Every accountant will tell you that one of the most difficult tasks in accounting is summing up the results of a period. But fortunately, 1C has a special mechanism that allows you to close a month without errors - no need to stress and worry that something went wrong. The main thing is to understand this mechanism and pay attention to the program prompts. So, let's figure out how to close the month in 1C 8.3 Accounting one, two, three!

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Which accounts are closed at the end of the year?

Before starting to prepare the annual financial statements, that is, before reforming the balance sheet, the accountant is required to generate the final entries for the reporting period. In accounting, the reporting period is a calendar month (clause 48 of PBU 4/99). Consequently, before closing the financial year, the accountant will need to draw up the final monthly turnover.

Which accounts are closed at the end of the month or year? Such BSCh can be tentatively divided into three groups:

- Cash balances that cannot have balances at the end of the reporting (financial) period. These include counting. 25 “General production expenses” and 26 “General operating expenses”.

- BSCs that may have a remainder, but which can be completely closed. These include counting. 20 “Main production”, 23 “Auxiliary production”, 29 “Service facilities and production”.

- BSCs that cannot have a general balance, but have a balance in open subaccounts. These are 90 “Sales” and 91 “Other income and expenses”.

Next, we will look at how accounts are closed at the end of the year; the entries are also suitable for generating final entries at the end of the month. We will determine the procedure for generating final accounting entries separately for each account, which directly affect the financial results of the company.

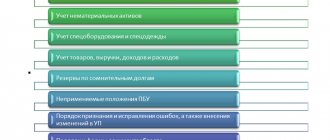

Reliability of accounting

According to the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ, financial statements must be reliable. Reliability can be ensured by timely and complete reflection of the facts of economic life that correspond to reality.

In December, it is advisable to check the availability and correctness of primary documents and replace copies with originals. All transactions must be reflected in accounting and tax records.

If errors are found during the check and analysis, they can be corrected this year.

Do not forget to submit updated returns if the errors found led to an understatement of the tax base.

We write off general production costs

The BSC is closed monthly, and all accumulated overhead costs must be written off to the accounts of the relevant production facilities. In other words, costs are written off to the accounts of those production facilities that were serviced.

Typical accounting entries:

| Operation | Debit | Credit |

| ODA written off in favor of core production | 20 | 25 |

| ODA included in the costs of servicing auxiliary production facilities and workshops | 23 | 25 |

| ODA aimed at maintaining service farms is written off to the appropriate accounts | 29 | 25 |

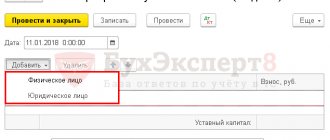

How to close a zero account when entering balances

If the company switches to automated accounting, then balances will have to be recorded using the zero BSC “000”.

Working with this BSCh has a number of distinctive features:

- When entering balances for an active account, the balance is recorded as a debit when a zero balance sheet corresponds to a credit. For passive accounting accounts, the exact opposite rule applies.

- Balances according to the work plan of the BSC should be registered on the last day of the financial year preceding the year in which automated accounting began. For example, if automated accounting has been used since 2021, register the balances in the accounting program as of 12/31/2018.

- Enter the balance on the BSC in the context of open subaccounts. Don’t forget about analytical accounting and detailed information on individual accounting indicators. For example, when entering balances for fixed assets, enter information separately for each fixed asset object.

