Reflection of inventory results in accounting is the final stage after an audit in an organization. It is very important to complete the documents properly. If mistakes are made, this may result in distortion of the entire company’s reporting. And for false information there are quite serious penalties.

And for quick checks of inventory relevance, we recommend using modern automation applications from Cleverens. Thanks to new technologies, it is possible to reduce time costs and obtain availability data online. Barcode systems and terminals will make life easier for storekeepers, and unscrupulous workers will stop taking goods past the cash register.

Method Functions and Definitions

The legislation establishes the obligation of legal entities to show complete and reliable information about the financial condition of the organization in their accounting records. The essence of these actions is control and comparison of the actual availability of material assets and their nominal presence on the company’s balance sheet. In other words, it is a tool for analyzing the state of a company/enterprise. Each stage is strictly regulated by federal laws and recommendations of the Ministry of Finance of the Russian Federation.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Accounting records based on inventory results take into account not only the legal entity’s own property, but also leased, temporarily owned assets. According to accounting legislation, reconciliation is required in the following situations:

- In advance of the annual report.

- After there were changes in the management team responsible for the safety of money/property.

- When facts of misappropriation/damage are revealed. As well as if there are suspicions of such actions.

- If you plan to rent out material assets or put them up for sale.

- When liquidation is initiated.

- In case of business reorganization.

- Due to unforeseen emergency circumstances.

Whatever the basis for the recalculation, the procedure for reflecting the inventory results in accounting will be the same. You will see that filling out forms correctly only looks complicated. If you understand the essence of the system, then in reality everything turns out to be much simpler.

If the organization has established a procedure for collective responsibility, then the basis for starting the process may be:

- Change of leadership.

- Renewal of the team by more than half.

- At the request of any of the responsible employees.

For most LLCs/IPs, the minimum inventory frequency is 1 year. Some exceptions apply to libraries (once every five years), OS (once every three years), as well as for legal entities operating in the Far North.

Regulatory documents governing the procedure for conducting an inventory of property

An inventory of an organization’s property and liabilities is a check and documentary confirmation of their presence, condition and assessment. Inventory ensures the reliability of accounting and financial statements.

The regulatory documents that regulate the procedure for conducting an inventory of property include the following:

Business entities must necessarily carry out an inventory of property and liabilities, while an inventory may be carried out in accordance with the scale of the enterprise’s activities and inventory objects.

The procedure for conducting an inventory of property is aimed at confirming the entries in the accounting accounts with the working chart of accounts of the organization, as well as establishing compliance of the current accounting of business transactions, preparation and presentation of financial statements with the current legislation governing accounting and regulatory support for accounting.

In organizations, inventory is carried out in accordance with the provisions of regulatory documents and current legislation governing accounting.

Order and regulated actions

There is an established algorithm for conducting the inventory. In order for the event to be considered legal and bring results, it is recommended to strictly follow the roadmap that we provide below.

Creation of a commission

To do this, you need to draw up an official order on behalf of your immediate supervisor. More information about the compilation can be found in. It is imperative to follow the standard for filling out the form.

As for the list of participants, it can be compiled from absolutely any employee of the company. Representatives of various services often gather. Administrative staff must be present at every stage. The accounting department is assigned its own representative. Technical specialists, legal department, financial sector, etc. participate along with everyone else.

It is worth noting that those responsible for matrimonial duties are not included in the list. However, their presence at each stage is considered mandatory. There is only one limit on the number of participants - at least two people. The procedure for processing inventory results does not depend on the number of participants.

The order identifies not only the direct executors, but also substantiates the reasons for the event, as well as its time frame. It is important to determine the materials to be accounted for, as well as to outline the obligations of employees for their safety. The signature of the director and each member is required. Strictly ensure that a note is made in the accounting journal for the execution of orders in the form.

Surpluses identified: what will the wiring be like?

Surplus is the identification of a larger number of accounting objects compared to what is reflected in the primary account. Surpluses in value terms are subject to inclusion in the non-operating income of the company based on data on the market value of accounting items (clause 20 of Article 250 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 06.06.2008 No. 03-03-06/4/42).

