Due date for October 2021

The tenth month of 2021 usually marks the submission of quarterly reports to the Federal Tax Service on taxes and fees and calculations of contributions for injuries to the Social Insurance Fund.

In addition to quarterly reporting forms, employers are required to submit personal information about insured persons to the Pension Fund of the Russian Federation. Unified deadlines for submitting reports according to the accountant’s calendar for October 2020 in the table:

| Deadline | Reporting form | Where to take it | Recommendations for filling |

| Monthly reporting forms | |||

| 15.10.2020 | SZV-M for September | Territorial branch of the Pension Fund | Include in the report all employees with whom employment contracts and civil contracts have been concluded. All employees should be included in the SZV-M, even if they were not paid wages during the reporting period. For example, an employee has been on unpaid leave for the entire month or has fallen ill, but has not yet provided a certificate of incapacity for work. |

| 15.10.2020 Important! In case of dismissal or hiring, the SZV-TD should be submitted to the Pension Fund no later than the day following the day of approval of the order of hiring/dismissal. | SZV-TD for September | Territorial branch of the Pension Fund | Include in the reporting only those employees for whom personnel changes have occurred, or if the employee has requested an extract from his work history or submitted an application for the procedure for maintaining a work record book. |

| 28.10.2020 | Income tax return for September | Inspectorate of the Federal Tax Service | Monthly submission of income tax returns is provided for OSNO taxpayers who pay tax based on actual profits. |

| Quarterly reporting forms | |||

| 20.10.2020 | Paper calculation 4-FSS for the 3rd quarter | Territorial branch of the FSS | Only policyholders who have made payments to 24 or fewer employees have the right to report their insurance premiums for injuries on paper. If there are more than 25 people on staff, you cannot submit 4-FSS on paper. |

| 20.10.2020 | Declaration on UTII for the 3rd quarter | Inspectorate of the Federal Tax Service | All taxpayers using imputation are required to report on UTII. Fill out the report based on data for the 3rd quarter of 2021 (from July to September). Do not include information for previous quarters in your declaration. |

| 26.10.2020 | VAT return for the 3rd quarter of 2020 | Inspectorate of the Federal Tax Service | All OSNO taxpayers are required to file a VAT return. In addition, reports are submitted:

|

| 26.10.2020 | Electronic calculation of 4-FSS for the 3rd quarter of 2021 | TO FSS | Prepare 4-FSS in electronic form. Include in your calculation all types of benefits to employees, including those subject to personal injury contributions. Separately provide information about settlements with the fund. Don't forget to include information about mandatory medical examinations and special medical conditions. |

| 28.10.2020 | Income tax return for the 3rd quarter of 2021 | Inspectorate of the Federal Tax Service | All taxpayers report to OSNO (legal entities). |

| 30.10.2020 | DAM for the 3rd quarter of 2021 | Inspectorate of the Federal Tax Service | All policyholders are required to submit calculations for insurance premiums. Include in the calculation information about wages and other remuneration for work, the amount of accrued and paid insurance premiums. |

All reporting until October 1, 2021

Apply for excise tax refund

Submitting an application for tax refund indicating bank account details for transferring funds and submitting a bank guarantee.

Submit an application for refusal of VAT exemption or its suspension

Submission of an application: • for refusal of VAT exemption; • on suspension of the use of VAT exemption.

Report to statistics on the level of prices in the housing market

Information on the price level in the housing market (form N 1-Рж) The report form is established by Order of Rosstat dated 05.08.2016 N 390

Report to statistics on salary arrears

Information on overdue wages (form N 3-F). The report form is established by Rosstat Order No. 485 dated 08/06/2018 until October 2, 2019

Report to statistics using form 3-farmer

Information on the production of livestock products and the number of livestock (form N 3-farmer). The report form is established by Rosstat Order No. 545 dated August 24, 2017.

Report to harvest statistics

Information on the harvest of agricultural crops (form N 2-farmer) The report form is established by Order of Rosstat dated 08/24/2017 N 545 Information on the harvest of agricultural crops (form N 29-СХ) The form is established by Order of Rosstat dated 04/08/2016 N 387

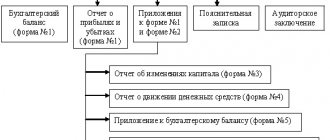

Accounting statements in October

State employees are required to submit accounting reports in October 2020 for the past 9 months. The composition and content of accounting records for public sector institutions is determined by:

- Instruction No. 33n - for budgetary and autonomous institutions;

- Instruction No. 191n - for government institutions and authorities.

Commercial organizations are not required to prepare interim financial statements, but many accountants prepare a balance sheet for 9 months of the year. This allows:

- Identify counting and arithmetic errors in accounting.