Having registered all accounting data, it is necessary to generate a balance sheet for the zero balance sheet on the day the balances are entered and compare with the current balances of all balance sheets (from 01 to 99). Then the accountant determines the financial result of the activity and closes the account with the appropriate entries:

| Operation | Debit | Credit |

| If the debit of accounting account 00 exceeds the credit turnover, then the operation is reflected (retained earnings of the company as of December 31, 2018) | ||

| If the credit turnover is less than the debit turnover, then an entry is made (the uncovered loss is reflected as of December 31, 2018) |

Write-off of general business expenses

The procedure for concluding an account. 26 depends on the method of forming the cost of finished products (sold services, work), which must be enshrined in the accounting policy of an economic entity. So, there are two key ways:

- At full production cost, the following standard transactions are generated monthly:

| Operation | Debit | Credit |

| OCR written off for main production | 20 | 26 |

| OCR included in the costs of auxiliary production | 23 | |

| OCR written off to service farms | 29 |

- According to the reduced production cost, all general operating costs are charged directly to the operating cost of sales. In this case, a monthly accounting entry is generated:

| Operation | Debit | Credit |

| OCR written off as the cost of products, works, services | 90-2 “Cost of sales” | 26 |

Reference materials on the topic

Save the article to social networks:

The final stage of the chief accountant’s work is an action called “closing the month.” The majority of all enterprises perform this action every month. Today we will find out what the meaning of “closing the month” is.

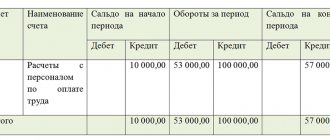

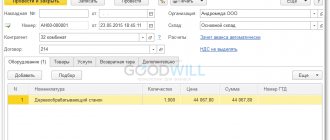

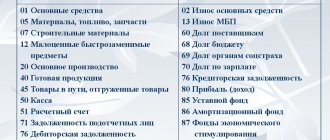

Let's imagine a running enterprise. All his activities with the help of accounting tools will be recorded in ledger accounts. We will see the results of the accounting accounts in the SALT reports.

Let's briefly look at the “turnover” of a real enterprise until the “closing of the month”. I made a turnover for the accounts as a whole, i.e. without using subaccounts. I did this to make it easier to understand. When the meaning of the “closing the month” process is clear, then it will be possible to look at SALT with subaccounts.

Some comments on the report

- Looking at the list of accounts (code and name), we see which areas of accounting were involved.

- The absence of accounts 41 and 44 shows us that this is not a company trading in goods.

- There are no 43, 40, 25 and 20, accounts - this is not production.

- There is no purely one 20 invoice - this is not the completion of work

- What remains is the provision of services. This is the case in our example.

- The report was generated for the month “November 20XX”

- OSV consists of three groups of indicators:

— At the beginning of the month : as of 10.31.XX at 23.59.59 — For the month (TURNOVER) from 01.11.XX 00.00.00 to 11.30.XX at 23.59.59 — At the end of the month . For each account they are added according to the following rules:

- If the accounting account is “Active” = Beg.Ost. + Turnover – Turnover

- If the accounting account is “Passive” = Beg.Ost. + Turnover – Turnover

In SALT, we can highlight the accounts responsible for the financial result. Such accounting accounts include accounts for “Revenue (Income) from sales” and “Accounts for accounting expenses for carrying out activities,” namely 90, 91 accounts.

Since the financial result is one number, which can be “Profit”, or can be “Loss”, then we need to get this one number from the “turnover”, which we will record on account 99.

To summarize the financial result, the formula will help us: “Revenue (Income) - Expenses.” As you understand, we need to select the amounts for the formula. Some amounts will go to the indicator “Revenue (Income) from sales”, others - “Operating expenses”

Each accounting account 90, 91 contains two indicators: “Proceeds (Income) from sales” and “Costs of activities”. How can we see this?

Everything is very simple. Credit turnover on accounts 90 and 91 will show “Revenue (Income)”. Moreover, this will only be on the first subaccounts, i.e. KO(90.1) and KO(91.1). It should be especially noted that credit turnover (CR) on subaccounts 90.1 and 91.1 appears within a month whenever a sale occurs. But the same cannot be said about expenses.

Debit turnovers of accounts 90 and 91 are designed to collect information about the Expenses of the enterprise. However, the time at which expenses reach these accounts during the month is not the same. Some expenses will be incurred at the time of sale. These expenses will be the cost of goods sold.

