Moscow, 01/28/2021, 05:21:56, editorial office PRONEDRA.RU, author Natalya Yazan.

Individuals in Russia must pay property tax in 2021. If you do not pay it on time, penalties will begin to accrue. This year, citizens must pay 3 property taxes, the payment deadlines for which are the same. They must be transferred to the federal treasury no later than December 1, 2018. These are taxes for the previous reporting period. Since the first day falls on a non-working day, the payment deadline becomes the 3rd.

Exact payment deadline in 2021

As before, individuals in 2021 pay 3 property taxes based on notifications sent to them by the tax authority.

For all property taxes, the payment deadlines in 2021 are the same - in accordance with the current legislation, this must be done no later than December 1 of the year that follows the previous tax period (year). And this was 2017.

However, December 1st in 2021 is a Saturday, so the due date for property taxes in 2021 is moving forward. They must be deposited into the treasury on December 3, 2018 inclusive. It will be Monday.

2021 Property Taxes: Alerts, Deadlines and Payment Methods

In Russia, the deadline for paying property taxes for 2018 is coming. Marina Ryabova, deputy head of the Sverdlovsk Federal Tax Service, gave her recommendations and explanations on the “Accent” program on OTV.

The calculation of property taxes has been completed. What does it mean?

This means that in the software package of the tax authorities, taxes are calculated for each individual who owns land, transport, or real estate. All notices have now been printed and sent to taxpayers. Approximately 530 thousand notifications were uploaded to your personal account. Almost one million three hundred thousand notifications were sent by mail to those who checked the box requesting delivery in their personal account. This year they will come from Ufa and St. Petersburg.

That is, when something comes from Ufa or St. Petersburg, this is not an error - it means you have received a notification, you need to open it and look at it.

Yes, this is a notification. We have already told you that tax authorities are trying to minimize their costs and centralize the printing of all documents that come from us. At the same time, in response to such notifications, you still need to contact the tax authorities of the Sverdlovsk region and preferably at your place of residence.

What about those who do not receive notifications?

Firstly, those who have tax benefits do not receive notifications. We also do not send notifications to owners of apartments that were built after January 1, 2013, and objects for which the tax amount is less than 100 rubles. Economically this is not feasible. Don't be alarmed - these notifications will be sent every three years.

You can check your taxes even without notifications in your personal account. I looked in, saw the amount and paid with a card. It's quick and easy.

Yes. You can pay immediately. Moreover, this year there was no need to wait for notifications and pay into a single account. Tax authorities from this account will themselves distribute taxes in the required areas.

What's new about the paper receipts they send out? Previously, there was a receipt that you printed out and went to the bank with it.

Now the single notification does not contain those objects for which tax is not calculated. And this year we have no receipts - this is also optimization. The tax notice contains all the details that you can use to pay, there is a quar code that you can use to pay. If you pay through a Sberbank ATM, there is a document index that you can type, insert a card and pay taxes.

What has changed this year in terms of amounts?

Generally speaking, transport tax charges have increased by five to six percent. Land tax accruals decreased by three percent. On average, property tax charges for individuals increased by 4% due to the new deflator coefficient - it was 1.425, and now 1.481 (this is the coefficient of increase in inventory value).

Let's say I have some doubts about the correctness of the calculation. How can I get my taxes recalculated?

All questions can be addressed through your personal account - it really works. In your personal account, the response time is 20 working days.

That is, I can write there in simple Russian, and they will answer me?

Yes, write in your own words: it seems to me that my accrual is incorrect, and they will answer you. For those who do not have a personal account, you can go to the tax office, we work on Tuesdays and Thursdays until 20:00, and we also work two Saturdays a month so that you do not have to take time off from work. Or you can contact us through the website, but this will not be so effective, because we do not understand who is asking us on the other side and to what extent we can provide information.

What about the timing? Can I pay now?

Of course, you can pay now. The payment deadline is December 1, but since it is Sunday, it is postponed to Monday, December 2. Many people say: I don’t have any debt on the government services website, how can I pay it? There really is no debt now; it will arise only after December 2.

What is paid now until December 2, conditionally, becomes an overpayment. Those accruals that went through a single tax notice will become active on December 2, the overpayment with accruals will “collapse”, and the result will be zero. Only after these accruals become active will this debt be displayed on the public services website.

And after that it will be possible to pay for it?

Yes, but then it will already come with penalties, so you have to pay in advance - either according to the notification that arrived by mail, or according to the notification that was uploaded to your personal account. If you have any doubts, it is better to go to the tax authority and clarify.

When to expect and where to look for a tax notice

Notification for three property taxes is sent to payers no later than 30 working days before the due date for their payment, along with bills for their transfer.

