Recalculation of tax upon receipt of benefits

According to Letter No. BS-4-21/ [email protected] , in accordance with clause 21 of Article 52 of the Tax Code of the Russian Federation, property tax is recalculated for the last 3 periods preceding the calendar year in which it was sent notification of recalculation, unless the law provides for a different procedure.

When a taxpayer applies for a tax benefit, the recalculation of obligations is carried out for the last 3 periods preceding the year in which the relevant application was submitted, but not earlier than the date on which the citizen became entitled to receive this benefit.

In the absence of restrictions regarding the tax period, recalculation can be carried out for any period if there are grounds for doing so.

Where and how to get a compulsory medical insurance policy - 5 stages of the procedure

Read

Who is required to undergo genomic registration in the Russian Federation and who else the law may apply to?

Read

Recalculation of property tax when cadastral value changes in 2021

The basis for recalculation of property tax is a written decision to establish a new cadastral value, issued by a special commission under Rosreestr or a court.

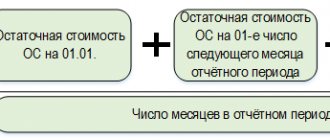

In 2021, there is a procedure for recalculating property tax on the above grounds, according to which the calculation of tax based on the new (revised) cadastral value is calculated not from the moment the corresponding decision is made, but from the moment the owner submits an application. Since, in general, the applicant’s appeal and the decision are made within the calendar year, the tax is recalculated at the new cadastral value for the full reporting period.

Let's look at an example . In March 2021, a representative of Etalon LLC applied to the cadastral commission under Rosreestr with an application for documents to revise the cadastral value of the building complex. In April 2021, the cadastral commission decided to satisfy the applicant’s requirements and establish a new cadastral value, of which it notified the organization’s representative.

Based on a written decision of the commission at Rosreestr, Etalon LLC has the right to recalculate property taxes for the entire year 2021, recognizing the new (revised) cadastral value as the basis for taxation.

How to recalculate the property tax of an individual

To recalculate the property tax of an individual, the taxpayer should submit a corresponding application to the Federal Tax Service.