Home — Articles

- Law and explanations of officials

- Formalization of empowerment

- Message form

- Other features

At first glance, the rules for calculating and paying insurance premiums established by Chapter 34 of the Tax Code of the Russian Federation are almost no different from the provisions of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Mandatory Fund medical insurance" (Law No. 212-FZ). But it’s “almost”.

Thus, Law N 212-FZ ordered a separate division of the insurer to fulfill the organization’s obligations to pay insurance premiums (monthly mandatory payments), as well as the obligation to submit calculations for insurance premiums at its location, provided that the division has a bank account and a separate balance sheet , as well as if they received payments and other remuneration in favor of individuals.

If the above conditions were not met, then the payment of fees and submission of reports for the separate unit was carried out by the parent organization at its location (including if the separate unit was located outside the territory of the Russian Federation (clause 14 of Article 15 of Law No. 212-FZ)).

Clause 11 of Article 431 of the Tax Code of the Russian Federation also obliges the organization to pay insurance premiums and submit a calculation of insurance premiums (calculation form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11 / [email protected] ):

- at its location and

- at the location of separate divisions that accrue payments and other remuneration in favor of individuals.

The date of submission of the specified calculation is no later than the 30th day of the month following the settlement (reporting) period, to the tax authority at the location of the organization and at the location of separate divisions of organizations, which again accrue payments and other remuneration in favor of individuals (p 7 Article 431 of the Tax Code of the Russian Federation). The amount of insurance premiums payable at the location of a separate subdivision is determined based on the size of the base for calculating insurance premiums related to this separate subdivision. The calculation period for insurance premiums is the calendar year, the reporting periods are the first quarter, six months, nine months of the calendar year (Article 423 of the Tax Code of the Russian Federation).

There are no other rules regarding the responsibilities of separate units located on the territory of the Russian Federation regarding insurance premiums in Chapter 34 of the Tax Code of the Russian Federation.

What is a separate division?

A separate unit (SU) can be any office whose actual location differs from the legal address of the enterprise. The main condition is the availability of a workplace for 1 calendar month.

This could be a separate office for accountants or lawyers, which is located away from the main enterprise. Or a workshop that was rented in a neighboring building.

There are 3 types of separate divisions:

- branches;

- representative offices;

- other separate divisions.

Here's how these types of units differ from each other:

| Branch | Representation | Other separate division | |

| Main functions | Partial or full implementation of the functions of the parent company and representative office | Representation and protection of the interests of the parent company | The actual place of performance of labor functions of employees |

| Notification of the Federal Tax Service on the opening of an OP | Not required. The main thing is to make changes to the Unified State Register of Legal Entities | Not required. The main thing is to make changes to the Unified State Register of Legal Entities | Mandatory within 1 month |

| Reflection of information in the Unified State Register of Legal Entities | Necessarily | Necessarily | Not required |

| Conducting commercial activities | Permitted in full (as with the parent company) | Forbidden | Workers are allowed to perform work functions |

| Main document when created | Decision of the owners of a legal entity | Decision of the owners of a legal entity | Order of the head of a legal entity |

| Own current account | Allowed with the consent of the parent company | Allowed with the consent of the parent company | Allowed with the consent of the parent company |

That is, the main difference between the 3 different categories of divisions is the main functions and the ability to conduct commercial activities.

Depending on which category the unit belongs to, they have different opening and closing procedures, as well as accounting and conduct of activities.

. The management of the parent company may have doubts about how exactly to classify a separate division, then it is best to submit a request to the Federal Tax Service.

It is advisable to ask the tax authority to provide a response in writing.

. If a dispute arises in the future, the legal entity will be able to prove that its actions were carried out in accordance with the explanation of the Federal Tax Service specialist.

How to open a separate division?

The opening of a separate division begins with the head of the parent company making a decision. It does not have to be in writing; there is no such obligation in law. However, in practice, it is better to issue such an order in writing.

, since in it the enterprise will be able to accurately indicate the date of opening of the unit and take further actions on its work (start of operations and employment of employees).

The parent structure must notify the tax authority of the decision to open a division. To do this, fill out form C-09-3-1 indicating the name of the separate division (if any), the address of its location and the date of its opening. The application is signed by the head of the parent company or another authorized person.

Form for notification of the opening of other separate divisions

(which are not representative offices or branches) are sent to the Federal Tax Service inspection at the place of registration of the parent company within 1 month from the date of their opening.

If the application is sent electronically, it must be signed with an enhanced electronic digital signature

.