In this regard, the above documents used for accounting the results of the inventory of the enterprise's property can be supplemented by others that show the market value of the accounting objects as of the date of the inventory.

Using the prepared documents, the accountant generates the following entries for the inventory date:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- by debit - indicating the account in which the asset being recorded is reflected (for example, Dt 08, if a surplus of fixed assets is identified);

- credit account 91 (subaccount 1, corresponding to other income).

Next, we will consider how the shortage is reflected in accounting.

Obtaining data on movements for the last period

The time period for which receipt and expense invoices are prepared is determined depending on the type of activity and specific conditions. After compiling the list, it is certified by an authorized member of the commission, with the obligatory indication of the date. Thanks to this step, it will be possible to generate current balances for a specific day.

Collection of receipts

This is done well in advance of the process. It indicates that all invoices for receipt and write-off were submitted to the accounting department. Items that have not been capitalized or written off at the warehouse cannot exist. It is the responsibility of each participant to ensure that the generated list is valid at the time of recount.

Checking availability and condition

The group's powers include the following actions:

- Determination of the quantity and name of items actually located on the entrusted territory. This applies not only to goods directly, but also to cash, etc. In addition to the quantitative expression of these resources, their condition is determined. It is important to find out whether it allows you to use them for their intended purpose.

- If the nomenclature is not expressed in physical form, then the documentation is verified, which records the rights to these virtual resources. This applies to such types of property as financial investments, intangible assets, etc.

- Members of the commission assess the status of counterparties' debts to the organization and debts to creditors. This occurs by signing mutual settlements, as well as by checking contracts establishing and confirming the debt obligations of the parties.

The procedure for reflecting inventory results in accounting is as follows:

- All information is entered into inventory forms.

- All participants put signs under the decision.

In this way, the fact of participation of the designated people is recorded, and their agreement with the data entered in the forms is confirmed.

Reconciliation

After establishing the actual state of the assets, a comparison is made with the balance sheet of the enterprise. When discrepancies are identified between what is nominally and what actually exists, a statement is drawn up in which all the pros and cons are entered. Only those positions for which there are discrepancies require inclusion in this register. We will tell you below how to process the inventory results (sample).

Mixing

All participants will have to come to a common conclusion at the meeting after completing the activities on the fifth point. If discrepancies are found, they are all entered in form No. INV-26. The absence of deviations is also recorded by group members. At this stage, it is possible to discuss options for resolving controversial situations. After finding a consensus, the final protocol with visas of authorized persons is sent to the head for signature.

Statement

All acts/statements on the basis of which the commission made its conclusion are submitted to the director for signature. The boss also indicates in his resume the procedure for eliminating the discrepancies found. After this, the entire package is sent further.

Reporting

The results of the inventory are reflected in the accounting documents. All items that, for one reason or another, cannot perform their function are subject to write-off. The same applies to financial obligations for which the statute of limitations has expired.

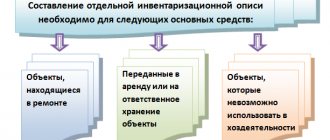

Documentation in inventory accounting

To carry out an inventory, the head of the company forms an inventory commission, the composition of which is approved in an order in the form INV-22.

Each inventory is recorded in the journal using the INV-23 form.

Before the start of the verification procedure, the responsible persons confirm in writing that all accounting documents have been transferred to the inventory commission.

For each type of values and obligations, there are separate inventory forms:

- INV-1 - for OS;

- INV-3 - for goods and materials;

- INV-4 - for shipped goods;

- INV-6 - for goods and materials in transit;

- INV-15 - for cash;

- INV-16 - for securities and BSO;

- INV-17 - for checking settlements with counterparties.

Inventories record information about the property being inspected: name, quantity, condition, inventory numbers, etc. Data in the inventory is entered manually or using computer technology. Marks are not allowed.

If the audit reveals a deviation of the accounting data from the actual availability of property, the commission creates matching statements using the following form:

- INV-18 - for OS;

- INV-19 - for inventory items.

Such statements are drawn up in two copies: for the accounting department and for the financially responsible person, who must explain in writing the reason for the discrepancies.

Discrepancies can be of the following types:

- Surpluses are credited to the account. 91 in correspondence with the property accounting account at market prices (clause 29 of the Methodological Instructions for the accounting of inventories, approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n).

