How do intangible assets differ from fixed assets?

To understand how intangible assets differ from fixed assets, let's consider each concept separately.

According to clause 5 of PBU No. 6, fixed assets are recognized as real estate, namely: buildings, structures, land plots. In addition, this includes equipment, various instruments and devices, computers, transport, production tools, livestock, perennial plantings, etc. Also included in the fixed assets are capital investments and property used on the basis of long-term lease relationships.

Assets will be taken into account if a number of conditions are simultaneously met:

- used in production or for administrative needs;

- used for more than a year;

- will generate income for the company;

- there are no plans to implement them.

Intangible assets do not have a natural form. According to PBU No. 14, intangible assets will include exclusive rights to authorship and patents (their value is taken into account), as well as long-term investments of the company.

As well as fixed assets and intangible assets, it is necessary to have a period of use of more than a year, as well as the likelihood of generating income for the company in the future.

Specific signs

What are intangible assets? What does this mean? A novice accountant is probably tormented by such questions. If the image of material property emerges immediately, then how can one imagine something else?

Let us analyze the main conditions for classifying funds into the group of intangible assets. So, representatives of this category must meet the following criteria:

- lack physical fitness;

- used in the production and sales processes of the enterprise or for management needs;

- be in circulation for 12 months or more;

- bring profit in the present or forecast time;

- comply with legal documentation requirements;

- have the opportunity to transfer ownership to another individual or legal entity.

In order to use intangible assets in its activities, the enterprise itself must have ownership rights to them.

Accounting for fixed assets and intangible assets

We will briefly describe how fixed assets and intangible assets are accounted for.

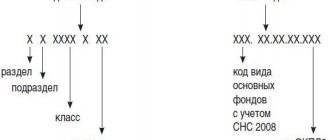

Fixed assets are accounted for at their primary cost (the company's actual expenses excluding VAT) on active account 01 “Fixed Assets”. During the use of the OS, this cost is written off in the form of depreciation. The list of fixed assets included in the depreciation classifier is specified in Decree of the Government of the Russian Federation No. 1 of January 1, 2002.

All transactions involving capitalization, write-off and other actions in relation to fixed assets must be documented. Documentation taken into account:

- acceptance certificate (OS-1);

- acceptance certificate as a result of elimination of defects, reconstruction or modernization (OS-3);

- decommissioning act (OS-4 or OS-4a, if it is a vehicle);

- inventory item registration card (OS-6);

- certificate of acceptance of equipment for production (OS-14);

- acceptance certificate for installation (OS-15);

- report on detected defects (OS-16);

- technical passports and supplier papers.

Intangible assets are taken onto the balance sheet at their primary cost in active account 04 “Intangible assets”. The grounds for recording intangible assets will be:

- account card;

- act of acceptance and transfer of intangible assets;

- act of writing off intangible assets.

Based on the characteristics of the company, other papers are also developed indicating the required details. Their use must be specified in the administrative document.

An inventory object is taken as a unit of accounting for fixed assets and intangible assets. If we consider the accounting of fixed assets and intangible assets briefly, then they will be placed on the balance sheet through the entries indicated below.

Posting via intangible assets:

- D 08.5 K 60 (76) – registration of supplier documentation;

- D 19 K 60 (76) – VAT accounting;

- D 04 K 08.5 – setting at primary cost according to the act.

OS wiring:

- D 08 K 60 (or 71) – registration of supplier documentation;

- D 19.1 K 60 (or 71) – reflection of VAT;

- D 01 K 08 – commissioning at primary cost.

Control over the accounting of fixed assets and intangible assets is carried out through inventory.

Intellectual property

The results of intellectual activity are also intangible assets. What does this mean? Mainly patent or copyright assets. The first category includes rights arising in the scientific and design field. This:

- new inventions;

- industrial designs;

- technical models;

- names and trademarks.

The second category includes property created on the basis of the objective views of a specific author. These include works of art, software, databases, integrated circuit layouts and other assets.

The main difference between copyright and patent law is the method of its recognition, which in this case resembles the relationship of a part to the whole. If a patent is issued for any invention and protects the work itself, then copyright is assigned only to the form of expressing the subjective view of different owners on the same idea.

Inventory of fixed assets and intangible assets

An inventory of fixed assets and intangible assets is carried out based on the order of the head of the company or upon inspection by the tax authorities. A special commission is being created for this purpose. During the inventory the following is checked:

- availability and correct completion of primary documentation for commissioning and operation;

- condition of cards and other analytical accounting registers;

- correct reflection of the primary cost of objects;

- correct reflection of data on the movement of fixed assets and intangible assets on accounts.

When unaccounted for fixed assets are identified, they are classified as non-operating profit received in kind. If a shortage of intangible assets or assets is detected, then it is necessary to identify the guilty employees. When these are not established or the court refuses to compensate for losses, the shortage is written off as production costs or a decrease in funds.

