An individual entrepreneur can pay his taxes and insurance premiums without leaving home and without first visiting an inspector. Paying taxes for individual entrepreneurs online is available to everyone, including those who do not have profiles on the government services portal or the Federal Tax Service website. There are a variety of payment methods - an entrepreneur's current account, an individual's card, electronic wallets and even a mobile phone account.

Frequency of tax payments for individual entrepreneurs on different taxation systems

The frequency of payment for each type of tax is prescribed in the Tax Code (TC) of the Russian Federation. The types of taxes that an individual entrepreneur must transfer to the budget depend on the taxation system he has chosen, and each of them is regulated by the same code.

Types of taxes for each taxation system and the frequency of their payment are regulated by the Tax Code of the Russian Federation

In 2021, individual entrepreneurs have five tax regime options available to choose from:

- General taxation system (GTS).

- Simplified (USN, “simplified”).

- Unified tax on imputed income (UTII, “imputed income”).

- Unified Agricultural Tax (USAT).

- Patent taxation system (PSN, patent).

Don't have time to read the article?

Get an initial consultation from several companies for free

: fill out an application and the system will select suitable companies!

74 companies are connected to this service

Start selection in a few clicks >

One of the axioms in the science of starting your own business competently is the need to carefully study the taxation system and rules. It is advisable to acquire this knowledge before registering yourself as an individual entrepreneur.

It is necessary to thoroughly understand the taxes that are levied on the category of individual entrepreneurs you have chosen. But don't worry. If you don’t yet know everything about paying taxes as an individual entrepreneur, let’s understand the fundamental principles together.

Frequency of payment of taxes for individual entrepreneurs on the OSN

The general taxation regime is characterized by the maximum number of taxes. The individual entrepreneur using it must pay:

- Personal income tax (NDFL).

- Value added tax (VAT).

- Property tax if used in commercial activities.

Individual entrepreneurs pay personal income tax on their income four times a year - quarterly - according to the following scheme:

- July 15 - simultaneously based on the results of last year and the first advance for the current year (these are two different payments made according to separate documents);

- October 15 - second advance for the current year;

- January 15 of the following year - the third advance for the previous year;

- July 15 - simultaneously the balance of personal income tax for the previous year and the first advance for the current one.

The amounts of all three advances are calculated by the tax inspectorate based on the individual entrepreneur’s information about the first income from the beginning of the year; the remaining amount due at the end of the year is determined by the individual entrepreneur himself when filling out a declaration, which is submitted once a year.

VAT is calculated based on the results of the quarter, but is paid monthly - in equal parts until the 25th day of each month of the new quarter. For example, for the second quarter of 2021, an individual entrepreneur will have to make three payments:

- one third of the amount – until July 25, 2021;

- another third - until August 27;

- the balance of the amount is until September 25.

Property tax is paid once a year - until December 1 of the following reporting year based on a notification from the tax office.

Frequency of payment of taxes for individual entrepreneurs on a “simplified” basis

An individual entrepreneur using the simplified tax system pays a single tax on his income due to the use of a simplified taxation system. It is transferred to the budget quarterly:

- until April 25 - for the first quarter;

- until July 25 - for the first half of the year;

- before October 25 - nine months;

- until March 31 of the following year - based on the results of the past year.

Frequency of payment of UTII for individual entrepreneurs

“Imputed” tax is also paid quarterly:

- for the first quarter - until April 25;

- for the second - until July 25;

- for the third - until October 25;

- for the fourth - until January 25 of the following year.

Procedure for payment of Unified Agricultural Tax for individual entrepreneurs

The unified agricultural tax is paid twice a year:

- until July 25 - for the first half of the year;

- until January 25 of the following year - for the second.

Deadlines for paying taxes for individual entrepreneurs on a patent

The timing of payment for the cost of a patent depends on the period for which it is purchased. An individual entrepreneur has the right to buy a patent for a period of one to twelve months within one calendar year. So, if an individual entrepreneur acquires a patent for the period from July of the current year, then its validity period will be a maximum of six months - from July to January inclusive. But if you purchase a patent from January - up to 12 months.

The validity period of the patent also determines the frequency of payments:

- for a period of one month to 90 days - no later than 40 days from the beginning of the patent;

- for a period of 90 days or more - the first third of the cost of the patent within 90 days from the beginning of its validity, the balance of the amount - until the expiration of validity.

Payment of personal income tax for employees

When an individual entrepreneur has at least one employee, including under a civil contract, regardless of the taxation system applied, the businessman becomes a tax agent for such employees. This means the obligation to withhold personal income tax from the accrued salary, remuneration or other payments at a rate of 13% and transfer it to the budget.

Personal income tax for an employee is paid every month until the 15th day of the next month: until February 15 from salaries accrued in January, until March 15 for February payments, etc.

Video: what taxes does an individual entrepreneur pay?

Is it possible to get a fine for working in a city other than your own?

Penalties may be applied if:

Fines

- no patent received;

- registration as a UTII payer was ignored;

- taxes and insurance payments are overdue.

Important! To avoid costs, it is better to familiarize yourself with all the requirements immediately. By working honestly, you won’t have to pay hefty fines.

After a citizen has received the status of an individual entrepreneur in a certain region, he can do work in another region without re-registering with the simplified tax system, OSNO and unified agricultural tax. When the chosen payment scheme is PSN or UTII, you need to register in the new territory. For violation of the registration procedure and non-payment of taxes and contributions, the Federal Tax Service has the right to apply fines.

Where should individual entrepreneurs pay taxes in 2021?

