Have you ever tried to ask the government for something? Benefits, allowances, deductions? Officials will find thousands of reasons to refuse courtesy, as if their personal money is involved. You will have to fight to defend your rights, spend money on lawyers - sometimes without hope of success. But just try not to pay the state what is rightfully due to it! A well-coordinated mechanism will come into play: the Federal Tax Service, investigative authorities, court, bailiffs.

But there is always a temptation to check: what will happen if you evade paying taxes? How quickly will criminal liability occur? And will it ever come to that? And are there any statute of limitations beyond which it is no longer possible to file a claim? We have put together scattered information especially for you. Forewarned is forearmed.

a large fine is imposed for non-payment of taxes by an individual or an attempt to

(up to $100,000) and/or

imprisonment

(up to 5 years). Additionally, expenses incurred by the state for the criminal prosecution of the person are recovered.

Penalty size

The tax office itself calculates penalties, so you don’t have to waste your time on calculations.

But it’s still useful to know why they require penalties from you and how they were calculated for you. This way you can estimate your expenses in advance if you suddenly missed a deadline, and you can even check the tax office. Penalties are calculated for each day of delay - the longer you do not pay, the more penalties will be charged. If the amount of the debt and the duration of the delay are small, few penalties will be charged: 0.72% of the tax for the month of delay.

The key rate is set by the Central Bank. Take into account the one that was valid during the period of delay. You can find it on the website of the Central Bank of the Russian Federation. From September 17, 2021, the key rate is 7.5%, and from December 17 - 7.75%.

Penalties begin to accrue the day after the deadline for payment expires, and end on the day you remit the tax. That is, for the day when you paid the debt amount, there will be no more penalties. This position is shared by the Ministry of Finance in a letter dated July 5, 2021, and the Tax Service in a letter dated December 6, 2017.

For example, October 25 is the last day to pay taxes, and you transferred the money only on October 29. Penalties will be accrued for 3 days - October 26, 27 and 28.

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. The service will prepare reports, calculate taxes and free up time for useful things.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Are there any statute of limitations for paying taxes?

According to Article 113 of the Tax Code of the Russian Federation, the general statute of limitations is 3 years from the date of commission of the offense

until it is identified or from the date of completion of the inspection until prosecution. But if an individual actively opposed the Federal Tax Service, the calculation of time is interrupted.

Another side of the coin is the period during which fines calculated on the basis of the Tax Code of the Russian Federation can be collected. According to Article 115 of the Tax Code, the Federal Tax Service has 6 months from the day following the deadline specified in the request for payment of funds.

But if the deadline is missed for a good reason, the court can restore it

. Do you think our servants of the hammer and mantle will meet the valiant workers of the Federal Tax Service?

Calculation of penalties using an example

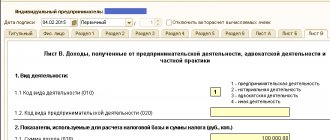

Until October 25, Nikita must pay an advance payment under the simplified tax system for 9 months—50 thousand rubles. But he waited for payment from the client and transferred the tax only on November 1. We will calculate penalties for 6 days of delay.

First, we look at the key rate on the website of the Central Bank of the Russian Federation - since December it has been 7.75%. Now let’s substitute everything we know into the formula:

7.75% / 300 * 50,000 * 6 days = 75 rubles.

This amount will have to be paid along with the tax amount.

In fact, few people count penalties manually. It is more convenient to use a calculator.

Violations of accounting rules

A number of violations that lead to sanctions under Art. are directly related to income tax. 120 Tax Code of the Russian Federation. This refers to gross violations of the procedure for accounting for expenses, income and taxable items. These include (clause 3 of article 120 of the Tax Code of the Russian Federation):

- missing primary;

- lack of tax accounting registers;

- constant (more than one case during the year) errors in recording transactions in tax registers.

Even if there is no distortion of the tax base, the following may be punished:

- for 10,000 rubles. (Clause 1 of Article 120 of the Tax Code of the Russian Federation), if violations were present during one tax period (year);

- for 30,000 rub. (Clause 2 of Article 120 of the Tax Code of the Russian Federation), if they occur over more than one tax period (year).

If such violations lead to an underestimation of the tax base, the fine will be 20% of the underpaid tax - at least 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation).

Penalties for LLCs from October 1, 2021

Since October 1, penalties for LLCs for long delays have increased. If you do not pay tax for more than a month, then from the 31st day the penalties will become twice as large.

The World of Socks organization did not pay the simplified tax system for the 1st quarter of 2021 until April 25. And for 40 days now she has been in debt of 20 thousand rubles. Here is how penalties for this delay are calculated:

For 30 days of delay = 7.25%/300 x 20 thousand x 30 days = 145 rubles.

For 31-40 days of delay = 7.25%/150 x 20 thousand x 10 days = 96.67 rubles.

In total, for 40 days of delay, Mir Socks LLC will pay 241.67 rubles in penalties.

