General rules for paying dividends

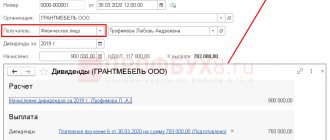

Dividends are paid from the company's net profit in proportion to the shares of participants (shareholders) in the company's authorized capital. The profit remaining after the organization has paid all necessary taxes and fees is recognized as net profit. Its distribution in the form of dividends between owners is subject to Federal Laws dated 02/08/1998 No. 14-FZ on LLCs and Federal Laws dated 12/26/1995 No. 208-FZ on JSC:

| Type of ownership | OOO | JSC |

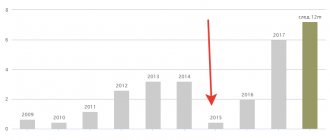

| Frequency of dividend payments | Every quarter, every half year or every year | At the end of the 1st quarter, half year, 9 months or year |

| Who decides whether to pay dividends? | General meeting of participants | General Meeting of Shareholders |

| When profits cannot be distributed |

| |

|

| |

If there is a danger of bankruptcy and an unacceptable amount of net assets, dividends cannot be paid, even if such a decision has been made.