You always want to expand and multiply a successful profitable business by opening an additional structural division for this. Or, for example, sometimes it is necessary to bring production facilities closer to sources of raw materials, remove “dirty” production from large cities, bring sales points closer to consumers, and reduce costs for resource and property payments. One of the options for achieving these goals and solving the problems facing management is to open an additional office.

The decision to open a new structural unit adds work and questions to the manager (what legal status to give to the structural unit,

how to register, where, what documents are needed) and the accountant (how to keep records, how to submit financial statements, what taxes to pay, what you can get fined for). A newly created structural unit can be given the legal status of a branch, representative office or other separate unit (hereinafter referred to as OP). In our article we will talk specifically about other OPs, for example, a retail outlet.

What is a separate division

The concepts of “branch” and “representative office” are given in Art. 55 Civil Code of the Russian Federation. The concept of a separate unit is specified in Article 11 of the Tax Code of the Russian Federation - “... any territorially separate unit from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. At the same time, a workplace is considered stationary if it is created for a period of more than one month...”

A separate unit is characterized by two characteristics - territorial isolation and the presence of a stationary workplace created for a period of more than a month.

Personal income tax

The company, as an employer, acts as a tax agent for the withholding and payment of income tax on the paid income of its employees. The company must submit data on employee income to its tax office. And the tax withheld from employees must be transferred to the place of registration of these employees as taxpayers. For this purpose, when opening separate units, organizations must register with the tax office at the location of each unit. Personal income tax is paid according to the details of each tax office, and duplicate data on the income of employees of a separate department is also submitted there.

A separate division requires a power of attorney

A separate division is created with the purpose of performing the functions of the organization (all or part of them) or representing the interests of the organization and protecting them at its location. However, an OP is not an independent legal entity and therefore, in order to enter into any legal relations on behalf of the parent organization, it is necessary that all powers are spelled out not only in the constituent documents and regulations of other OPs, but also in a properly executed power of attorney. For example:

- carrying out transactions and other actions related to the current activities of the division. In this case, you can set restrictions. For example, to provide the right to enter into contracts only of a certain type or contracts whose maximum price is limited, etc.;

- opening bank accounts, performing operations to manage funds in these accounts;

- disposal of property with which the unit is allocated, or certain types of property (for example, with the exception of real estate);

- conclusion and termination on behalf of the organization of employment contracts with persons hired to work in a separate unit;

- the right of first signature of various documents drawn up in a separate division: accounting, financial documents, invoices, reporting, etc.;

- representing the interests of the organization in government bodies;

- the possibility of transferring certain powers to third parties, since the head of a department cannot always independently perform his functions for various reasons (for example, a business trip, illness, etc.).

Unlike branches and representative offices, the emergence of another separate division is not accompanied by changes to the constituent documents of the organization, except for documents that actually confirm the creation of a stationary workplace (for example, a lease agreement and an order to hire a person who will be located there). Moreover, when creating a separate division, it is not necessary to approve the Regulations on this separate division, and you can also do without appointing the head of a separate division, without issuing a power of attorney to him (for example, you just hired several additional ordinary employees who will be located in a remote office). However, in practice, as a rule, an order from the head of a legal entity is still issued (there is definitely no need to hold a general meeting of participants for this). It seems to us that it is most appropriate to issue an order to make changes to the staffing table and organizational structure of the legal entity (if there is one).

Payment order details

If the parent organization transfers personal income tax to a separate division, then the following information should be indicated in the payment order (letter from the Ministry of Finance dated May 29, 2017 No. 03-04-06/32972, Federal Tax Service dated March 12, 2014 No. BS-4-11 / [email protected] ) :

- TIN of the organization (the OP does not have its own TIN);

- Checkpoint of a separate unit;

- payer - the name of the parent organization or its OP - depending on who transfers the tax;

- recipient - details of the Federal Tax Service, where the tax is paid;

- OKTMO of the municipality where the unit is located.