The new rules apply only to late payments that occurred after October 1.

Nothing changes for individual entrepreneurs. Even after a month of delay, they pay 1/300 of the key rate.

Who should pay what taxes?

Every citizen who owns property is required to pay the following types of taxes:

- transport;

- property;

- land.

The amounts of these taxes fill the local budget and go towards the implementation of government programs. Personal income tax is deducted for working citizens, but in some cases people must pay this contribution themselves.

Individuals learn about the need to pay annual fees for their property from notifications. To receive them, you must submit an application to the Federal Tax Service. If you do not do this, you will not receive letters from the tax office, but you will not be exempt from paying contributions.

You can receive notifications in the taxpayer’s Personal Account, which can be registered on the official website.

Individual entrepreneurs and legal entities have a higher tax burden. They pay income taxes for employees and for themselves and pay a single fee. Some tax systems provide for VAT. Under the simplified tax system, a popular tax scheme for LLCs, there is no such payment. Each organization independently decides according to which scheme it will pay taxes and report on its activities.

Tax inspector fines

The tax inspectorate may impose a fine in addition to penalties. But you won't be fined just because you missed a deadline. To impose a fine, you must incorrectly calculate the tax and underestimate it. This is explained by the Supreme Arbitration Court in paragraph 19 of the resolution.

- If you pay tax later than necessary, but in the correct amount, only penalties will be charged.

- If you underestimate the tax in your return and pay this amount, the tax office will charge additional taxes, penalties and fines.

The amount of the fine is fixed; it is charged not for days of delay, like penalties, but for the violation as a whole. The fine for non-payment of tax is 20% of the debt amount if the tax was not underestimated on purpose, 40% if it was intentionally underestimated.

Fines for failure to submit or failure to comply with reporting deadlines

Enterprises and entrepreneurs (IE) are required to submit reports to the Federal Tax Service, for violation of deadlines or failure to submit reports within a certain period of time, the Tax Code of the Russian Federation has established sanctions.

For late submission of a tax return or reporting of insurance premiums, the taxpayer faces a penalty for each month of absence, full or partial, in the amount of 5% of the tax or contribution that is not paid on time. This is stated in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation. The minimum penalty is 1000 rubles, the maximum is 30% of the unpaid fee or contribution.

A company that fails to submit other fiscal statements on time faces the following sanctions:

1. For each month of missing personal income tax reporting, the fine will be 1,000 rubles.

2. For enterprises that are late to report, the amount of the administrative fine for late submission of the transport tax return for 2021, established by Art. 15.5 of the Administrative Code, for a manager it is 300–500 rubles.

3. Expiration of the time allotted for submitting reports threatens with a fine for failure to submit a single declaration on time in 2021 in the amount of 1000 rubles, this amount is established in clause 1 of Art. 119 of the Tax Code of the Russian Federation.

4. An enterprise that has committed a violation may be subject to an additional measure of liability for late submission of a VAT return - blocking of the current account. The tax authorities will make a decision if the delay exceeds 10 working days. The norm is established by clause 2 of Art. 76 Tax Code of the Russian Federation.

For failure to comply with the reporting period, it is possible to hold an official of the enterprise accountable - he faces a warning or financial sanctions. If the violation is committed by the head of a state or municipal body, a notary, under Art. 15.6 of the Code of Administrative Offenses of the Russian Federation, the fine for a manager for late submission of reports and failure to provide information necessary for the authorities to carry out control functions ranges from 500 to 1000 rubles.

Refusal to provide Federal Tax Service employees with documents requested during an inspection is considered a violation, as stated in paragraph 4 of Art. 93 Tax Code of the Russian Federation. For business entities, the fine for failure to provide documents and information at the request of the tax office in 2021 is determined by Art. 126, 126.1 and Art. 129.1 Tax Code of the Russian Federation:

- 200 rub. for 1 unsubmitted document;

- 500 rub. for an incorrect document (the tax agent is fined);

- 5000 rub. for unlawful failure to report information;

- 20,000 rub. for repeated similar violation.

It is useful to remember about penalties and fines

- The tax office charges penalties if taxes and fees are not paid on time.

- Penalties are calculated for each calendar day of delay. The amount of penalties is approximately 10% per annum of the debt amount for an individual entrepreneur and about 20% for an LLC.

- From October 1, 2021, LLCs from 31 days of delay will pay twice as many penalties as before.

- In addition to penalties, the tax office may charge a fine. But to do this, you need to calculate the tax incorrectly and show an underestimated amount in the declaration. For simply missing a deadline, you only face penalties.

The Tax Code of the Russian Federation under the concept of “non-payment of tax” implies several situations

- Partial payment of due taxes,

- Complete tax waiver

- Incorrect calculation of tax amount,

- Intentional reduction of the tax base,

- Late submission of income declarations.

Let's start by understanding what taxes we most often encounter in life as individuals, and what responsibility is provided for failure to pay them on time to the state. All figures are current for 2021.