For failure to comply with the deadline for submitting an application, the enterprise can be fined in the amount of 200 rubles, and the manager - in the amount of 300 to 500 rubles.

If a separate division is organized as a representative office or branch

, then information about it must be

entered into the Unified State Register of Legal Entities

. Within 3 days after opening a unit of this type, a legal entity must:

- submit an application for state registration of changes made to the Unified State Register of Legal Entities;

- attach the decision of the owners of the enterprise and the new version of the constituent documents;

- pay a state fee of 800 rubles (except for cases when documents are submitted through the MFC or a notary).

The tax authority sends a response within 5 working days about the registration of a separate division with the assignment of a checkpoint.

The Federal Tax Service does not have the right to refuse a legal entity to register a separate division

.

If the department has its own current account and pays wages to employees, then it will have to be registered with the Pension Fund and the Social Insurance Fund. To register a separate division with the Pension Fund of the Russian Federation, it is enough to notify the tax authority about vesting the OP with the authority to pay wages to individuals. The Federal Tax Service will independently inform the Pension Fund of this decision. This application must be sent to the tax authority within 1 month from the date the department is vested with such powers.

And to register an individual enterprise with the Social Insurance Fund, the parent enterprise must send an application in the form presented in Appendix No. 1 to Order No. 217 of the Federal Social Insurance Fund of the Russian Federation dated April 22, 2019. The application must be accompanied by a certificate in the bank’s form on opening a current account and a copy of the order granting powers

on the calculation and payment of remuneration to individuals.

The maximum period for submitting a notification to the Social Insurance Fund is 30 calendar days.

For failure to comply with the established deadline, a legal entity will be fined in the amount of 5,000 rubles if the delay is 90 days or 10,000 rubles if the delay is more than 90 days.

Formalization of empowerment

Neither the legislation on insurance premiums nor the Tax Code of the Russian Federation specifies what documents must confirm the fact that a separate unit has been vested with the powers in question. It is logical to assume that this fact is documented in an internal administrative document of the organization, for example:

- regulations on the branch (representative office, other separate division), approved by order of the head of the organization;

- by a special order from the head of the organization to vest a separate division with the authority to accrue payments and remuneration to individuals.

In the first case, a separate unit receives powers from the moment of its formation, in the second - from the date specified in the order or directive of the head of the organization.

If management considers it inappropriate to further exercise the relevant powers, then an order should be issued to deprive the separate division of the authority to accrue payments and remuneration to individuals. And accordingly, report this to your tax office within a month.

It is desirable that the start date for the separate division to make payments and remunerations to individuals falls on the first day of the calendar month. It is from this moment that the payer must submit calculations for insurance premiums at the location of the organization and the location of the separate division.

If the date falls on the first day of the quarter, then the organization will not have to submit reports on insurance premiums at the location of the separate unit for the previous reporting period.

Nuances of paying taxes and contributions

The main nuances that are worth paying attention to include:

- income tax;

- excise taxes;

- transport tax;

- NFDL;

- insurance premiums.

Other taxes, for example the simplified tax system or UTII, must be paid at the location of the head company or taxable objects.

Payment of income tax

must be produced separately in each region of Russia. This is due to the fact that of the total tax rate of 20%, part – 3% – goes to the federal budget, and 17% goes to local budgets. That is, advance payments of income tax at a rate of 3% are paid at the location of the parent company (but based on the total profit for all separate divisions), and 17% are paid to the divisions independently to the local budget.

Income tax reporting is prepared separately in the parent company (taking into account the indicators of all branches) and for each division.

If a parent enterprise and separate divisions (or several divisions) are located on the territory of one subject of the Russian Federation, then the income tax declaration and payment of this tax can be combined

.

For a separate division located on the territory of a foreign state, the parent company pays taxes and submits reports.

Payment of excise taxes

and reporting on them is carried out by separate divisions if:

- the branch actually carries out activities in the production of excisable goods;

- the division carries out excise operations;

- OP comes denatured ethyl alcohol;

- the branch carries out operations using grapes (ownership rights belong to a separate division).

If there are several separate divisions in the territory of one region, then reporting and payment of excise taxes can be combined.

Payment of transport tax

and submission of reports for periods up to 2021 inclusive is carried out at the place of registration of the vehicle. The exceptions are:

- Water transport (except for small vessels). Tax payment is made to the Federal Tax Service depending on the territory of assignment (port of registry).

- Air Transport. Payment of transport tax is made by the head enterprise.