When paying centralized personal income tax, the tax can be transferred in one payment order indicating OKTMO of the selected responsible person indicated in the notification (clause 3 of the Federal Tax Service letter No. BS-4-11/23247 dated November 15, 2019).

To learn about which BCCs must be indicated in payment documents for personal income tax, read the article “What are the BCCs for personal income tax for employees?”

Differences between a branch and a separate division

We have reflected the main differences in the table:

| Type of separate division | Representation | Branch | Separate division |

| example | representative office of a foreign company in the Russian Federation | branch of a Moscow company in Smolensk | shop |

| Functions | represents the interests | performs a function elsewhere | fulfills a need |

| Legal entity status | No | No | No |

| Conducting business activities | No | Yes | Yes |

| Availability of information in the constituent documents of the organization | Yes | Yes | No |

| Legal documents for carrying out activities | Regulations on representation; Entering information into the organization's Charter | Regulations on the branch; Entering information into the organization's Charter | Manager's order |

| Having your own balance and account | More often than not | Yes | Not necessary |

Important! The head of the organization must also keep in mind when opening a structural unit the fact that the presence of a branch or representative office prohibits the organization from using the simplified taxation system, which does not apply to other OPs.

Results

When opening a separate division, a legal entity using the simplified tax system must make sure that this division does not have all the signs of a branch in order to avoid losing the right to apply the simplified tax system. Otherwise, the rules for registering, paying taxes and submitting reports for separate divisions do not differ from the rules established for other taxation systems.

Sources:

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

- Labor Code of the Russian Federation

- Federal Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ

- Order of the Federal Tax Service of Russia dated January 10, 2017 No. ММВ-7-14/ [email protected]

- Order of the Federal Tax Service of Russia dated August 11, 2011 No. YAK-7-6/ [email protected]

- Order of the Federal Tax Service of Russia dated 06/09/2011 No. ММВ-7-6/ [email protected]

- Order of the Federal Insurance Service of the Russian Federation dated April 22, 2019 No. 217

- Order of the Ministry of Labor of Russia dated April 29, 2016 No. 202n

- Letter of the Federal Tax Service of Russia dated September 3, 2010 No. MN-37-6/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for opening and closing separate divisions

As for registering a separate division, it is much simpler than for branches and representative offices (we discussed the registration of branches in the article “Registration of an LLC branch”).

So, registration of a separate division:

- easier! There is no requirement to formalize the corresponding decision of the founder;

- there is no need to enter information about a separate division into the constituent documents and into the Unified State Register of Legal Entities.

It is enough just to register for tax purposes according to the rules of Art. 83 Tax Code of the Russian Federation.

Procedure for opening (registration) of a separate division

We remind you that we are talking about a structural division separate from the main company.

4.1. We issue an order to open a unit . On the opening of a division, the director of the Company issues a corresponding order (see completed example below) and issues a power of attorney to the head of the OP.

Order No.___ on the creation of a separate division

"___"___________2018 _______________________

Due to the development of the company and the need to expand its structure

I ORDER: 1. To create from 07/01/2018, without changing the staffing table, a separate division in the marketing and sales department, located at the address: 214000, Smolensk, st. Sovetskaya, 1, office U1 (hereinafter referred to as OP-SML).

2. The created separate division of OP-LSU is not a legal entity, branch, representative office, does not have an independent balance sheet, and does not have a current or other bank account. Accounting, payment and submission of reports on taxes and fees are carried out by the parent organization - Primer LLC, centrally, at its location.

3. The Company performs the following functions for managing the Separate Division:

- determines the main directions of its activities, approves plans and reports on their implementation;

- carries out inspections of the financial and economic activities of the Separate Division;

- appoints and dismisses the Manager on the grounds provided by law;

- determines the structure of the Separate Division;

- makes a decision to terminate the activities of the Separate Division.

4. The management of the activities of a separate division of OP-LSU is carried out by a Manager appointed by the director of the Company. The head of the Separate Division of OP-SML acts on the basis of a power of attorney issued and signed by the director of the Company.

