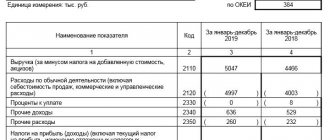

Explanations to the balance sheet and financial results statement may consist of two parts - tabular and text. To reflect quantitative data, it is more convenient to use the tabular form given in Appendix No. 3 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

The numbers of explanations are indicated in column 1 (“Explanations”) of the balance sheet.

If the information presented in tabular form is not enough to fully reveal the picture of the organization’s financial condition (and this is what most often happens), additional explanations are provided in text form.

In the application it is advisable to disclose:

1) those provisions of the accounting policy that are necessary to explain the procedure for the formation of balance sheet indicators, a statement of financial results and a report on the intended use of funds. For example, was the cash method of accounting for income and expenses used, was deferred income tax taken into account along with the current one, the facts of prospective changes in accounting policies or prospective recalculation when correcting significant errors, etc.;

2) information about significant facts of economic life that are not disclosed by the balance sheet and financial performance statements. For example, about significant transactions with owners (founders), such as accruals and payments of dividends, contributions to the authorized capital, etc.

The amount of information included in the explanations is determined by the accounting regulations.

Explanations for the balance sheet and financial results statement recommended by the Russian Ministry of Finance consist of the following sections.

- Intangible assets and expenses for research, development and technological work (R&D).

- Fixed assets.

- Financial investments.

- Inventories (information about the availability of inventories and their movement).

- Accounts receivable and accounts payable.

- Production costs.

- Estimated liabilities.

- Securing obligations.

- Government assistance.

Let's talk about filling out some of them in detail.

Read also “What data should be used to generate a financial performance report?”

What is the difference between an explanation and a note to the balance sheet?

It is immediately necessary to clarify that despite the consonance, the explanatory note and explanations to the balance sheet are not interchangeable concepts. If we turn to the official wording, the explanation recognizes the decoding of financial statements and the deciphering of individual forms of documentation:

- Changes in authorized capital;

- Movements of money supply and transactions;

- Other applications and add-ons.

Important! An explanatory note is also called a decoding of financial statements, but done in any form. In particular, this document may contain only general information or detail each line of the report.

What happens if you don’t submit confirmation?

Do companies have to regularly confirm their main activity if they carry on the same activity without changes? If an organization or entrepreneur does not submit an application and certificate, there will be no fine. But they still risk money, and here's why.

When registering with a tax organization or individual entrepreneur, they could declare more than one type of activity. These types of activities are recorded in the Unified State Register of Legal Entities/Individual Entrepreneurs. The tax office transmits this information to the Social Insurance Fund: social insurance knows what types of activities the company can conduct. He only knows what type of activity you are primarily engaged in, and whether anything has changed in the structure of your business over the past year.

Therefore, if you do not submit supporting documents, FSS officials will turn to the list of your types of activities and assign you an insurance rate for the most dangerous of them - just to be on the safe side. This will be the highest rate of insurance premiums in case of injury for your types of activities, which are registered in the Unified State Register of Legal Entities / Unified State Register of Individual Entrepreneurs. Contributions at the assigned rate will have to be paid until the end of the year. Therefore, if during registration you indicated one type of activity and are engaged only in it, then the Social Insurance Fund will have no reason to set a higher professional risk class for the new year, and you will not face a tariff increase.

Another situation when you do not submit confirmation of your main type of activity and do not risk anything: if you are in fact engaged in the most dangerous activity of those that you notified the tax office about. In this case, the FSS will consider the list of your activities and set the rate of insurance premiums for injuries for the most dangerous and harmful type of activity. He would have done the same after reviewing the documents confirming this type of activity. Nothing changes.

You can find out the occupational risk class of your activities in the table approved by Order of the Ministry of Labor No. 851N dated December 30, 2021. Each class of professional risk has its own tariff rate - from 0.2 to 8.5%.

| 1 class | 0,2% | 9th grade | 1% | 17th grade | 2,1% | 25th grade | 4,5% |

| 2nd grade | 0,3% | Grade 10 | 1,1% | 18th grade | 2,3% | 26th grade | 5% |

| 3rd grade | 0,4% | Grade 11 | 1,2% | 19th grade | 2,5% | 27th grade | 5,5% |

| 4th grade | 0,5% | 12th grade | 1,3% | 20th grade | 2,8% | 28th grade | 6,1% |

| 5th grade | 0,6% | 13th grade | 1,4% | 21st grade | 3,1% | 29th grade | 6,7% |

| 6th grade | 0,7% | 14th grade | 1,5% | 22nd grade | 3,4% | 30th grade | 7,4% |

| 7th grade | 0,8% | 15th grade | 1,7% | 23rd grade | 3,7% | 31st grade | 8,1% |

| 8th grade | 0,9% | 16th grade | 1,9% | 24th grade | 4,1% | 32nd grade | 8,5% |

Who should include explanatory notes in the annual report

Such a document will be required by all enterprises and organizations submitting financial statements. The note displays information that cannot be included in other reporting forms. In this case, it is necessary to take into account the fact that the information under consideration is of interest not only to the tax authorities, but also to the founders and creditors of the enterprise. For example, if the tax on profit received in the new reporting period turned out to be noticeably lower than in the previous one. To avoid legal consequences and possible claims from the Federal Tax Service, the reasons for this event can be stated in an explanatory note to the prepared reports.