- Correct any shortcomings.

- Find unrecorded transactions and facts of economic activity.

- Initiate reconciliations of mutual settlements with counterparties.

- Reduce the amount of overdue debt at the end of the year.

- Eliminate overpayments and arrears of taxes and contributions.

- Eliminate arrears in personnel remuneration calculations.

The preliminary balance sheet is drawn up according to general rules. There is no need to approve the report or submit it to the tax authority.

until October 10, 2021

Report to statistics on the remuneration of workers in culture, healthcare, education, science and social services

Information on the number and remuneration of cultural workers by personnel category (Form N ZP-culture) Information on the number and remuneration of healthcare workers by personnel category (Form N ZP-health) Information on the number and remuneration of education workers by personnel category (form N ZP-education) Information on the number and remuneration of employees of organizations carrying out scientific research and development, by personnel category (form N ZP-science) Information on the number and remuneration of workers in the social service sector by category of personnel (form N ZP- social) Report forms are established by Order of Rosstat dated December 27, 2018 N 781.

Report to statistics on the movement of goods

Statistical form “Accounting for the movement of goods” The form was approved by Decree of the Government of the Russian Federation of December 7, 2015 N 1329

Report to statistics on investment activity

Survey of investment activity of organizations (Form N IAP) The report form is established by Order of Rosstat dated August 30, 2017 N 562

Mandatory payments October

In addition to reporting, the accountant’s calendar for October 2020 also provides for the payment of mandatory payments to the budget and extra-budgetary funds. Payment deadlines:

| Insurance contributions to the Federal Tax Service and Social Insurance Fund for September 2021 | Until 15.10.2020 |

| Income tax for 9 months of 2021 | Until October 28, 2020 |

| VAT - first third for the 3rd quarter of 2021 | Until October 26, 2020 |

| UTII for the 3rd quarter of 2020 | Until October 26, 2020 |

These are generally accepted deadlines for paying taxes and contributions. But due to the coronavirus epidemic, payment dates for small and medium-sized businesses have been postponed.

New payment deadlines for SMP due to coronavirus

| Income tax | 08/28/2020 - 1st payment for the 2nd quarter. 09/28/2020 - final tranche for 2021, 3rd payment for the 1st quarter, 2nd payment for the 2nd quarter. 10.28.2020 - tranche based on the results of the 1st quarter, 3rd payment for the 2nd quarter. November 30, 2020 – payment based on the results of the 2nd quarter. |

| Tax under the simplified tax system for organizations | 09.30.2020 — final tranche for 2021 10.26.2020 - payment for the 1st quarter. 11/25/2020—semi-annual payment. |

| Tax under the simplified tax system for individual entrepreneurs | 10.26.2020 - payment for the 1st quarter. 10.30.2020 — final tranche for 2021 11/25/2020—semi-annual payment. |

| Unified agricultural tax | 09.30.2020 - final payment for 2021 11/25/2020—semi-annual payment. |

| UTII | 10/26/2020 — tax for the 1st quarter. 11/25/2020 — tax for the 2nd quarter. |

| Property tax, transport and land | 10/30/2020 — advance payments for the 1st quarter. 12/30/2020 — advance payments for the 2nd quarter. |

| Insurance premiums | 10.15.2020 - for March. 11/16/2020 - for April and June. 12/15/2020 - for May and July. |

| Insurance premiums for individual entrepreneurs for themselves | 02.11.2020 — additional payment for 2021 |

| Personal income tax on individual entrepreneur income | 10/15/2020 – tax for 2021 10.26.2020 - payment for the 1st quarter. 11/25/2020—semi-annual payment. |

| PSN | Patent payment deadlines for the 2nd quarter have been postponed by 4 months. For example, if the patent indicates a deadline of 04/01/2020, pay 08/03/2020, and if 06/30/2020, then the new deadline is 10/30/2020. |

For organizations and individual entrepreneurs included in the SME register as of 03/01/2020, whose main activity according to the Unified State Register of Legal Entities (USRIP) is on the list of affected industries, the deadline for paying taxes has been extended and automatic installments have been provided. Pay taxes and contributions gradually - 1/12 of the amount due. Payment due date is no later than the last day of each month, starting from the month following the one in which the new payment due date occurs.

until October 7, 2021

Report to statistics on product production using Form 1-IP (months)

Information on the production of products by an individual entrepreneur (form N 1-IP (month)). The report form is established by Rosstat Order No. 472 dated July 31, 2018.