5. Head of the Separate Division:

- has the right to conclude on behalf of the Company contracts for the sale of goods, works, services produced by the Company in the amount of up to 300,000 (three hundred thousand) rubles, while splitting contracts is not allowed;

- acts by proxy on behalf of the company within the powers determined by the power of attorney issued to him;

- carries out operational management of the activities of the Separate Division in accordance with the plans approved by the Company;

- signs primary accounting documents and invoices issued by the LSU OP (the right of first signature on documents);

- signs and submits accounting, tax, statistical reporting, reporting to extra-budgetary funds of the LSU OP;

- represents the interests of the Company in the person of the Separate Division in relations with government bodies, local governments, extra-budgetary funds, tax authorities, Rosstat bodies, banks, insurance companies, all institutions and organizations regardless of their form of ownership, citizens of the Russian Federation and beyond abroad in connection with the activities of the LSU OP;

- within the limits of available powers, issues orders and instructions, gives instructions that are mandatory for all employees of the Separate Division;

6. Responsibility. For obligations arising as a result of the economic activities of a separate division, the Company bears unlimited liability with all its property, acts as a plaintiff and defendant in court, arbitration (arbitration court). Claim work is carried out by the Company.

7. Make changes to the organizational structure, familiarize employees with this order as it relates to them.

8. In its work, the created separate division shall be guided by the Charter of Primer LLC, this order and the instructions of the director of the company.

4.2. We notify the tax office about the opening of a division .

A notification is filled out in form No. S-09-3-1, which is submitted to the Federal Tax Service at the location of the parent company. The Federal Tax Service at the location of the parent company forwards the information to the Federal Tax Service at the location of the OP. After receiving this message, the tax office at the location of the OP must register it within 5 (five) days. If it is necessary to change information about the OP (for example, a change of legal address), the company must submit a message to “its” Federal Tax Service Inspectorate. If a company opens several separate divisions in one municipality, then a notification about the selection of an inspectorate to register several separate divisions will also be added to the package of documents for registration of an OP. It must be submitted to the inspectorate in which all OPs will be registered within a month from the date of their creation.

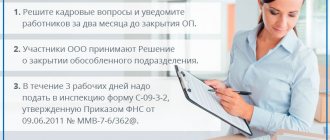

Procedure for closing (liquidating) a separate division

4.3 We issue an order to liquidate a separate division (completed example below).

Order No.___ on the liquidation of a separate division

"___"___________2018 _______________________

Due to failure to meet planned targets

I ORDER: 1. To liquidate from 01.11.2018 a separate division located at the address: 214000, Smolensk, st. Sovetskaya, 1, office U1 (hereinafter referred to as OP-SML).

2. Head of the sales department I.I. Ivanov develop and approve the liquidation procedure for OP-LSU, organize the liquidation process: rent, utilities, transfer of debt, dismissal of employees, removal of property. 3. Chief accountant of Primer LLC Semenova S.S. conduct a complete inventory of OP-LSU, submit accounting and tax reports, make all payments to employees, deregister a separate division. 4. I entrust control over the implementation of the order to the head of the legal department, P.P. Petrov.

4.4. We inform employees about dismissal due to staff reduction or in connection with the liquidation of the organization (Article 81 of the Labor Code of the Russian Federation). The second option is acceptable only if the division is located in an area different from the location of the parent organization and other branches of the company. Otherwise, the employer will have to formalize a layoff. Any employee can be fired due to liquidation, even a pregnant woman. When reducing staff, the employer agrees not only to provide the employee with the guarantees of Art. 180 of the Labor Code of the Russian Federation, but also to comply with the rules of Art. 179 of the Labor Code of the Russian Federation on preferential retention at work.

4.5 We notify the Federal Tax Service about the liquidation of the division. We submit a message in form No. S-09-3-2 to the inspectorate at the location of the company’s head office within 3 (three) working days from the date of termination of activity through another regular separate division.

The company will be deregistered at the location of other separate divisions - within 10 (ten) working days from the date of receipt by the inspectorate of the notice of termination of activities.