Where to submit confirmation of the main type of activity

Submit documents in paper or electronic form to the territorial body of the Social Insurance Fund at the place of registration of the organization. Contributions for injuries are under the control of social insurance, and nothing needs to be sent to the tax office. Papers can be taken to a fund branch or sent by mail. If you send documents via the Internet, sign them with an enhanced, qualified electronic signature. If papers are submitted to the fund on behalf of the manager by another person, he will need a power of attorney - without it confirmation will not be accepted.

Social Insurance recommends sending confirmation through the government services portal, the site confirming the main type of economic activity, the FSS gateway, or the policyholder’s personal account on the FSS website. Not all fund branches accept documents via the Internet; check with your territorial branch about how to accept documents.

Regulatory framework

Key aspects regarding the need for registration and correctness of explanatory notes are disclosed in the following documents:

- Article 14 of Federal Law No. 402-FZ;

- Order of the Ministry of Finance No. 66n;

- PBU 4/99, which regulates the financial statements of organizations.

How to apply tariffs

The rate of insurance premiums for injuries established by the FSS has been applied since the beginning of the year, in accordance with clause 5 of Order No. 55 of the Ministry of Health and Social Development of the Russian Federation of January 31, 2006. You will learn the tariff within two weeks from the date of submission of documents. But until the new tariff is documented by social insurance, contributions can be paid at the previous year’s tariff. The sooner you submit confirmation of your main activity, the sooner you will receive new tariffs. This is especially important for a company if it has switched to an activity with a lower profit class.

If the Social Insurance Fund has increased the tariff, then contributions for injuries must be recalculated at the new rate on an accrual basis from the beginning of the year. Transfer the amount of the underpayment to the budget at the next payment deadline. If tariffs are reduced, contributions can also be recalculated from the beginning of the year. The overpayment amount can be returned or offset against future payments.

Send confirmation of the type of activity to social insurance in a timely manner - in the interests of the policyholder. Take forms and samples to fill out in our article, find out the deadlines and the address to which you need to send the documents.

Pay contributions and send reports to the Social Insurance Fund using the online service Kontur.Accounting. Here you can keep records, calculate salaries, send reports, use the support of our experts and other service features.

The procedure for preparing explanatory notes

It should be noted here that there is no unified template for drawing up this document, so each company develops its own template for such a note.

However, there are a number of points that must be displayed when filling out. Read also: Payments by agreement of the parties upon dismissal

Document structuring

The sections included in the explanatory note are indicated here. They are approved by the head of the organization and can be arranged in any order. For example, like this:

- General information;

- Accounting policy;

- Comparative analysis of indicators;

- Balance sheet assessment and analysis;

- Explanations on the articles of the report;

- Information about joint activities with other enterprises;

- Data on individual business segments and regional branches;

- Information on transactions with affiliates;

- Data on pending litigation and disputes with the Federal Tax Service;

- Data on state support and sponsorship.

Initial data

This may include:

- Information about the subject’s commercial activities;

- Analytical data on items of income and expenses;

- Assessment of the current financial situation;

- Important notes and transcripts of significant information.

Additionally, financial and economic stability, the degree of possible risks, and financial independence can be noted.

Sample design

Explanatory note to the balance sheet sample

Analytics

Here is an assessment of the objectivity of this information with explanations. For example:

- How detailed is the information provided?

- Are all factors affecting the financial statements noted;

- Are changes in the material and financial situation indicated;

- How accurate is the assessment of the business activity of the enterprise;

- Have the key points of commercial activity been identified?

- Relevance of analytics for the financial outcome.

Deadline for confirming the main type of activity

Confirmation of the type of activity is regulated by Order of the Ministry of Health and Social Development of the Russian Federation No. 55 dated January 31, 2006, and the procedure for submitting documents is specified in the Appendix to it.