You need to wait for these documents:

- at the address of residence (registration) of the payer;

- to a different address that the payer indicated in the corresponding written application (the form of such an application was approved by order of the Federal Tax Service dated May 29, 2014 No. ММВ-7-14/306).

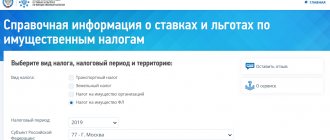

For payers registered in the “Personal Taxpayer Account for Individuals” on the official website of the Federal Tax Service of Russia, tax notices for payment of property taxes are posted ONLY in the specified electronic service and are not sent by regular mail.

But there is an exception: payers can submit notifications to the Federal Tax Service about the need to receive the documents in question on paper. Then tax notices will be sent to them both on paper and posted in their personal account.

Exceptions and additions

As usual, the state cannot stop at this “level of simplicity”, and all sorts of exceptions are introduced. We present the most frequently used of them.

If the work involves hazardous conditions that are hazardous to health, the employer is obliged to pay additional interest to the Pension Fund, the amount here depends on the specific hazardous production, but usually it ranges from 2 to 8%. It is important that the size of this payment does not depend on the level of wages, it is fixed.

There are limits on the annual salary; once it is reached, the insurance percentage is significantly reduced.

These limits are adjusted annually. Since the current practice in Russia is to pay an advance for the work performed and the salary itself, it is separately stipulated that all taxes are paid from the salary. This rule applies if the advance is paid, as is generally accepted, on the 7th-15th of the month, and the salary itself is paid after the 20th.

But there is a nuance - if the advance is paid on the last day of the month, then taxes come from it. This nuance is a common stumbling block between the employer and the Pension Fund. Disputes on this issue have reached the courts more than once, but they almost always take the side of the Pension Fund.

In Russia, there is also a widespread practice of using deductions; they also need to be taken into account when calculating taxes. Thus, all tax calculations are made from the amount of earnings received after deducting 4 types of amounts from it:

- Standard - this deduction depends on the number of children and the benefits of the employee himself, but if annual earnings do not exceed 350 thousand rubles (29,166 rubles per month).

- Social – money for treatment, education.

- Property – expenses for the purchase of real estate.

- Investment – funds spent on transactions with securities.

The deduction for children begins to “play” after providing the child’s birth certificate and the corresponding application. This deduction is:

- 1400 rubles at the birth of the first and second child;

- 3000 rubles at the birth of the third and each subsequent one;

- 12,000 rubles - if a disabled child is being raised in a family, until he reaches the age of 18 years or, upon completion of education, 24 years.

These deductions are doubled if the citizen is a single parent.

Please note that the number of children does not depend on their age. Even if the first two are already over 20, but for the twins, 3rd and 4th, who are 10 years old, the parent will receive a deduction of 6 thousand rubles for another 8 years.

Among the preferential deductions:

- 500 rubles – Heroes of Russia and the USSR, combatants, disabled people of the 1st and 2nd groups, liquidators of radiation accidents.

- 3000 rubles – persons who received radiation sickness or disabled combatants.

All possible reduced insurance payments are summarized in the following table (limit values are given, %):

| Insurance type | Notes | ||

| Pension | Social | Medical | |

| 20 | 0 | 0 | · Individual entrepreneurs on a simplified taxation system; |

| · Employees of pharmaceutical companies and entrepreneurs on a single tax; | |||

| · Employees of charitable organizations | |||

| 14 | 0 | 0 | Valid for 10 years for |

| 8 | 2 | 4 | IT companies with simplified tax and companies in special economic zones |

| 6 | 1.5 | 0.1 | Only within 10 years after registering a company in Crimea, Sevastopol, Vladivostok, or any priority development zone |

| 0 | 0 | 0 | For crews of sea vessels from the Russian International Register |

There are also cases of additional contributions under the Pension Fund program. Examples of these cases are in the following table:

| Bid (%) | Notes |

| 14 | For civil aircraft crews |

| 9 | For specialists in heavy production, unless a special assessment has been carried out |

| 02.08.2017 | For specialists in heavy production, if a special assessment has been carried out (2% - simply hazardous production, 8% - also dangerous) |

| 6.7 | For coal mine workers |

| 6 | For workers in hazardous production, unless a special assessment has been carried out |

A special case

Relatively recently, the Federal Tax Service resolved the situation with the distribution of notices and payments for too small amounts of property taxes.

As a result, a tax notice is not generated in two cases:

- If there are tax benefits in the amount of calculated taxes (for all types of taxable property).

- If the total amount of taxes payable by an individual is less than 100 rubles.

And again there is an exception: in any case, even a small amount of payment of property taxes in 2021 will have to be carried out upon notification (up to 100 rubles). But the tax office will send it in the year after which it loses the right to send it. And this is after the expiration of the previous three years (clause 2 of Article 52 of the Tax Code of the Russian Federation).