- The shortage may be within the framework of natural loss - then it is charged to cost accounts. Excessive loss is written off at the expense of the guilty parties. If there are none or the court refuses to recover damages, then the shortage is written off as production costs (paragraph 5, clause 5.1 of the Methodological Instructions for Inventory of Property and Financial Liabilities).

Attention! Natural loss rates can be used only if they are approved by legislative acts of the relevant government agencies. The accountant must write off shortages or damage to valuables in excess of the norms on the basis of a court decision (in the absence of the perpetrators or refusal to recover from the guilty person) or a conclusion on damage to property issued by a specialized organization (clause 5.2 of the Guidelines for the inventory of property and financial obligations).

During inventory, misgrading may be detected. Then the surpluses and shortages are counted against each other, and the responsible persons provide the commission with written explanations. The offset can be carried out only for the same audited period from the same financially responsible person for the same values (clause 5.3 of the Methodological Instructions for Inventory of Property and Financial Liabilities). If the surplus is not enough to cover the shortage, then the procedure is similar to that when a shortage is detected.

Important! In tax accounting, a credit for regrading cannot be made (letter of the Ministry of Finance dated May 23, 2016 No. 03-03-06/1/29309).

The results of all inventories are recorded in the statement of results in the INV-26 form.

Correct preparation of forms

There are quite strict regulations in this matter. The main point is the choice of the correct reporting act.

What documents are used to document inventory results?

- Inventory-OS No. INV-1, as well as statement in form No. INV-18.

- MPZ No. INV-3, No. INV-4, No. INV-19.

- To indicate future expenses No.INV-11.

- Upon completion of the cash register comparison - No. INV-15.

- Intangible assets are recorded according to No. INV-16.

- Financial obligations are entered in this format - No. INV-17.

We will describe in more detail below the postings for reflecting the results of the recalculation. You can also refer to the list of legislative acts that regulate documentation templates.

Results

The owner is primarily interested in conducting an inventory of property: both the property is under control and the reporting is reliable. An inventory list, which can be compiled according to the unified INV-1 form, helps to correctly document the results of the inventory of fixed assets.

Sources

- https://nalog-nalog.ru/buhgalterskij_uchet/poryadok_provedeniya_inventarizacii_osnovnyh_sredstv/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/unificirovannaya_forma_inv1_blank_i_obrazec/

- https://odiplom.ru/lab/buhgalterskii-uchet-rezultatov-inventarizacii.html

- https://www.cleverence.ru/articles/bukhgalteriya/oformlenie-rezultatov-inventarizatsii-v-otchete-poryadok-otrazheniya-itogov-v-bukhgalterskikh-ucheta/

- https://www.klerk.ru/buh/articles/479912/

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Types of inventories carried out at the enterprise

Types of inventory are systematized according to the following criteria:

By volume

- full;

- partial.

A complete inventory is control over all types of property of an organization, carried out at the end of the calendar year, for the correct preparation of annual reports.

In a partial inventory, a separate type of property (or several, depending on the purpose) is subject to inspection, for example, an inventory of a warehouse of material assets.

Based on the basis for

- planned;

- unscheduled.

The timing of the planned inventory is carried out according to the approved schedule (before the preparation of annual reporting).

Unscheduled (sudden) is carried out in connection with an emerging need (mistakes, theft, change of the financially responsible person, etc.).

Deadlines

To answer this question, let’s decide on the type of event being held. If the process is initiated voluntarily, then the deadlines for it are established by internal decisions. If the inventory is mandatory, then we are guided by the norms of the current legislation. Much depends on the reason for the obligation. One of the most common is annual reporting. For the most part, reconciliation is carried out at least once a year. A much more difficult situation is bankruptcy. Then, according to the law, a period of three months is allocated from the moment the bankruptcy proceedings begin for calculating the company’s assets.

Purposes and frequency of property inventory

In organizations and enterprises, the chief accountant develops, and the manager approves, a plan for conducting inventories in the organization. The plan determines the procedure, forms and timing of scheduled and unscheduled inventories.