Business managers confirm the type of activity at the beginning of each year. The regulations indicate the deadline by which confirmation must be submitted - no later than April 15. Previously, FSS branches required submitting a report before the weekend if April 15 falls on a Saturday or Sunday. But in a letter dated February 8, 2021 No. 02-09-11/16-07-2827, fund specialists explained that from the weekend the deadline is shifted to the next working day. In 2021, the last day of submission falls on Thursday, April 15th. It is better to take care of the documents in advance; they can be submitted starting from the first working days of January.

Officials will wait until April 15 for supporting documents. Then, by May 1, they must send notice of the injury contribution rate that should apply until the end of the current year.

After April 15, it is impossible to confirm the main type of activity. The Social Insurance Fund will independently establish as the main type of activity of the organization for which the maximum tariff applies. The appointment can only be challenged in court. It is worth noting that insurers are succeeding in this (Resolution of the Moscow District Court of Justice dated 09/04/2020 in case No. A40-282310/2019; Resolution of the Moscow District Court of Justice dated 09/02/2020 in case No. A40-48210/2019; Resolution of the Moscow District Court of Justice of 01.09 .2020 in case No. A40-191472/2019).

What is stated in the document

Let's briefly go over the main points.

Business entity data

- Full name;

- Organizational and legal form of management;

- Legal address and actual location;

- Information about licenses: date of issue and validity period;

- Information on the number of employees working during the reporting period;

- Founders and authorized capital of the enterprise;

- Details of the legal entity;

- The total amount of taxes paid at the end of the year.

Accounting policy

- The procedure for accounting for assets and liabilities;

- The need to make changes;

- Forecasted consequences;

- A note indicating that the financial statements have been adjusted.

Assets and Liabilities

This section includes several subparagraphs.

Basic tools:

- Initial assessment and recalculation taking into account depreciation at the beginning and end of the reporting period;

- Useful life period;

- Methodology for determining depreciation and the method of displaying this information in accounting;

- Information on the turnover of basic funds: crediting to the balance sheet, writing off, etc.;

- Property undergoing state registration, but already in operation;

- Own types of fixed assets at the beginning and end of the reporting period;

- Leased/borrowed fixed assets in the reporting period;

- Objects with non-repayable value;

- Assets that provide for the fulfillment of obligations in non-cash equivalent;

- Items accounted for as retained earnings.

Production and material stock

- Assessment methodology for each type;

- Possible consequences of changing the assessment methodology;

- Amount and turnover of inventories.

Borrowed funds

- Availability of loans, credits, bills and bonds, indicating the type, amount of debt and repayment terms;

- The rate for the use of borrowed funds;

- Financial costs for borrowed funds included in current expenses.

Investments

- Evaluation of each type of investment;

- The value of securities and other investments encumbered with collateral;

- Information on the transfer of securities to other persons;

- Valuation of debt obligations;

- The amount of reserve allocated for asset depreciation.

Investments and liabilities in foreign currency

- The difference in exchange rates attributed to the financial result and accounted for in another way;

- The official rate dictated by the Central Bank at the time of filing financial statements.

Explanatory note to the balance sheet

Analytical assessment of balance and dynamics

Short term prospects:

- Liquidity forecast - critical, absolute, current;

- Providing with own assets;

- Probability of credit recovery;

- Profitability;

- Financial activity - activity, stability, dependence.

Read also: Sale of an LLC with debts

Current creditworthiness:

- The volume of money supply in the cash register and in current accounts;

- Losses;

- Existing accounts payable and receivable;

- Loans and credits not repaid on time;

- Debt to the budget: presence or absence;

- Fines - paid and outstanding;

- Analytical assessment of the position of the company's securities on the stock market.

Long term prospects:

- Dependence on external investment;

- Sources of financing.

Profit and loss of the enterprise

- Sales volume of goods or services provided;

- Production costs;

- Available reserves;

- Other items of income and expenses;

- Force majeure affecting commercial activities and their consequences.

Explanations on significant accounting items

This section is completed in cases where there is significant information not shown in the financial statements.

Business activity

- Sales market, including export deliveries of products;

- The company's reputation in the commercial sphere;

- Mandatory implementation of planned indicators and ensuring their stable growth;

- Effective use of own resources.

Change in opening balance

- Reasons for the change: reorganization, new accounting requirements, etc.;

- The magnitude of the current changes.

Affiliates

- A complete list of such persons;

- Criteria classifying an individual or enterprise as an affiliate;

- The nature of partnerships;

- Joint operations, indicating prices for each type;

- Share of assets owned by affiliates.

Conditional factors

- Characteristics of obligations and deadlines;

- Existing uncertainties;

- Dedicated reserves;

- Possible consequences.

Partnerships

- Agreements of simple partnerships;

- Partnership goals;

- The company's contribution to joint activities;

- Volume and value of generalized assets;

- Profit received or loss incurred;

- Data on combined assets and transactions performed.

