How to submit tax reports?

Reports to the tax office can be submitted in person or through a representative, and can also be sent by mail or via the Internet. By the way, the latter option is preferred by an increasing number of individual entrepreneurs and LLCs. The advantages are obvious: there is no need to stand in queues, wasting time, install special programs for preparing reports, you can submit reports and declarations at any time of the day.

The ability to send tax reports via the Internet is provided in the online accounting “My Business”.

By becoming a user of the service, you will not look for options on how to submit a report to the tax office for free - after free registration in “My Business”, you will be able to learn how to submit reports to the tax office yourself. It is important that this does not take much time, and you will be sure that everything is done correctly and the order is not broken.

Tax reporting storage

Tax records must be kept for several years. The storage periods for tax accounting documents are established in paragraph 1 of Art. and clause 3 of Art. Tax Code of the Russian Federation. The storage periods for tax reporting are fixed in the Order of the Federal Archive of December 20, 2019 No. 236.

Tax returns and calculations must be kept for five years. There is a caveat for individual entrepreneurs: all declarations for 2002 and earlier must be stored for 75 years. The calculation of insurance premiums is stored for 50 years from the date of its preparation.

In order not to waste time on visits to the Federal Tax Service, or to stand in queues at the post office, send your reports via the Internet. The Kontur.Extern system will help you submit any tax reporting electronically. When you log into the system, you will always have only current forms that comply with the law. All you have to do is select the desired declaration and fill it out. The system will check compliance with the control ratios and suggest which lines of the report must be filled out. You will see the entire reporting cycle: from sending to acceptance by the tax authority. If the declaration does not go through for some reason, go to Kontur. A notification will appear externally, as well as a clear explanation of the reasons for the refusal and recommendations for correcting the error. You can also create and fill out reports in the accounting program and upload a ready-made form to Extern.

Types of reports and declarations to the Federal Tax Service

Reports on simplified tax system and UTII

If a simplified taxation system is used, then an individual entrepreneur without employees is limited only to filing a declaration according to the simplified tax system; it is submitted for the reporting year no later than April 30 of the year following the reporting year. Organizations using the simplified tax system also submit a declaration once a year, but until the end of March inclusive.

Generate a simplified taxation system declaration online

Payers of the single tax on imputed income submit reports to the tax office quarterly - no later than the 20th day of the first month following the previous quarter.

Generate UTII declaration online

In addition, LLCs and individual entrepreneurs with employees (in terms of basic tax reporting), regardless of the taxation regime, must report on the average number of employees - no later than January 20 of the year following the reporting year; for personal income tax ( NDFL ) - no later than April 1 of the year that follows the reporting year in form 2-NDFL and no later than the last day of the month following the first quarter, half year, 9 months and no later than April 1 of the year of the previous year. Form 6-NDFL (from reporting for the first quarter of 2021).

Personal income tax declaration

Personal income tax is a tax imposed on the income of an individual or individual entrepreneur. Payers of this tax are all individuals and individual entrepreneurs (using special tax regimes) who receive any income.

There are several forms of declaration for this tax. The most common are:

2-NDFL

2-NDFL - certificate of income of an individual. It is a form of accounting for employee income and withholding personal income tax. This report must be submitted to all organizations and entrepreneurs using hired workers. It must be remembered that the report must be submitted for each employee to whom payments were made during the reporting period. This declaration must be submitted once a year, no later than April 1 of the year following the reporting year.

3-NDFL

3-NDFL is a document that reflects information about the income of an individual or entrepreneur. This report must be provided to individual entrepreneurs who do not use special tax regimes and to individuals who received income other than payments from the employer (sale of property, provision of services, private practice, etc.). The declaration must be submitted once a year by April 30 of the year following the reporting year.

Insurance premiums: how we report for 2021

The unified calculation of insurance premiums (ERSV) is submitted to the Federal Tax Service on a quarterly basis - 30 days are allotted for its preparation and transmission to controllers after the end of the reporting quarter (clause 7 of Article 431 of the Tax Code of the Russian Federation). Based on the results of 2021, the ERSV must be submitted no later than January 30, 2021.

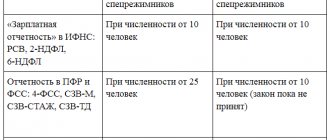

IMPORTANT! You can submit the DAM for 2021 on paper only if there are up to 10 people.

If you do not have time to send the calculation to the tax authorities, you may be fined and your account blocked.

How to pay the fine, see the material.

