Dividends, like all income received by residents of the Russian Federation, are taxed. Accordingly, an individual is obliged to transfer thirteen percent (the rate for personal income tax) of these funds to the state treasury. In this material, we will look at the details of taxation of dividends, and also find out what types of personal income tax codes exist on dividends.

KBK personal income tax on dividends

Tax rate

After January 1, 2015, personal income tax on dividends must be deducted in the amount of 13 percent (before January 1, 2015 it was less - only 9%). Moreover, regardless of the period of their distribution. But in practice, one can also encounter special cases of calculating and paying income tax on such income.

Based on paragraph 1 of Article 224 of the Tax Code of the Russian Federation, personal income tax on dividends in 2018 for those persons who stayed in the Russian Federation at the time of payment for at least 183 days during the year - that is, for residents - is 13%. Although, as for non-residents, the tax for this category is 15%.

The company determines the tax status of its member or shareholder at the time of any dividend payment. That is, a person can become a non-resident or still a resident of the Russian Federation within a year. Based on the results of the 12-month period, the company determines the exact tax status of the dividend recipient and determines the appropriate tax rate for it. Keep in mind: if a person’s status changes, personal income tax is recalculated as for the full tax period.

Recipients of dividends and procedure for receiving them

Based on annual results, all shareholders of the company expect to receive additional profit. At the same time, both legal entities and individuals can be the owners of shares. Thus, profit tax is withheld from legal entities, and personal income tax is withheld from individuals.

Depending on how it is reflected in the company's charter, the division of profits between participants occurs in a specific order. The most common variant of “division” is from proportion to share. If it is decided differently, the company will inevitably face a dispute with the tax authorities. Community members who were accepted later than others, according to the share they purchased, receive payments.

How are payments made?

Dividend payments are deducted at the moment when the organization has already covered all necessary expenses. That is, participants receive unallocated money (for example, not needed to pay for something or to maintain the work in an efficient state). The very fact of receiving dividends indicates that the business is performing excellently and is being managed wisely. That is, shareholders must be interested in the company’s income generation and its stable activities.

Payments themselves cannot have a fixed schedule. Shareholders or management of the company decide together at what time (or at what interval) dividends will be transferred. For this purpose, general meetings of shareholders are held, at which the following are decided by a majority vote:

- What part of the profit will be sent as dividends?

- How the profit will be divided among the shareholders.

- When will payments be made?

When a decision is made, a protocol is drawn up confirming that such and such shareholders were present at the meeting, made such and such a decision and contains their personal signatures. You must understand that changing it often or just like that is undesirable, since it affects accounting and interaction with the tax office.

Video - Why pay dividends?

To tax or not

From any income of an individual, including dividends, a percentage of the amount issued must be transferred to the treasury.

The date of transfer of dividend income is the day of their payment, regardless of how they were received - through the organization's cash desk, from its current account, or the money was issued in cash. That is why tax on dividends must be withheld on the day they are transferred.

Some people are concerned about the question of whether dividends are subject to personal income tax if they are received in kind. So: if they are issued to an individual in any form, the tax rate is 13%. Therefore, the tax occurs regardless of how such income from participation in the business was received.

The legislative framework

| Legislative act | Content |

| Chapter 23 of the Tax Code of the Russian Federation | “Income tax for individuals” |

| Article 7 of the Tax Code of the Russian Federation | "International treaties on taxation issues" |

| Article 275 of the Tax Code of the Russian Federation | “Features of determining the tax base for income received from equity participation in other organizations” |

| Letter of the Ministry of Finance of Russia dated No. 03-04-06/1951 01/23/2015 | “On the calculation and payment of personal income tax by a tax agent - a depository when paying dividends to a shareholder, including if they are returned to the tax agent” |

| Article 123 of the Tax Code of the Russian Federation | “Failure of a tax agent to fulfill the obligation to withhold and (or) transfer taxes” |

Where to pay

Personal income tax must be paid at the time of transfer of dividends. But there are cases when a company is registered with the tax inspectorate of one city, and transfers a share of the profit to its founder in a completely different area. That is, at his place of residence. In this situation, the question arises: where to pay income tax on dividends?

It is important to know that payment of tax does not depend on where the recipient of a portion of the profit from the business lives or is registered. The company must necessarily transfer personal income tax on dividends received by the person to the place of the inspection where it is registered. This is done on the day of transfer of dividends or on the next day on the basis of paragraph 6 of Article 226 of the Tax Code of the Russian Federation.

Income tax on dividends is transferred to the usual for personal income tax KBK - 182 1 0100 110.

Dividend accruals

Let's look at an example of how a company calculates dividends for investors. Mr. Sergeev and Mrs. Andreeva created the limited liability company “Dog and Cat”. Sergeev contributed 60% to the authorized capital, Andreeva - 40%. During the quarter they earned one hundred thousand rubles of retained earnings. Accordingly, Andreeva will receive forty thousand rubles as dividends, Sergeev – sixty thousand.

Now “Dog and Cat”, as a tax agent, must calculate and withhold personal income tax amounts. According to the letter of the law, the income tax rate is 13 percent. That is, personal income tax for Sergeev will be equal to 7,800 rubles, for Andreeva – 5,200 rubles. These amounts will be withheld in favor of the state, and citizens will receive 52,200 rubles and 34,800 rubles, respectively.