Report by company segments

- Full list of segments: subsidiaries, dependent companies, unions, associations;

- Revenue from sales to third parties and between segments;

- Financial results;

- Total assets and liabilities;

- The volume of capital investments in fixed assets and intangible assets, including depreciation;

- Share of net profit and financial costs based on the results of joint activities.

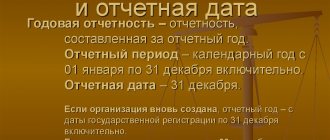

Events that occurred after the date of filing the report

- The reasons that led to these events.

- Likely consequences.

State support

- Amount of allocated funds;

- Special purpose;

- Forms of government support;

- Report on fulfilled and unfulfilled obligations.

Environmental component

- Company activities that have a negative impact on the environment;

- Activities carried out to protect the environment and the amount of funds allocated for this.

Information disclosure

- Number of shares issued: fully paid, partially paid, unpaid;

- The par value of securities owned by the issuer and its subsidiaries.

When re-issuing, the following shall be indicated:

- Cause;

- Date of issue;

- Conditions of accommodation;

- Number of securities;

- The volume of investments received.

Information included in the report based on PBU 18/02

- Conditional income tax expense/income;

- Differences that triggered the adjustment of conditional income/expenses;

- Amount of tax liabilities;

- Reasons for changing the tax rate;

- Volume of tax assets and liabilities.

Termination of business activities

- Description of the business activity that will be discontinued;

- Termination date;

- The total value of the company's assets and liabilities;

- Cash flow statement;

- Amounts of expenses and income before taxes;

- Profit and loss associated with disposal of assets.

Read also: Register of unscrupulous suppliers

Other indicators

- Information reflecting the effectiveness of the company’s activities;

- Competitiveness of goods and services in the market;

- Solvency, credit policy and history;

- Information about property held as collateral or in trust.

Structural composition of the document

The legislation does not provide for a special form in which this independent document must be drawn up, so its preparation is free. But the basic requirements remain the same, and therefore we can consider its approximate structural form.

- The first section provides general information. All data about the enterprise is described here, including the form of its organization, the number of employees, all the main codes, etc.

- The topic of the second section is most often the accounting policy chosen by the enterprise. Here there is a display of its main provisions, as well as changes made or planned.

- The third section provides a comparison of significant indicators regarding this reporting period with previous periods. Where certain inconsistencies are found, this part provides an explanation for them.

- In the fourth section, the processes of analyzing and evaluating activities and their profitability are carried out.

- The fifth, mandatory section, provides explanations of the items in the balance sheet, as well as the profit and loss statement.

Depending on the need, other sections may be included in the note. For example, segmental information, data on temporary cessation of activities, and events that occurred after the reporting date are provided.

Watch also a great video about balance in general:

Explanations when discrepancies with tax reporting are identified

Such reporting undergoes a desk audit along with the submitted declarations.

If contradictory data is identified, the declarant is given 5 working days to provide explanations. There are no fines or other penalties for failure to submit explanations, but it is in the interests of the company to send such a document. For example, if an error in an accounting report led to a reduction in the amount of tax, such an action may be regarded as tax evasion, with all the ensuing legal consequences. To correct the situation, it is necessary to submit an updated report or declaration to the Federal Tax Service.

Who must confirm the main activity

submit an application and confirmation certificate. If an organization submits documents via the Internet, they must be certified with an electronic signature.

Legal entity- Separate divisions must confirm their main type of activity if they are registered as an insurer and have a separate rate for contributions for injuries. If you previously confirmed the main type, but have now forgotten, then the FSS will assign the same tariff as the parent organization.

- Individual entrepreneurs are not required to submit confirmation annually. Individual entrepreneurs with employees who are registered with social insurance calculate contributions based on OKVED, indicated in the Unified State Register of Individual Entrepreneurs as the main one. But if an individual entrepreneur changes this main OKVED and switches to another area of work, he will have to make changes to the Unified State Register of Individual Entrepreneurs. The FSS will independently set a new tariff when the Federal Tax Service transmits new data to it.

- If there is no activity , the company still submits supporting documents. Show zero income on your confirmation certificate. Then the FSS will take the main type of activity from the Unified State Register of Legal Entities. Otherwise, social insurance will assign the policyholder the maximum rate of contributions possible according to its OKVED codes, and at this rate contributions will have to be paid when resuming activity before the end of the year.

The exception is newly created companies. The supporting documents provide revenue figures for the previous year. New companies do not have them; they receive the tariff for contributions for injuries after registering with social insurance. The main type of activity will be the one listed first in the Unified State Register of Legal Entities. The type of activity will need to be confirmed based on the results of the first calendar year of work.