From 2021, that is, from reporting for 2021, reporting on transport tax is no longer required.

Regarding personal income tax

only one rule applies: if in an employment or civil law contract a separate division acts as one party, then it is it that pays the tax and submits reports. If contracts are concluded with employees on behalf of the parent company, then the OP does not report on such employees and does not pay tax on them (regardless of where they actually perform their duties).

Insurance premiums

a separate division pays if two conditions are met simultaneously:

- he has his own current account;

- The department itself pays wages.

If at least one condition is not met, then the payment of insurance premiums is made at the expense of the parent company. Similar requirements apply to reporting on insurance premiums.

Law and explanations of officials

The concept of a separate division and its distinctive features are given in paragraph 20 of paragraph 2 of Article 11 of the Tax Code of the Russian Federation. The location of a separate division of a Russian company is considered to be the place where this organization carries out its activities through its division (paragraph 18, clause 2 of the Tax Code of the Russian Federation).

The territorial isolation of a subdivision from an organization is determined by an address different from the address of the specified organization (letter of the Ministry of Finance of Russia dated August 18, 2015 N 03-02-07/1/47702). The equipment of a stationary workplace is considered to be the creation of all conditions necessary for the performance of labor duties, as well as the very performance of such duties (letter of the Ministry of Finance of Russia dated June 14, 2016 N 03-02-07/1/36019). A workplace is considered to be a place where the employee must be (or where he needs to arrive in connection with his work) and which is directly or indirectly under the control of the employer (Article 209 of the Labor Code of the Russian Federation). The form of work organization is a shift or a business trip; the period of stay of a specific employee at a stationary workplace created by the organization has no legal significance in this case.

From January 1, 2021, Article 23 of the Tax Code of the Russian Federation, which determined the obligations of taxpayers and payers of fees, was supplemented with clause 3.4, establishing the obligations of payers of insurance premiums (subparagraph “b”, paragraph 17, article 1 of the Federal Law of July 3, 2016 N 243-FZ, hereinafter referred to as Law No. 243-FZ).

Among these, organizations are required to report to their tax authority that a separate division established on the territory of the Russian Federation has been vested with the authority to charge payments (remunerations) to individuals (about the deprivation of such authority). Both the granting of powers and their deprivation must be reported within one month from the date of granting (deprivation) (subclause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation).

If the separate division being created is not endowed with the appropriate powers, then there is no need to inform the tax authority about this (letters of the Ministry of Finance of Russia dated December 28, 2016 N 03-04-12/78677, dated January 12, 2017 N 03-15-06/679). In this case, both the payment of insurance premiums and the submission of payments for the designated separate unit are carried out by the organization at the location of the head unit.

The decision to vest the department with the appropriate powers is made by the payer of insurance premiums independently (letters of the Federal Tax Service of Russia dated 02/14/2017 N BS-4-11 / [email protected] , Ministry of Finance of Russia dated 03/23/2017 N 03-15-06/16906, dated 02/27/2017 N 03-15-06/10903).

If an organization with separate divisions, before January 1, 2021, centrally calculated payments and other remunerations in favor of individuals, paid insurance premiums, submitted calculations, and this procedure did not change after January 1, then payment of insurance premiums and submission of calculations in the current year are carried out such organization to the tax authority at its location.

If the payment of insurance premiums and the submission of calculations last year were carried out separately by the organization itself and its separate divisions and this procedure did not change after January 1, then from 2017 contributions are still paid separately. There is no need to notify the tax authorities about the vesting of separate divisions with the corresponding powers.

If, from 2021, an organization switches to centralized calculation and payment of insurance premiums, then it is obliged to notify the tax authority of the deprivation of separate divisions of the relevant powers. Such an organization submits reporting on insurance premiums only to the tax authority at its location (letter of the Ministry of Finance of Russia dated March 6, 2017 N 03-15-10/12652).

The obligation to report to the tax authorities about registered payers of insurance premiums - separate divisions of Russian organizations that independently accrued payments and other rewards to individuals as of January 1, 2021, in accordance with paragraph 1 of Article 4 of Law No. 243-FZ, is assigned to the territorial bodies of the Pension Fund of the Russian Federation. .

The department’s own seal: is it necessary or not?

Here everything depends on the desire of the head of the parent company and the separate division. The legislation does not indicate the obligation or prohibition of a separate seal for a separate unit. If the head of the parent company allows it, the division can order its own stamp

.

The Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” and the Federal Law of 12/26/1995 No. 208-FZ “On Joint-Stock Companies” indicate that companies can

(

but are not required

) to have their own seal, emblem, stamps.

However, separate divisions cannot be classified as independently operating companies, since, according to paragraph 3 of Article 55 of the Civil Code of Russia, they are not recognized as a legal entity. This is due to the fact that divisions and branches do not have their own property.

If a separate division concludes all contracts (supply of goods, provision of services, labor, civil law and others) on behalf of the parent company, then there is no point in spending money on making a seal

. But if the division has a separate balance sheet or is located in another area and enters into contracts on its own behalf, then the seal can be made by agreement with the general director of the parent company.

But it is worth paying attention to the fact that, for example, bank branches are required to have their own seal

on the basis of Bank of Russia Instruction No. 135-I dated April 2, 2010 “On the procedure for the Bank of Russia to make decisions on state registration of credit organizations and issuance of licenses for banking operations.” The imprint of such a seal must contain the full name of the banking institution, legal address, name of the branch and its actual location.

On-site tax audits of a separate division

An on-site inspection can be assigned not only to the entire legal entity, but also to a branch or representative office. That is, if a separate division is not a branch of an enterprise in another city, then a separate on-site tax audit cannot be assigned to it.

The local Federal Tax Service inspection has the right to inspect a branch or representative office only in relation to local and regional taxes

. Tax authorities do not have the right to check federal taxes (we are talking about special regimes and VAT).

On-site inspections must meet the following conditions:

- maximum inspection period – no more than 1 month;

- a ban on conducting repeated tax audits of the same taxes for the same period;

- prohibition on conducting more than 2 on-site inspections for various reasons during 1 calendar year.

For an independent tax audit of a representative office or branch, a decision must be made by the local Federal Tax Service.

An on-site inspection of the parent enterprise together with its divisions is not a basis for prohibiting an independent inspection of a branch or representative office.

in one calendar year.

An on-site tax audit of a separate division is carried out according to general rules. The Federal Tax Service makes a decision to schedule an on-site tax audit, sets a date and notifies the head of the representative office about this via electronic communication channels or by Russian Post.

Inspectors who are members of the commission can check all documentation and request additional documents and clarifications. Upon completion of the tax audit, a protocol is drawn up

.

If errors or violations are discovered during the inspection, the report must be drawn up in the name of the parent company, and not in a separate division. This is due to the fact that the divisions are not a legal entity or independent taxpayers according to Article 19 of the Tax Code of the Russian Federation.

How parent organizations can fulfill their new responsibility

After January 1, 2021, the parent organization has the right to transmit to the Federal Tax Service a message about vesting a separate division (including a branch or representative office) with the authority to calculate payments and remunerations in favor of individuals (or about depriving such authorities) (clause 7 of Article 23 of the Tax Code of the Russian Federation):

- by mail;

- in electronic form via telecommunication channels;

- through the taxpayer’s personal account.

The Federal Tax Service is obliged to approve the procedure for transmitting such messages to the Federal Tax Service in electronic form and the forms of “paper” messages. This is provided for in paragraphs 3 and 4 of paragraph 7 of Article 23 of the Tax Code of the Russian Federation.

A separate division is vested with the authority to accrue payments and rewards to individuals from the date of issuance of the relevant order or instruction of the parent organization.

The form of notification of a Russian organization - payer of insurance premiums about vesting a separate division (including a branch, representative office) with powers (about deprivation of powers) to accrue payments and rewards in favor of individuals was approved by Order of the Federal Tax Service of January 10, 2021 No. ММВ-7-14/4 .

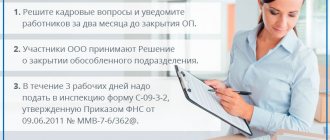

Closing a separate division

In order to close a unit, an appropriate decision must first be made

. Depending on which category a separate division belongs to, the decision to close is made differently.

If a separate division was registered with the Social Insurance Fund upon opening, then the fund must be notified of the closure of the division. To do this, an application is drawn up in the form presented in Appendix No. 2 to Order No. 217 of the Federal Social Insurance Fund of the Russian Federation dated April 22, 2019. A copy of the order on closing a separate division and a certificate on the bank’s form on closing a current account must be attached to the application.

After the unit is deregistered, all reports are submitted for it and the remaining taxes and contributions are paid

. The income tax return is completed for all periods before the end of the calendar year, including those when the division has already been closed. It must be submitted to the Federal Tax Service at the place of registration of the head enterprise.