Costs of organizing a legal entity

It would seem that what is common between the costs and assets of an enterprise? In some cases, they may be reflected as part of intangible assets. To do this, it is enough to meet several conditions:

- expenses must be incurred during the preparation of documents when creating an enterprise until its registration with the regulatory authorities;

- they are aimed at paying legal consultants, paying registration fees and other costs for the legal opening of a legal entity;

- the amount of expenses must be included in the authorized capital of the organization.

Funds that meet these criteria can be confidently included in intangible assets. All further expenses for changing accounting policies, stamps, seals and other documents are classified as general business expenses.

Goodwill

The classification of intangible assets provides for the formation of such property as business reputation. It is considered only if the company is sold. Goodwill is understood as the difference between the market and the company, taking into account the accumulated reputation (positive or negative). It turns out that goodwill has its own price, which means it is bought and sold in the same way as any other property.

In the case of the formation of a positive business reputation, they speak of an additional amount of premium that must be paid to the seller, since in the future the presence of goodwill will bring economic benefits to the new owner. Negative characteristics of a company in the market can lead to problems and difficulties that hinder activity and profit. This happens due to poor management, lack of an established sales system, marketing plan, regular customers and connections, and other reasons. This situation reduces the value of the enterprise and requires a discount from the seller.

Service life of intangible equipment

After determining the initial cost, it is necessary to establish the useful life of intangible assets. The duration of the property rights to own intangible assets is taken as a basis. In other cases, they rely on the possible period of profit. Basic intangible assets are divided into two categories:

- with an indefinite operational life;

- with a limited period of use.

If everything is clear with the second type, then for the first it is recommended to stop at 20 years. Determining the operating life must necessarily be based on an analysis of possible profit, since the period is used to calculate depreciation.

Correspondence with other accounts

Knowing what intangible assets are and what relates to them, we can assume which accounting accounts account 04 will interact with. Based on the characteristics of the active account, debit transactions characterize the acceptance of intangible assets for accounting through purchase, receipt, exchange. The interconnected accounts become 04 and 08, 50-52, 55, 75-76, 87-88. The write-off of intangible assets in particular cases of sale, liquidation, exchange leads to an entry in the credit of account 04. In this case, interaction occurs with the debit of accounts 06, 48, 58, 87.

Rules for calculating depreciation

It has already been clarified what intangible assets are, what relates to them, and what their specific characteristics are. Having realized that this property is equivalent to fixed assets, one should ask the question: is it depreciable? Since intangible assets do not have a physical form, how will they wear out? Basically, depreciation takes the form of obsolescence. When determining the amount of deductions, you should rely on the following rules:

- Assess the cost and useful life of intangible assets.

- Depending on the specific situation and the provisions of the accounting policy, calculate the amount using one of three methods: linear, reducing balance, production.

- Deductions are made from the 1st day of the month following the acceptance of the asset for registration.

- Depreciation is not charged on intangible assets of non-profit organizations.

To collect accumulated depreciation amounts, account 05 is used. This is a passive accounting account: credit is accrued, and debit is written off. When drawing up a balance sheet, the credit balance is used to calculate the intangible asset indicator.

Characteristics of depreciation methods

Different types of intangible assets require an individual approach to their assessment and depreciation. The linear method is universal for any property, regardless of its useful life, the amount of profit generated and other indicators. The method is often used in cases where it is impossible to determine the exact operating period, and predicting possible economic benefits in the future is difficult. The method assumes an even distribution of the total depreciation amount across months.

Used for intangible assets, the profit from which will be greatest in the first years of operation. The amounts are distributed unevenly but remain constant during one period. For the calculation, an acceleration factor is used, which is regulated by accounting policies. The residual or market value indicator is multiplied by a fraction: the numerator is the coefficient, the denominator is the remaining service life, determined in months.

The production method is the most flexible approach depending on the financial result obtained. The amounts are calculated directly proportional to the volume of manufactured/sold products with the participation of intangible assets.

Enterprise economics concept

Definition 2

Enterprise economics is the knowledge used to organize and manage the activities of an enterprise.

The work of firms and individual companies is considered within the framework of the micro-economic direction of economic theory. The main goal of science is to find optimal solutions to meet the needs of society in conditions of limited resources. The economy itself is built on the production process, which includes stages from the creation of goods to their complete consumption by humans.

An enterprise is a unit engaged in the production of goods, or their marketing and sale. It is an independent economic entity, the purpose of which can be called maximizing profits and achieving the best position in the market. Enterprises perform a socially significant function. They create goods that can satisfy the needs of society.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Enterprise economics is an applied discipline that studies the following areas:

- Enterprise structure.

- Organization of production processes.

- Methods and characteristics of the management process.

- Principles of accumulation and use of production factors.

- Impact of technological processes on productivity.

- Costs and production costs.

- Optimal use of labor resources.

- Foreign economic activity of the enterprise.

Note 1

Thus, enterprise economics studies the internal and external environment of a business entity in order to maximize its income.