Even if you met the deadline, tax authorities may consider your ERSV unsubmitted, in particular if:

- the total amount of insurance premiums does not correspond to the amount of calculated contributions for each insured person; and/or

- In the calculation, inaccurate personal data about the insured persons was found.

More errors that lead to non-acceptance of the calculation by controllers can be found here.

The tax authorities themselves will inform you about this in a notification no later than:

- the next day after receiving the payment in electronic form;

- 10 days after receiving a paper copy of the ERSV.

From the date of receipt of the notification, you have 5 days to submit a calculation in which the specified discrepancies are eliminated. In this case, the date of sending the updated calculation will be considered the date of submission of the primary ERSV.

Note! From 2021, the ERSV includes information on the average number of employees. Therefore the form has been updated. See the new calculation form here.

ConsultantPlus experts explained how to correctly fill out the updated form. To avoid mistakes, get trial access to the system and go to the Ready-made solution. It's free.

Find out how to correct incorrect data in ERSV from the publication.

VAT declaration

VAT - value added tax. Accounts for 18% of the difference between the cost of goods/services and the costs of their production.

A VAT return must be submitted to all organizations and entrepreneurs that do not use special tax regimes.

The VAT return must be submitted every quarter no later than the 25th day of the month following the reporting quarter.

Attention! Since 2015, the VAT return is the only return that must be submitted electronically. Submitting a declaration in paper form is equivalent to not submitting a declaration.

We will show you how to generate any declaration automatically in 3 clicks using the “My Business” service

Try for free

How to submit electronic reports from the office

The first method is economical. If you are saving the organization’s money, try submitting reports for free through the portals of government agencies (https://www.nalog.ru/, https://fss.ru/, etc.). The costs in this case are minimal - you only need to issue an electronic signature at any of the certification centers. But submitting through portals can hardly be called simple, because instead of one program you will have to master the service of each authority that expects reporting from you: register, understand the logic of work, download additional software. In addition, there is no technical support or assistance in filling out.

In the article “Electronic signature: how to choose and execute” we talked about the types of electronic signatures, certification centers, registration methods and the procedure for using signatures.

The second method is more expensive, but much more comfortable. Enter into an agreement with an electronic document management (EDF) operator or its partner. As a result, you will receive a single software for preparing and sending reports via the Internet. An accountant can prepare a report in the program he is familiar with, and only then upload it to the service for sending. Additionally, you will need an electronic signature for the manager or other person responsible for checking and submitting reports.

This is a good way to control your reporting - you will regularly receive reminders about upcoming deadlines, and the service will automatically check reports for errors before sending.

But there are also a couple of disadvantages: firstly, such services cost money, and secondly, you will need a person who is at least at a basic level familiar with the work of an accountant and is not afraid of online services.

Declaration on property tax of organizations

Organizational property tax is a tax imposed on the property of an organization. The tax base for this tax is all movable and immovable property on the balance sheet of the organization. Payers of this tax are all organizations that have movable or immovable property on their balance sheet and do not apply special tax regimes.

The tax return for this tax is drawn up in the form KND 1152001, which reflects the average value of the organization’s property on the 1st day of each month of the reporting period and the month following the reporting period. The reporting period for this declaration is 1 quarter, the tax period is 1 year. At the end of each reporting and tax period, an organization or entrepreneur must submit a declaration and make advance payments. The declaration is submitted to the tax authorities no later than the 30th day of the month following the reporting or tax period.

Financial statements

Accounting statements allow you to get a complete picture of the state of affairs in the organization in terms of financial and economic condition. In fact, this is a system of indicators that are recorded in special documents and talk about the company’s profits, its debts and losses, the taxes the company pays, and the assets on its balance sheet.

The main accounting documents are the balance sheet

and

income statement

.

In most cases, they are enough to understand what the economic situation of the organization is. In large companies, in addition, it is necessary to have reports on cash flows and their intended use

, as well as

changes in capital

. All information on these documents is regularly sent to the fiscal authorities, some - to the Pension Fund of the Russian Federation, the State Committee and other regulatory authorities. The deadlines for submitting financial statements are determined by law, and violation of them is subject to a fine.

Accounting reporting forms are approved at the state level; errors in them are unacceptable and are punishable by fines. If the error led to an underestimation of tax figures, the fine can reach 40 thousand, and the head of the company in this case will bear administrative responsibility.

