If dividends are received by an individual, then income from them is subject to personal income tax, and for an organization it is necessary to calculate income tax.

Dividends are profits that are distributed in favor of the founders of an LLC or the owners of shares of a joint-stock company. When they are transferred, they receive income on which tax must be paid.

The amount of the fee depends on whether the recipient is a tax resident of the Russian Federation or not, whether the income is paid to a Russian or foreign company. Dividend taxes for founders in 2021 are usually withheld by the organization that distributes the profits. If income is transferred to a citizen, it is subject to personal income tax. The obligation to withhold it does not depend on the taxation system applied by the organization distributing the profit. In case of payment of income to another company, income tax is calculated.

Whose responsibility is the taxation of dividends?

The taxpayer for dividend income is the recipient. This can be either an organization or an individual. In the first case, income tax is paid on dividends, in the second - personal income tax. However, the direct responsibility to calculate, withhold and pay taxes on dividends lies with the company that distributes profits and pays dividends, since in this situation it acts as a tax agent (clause 3 of Article 275 of the Tax Code of the Russian Federation).

The responsibilities of a dividend tax agent also arise if the organization that is the source of payment applies special regimes (STS, UTII (until the end of 2021) or Unified Agricultural Tax). And for a recipient of dividends working under a special regime, the use of this regime does not prevent them from receiving dividends minus tax on them.

Tax deductions for individuals

- individual entrepreneurs;

- notaries and lawyers engaged in private practice;

- from the provision of services and performance of work in civil law;

- in the form of royalties and royalties received for the creation of works of art, discoveries and inventions.

The tax deduction can be applied to several objects sold during the tax period, but its total amount should not exceed the specified amounts. The balance of the deduction unused in the current tax period can be carried forward to the next year.

Algorithm for calculating tax on dividends

The formula by which taxes on dividends are calculated is given in paragraph 5 of Art. 275 of the Tax Code of the Russian Federation and has the following form:

N = K × Sn × (D1 - D2),

Where:

N - amount of tax on dividends to be withheld;

K is the ratio of the amount of dividends to be distributed in favor of their recipient to the total amount of dividends distributed by the organization;

Сн - tax rate;

D1 - the total amount of dividends distributed in favor of all recipients;

D2 - the total amount of dividends received by the organization itself in the current and previous reporting (tax) periods, provided that they were not previously taken into account when calculating income; This figure does not include dividends, which are subject to a zero income tax rate.

From 2021, a company that receives and pays dividends will calculate tax differently. From indicator D2 you will need to exclude the amount:

- dividends taxed at a 0% rate from an international company that owns a share or contribution of more than 15% for more than a year;

- dividends from foreign enterprises that the company received through Russian organizations and to which it has the actual right. It does not matter whether such dividends were subject to income tax for the recipient or whether tax was calculated on them at a 0% rate.

According to the above formula, both income tax on dividends paid to organizations and personal income tax on dividends in favor of individuals are calculated (clause 2 of Article 210 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 17, 2015 No. 03-04-06/34935).

However, it is not used when calculating taxes on dividends in favor of foreign companies and individuals - non-residents of the Russian Federation. For them, taxes are calculated based on the full total amount of dividends distributed by the organization (clause 6 of Article 275 of the Tax Code of the Russian Federation). If the final recipients of such a payment are individuals or legal entities who are residents of the Russian Federation, then the prohibition on using the above formula does not apply to payments to non-residents.

Nuances of calculating taxes on dividends

When calculating tax on dividends, it is important to consider the following features:

- The total amount of distributed dividends (in the formula this is indicator D1 and the denominator of indicator K) includes, among other things, dividends in favor of:

- foreign - non-residents of the Russian Federation.

This follows directly from paragraph 5 of Art. 275 of the Tax Code of the Russian Federation (as well as from letters of the Ministry of Finance of Russia dated July 8, 2014 No. 03-08-05/33030 and the Federal Tax Service of Russia dated August 12, 2014 No. GD-4-3 / [email protected] ).

- The total amount of dividends should include those from which the “profitable” tax is not withheld (paragraph 6, paragraph 5, article 275 of the Tax Code of the Russian Federation). In particular, dividends on shares that are state or municipally owned or that constitute the property of mutual funds and public legal entities (letter of the Ministry of Finance of Russia dated June 11, 2014 No. 03-08-05/28295).

- Dividends for past periods are taxed at the rate that is established on the date of issue of these dividends (letter of the Federal Tax Service of Russia for Moscow dated March 14, 2007 No. 20-08 / [email protected] ).

- Indicator D2 takes into account dividends (not counting those taxed at a zero rate) received from both domestic and foreign companies. Moreover, they are taken into account in the so-called pure form, that is, without the tax that the source of payment withheld from them (letter of the Ministry of Finance of Russia dated June 11, 2014 No. 03-08-05/28295).

- If the calculation results in a negative tax amount, then the agent does not need to pay tax. But he won’t be able to get the difference from the budget. This is directly stated in paragraph. 9 clause 5 art. 275 Tax Code of the Russian Federation.

- An organization paying dividends through tax agents must notify about the values of indicators D1 and D2 used in the calculation no later than 5 days from the date of determining the circle of persons entitled to receive dividends (if the organization is an issuer), but no later than the day of their payment each of the tax agents. Notification is carried out by sending information electronically or on paper or posting it on the website or in a payment document for the transfer of money (clauses 5.1 and 5.2 of Article 275 of the Tax Code of the Russian Federation).