Criminal liability

Officials may also be subject to additional liability—criminal liability. According to Article 199 of the Criminal Code of the Russian Federation, for late submission of reports, false information in the declaration or non-payment of taxes, one of the penalties may follow:

- A penalty imposed on the organization as a whole. Its amount will depend on the court decision - from 100 to 300 thousand rubles. As an alternative type of punishment, but imposed only on the head of the company, arrest and a ban on holding certain positions may be applied. Sometimes officials are prohibited from conducting business activities in a certain area.

- If the company evaded paying taxes for more than 3 years or the income was hidden by a group of people (for example, an accountant and a manager), then the fine will be more from 200 to 500 thousand rubles. In some cases, the court may recover 1-3 years of income in full or imprison officials involved in this crime.

The general director is most often responsible for committing this crime, since it is believed that since he is the one who signs the declaration, he must bear responsibility for the information himself. Under certain circumstances, when, during an inspection by the economic security department of the police, facts emerged that other officials were involved in the crime, not only the director of the company, but also the accountant, auditor, lawyer, founders and other employees may be held accountable.

Individuals are also subject to liability in accordance with Article 199 of the Criminal Code of the Russian Federation. It may occur if more than 1,800,000 rubles of payments are not transferred to the budget. A particularly large amount includes amounts of 3 million rubles (with only a fifth of taxes included) or 9 million.

At the same time, the court is also influenced by the following mitigating circumstances:

- unintentional failure to pay taxes;

- cases of force majeure;

- disease;

- lapse of time.

Tax evasion cases are subject to a statute of limitations of 3 years. After its expiration, no type of liability arises. However, the Federal Tax Service submits documents to law enforcement agencies or the court quite quickly. Therefore, in most cases, the statute of limitations does not have time to expire.

Definitions

An income tax fine is a sanction for late filing of a declaration or if the documents are filled out incorrectly.

Postings – accounting display in the register, tax accounting of all financial receipts and write-offs.

A payment order is a document that accompanies all debits and additions of an accounting type.

A penalty is one of the types of sanctions that is applied to a violator.

Whose fault is it if the notification from the Federal Tax Service did not arrive?

Failure to provide notice does not exempt you from paying taxes.

If you own property, but the notification from the tax office did not arrive until November, then you should not rejoice. Since the beginning of 2015, Russians must themselves report the availability of land or apartments. The fine is 20% of the unpaid amount. No matter how hard you try to prove that it is not your fault, it is unlikely to be possible.

But what if you have registered property, but notifications from the Federal Tax Service simply do not arrive? Receipts are sent out in advance - until mid-October. They reach recipients no later than the first days of November. If you do not see a notice in your mailbox, then you need to contact the Tax Service yourself and pay all fees before December 1. Otherwise, the Federal Tax Service will impose a fine.

Types of taxes

There are significant differences between the taxation of citizens of a country and organizations.

Basically, individuals are concerned with contributions on their existing property and profits. Personal income tax (NDFL) is paid by the employer.

Mandatory monetary contributions to the treasury of the powers include the following:

- to the ground;

- transport;

- on property.

Every resident of the country who officially owns real estate is required to pay a property fee. To do this, he applies to the Federal Tax Service (FTS) and a personal account is registered for him. An account is also opened to which he will transfer finances. The person is notified in writing by sending information by mail to the place of registration.

If a person does not contact government authorities, he will not be informed about the assessment of taxes.

NOTE! Failure to report to the Federal Tax Service does not eliminate mandatory contributions and penalties.

Individual entrepreneurs, LLCs and legal entities make the following contributions:

- Personal income tax for each employee;

- from all receipts;

- for added value;

- for transport;

- land;

- insurance premiums.

Penalties for evading mandatory payments to the state will not increase this year, however, control by the civil service will remain strict.

The legislative framework

The law of the Russian Federation provides for the payment of contributions to the state by all persons, regardless of the size of their income.

Refusal to comply with or ignorance of the relevant legal norms regulated by the Tax Code of the Russian Federation leads to monetary sanctions or even imprisonment. The Code of Administrative Offenses and the Criminal Code of the Russian Federation provide for various measures of influence depending on the severity of the crime. The legal liability of persons of any type of activity differs significantly from each other. This depends on the different amounts of contributions they make.

The Tax Code defines the following concepts of “tax evasion”:

- refusal to pay the amount in full;

- submitting the report later than the agreed date;

- partial payment;

- erroneous payment calculation (independent);

- reduction in base rates.

The latter type applies to all citizens.

Cases when penalties are not charged

- In the event that the taxpayer’s property or bank accounts are seized, and therefore he cannot use his funds. But penalties are not charged only for the period during which these restrictions apply.

- If the taxpayer delayed payment of the duty due to the fact that he followed the explanations or instructions that were given to him from the tax authorities. It is important that all the data provided to him is true and accurate. If the debt is nevertheless accrued to the account, then in this case the payer has the right to file a claim with the court to review the amount of the penalty.