In the case when the financial result of the organization's activities is profit, the founders decide where to direct it. Typically, they want to receive their dividends. Let's consider the procedure for settlements with founders for the payment of dividends in limited liability companies.

Dividends are any income received by a participant in an organization during the distribution of net profit, in proportion to the participants’ shares in the authorized capital of this organization (Article 43 of the Tax Code of the Russian Federation). Dividends also include all income received from sources outside the Russian Federation that are classified as dividends in accordance with the laws of foreign countries.

Limited liability companies have the right to distribute net profit among participants quarterly, once every six months or once a year (Article 28 of Federal Law 14-FZ “On LLC”). The period and procedure for paying dividends (distributing profits) are determined by the company's charter. In order for the decision to pay dividends to comply with the law, restrictions must be taken into account.

What income is recognized as dividends?

Every year, companies, if their performance results are positive, distribute the profits received among persons owning shares or shares.

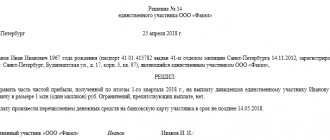

Most often, this is done in the form of dividends, and the decision on their size and timing of payments is made by the general meeting. Such a meeting may be annual or extraordinary; for joint stock companies this is a meeting of shareholders (clause 1 of article 47, subclause 10.1, 11 of clause 1 of article 48 of the law “On joint stock companies” dated December 26, 1995 No. 208-FZ, hereinafter referred to as law No. 208-FZ), and for an LLC - a meeting of participants (clause 1 of Article 28, subclause 7 of clause 2 of Article 33 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ, hereinafter referred to as Law No. 14-FZ).

According to paragraph 1 of Art. 43 of the Tax Code of the Russian Federation, a dividend is any income of a participant or shareholder if it is received from the company during the distribution of net profit in an amount proportional to the share in the authorized capital.

If a company received income from sources located outside of Russia, and such income falls within the definition of dividends in that country, then it will be recognized as a dividend in the Russian Federation.

In addition, dividends are recognized in accordance with clause 6 of Art. 269 of the Tax Code of the Russian Federation, and excess interest paid by a resident of the Russian Federation to a foreign company on controlled debt.

We pay interim dividends

Trebisova Ksenia Aleksandrovna, chief expert consultant of the company PRAVOVEST

Companies (both joint-stock and limited liability companies) have the right to pay dividends to their shareholders or distribute net profit among participants.

The procedure for paying dividends and distributing profits is basically the same, so we can use one term “dividends”, and distinguish between concepts only if there are specific features.

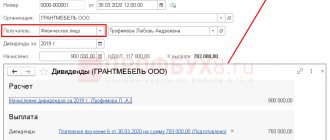

The decision to pay dividends is made by the general meeting of shareholders (participants) of the company and is recorded in the minutes.

If the charter of the joint-stock company does not specify the period for payment of dividends, then it should not exceed 60 days from the date of the decision, which is confirmed by Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 18, 2003 No. 19.