Also see When a Property Tax Notice Doesn't Receive.

Read also

15.06.2018

Addition for transport tax

Transport tax applies to everyone who owns any vehicle. You have to pay it every year. To calculate it, various technical indicators are taken into account. But starting from the new year 2021, it is worth paying attention to the latest information about additional transport fees. It will be divided into 2 principles:

- owning an electric car or ECO car;

- use of a diesel, gasoline or gas vehicle.

The first category of persons will not pay property tax. The second half will transfer funds much more than before. Why? The ECO machine does not harm the environment. There are no emissions or pollution. The government no longer needs to allocate funds to clean up the environment.

The second innovation concerns those who repair equipment. The size of the tax is affected by the size of the engine and its ability to develop speed. Therefore, in no case should you forget after increasing or decreasing the engine that the tax service itself will not send notifications asking you to provide it with new data. If the available documents of the two parties do not match, the driver will have to pay a fine, and it will be equal to several transport taxes at once.

Land tax 2021

In the year of the Yellow Dog, collection from the land owner will also be carried out based on the cadastral value of the territory owned by a person, that is, we are again talking about the need to establish the real value of the land plot. However, practice shows that officials’ assessments are often biased and overstated; in this case, a taxpayer who disagrees with the established fee rate may go to court. The payment amount will increase by 20% and will continue to grow until 2021. According to preliminary estimates by experts, in a number of regions budget revenues will increase by 7-8 times and thereby make it possible to allocate sufficient funds for the development of urban infrastructure. Vacation tax 2021 From January 1, 2021 to December 31, 2022, as an experiment, it is also planned to introduce a special tax levy in 4 resort areas: in the Altai Territory; in the Republic of Crimea; in the Stavropol Territory; in the Krasnodar region. The resort tax will be levied on visiting tourists, both Russians and foreign citizens, with the exception of traditional categories of beneficiaries (veterans, disabled people, students, persons under 18 years old, etc.). It is assumed that the fee will be up to 100 rubles per day for the actual stay in the accommodation facility, and the principles of seasonality and differentiation are allowed depending on the place of stay of the vacationer in the resort region, the purpose of his trip, the significance of the area and its importance for surrounding municipal institutions. Income tax 2021 Excise rates will also increase more strongly. It is possible that the heads of enterprises will have to pay a profit tax increased by 15%, with at least half of this figure (6-8%) going directly to the federal treasury.

Officials plan to mitigate the increase in personal income tax with compensatory introductions - a reduction in insurance premiums by 21% and, in general, maintaining an unchanged tax system for employers. The option of switching to a progressive scale of personal income tax rates in the new year is also being considered. New taxes in 2018 The list of qualitatively new taxes for Russians from 2021 may include: AIT - a tax on additional income, which will replace the mineral extraction tax, or mineral extraction tax. AIT will be associated with the zeroing out of export duties on petroleum products and oil, as well as with a gradual transition to a system of internal taxation; robot labor tax; pension tax (will be collected by the Central Bank from pensioners for budget payments using the Mir payment card system, for the maintenance of which you will need to pay 750 rubles annually). It is still unknown whether the introduced changes will cover the budget deficit. Be that as it may, we now know what to prepare for. This article discussed the main changes that are coming to the tax system in 2021. The development of legislative projects will continue and be adjusted. However, today, thanks to this material, it is possible to get a comprehensive picture of new taxes in 2021 and changes to existing fees.

Lawyer and real estate expert Svetlana Kirillova answers:

Property tax is accrued from the date of state registration of ownership of real estate. Rosreestr, in the manner of interdepartmental interaction, transmits all information about owners to the tax authority. However, this information is not always promptly recorded by the Federal Tax Service.

As soon as the tax authority discovers a house that you own, property tax will be assessed, and you will receive a notification about this in your personal account on nalog.ru. For my part, I would recommend that you send information about ownership to the Federal Tax Service through this personal account. You can attach a scan of an extract from the Unified State Register for the house and land plot to your application. If you have a property tax benefit, for example, you are a pensioner, then also attach documents confirming the benefits in the form of a scan.

From when do you have to pay property taxes?

How to register a house according to the new rules

Tax rates for personal income tax in 2018

Income tax is levied on every citizen and organization that makes a profit. 13% and 30% (from non-residents) do not disappear into the depths of the treasury of the Russian Federation. You have the right to return them if you have made a large purchase (real estate, car), pay for studies, or treatment.

Helpful information! To get a refund in the form of a deduction, you need to contact the accounting department at your place of work or fill out 3-NDFL. The amount of deductions cannot be more than the amount you contributed during your entire work activity. Within the framework of this setting, each type of deduction has its own rules (Articles 207 - 220 of the Tax Code of the Russian Federation).

Personal income tax for other types of profit is calculated at the interest rates indicated in the general tax table.