The recipient of taxes transferred by an individual entrepreneur to the budget is the tax office at the place of his registration.

It is best to accurately determine the recipient of payments using the “Pay Taxes” service on the website of the Federal Tax Service (FTS) of Russia. It also allows you to generate a payment document with the exact details of the required Federal Tax Service inspection (IFTS).

Home page of the “Pay taxes” service on the website of the Federal Tax Service of Russia

Receipt for payment of individual tax

To pay taxes and transfer other payments to the budget, for example, state duties, fees, fines, etc., in 2021, a receipt of the PD-4sb form is used, the form of which can be found on the website of the Federal Tax Service of Russia.

When using it, you must take into account that a separate receipt is used for each payment to the budget; several payments cannot be made at the same time.

The receipt must indicate:

- OKATO and OKTMO codes of the municipality according to the All-Russian Classifier of Objects of Administrative-Territorial Division, the budget of which will receive money. You can find them out using the service on the website of the Federal Tax Service of Russia.

- BCC, which is different for each type of payment. When filling out, you need to pay attention to the 14th symbol. If tax is paid, there should be a “1” there. Options “2” and “3” are provided for penalties and fines, respectively. The current 2021 list of BCCs for taxes and obligatory payments of individual entrepreneurs can be viewed on the website of the Federal Tax Service of Russia.

- Payer's TIN. In the case of an individual entrepreneur, the TIN that was assigned to him as an individual is given.

- The name of the payer in the corresponding field of the receipt is determined by how the payment is made. If on behalf of an individual in cash or from an account opened for an individual, only full name is indicated. When money is transferred from the current account of an individual entrepreneur, his full name is indicated, for example, “Individual entrepreneur Sidorov Ivan Petrovich.”

The OKTMO search form on the website of the Federal Tax Service of Russia is intuitive for the user

Payments for employees

When an individual entrepreneur hires his first employee, the entrepreneur turns into a tax agent for the payment of personal income tax. In other words, from now on the individual entrepreneur must calculate, withhold and pay income tax. In addition, it now contains monthly, quarterly and annual reports in this area, as well as the transfer of insurance premiums to the relevant funds.

To correctly calculate and pay taxes, individual entrepreneurs now need the help of a professional accountant. After all, the punishment for a mistake becomes even more serious than it could be when paying taxes “for yourself.” And for each employee you need to calculate not only personal income tax (13%).

Only for insurance funds it is necessary to calculate and enter:

- pension contributions - 22%;

- social security contributions - 2.9%;

- payment for health insurance - 5.1%;

- payment for injury insurance - 0.2–8.5% (set depending on the type of activity of the individual entrepreneur).

The natural desire not to inflate the staff (per unit of full-time accountant) here comes into conflict with one of the basic laws of business. The manager of the entire project should be able to delegate part of his load, and not try to pull the whole load on himself. In this case, the best option would be to invite a remote accountant.

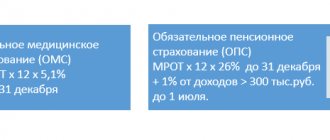

Procedure and deadlines for paying fixed contributions to individual entrepreneurs

In 2021, tax inspectorates accept from individual entrepreneurs not only taxes themselves, but also mandatory social contributions, the administrator of which was previously the Pension Fund.

The timing of their transfer remains flexible:

- fixed payments not tied to the income of the individual entrepreneur and the fact of his activities, the amount of which in 2021 is 26,545 + 5,840 rubles, are payable until December 31 of the current year;

- payment to the Pension Fund in the amount of 1% of the annual income of an individual entrepreneur in excess of 300 thousand rubles - until July 1 of the next year.

In practice, it is more profitable for individual entrepreneurs to make payments within the same time frame as paying taxes. In this case, he has the right to reduce the amount of tax by the amount of such payment made in the same tax period for which the tax or advance payment is paid. So, if an individual entrepreneur pays taxes quarterly, it is beneficial for him to make deductions for himself at the same frequency.

To pay contributions, individual entrepreneurs use the following KBK:

- 182 1 0210 160 - for mandatory contributions for yourself to the Pension Fund;

- 182 1 0213 160 - for contributions to compulsory health insurance;

- 182 1 0210 160 - for 1% of annual income over 300 thousand rubles.

An individual entrepreneur can pay fixed contributions using the Federal Tax Service website. To do this, in step 4 of the instructions given earlier, you need to enter the corresponding value in the field for KBK and press the Enter key. The system will select the remaining values automatically.

Further steps must be taken in full accordance with the instructions.

You can also pay contributions through the Sberbank Online system and the Sberbank mobile application (if there is a QR code), a bank cash desk, a Sberbank terminal, through a client bank from your business account or by transferring a payment to the bank where the current account is opened.

Video: about fixed contributions of individual entrepreneurs in 2021

How to find out about debts

Since the Russian Post, like the Federal Tax Service itself, does not always work properly and deliver receipts on time, the responsibility for timely payment of taxes falls on the shoulders of the citizen himself. This leaves many taxpayers wondering whether liens are accumulating on their account. There are several ways to reliably answer this question:

- visiting the Federal Tax Service office;

- request by mail;

- using your personal account on one of the sites mentioned above (Government Services, Sberbank Online, etc.).

Also, if you have a TIN number, you can get up-to-date information about debts using a payment system such as Qiwi.

Qiwi wallet provides tax payment services

Reference. To avoid mortgages, it is strongly recommended to transfer money to the Federal Tax Service in advance. Each payment method has its own costs and there is no need to talk about crediting funds on the day of the financial transaction.

You can read below about which services allow you to pay taxes without commission.