Law Club Conference

4. For income for which other tax rates are provided, the tax base is determined as the monetary value of such income subject to taxation. In this case, tax deductions provided for in Articles 218 - 221 of this Code are not applied.

Question: The organization annually pays dividends to individuals and, accordingly, in accordance with Art. 226 of the Tax Code of the Russian Federation is recognized as a tax agent who is entrusted with the responsibility for calculating, withholding from taxpayers and paying to the budget the amounts of personal income tax calculated from these payments. Does the accounting department have the right to provide a property tax deduction in 2005 in connection with the purchase of an apartment in accordance with paragraphs. 2 p. 1 art. 220 of the Tax Code to the founder of this organization when paying dividends on the basis of his written application and Notification issued by the tax authority?

If the price of a share has changed, I sell the share and record the profit or loss. If I make a profit, I pay tax. What's the situation with dividends? When is tax due? At the time of dividend accrual? And if I immediately reinvest the dividends in the same shares, is there still a tax?

The dividend tax for tax residents of Russia is now 13%. If personal income tax can be returned using deductions or not paying it at all, then this will not work with the tax on dividends. At least by legal means.

Dividends are transferred to a brokerage account, individual investment account or bank account after tax has been deducted. Reinvestment will not help: you will buy securities with dividends, from which tax has already been withheld. Even an IIS with a deduction for income will not save you from tax: tax deductions do not apply to dividends.

However, as usual, there are nuances.

Some companies whose shares are traded on the Moscow Exchange pay dividends in dollars. For example, gold miner Polymetal, registered on the island of Jersey.

In this case, dividends are credited to the account without tax withholding. You will have to pay the tax yourself, taking into account the exchange rate on the date of receipt of dividends.

Mutual funds do not pay tax on dividends received. Unfortunately, management fees usually offset this advantage.

Dividends from foreign companies are also subject to tax. If you invest in U.S. securities on the St. Petersburg Exchange or through an overseas broker, sign Form W-8BEN. It shows that you are not a US resident. Without it, the tax on dividends is 30%, and with it - 13%. At the same time, 10% of them are automatically withheld, and you yourself will only have to pay 3%. You can read more about this using the example of Tinkoff investments in a separate article.

At what rates are taxes on dividends calculated?

If we talk about income tax, then its rate in relation to dividends depends on who the recipient is - a Russian or foreign company (clause 3 of Article 284 of the Tax Code of the Russian Federation).

If income is paid to a foreign company, dividend tax is calculated at a rate of 15%.

If the recipient is a domestic organization, in most cases a rate of 13% is applied.

An exception is the payment of dividends to an organization that, on the day the decision on payment is made, has continuously owned for at least 365 calendar days:

- at least half of the share in the authorized capital of the company paying dividends;

- or depositary receipts giving the right to receive at least half of the total amount of dividends paid.

A 0% rate applies to such dividends.

The right to a zero rate must be justified. This must be done by the taxpayer who receives the dividends. To do this, he submits to the Federal Tax Service documents confirming the date of origin of ownership of the share in the management company or depositary receipts. He must submit the same documents to the agent company along with confirmation of their submission to the tax office. This is what the Russian Ministry of Finance thinks (letters dated 02/24/2009 No. 03-03-06/1/78, dated 06/09/2008 No. 03-03-06/2/68).

The personal income tax rate depends on the status of the individual receiving the income (Article 224 of the Tax Code of the Russian Federation):

- For a resident of the Russian Federation, dividend tax is withheld at a rate of 13%;

- non-resident - at a rate of 15%.

You can transfer personal income tax withheld from dividends of several “physics” participants in one payment.

How to report taxes on dividends

It is important for a tax agent not only to correctly calculate taxes on dividends, but also to report them to the Federal Tax Service.

Income tax on dividends paid to domestic companies is reflected in the usual “profit” declaration:

- The tax calculation itself is in section A of sheet 03;

- breakdown of dividend recipients - in section B of sheet 03;

- amounts payable - in subsection 1.3 of section 1.

For the tax on dividends of foreign companies, a tax calculation (information) is provided on the amounts of income paid to foreign organizations and taxes withheld. Its form was approved by order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected]

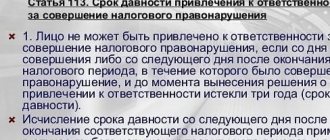

The deadlines for submitting a profit declaration and tax calculations coincide (clause 4 of Article 310 of the Tax Code of the Russian Federation). Their last date is defined as the 28th calendar day from the end of the reporting period (clause 3 of Article 289, clause 2 of Article 285 of the Tax Code of the Russian Federation), and for the annual report - as March 28 of the next year (clause 4 of Article 289, Clause 4 of Article 310 of the Tax Code of the Russian Federation).

Dividends paid to individuals are reflected in 2-NDFL certificates, annually submitted to the Federal Tax Service and handed over to the individual (clauses 2, 4 of Article 230 of the Tax Code of the Russian Federation). If information on the payment of income is submitted by a tax agent recognized as such under Art. 226.1 of the Tax Code of the Russian Federation (transactions with securities, derivative financial instruments, payments on securities of Russian issuers), and this agent submitted to the Federal Tax Service data on payments made as part of the profit declaration submitted by him (in Appendix 2 to it), then certificates 2- He does not need to submit personal income tax to the Federal Tax Service (clause 4 of Article 230 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated 02.02.2015 No. BS-4-11 / [email protected] ).

From the report for the 1st quarter of 2021, 2-NDFL certificates are submitted to the Federal Tax Service as part of form 6-NDFL.