Excise tax declaration

Excise tax is a tax imposed on certain types of goods and included in the cost of these goods. Goods subject to this tax are called excisable. These include alcohol, tobacco, cars, gasoline, medicines, perfumes, etc.

Payers of this tax are organizations and entrepreneurs selling or producing excisable goods. The full list of excise tax objects is enshrined in Article 182 of the Tax Code.

The tax return for excise taxes (except for tobacco products) is filled out and submitted in the form KND 1151084, for excise taxes on tobacco products in the form 1151074. These declarations reflect the tax base and the amount of excise duty payable. The declaration and payment of tax must be submitted monthly, no later than the 25th day of the month following the reporting month.

Declaration when using unified agricultural tax

The Unified Agricultural Tax is a special tax regime for organizations and entrepreneurs involved in agriculture. Like all special tax regimes, it was introduced to simplify tax reporting and reduce the tax burden on entrepreneurs and organizations.

Organizations and entrepreneurs using this tax regime submit a tax return in the KND form 1151059.

The Unified Agricultural Tax declaration is submitted once a year no later than March 31 of the year following the reporting year.

Deadlines for submitting reports in 2021 to the Pension Fund of Russia

The following reports must be submitted to the Pension Fund:

| Reporting type | For what period is it represented? | Deadline for submission to the Pension Fund |

| Information about insured persons in the Pension Fund (SZV-M) | For December 2021 | No later than 01/15/2021 |

| For January 2021 | No later than 02/15/2021 | |

| For February 2021 | No later than 03/15/2021 | |

| For March 2021 | No later than 04/15/2021 | |

| For April 2021 | No later than 05/17/2021 | |

| For May 2021 | No later than 06/15/2021 | |

| For June 2021 | No later than 07/15/2021 | |

| For July 2021 | No later than 08/16/2021 | |

| For August 2021 | No later than September 15, 2021 | |

| For September 2021 | No later than 10/15/2021 | |

| For October 2021 | No later than 11/15/2021 | |

| For November 2021 | No later than 12/15/2021 | |

| For December 2021 | No later than 01/17/2022 | |

| Information about the insurance experience of the insured persons (SZV-STAZH) | For 2021 | No later than 03/01/2021 |

| For 2021 | No later than 03/01/2022 | |

| Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records (EFV-1) | For 2021 | No later than 03/01/2021 |

| For 2021 | No later than 03/01/2022 |

Declarations for other taxes

In addition to the most common taxes and tax returns discussed above, there are less common taxes and tax returns for which a small number of organizations and enterprises are recognized as payers. The obligation to file these tax returns depends on the assets, activities and tax regime of the organization. All types of taxes, as well as the obligations for their payment, are enshrined in the Tax Code of the Russian Federation.

Declarations for other taxes (transport, water, land...). In addition to the most common taxes and tax returns discussed above, there are less common taxes and tax returns for which a small number of organizations and enterprises are recognized as payers. The obligation to file these tax returns depends on the assets, activities and tax regime of the organization. All types of taxes, as well as the obligations for their payment, are enshrined in the Tax Code of the Russian Federation.

What else should you remember to send to the tax authorities?

In addition to declarations, ERSV and accounting, do not forget about personal income tax reports: 2-NDFL certificates and 6-NDFL calculations. Their deadline is no later than 03/01/2021.

From the 1st quarter of 2021, 2-NDFL will need to be submitted as part of 6-NDFL. Read more about the innovations in the Review from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

You should also not forget that it is not only the Federal Tax Service that expects annual reporting from you - you also need to report to Rosstat and the funds on time so as not to be punished later.

Zero declaration

Any business activity may turn out to be ineffective and not generate income. However, this does not exempt the taxpayer from submitting a return. In this case, a so-called zero declaration is submitted to the tax authorities. A zero declaration is a declaration that reflects information about the absence of a tax base for any tax (income tax, VAT, simplified tax system, etc.). The concept of zero declaration is just a colloquial term. The concept of a zero declaration is not legally established in any way. In essence, a zero declaration is any declaration for which the tax base is equal to zero. The forms and deadlines for filing such a declaration are also standard and correspond to the tax for which it is filed.

What will you need to work in Extern?

It is very easy to start working at Externa. You will need a computer and internet access.

Transmission of reports via the Internet is possible with a qualified electronic signature. It is already included in the Extern tariff.

Taxpayers do not need to sign any additional agreements with the Federal Tax Service to start sending electronic reports.

Leave a request to connect and wait for our call. The connection to Extern itself is free. You only pay for using the system according to the selected tariff.