is repeated from the one already submitted, and sections 3, 4 and 5 are not filled out.

The procedure for filling out and the form for income received in 2021 by individuals was approved by Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 10/02/2018.

The procedure for correcting errors when calculating personal income tax for an employer

Standard tax deductions can be carried forward to the next month, but only within the same year

Author: Tatyana Sufiyanova (tax and duties consultant)

Every company or individual entrepreneur is faced with the calculation of personal income tax. Especially if they act as tax agents (employers). And here you can often encounter errors that we want to tell you about.

The first mistake is when an organization or individual entrepreneur relieved itself of the obligation to transfer personal income tax and agreed with the employee himself (another individual) so that the tax was paid directly by the citizens themselves. For example, concluding a lease agreement with an individual, performing work (services) for a company by an individual. When concluding contracts of a civil law nature, in the text of the contract itself you can find a condition about who assumes the obligation to pay personal income tax to the budget.

It is worth immediately paying attention to the fact that this is a gross mistake. The agreement does not need to describe the procedure for paying personal income tax. This is the direct responsibility of the company (IP) if they enter into an agreement with an individual. Even if the parties wrote about this in the agreement, this is not a basis for exempting the company (IP) from the status of a tax agent for personal income tax.

As the Federal Tax Service writes in its letter dated January 12, 2015 No. BS-3-11/14, according to paragraphs 1 and 2 of Art. 226 of the Tax Code of the Russian Federation, tax agents are recognized as Russian organizations, individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, as well as separate divisions of foreign organizations in the Russian Federation that are the source of payment of income to the taxpayer, with the exception of income in respect of which calculation and payment taxes are carried out in accordance with Articles 214.3, 214.4, 214.5, 214.6, 226.1, 227, 227.1 and 228 of the Tax Code of the Russian Federation.

Tax agents are required to withhold the accrued tax amount directly from the taxpayer’s income upon actual payment. At the same time, the Tax Code does not provide for specific features of the tax agent’s performance of his duties when paying income to the taxpayer based on a court decision.

The Ministry of Finance also considered a similar issue and noted that a Russian organization that pays rent to an individual for residential premises rented from him is recognized as a tax agent in relation to such income of the individual and, accordingly, must perform the duties of calculating, withholding and transferring tax on the amount to the budget. income of individuals in the manner provided for in Art. 226 Tax Code of the Russian Federation.

The second mistake is when the employer calculates the amount of the standard child tax deduction in proportion to the days worked in the month. For example, an employee was registered for work on May 15, 2021, he immediately presented all the documents to provide him with a standard child deduction for one child in the amount of 1,400 rubles. The employer's accountant provided a deduction for May 2021 not in the amount of 1,400 rubles, but calculated it in proportion to the time worked in May. This is mistake.

This is interesting: Filling out the 6 personal income tax report for 9 months

Based on sub. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation, the standard deduction for the first child is provided in the amount of 1,400 rubles per month and this is a fixed amount. You cannot divide or otherwise calculate the standard deduction for the month. Even if an employee works one working day in a month, he is entitled to a deduction of 1,400 rubles.

The fourth mistake is when the employer's accounting department, at the request or at the request of the employee himself, returns tax for those periods that could not have been deducted. Let's give this example: in April 2021, a company employee brought to work a tax notice for her employer to provide her with a property deduction (she bought an apartment in January 2017). And at work, at the request of the employee, they paid the previously withheld personal income tax for the period from January to March 2021. This is a big mistake.

The procedure for returning to the taxpayer the amounts of personal income tax overly withheld by the tax agent from the taxpayer’s income is established by Art. 231 Tax Code of the Russian Federation.

Refund of tax amounts withheld by the tax agent before receiving from the taxpayer a written application for the provision of property tax deductions and confirmation by the tax authority of the taxpayer’s right to receive these deductions on the basis of Art. 231 of the Tax Code of the Russian Federation is impossible, since the amounts of tax lawfully withheld by the tax agent cannot be qualified as excessively withheld.

Fifth mistake , when personal income tax was transferred by mistake for one or another employee. And after discovering this error, the accountant made amendments the following month. This cannot be done, it was necessary to carry out correct calculations in future periods, and for the amount of overpaid personal income tax it was necessary to submit a refund application to the Federal Tax Service. As advised by the Federal Tax Service of Russia in letter dated 02/06/2017 No. GD-4-8/ [email protected] , clause 9 of Art. 226 of the Tax Code of the Russian Federation establishes that payment of tax at the expense of tax agents is not allowed. Consequently, the transfer to the budget of an amount exceeding the amount of personal income tax actually withheld from the income of individuals does not constitute payment of personal income tax.