New form of informing the Federal Tax Service

The Federal Tax Service of Russia issued order No. ED-7-14/ [email protected] dated 09/04/2020, according to which, from 12/25/2020, all reports about separate divisions must be submitted using new forms. The order approved the following forms of messages for legal entities:

- on the creation of a separate division and on changes in previously sent information;

- about the closure of a unit;

- on granting a unit the authority to make payments in favor of individuals and on the deprivation of such authority.

The form of notification of the choice of a tax inspectorate for registering an organization at the location of one of its separate divisions has changed. The new forms are mandatory; tax officials will not accept information on old forms.

Due to recent changes, the remainder of this article may be incorrect!

We are already updating it and will republish it soon. If you need up-to-date instructions right now, use free access to ConsultantPlus materials.

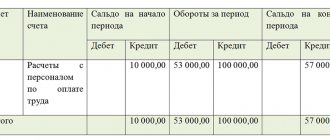

Accounting in a separate division

5.1. There are two ways of maintaining accounting in organizations with separate divisions - centralized and decentralized.

In the first method, the parent organization keeps records of all transactions. To do this, each OP transfers to it all primary documents, both received from counterparties and generated by its employees. Based on these documents, the accounting department of the parent organization reflects the data in centralized accounting.

In the second method, OPs maintain accounting records independently. The parent organization reflects in its accounting only the financial and economic transactions directly carried out by it. In this case, the financial statements as a whole for the legal entity are compiled by summing up the indicators of the accounting registers of the parent organization and the OP.

5.2. The procedure for accounting for business transactions depends on whether the OP is allocated to a separate balance sheet or not. In the first case, accounting is carried out decentralized, in the second - centralized.

OP is not allocated to a separate balance sheet

The rules for document flow (composition, terms of transfer, responsible persons) between the parent organization and the OP are approved in the accounting policy. Within the time limits established by the accounting policy, the OP transfers to the parent organization the primary accounting documents, on the basis of which accounting entries are made in the accounting of the parent organization. The transfer of primary documents is carried out according to a special independently developed and approved register. Accounting statements for such OP are not prepared separately.

OP is allocated to a separate balance

The OP maintains accounting records independently on a separate balance sheet, but the obligation remains to apply the accounting methods reflected in the accounting policies of the parent organization. A separate balance sheet of an OP is a list of indicators with the help of which its property and financial position is reflected for the preparation of financial statements of the organization as a whole.

Note that the document flow schedule between the parent organization and the EP allocated to a separate balance sheet, the working chart of accounts, as well as document forms developed by the organization independently are approved by the accounting policy.

The exchange of information between the parent organization and the OP occurs on the basis of the “advice” document. There is no unified advice form; the organization develops it independently and records it in its accounting policies. An advice note is drawn up for those cases when the parent organization does not participate in the operations carried out by the enterprise, and vice versa. Copies of primary documents confirming the operation are attached to each advice note. The financial statements of the organization as a whole must include indicators of the activities of the EP (including those allocated to separate balance sheets).

5.3 Features of taxation in EP

In the manner provided for in Art. 19 of the Tax Code of the Russian Federation, branches and other separate divisions of Russian organizations perform the duties of these organizations to pay taxes and fees at the location of these branches and other separate divisions. Let's look at the features of each tax

| Tax | Payment procedure | Reporting procedure |

| Corporate income tax | The tax is transferred to the federal budget in full at the location of the parent organization. To the regional budget - according to the location of the organization and its separate divisions (the distribution of tax amounts is made in proportion to the number of employees or the residual value of depreciable property). An exception is if the enterprise has several branches on the territory of one subject of the Russian Federation or the head office and branches are located in the same region. Then the organization has the right to choose a responsible unit (it can be either the head office or one of the branches) that will pay the tax. | At the location of the parent organization, a declaration is submitted for the organization as a whole, with the distribution of tax amounts among separate divisions. According to the location of the separate divisions, the following are filled out: Title page (Sheet 01), subsection 1.1 of Section 1; subsection 1.2 of Section 1 (when paying monthly advance payments during reporting (tax) periods); — calculation of the amount of tax (Appendix No. 5 to Sheet 02) payable at the location of this separate division. If the organization has chosen a responsible division, then it is the responsible division that must report. The declaration is submitted even if the OP is not operating. |