The Dog and Cat tax agent must transfer the above amounts the next day after withholding them from payments. To do this, a legal entity must fill out a payment order, which contains a special field for specifying the BCC. Let's figure out what this means.

Income calculation

In order to calculate a resident’s personal income tax, you need to use the general tax rate that is relevant on the day the income is received. If this is 2021, then dividends in the 2-NDFL certificate are calculated at a rate of 13%.

There are cases when a shareholder/business participant was unable to receive his money as a result of errors in the details, so he has no dividend income in such a situation.

If the company received its dividends from a business in another organization, then the formula from clause 5 of Art. 275 Tax Code of the Russian Federation.

In this case, the share of dividends of an individual is first determined, for which the amount of payment to his account is divided by all accrued dividends. Next, you need to calculate the difference between the dividends that a person received last year, the current period and the sum of all distributed dividends. That is, the first indicator is multiplied by the second and by the percentage tax rate.

An example of calculating personal income tax with transactions - formula 1

For example, it distributes net profit to its founders – residents and non-residents. This company itself is not a recipient of dividends.

Then a simple formula is used for calculation:

- Personal income tax resident = Dividends * 13%.

- Personal income tax non-residential. = Dividends * 15%.

Calculation example

Detailed calculation of personal income tax using the given formulas is presented in the table.

| Recipient of dividends | Individual status | Share in the authorized capital | Personal income tax rate | Profit, rubles | Dividends, rubles | Personal income tax, rubles |

| Ivanov I.I. | Resident of the Russian Federation | 60% | 13% | 500 000 | 300 000 | 39 000 |

| Schwartz M. | Non-resident of the Russian Federation | 40% | 15% | 200 000 | 30 000 |

In this example, the calculation follows a simple formula.

Example of accounting entries

In addition to calculations, the company must correctly reflect the payment of dividends and the payment of personal income tax on them in accounting documents.

Accounting entries for the calculation and withholding of personal income tax.

| Debit | Credit | Amount, rubles | Description |

| 99 | 84 | 500 000 | Net profit |

| 84 | 70 | 300 000 | Resident dividends Ivanov I.I. |

| 70 | 68 | 39 000 | Personal income tax |

| 84 | 75 | 200 000 | Dividends of non-resident Schwartz M. |

| 75 | 68 | 30 000 | Personal income tax |

| 70 | 50 | 261 000 | Dividends issued from the cash register to Ivanov I.I. |

| 75 | 51 | 170 000 | Transfer of dividends to r/r Shvarts M. |

| 68 | 51 | 69 000 | The calculated personal income tax has been paid |

Payment nuances

Let's say a company transferred dividends on shares to its participants and paid personal income tax. However, the money was returned due to changes in shareholder details. Then, in fact, she is forced to transfer the amount of income to them a second time. This means that you do not need to remit the tax.

If the shareholder did not receive money as a result of errors with details, then his actual income is missing. Personal income tax, which was previously transferred to the budget, has the status of an overpayment that must be returned. If there was a subsequent transfer of dividends to him, then the tax is withheld and paid again. But the position of the Ministry of Finance is that the company may not return the overpayment, since it can be counted during the second call, without even drawing up a special statement.

Tax deferment

An organization has the right to defer payment of personal income tax on dividends to the founder if it has a counterclaim against this person. For example, if the founder does not repay the debt or has not paid for the goods. Therefore, all counter debts must be offset. And if the founder’s debt is greater than or equal to the amount of dividends, then the company has the right not to transfer funds from dividends to him. It is as if she takes a deferment from paying personal income tax on such income.

The fact that the founder received income from which it was not possible to pay dividend tax must be reported to the tax office and to him himself no later than March 1 of the next year. Next, the participant or shareholder independently submits an income tax return, according to which he will pay the tax no later than July 15 of the following year.

Results

The income of non-residents received from sources in the Russian Federation is subject to personal income tax at a rate of 30%, with the exception of income in the form of dividends and labor income of certain categories of non-residents. At the same time, non-residents cannot reduce their income by tax deductions provided for in Art. 218-221 Tax Code of the Russian Federation.

Sources:

- Tax Code of the Russian Federation

- Resolution of the Constitutional Court of the Russian Federation dated March 1, 2012 No. 6-P

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to reflect 2-NDFL in the certificate

In addition to dividends, the income certificate includes all information about an individual’s income for the past year and tax amounts for a given period. How to reflect dividends on the income statement?

These data are reflected according to the established code of this income 1010. It was also used previously.

EXAMPLE

At the end of 2021, it was decided to pay dividends. However, until January 1, 2021, the corresponding amounts were not credited to the recipients’ accounts.

In this situation, the 2-NDFL certificate for 2021 will be without dividends. Income from them must be shown in the certificate for the period when the dividends were actually paid. That is already for 2018.

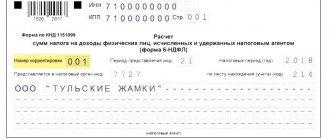

In addition, the total amounts of dividends paid and personal income tax taken from them must be reflected in the quarterly calculation in form 6-NDFL.

For more information about this, see “Dividends in 6-NDFL: filling out a sample calculation.”

Read also

17.06.2019

This might also be useful:

- Fines for late submission of 6-NDFL in 2021

- KBK for personal income tax in 2021

- New deadlines for submitting 6-NDFL in 2021

- Deadlines for paying UTII and submitting the declaration in 2021

- Insurance premium rates in 2021

- RSV form for the 4th quarter of 2021: new or old form?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!