The goals of conducting an inventory of property in accordance with clause 1.4 of the Methodological Instructions for Inventorying Property and Financial Obligations are the following:

The main purpose of conducting an inventory of property in organizations is to obtain objective and real information that allows one to assess the current property and financial situation and identify discrepancies with accounting and reporting data.

In accordance with the provisions of regulatory documents regulating the procedure for conducting an inventory of an organization's property, an inventory is mandatory, at least before the formation of annual financial statements. An inventory of fixed assets is allowed at least once every three years, and of library collections at least once every five years.

Reflection of inventory results on accounting accounts: postings

In accounting, everything is indicated in the same period in which the counting actions were actually carried out. Totals are also indicated in annual reports.

If goods/values are identified that were not in the possession of the company, then the following entry is generated:

- The goods discovered during the comparison were put on the balance sheet - Dt 08, 10, 41, 43, 50 Kt 91.

- The cost was written off - Dt 20, 23, 44 Kt 94.

- The shortage is attributed to the responsible person - Dt 73 Kt 94 (*If this person is still on the staff).

- Deducted from the salary of the responsible person - Dt 70 Kt 73

- Deposited into the cash register by the responsible person - Dt 50 Kt 73.

- The loss is written off due to the impossibility of collecting money for the damage caused - Dt 91-2 Kt 94

In the opposite case, when a shortage was detected, a posting is made to the debit of account 94 with a list of missing materials. If this can be attributed to loss due to natural causes, then the wiring is as follows:

When the value of the shortage exceeds the norms of natural values for write-off, and the person responsible for the loss is identified, the following entry is made:

According to the Labor Code of the Russian Federation, it is possible to withhold only 20% from an employee’s salary to cover losses:

If the employee is willing to pay the money to repay the debt independently from his own funds:

If it was not possible to identify the culprit, or there is no way to recover funds from him, then a record of the following type is created:

Postings during OS inventory: example

before the annual reporting, conducted an inventory of fixed assets. As a result of comparison of accounting and actual data, the following was revealed:

- shortage of a hydraulic machine with a purchase price of 42 thousand rubles. (28 thousand rubles residual value and 14 thousand rubles depreciation);

- shortage of a laptop (the culprit is Samokhin L. E.) worth 52 thousand rubles. (36 thousand rubles residual value and 16 thousand rubles depreciation);

- surplus hydraulic pump with a market value of 45 thousand rubles.

In accounting, the accountant recorded the following entries:

| Dt | CT | Amount (thousand rubles) | Wiring Description | Documentation | ||

| ||||||

| 01 disposal | 01 | 42 | The original cost of the hydraulic machine was written off | Act on write-off of fixed assets in form OS-4 | ||

| 02 | 01 disposal | 14 | depreciation of the hydraulic machine was written off | Accounting information | ||

| 94 | 01 disposal | 28 | The residual value of the hydraulic machine has been written off | |||

| 91 | 94 | 28 | Loss from machine write-off | |||

| ||||||

| 01 disposal | 01 | 52 | The original cost of the laptop has been written off | Act on write-off of fixed assets in form OS-4 | ||

| 02 | 01 | 16 | Laptop depreciation written off | Accounting information | ||

| 94 | 01 disposal | 36 | The residual value of the laptop has been written off | |||

| 73 | 94 | 36 | The shortage was attributed to Samokhina L.E. | |||

| 73 | 98.4 | 16 | The difference between the residual value of a laptop and the market value | |||

| 70 | 73 | 52 | The cost of the laptop was withheld from L. E. Samokhina’s salary. | |||

ATTENTION! The amount of damage caused by the shortage can be withheld from the employee’s salary within the limit - no more than 20% of the monthly salary (Article 138 of the Labor Code of the Russian Federation).

According to paragraph 36 of the Methodological Recommendations for the accounting of fixed assets, approved by Order of the Ministry of Finance dated October 13, 2013 No. 91n, unaccounted for fixed assets identified during the audit are taken into account in the fixed assets accounts at market value. Therefore, the hydraulic pump should be registered with the following wiring:

- Dt 08 Kt 91 - the hydraulic pump discovered during the inventory was capitalized;

- Dt 01 Kt 08 - hydraulic pump put into operation

Normative base

- Everything we wrote about above is regulated by Law No. 402-FZ. It describes in great detail all the recommendations and requirements. After reading this Federal Law, you will understand exactly in which document to reflect the inventory results, and you will also find answers to many questions related to accounting.