In this case, the tax agent has the right to contact the tax authority with an application for the return to the current account of an amount that is not personal income tax and was mistakenly transferred to the budget system of the Russian Federation.

The tax authority, if the specified tax agent has no debt on other federal taxes, shall refund the overpaid amount that is not personal income tax, in the manner established by Art. 78 Tax Code of the Russian Federation.

It should be taken into account that confirmation of the fact of erroneous transfer of amounts according to personal income tax payment details, as well as confirmation of the fact of excessive withholding and transfer of personal income tax, is made on the basis of an extract from the tax accounting register for the corresponding tax period and payment documents in accordance with paragraph. 8 clause 1 art. 231 of the Tax Code of the Russian Federation, and the return to the organization’s current account is carried out taking into account the provisions of paragraph. 2 clause 6 art. 78 Tax Code of the Russian Federation.

In addition, it is possible to offset such erroneously transferred amounts using the personal income tax payment details to pay off debts on taxes of the corresponding type, as well as against future payments for other taxes of the corresponding type.

The sixth mistake is when the accountant transfers standard deductions for the child to the next tax period (year). Standard tax deductions can be carried forward to the next month, but only within the same year.

But if we had such a situation in the period from December 2016 to January 2021, then in this case the amount of unaccounted standard deductions from December would in no way be included in the calculation of wages for January 2021.

How to prepare an adjustment

To make an adjustment means to fill out the information for an individual again, but with the correct information and details. Algorithm for submitting a 2-NDFL adjustment for 2021 in five steps:

- In field No. - the number of the submitted certificate, which contains inaccuracies.

- In the field “from__.___.__” - the date of registration of the clarifying information.

- In the “Adjustment number” field - a number starting with 01. For example, 03 means that you are submitting a third corrected form for this employee.

- Indicators (information) in which an error was made in the previously provided forms should now be indicated correctly.

- Indicators (information) that did not contain errors in the previously provided certificates should be duplicated.

How to avoid fines

So what should we do? Wait for the desk audit report? Of course not. We submitted the initial certificates and met the allotted deadline. This means that two hundred rubles have already been “saved” for each employee.

Now, without haste, we check each document again. There is no specific deadline for submitting adjustments, but you must meet the deadline before receiving the results of the tax inspector’s desk audit.

Since 2021, there are two types of clarifying certificates:

- Cancelling;

- Corrective.

How to check reporting information

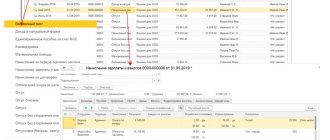

Before sending the corrected information to the tax office, you need to check the information. How to correctly check a report, what to compare information with - consider important recommendations:

- Information on income and deductions must match the organization’s accounting data. Check the information on the income tax certificate with the employee’s personal card. Also monitor the indicators of payroll records and wage journals. The information must match the monthly accounting data.

- If, in addition to wages and remuneration for labor, other types of income are accrued to employees, then it is necessary to include information in the 2-NDFL adjustment. Example: an organization pays dividends to subordinates, distributes profits, or pays for health packages. Include such income in the 2-NDFL certificate according to the appropriate income code.

- Different tax rates apply to different categories of income. For each rate you will have to draw up a separate 2-NDFL certificate.

- Similar rules apply to the adjustment attribute field in the 2-NDFL certificate. If the tax is withheld by the employer on time, then indicator “1” is indicated. If it is impossible to withhold income tax, then sign “2” is indicated in the 2-NDFL certificate.

- The deadlines for submitting reports for various characteristics of a taxpayer have been equalized. Report by March 1 of the year following the reporting year. If the due date falls on a weekend, submit the form on the first working day.

IMPORTANT!

Deductions and benefits for personal income tax are documented. Applications, certificates of study, birth certificates and other papers must be collected annually from subordinates. Based on the received certificates, adjust the benefits and deductions provided.

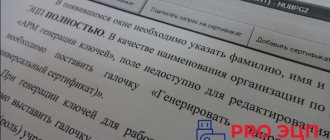

How to make a 2-NDFL adjustment in “Taxpayer”

The described algorithm of actions when entering clarifying information is the same both for providing corrections on paper and using any software products. This is 1C, online services, free software of the Federal Tax Service “Taxpayer Legal Entity”. The modern 2-personal income tax adjustment for 2021 is presented in any way of the taxpayer’s choice.

Specialized services offer detailed instructions on how to correct an error in 2-NDFL for 2021, tips on filling out reporting and adjustment forms. Carefully study the recommendations for using the services.

It is permissible to send corrections to certificates through the taxpayer’s personal account. This requires registration of the company on the official portal of the Federal Tax Service. Submission of reports requires an electronic signature.