Report to statistics on the sale of products using form No. 1-export

Information on the sale (shipment) of products (goods) at the location of buyers (consignees) (form N 1-export). The reporting form is established by Order of Rosstat dated July 6, 2016 N 327

Report statistics at the beginning of the academic year to universities and vocational schools

Information about the educational organization carrying out educational activities in educational programs of secondary vocational education (form N SPO-1) Information about the educational organization carrying out educational activities in educational programs of higher education - bachelor's programs, specialty programs, master's programs (form N HPE-1) Report forms are established by Rosstat Order No. 535 dated August 15, 2017

Statistical reporting

In addition to tax and accounting forms, companies and entrepreneurs submit statistical reports. The list of mandatory reporting forms is determined for each respondent individually. We recommend that you find out which reports to submit in October 2020 on the official Rosstat website. To obtain information, it is enough to enter the company’s TIN. Some forms and deadlines have been changed due to the coronavirus epidemic.

Report to statistics on the production and shipment of goods and services in form P-1

Information on the production and shipment of goods and services (Form N P-1) The form is established by Order of Rosstat dated August 21, 2017 N 541

Report to statistics on product production using the PM-prom form

Information on production of products by a small enterprise (form N PM-prom) The report form is established by Order of Rosstat dated 08.21.2017 N 541 Report to statistics on production of products in form 1-IP (months) Information on production of products by an individual entrepreneur (form N 1-IP (months)). The report form is established by Rosstat Order No. 472 dated July 31, 2018.

Report to statistics using form No. P (services)

Information on the volume of paid services to the population by type (form N P (services)) The report form is established by Order of Rosstat dated August 31, 2017 N 564

until October 18, 2021

Make advance payments on the tax assessment

Payment of quarterly advance payments for negative environmental impact.

Submit a notice of advance payment of excise taxes or exemption from its payment and a bank guarantee

Taxpayers (organizations producing alcoholic and (or) excisable alcohol-containing products) who have paid an advance excise tax payment shall submit: • a copy(s) of the payment document confirming the transfer of funds to pay the amount of the advance excise tax payment; • copy(s) of a bank statement confirming the debiting of the specified funds from the current account of the manufacturer of alcoholic and (or) excisable alcohol-containing products; • notice(s) of advance payment of excise tax (in 4 copies, including one copy in electronic form). The form of notification of advance payment of excise tax was approved by Order of the Federal Tax Service of Russia dated June 14, 2012 N ММВ-7-3/405. Taxpayers - producers of alcoholic and (or) excisable alcohol-containing products are exempt from paying advance excise taxes provided they submit: • a bank guarantee; • notice(s) of exemption from advance payment of excise duty. The form of notification of exemption from advance payment of excise tax was approved by Order of the Federal Tax Service of Russia dated June 14, 2012 N ММВ-7-3/405.

Submit declarations on the volume of production and turnover of alcohol

Submission of declarations (with the exception of declarations on the volume of grapes) and their copies to Rosalkogolregulirovanie. Declaration forms are approved by Decree of the Government of the Russian Federation dated 08/09/2012 N 815. The procedure for filling out declarations is approved by Rosalkogolregulirovaniya Order of 08/23/2012 N 231. Formats for submitting declarations in the form of an electronic document are approved by Rosalkogolregulirovaniya Order of 08/05/2013 N 198

Submit corrective declarations on the volume of alcohol turnover

Submission of corrective declarations (except for declarations on the volume of grapes). Declaration forms are approved by Decree of the Government of the Russian Federation dated 08/09/2012 N 815. The procedure for filling out declarations is approved by Rosalkogolregulirovaniya Order of 08/23/2012 N 231. Formats for submitting declarations in the form of an electronic document are approved by Rosalkogolregulirovaniya Order of 08/05/2013 N 198

Report to statistics using form 2-purchase price

Information on purchase prices of certain types of goods (form N 2 - purchase prices) The form is established by Order of Rosstat dated 05.08.2016 N 390

Other taxes

If the organization has real estate, transport or land, it is necessary to submit the corresponding declarations. For 2019, reports on land and transport are due no later than February 3, 2021, and for real estate – no later than March 30. Individual entrepreneurs do not submit such declarations; they receive notifications from the Federal Tax Service. The deadlines for paying these taxes are established by the laws of the constituent entities of the Russian Federation.

Water tax is paid by those who withdraw water from water bodies or use their water areas, but there are a number of exceptions, for example, watering agricultural land. The declaration and payment of water tax must be submitted no later than the 20th day of the month following the reporting quarter.

Excise taxes are paid by organizations and individual entrepreneurs that produce, process or import excisable goods specified in Art. 181 Tax Code of the Russian Federation. Declarations and tax payments must be submitted monthly, no later than the 25th day of the next month (except for operations with denatured alcohol and straight-run gasoline).