| VAT | VAT is paid entirely by the parent organization | The declaration is submitted by the parent organization, for the entire company. |

| Personal income tax | The tax is transferred to the location of the organization and its OP. The tax at the location of the OP is paid based on the amount of income accrued and paid to the employees of these divisions | Information on employee income in Form 2-NDFL is submitted by the parent organization. At the same time, the OP can submit information about the income of its employees itself. But provided that the OP is allocated to a separate balance sheet and the head of the OP is authorized by the parent organization to represent its interests in the inspection. In this case, information about the income of individuals working in an EP is submitted by the organization to the tax authority at the location of the EP, to which personal income tax is transferred from the income of such employees. |

| Insurance premiums | Contributions are transferred to the organization as a whole. With the exception of separate divisions that have a separate balance sheet, current account and accrual payments in favor of individuals. They register with extra-budgetary funds at their location, pay fees and submit reports at the place of registration. | If the OP is allocated to a separate balance sheet and has a current account, at the end of the reporting periods, reports are submitted at the place of registration of the OP. If the branch is not allocated to a separate balance sheet and does not have its own current account, the parent organization must report for it. |

| Property tax | Property tax on movable property is paid by the parent company. The exception is OP allocated to a separate balance sheet. They pay the tax themselves. In addition, the tax must be paid separately for real estate objects. Moreover, regardless of whether they are located at the location of divisions that are not allocated to a separate balance sheet, or in regions where the organization does not have separate divisions at all. Property tax must be paid where the property is located, according to the tax rates in force in the territory of the entity where this property is located. | The parent company must report property taxes. With the exception of OP allocated to a separate balance sheet. Such divisions must independently submit calculations and declarations: - for movable property that is listed on its balance sheet; - for real estate located in the territory under the jurisdiction of the same inspection as the branch. In addition, you will have to submit a report to the Federal Tax Service on the location of the real estate that is located outside the head office and the OP. |

| Transport tax | Payment of taxes and advance payments is made at the location of the vehicles. That is, at the place of their state registration | Transport tax declarations must be submitted to the inspection office in which the vehicle is registered. |

| Land tax | The tax and advance payments of the tax are paid to the budget at the location of the land plots recognized as the object of taxation | Declarations and calculations for advance payments must be submitted to the inspectorate at the location of the land plots. If a company has several plots on the territory of one municipality, then one general declaration or calculation can be submitted for them |

| Single tax under a simplified taxation system | The tax is transferred to the location of the parent organization | The declaration is submitted by the parent organization |

| A single tax on imputed income | If separate units are located in the territory where this tax is introduced and carry out “imputed” activities, the tax must be paid at their location. The tax is calculated at the rates in force in the territory of the constituent entity of the Russian Federation where the activity is actually carried out. | UTII declarations are submitted to those inspectorates where the company is registered as a UTII payer. That is, at the place of actual implementation of the activity (at the location of the OP) |

When creating a separate division, it is necessary to remember that the parent company is responsible for their activities. If a company is late in submitting an application to register a unit with the inspectorate, it will be charged a fine of 10,000 rubles. (Article 116 of the Tax Code). In this case, not only the organization itself, but also its leaders - the director and chief accountant - may suffer. For late submission of an application for registration with the tax inspectorate, officials may be punished with a fine of 500 to 1000 rubles. At the same time, conducting activities without tax registration is punishable by a fine of 10% of the income received by the organization during such activity, but not less than 20,000 rubles. or 20% (if the unit has been operating without registration for more than 90 days), but not less than 40,000.

Firmmaker, 2013 Dina Ermakova, Anna Sheshenina (Luksha) When reprinting, a link to the material is required