- Order of the Ministry of Finance of Russia No. 34n establishes the rules for maintaining reporting in organizations.

- Order of the Ministry of Finance of Russia No. 49 describes in detail the processes for registering the calculation. The guidelines from this standard will be extremely useful for familiarization.

- In the Decree of the State Statistics Committee of Russia No. 88 and No. 26 you will find all the forms and forms.

What is inventory?

Inventory is one of the procedures for monitoring the safety of company property.

Its essence is in comparing the actual availability of valuables (money, equipment, buildings, as well as liabilities) with accounting data. The procedure for conducting an inventory of fixed assets is regulated by the following legislative acts:

- methodological guidelines for inventory of property and financial obligations (Order of the Ministry of Finance dated June 13, 1995 No. 49);

- regulations on accounting and accounting in the Russian Federation (Order of the Ministry of Finance dated July 29, 1998 No. 34n);

- Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The company must conduct an inventory not only of its own property, but also of stored or leased property. The inventory is carried out at the location of the property and in the presence of the financially responsible person or the team leader, if we are talking about collective financial responsibility.

Is it necessary to conduct an OS inventory?

Companies must regularly check the actual availability of their fixed assets. Cases of mandatory inventory are specified in the Regulations on accounting and reporting in the Russian Federation (hereinafter referred to as the Regulations), approved. by order of the Ministry of Finance dated July 29, 1998 No. 34n (clause 27), and Methodological Instructions for Inventory (hereinafter referred to as the Methodological Instructions), approved. by order of the Ministry of Finance dated June 13, 1995 No. 49 (clause 1.5).

There are few such cases, and they are associated with the company’s plans to sell property or rent it out. Inventory is also needed after a fire and other extreme situations, before drawing up a liquidation balance sheet, etc. The most common situation is carrying out an inventory before drawing up an annual balance sheet. If the company's statements are subject to mandatory audit, then without carrying out an inventory procedure it will be problematic to confirm the accuracy of the balance sheet (namely, it contains information about the company's property status).

How often and for what reasons should reconciliation be carried out?

Based on the regulations that we indicated above, the process begins in situations where:

- Before submitting the report. This applies to those items that were not recalculated before October 1 of the current year. OS can be compared once every 36 months.

- If personnel who were responsible for certain resources leave.

- After detection of theft or damage.

- After an emergency: fire, flood, etc.

- In case of liquidation or reorganization.

It is allowed to count inventories at the request of individual employees if the need is justified.

At least when should inventory be taken?

An inventory of fixed assets should be carried out at least once every 3 years, and of library collections at least once every 5 years (clause 1.5 of the Guidelines for the inventory of property and financial obligations).

The exact timing of inventory is determined by the company independently. As a rule, an asset inventory is carried out before annual reporting. However, the law establishes cases in which a company is obliged to conduct an inventory:

- transfer of property for rent;

- reorganization;

- liquidation;

- sale of property;

- change of financially responsible persons or team leader (as well as at the request of team members or when more than half of its members leave the team - for participants in a collective responsibility agreement);

- establishing facts of theft, abuse, damage to property;

- before preparing financial statements for the year;

- emergencies.

Let's study the procedure for conducting an inventory of fixed assets.

Reflection of inventory in accounting if a shortage is identified

If the shortage is within the permissible natural loss, then the operations will be as follows:

| D94—K10(41.43) | The cost of losses is written off |

| D20(25,26,44)—K 94 | Shortage within normal limits canceled |

If exceeded, there are two scenarios:

- If the guilty person is identified, collect compensation from him.

- When it is not possible to find out the culprit, or it is impossible to take legal action against him, the loss is included in the other expenses column.

| D94—K01(10,41,43,5) | The cost of inventory items has been written off |

| D73(76)—K94 | The amount of the lost was attributed to those responsible |

| Dt50 (51.70)—K73 (76) | Collection made |

| D91—K94 | Loss exceeding the required value is included in other expenses |