Closing production accounts

Let's make a reservation right away that the balance for BSC 20, 23, 29 is unfinished and does not require mandatory write-off at the end of the reporting or financial periods.

How to determine? If the production cycle does not coincide with the reporting periods, then a debit balance is formed on the BSC - the cost of work in progress. And if the production process fits into a calendar month (year), then, according to the BSC, there should be no leftovers. Typical entries for writing off production costs:

| Operation | Debit | Credit |

| Production costs written off to cost of sales | 90-2 “Cost of sales” | 20 |

| 23 | ||

| 29 |

Note that companies whose activities are related to the provision of services can additionally establish in their accounting policies which accounts are closed at the close of the month. In other words, to secure that BSCs 20, 23, 29 will be closed monthly, without any work in progress balances.

Change of tax regime

If an organization plans to switch to the simplified tax system, it is necessary to submit a notification to the tax office before December 31 (Article 346.13 of the Tax Code of the Russian Federation). The same requirement is established for persons who decide to change the object of taxation according to the simplified tax system.

Payers of UTII and simplified tax system must make sure that they have not lost the right to use the chosen system next year. The income of companies using the simplified tax system should not exceed 68.82 million rubles for 2015 (clause 2 of Article 346.12 of the Tax Code of the Russian Federation), and the residual value of fixed assets should be less than 100 million rubles. Organizations and individual entrepreneurs whose number does not exceed 100 people can apply the simplified tax system and UTII (clause 2.2 of article 346.26, clause 15 of clause 3 of article 346.12 of the Tax Code of the Russian Federation).

When switching from the simplified tax system to another taxation system, you must notify the Federal Tax Service before January 15 (clause 6 of article 346.13 of the Tax Code of the Russian Federation).

We close accounting account 90 “Sales”

At the end of the reporting month, the company is obliged to determine the financial result of its activities. This operation is a comparison of subaccounts. 90. That is, the accountant compares the indicators of subaccount 90-1 “Revenue” and the value of cost of sales, which is defined as the sum of subaccounts 90-2 “Cost”, 90-3 “VAT”, 90-4 “Excise taxes”, 90-5 “Trade and export duties."

If the company made a profit (revenue exceeded total costs), then the accountant generates the following entry:

Dt 90-9 Kt 99 - profit from sales is reflected.

If the company operates at a loss (revenue is lower than total costs), then the following entry is recorded:

Dt 99 Kt 90-9 - reflects the monthly loss for the company’s activities.

Consequently, subaccounts. 90 may have a balance at the end of the reporting month, but the total value of the synthetic BSC must be equal to zero.

Which accounts are closed at the close of the year? The following accounting entries are generated for this account at the end of the year:

| Operation | Debit | Credit |

| The “Revenue” sub-account was closed at the end of the year | 90-1 | 90-9 |

| The cost of production is included in the financial result | 90-9 | 90-2 |

| VAT is written off in favor of profits and losses | 90-9 | 90-3 |

| Excise taxes are included in the financial results of operations | 90-9 | 90-4 |

| Export trade duties written off at the end of the year | 90-9 | 90-5 |

Notification of the Federal Tax Service on the procedure for paying income tax on separate divisions

Organizations that have several separate divisions in one subject of the Russian Federation can choose a responsible division and pay income tax for all divisions through it. The tax authority must be notified of this decision by December 31. Notifications are also submitted to the tax authority if the enterprise has changed the number of structural divisions on the territory of a constituent entity of the Russian Federation or other changes have occurred that affect the procedure for paying tax (clause 2 of Article 288 of the Tax Code of the Russian Federation).

We close account 91 “Other income and expenses”

The company must determine monthly financial results based on income and expenses from other activities. This financial result is determined as the difference between the subaccounts of the account. 91. That is, we compare 91-1 “Other income” with 91-2 “Other expenses”.

The results of activities are reflected in the following accounting entries:

| Operation | Debit | Credit |

| Profit at the end of the month from other types of company activities is reflected | 91-9 | 99 |

| Reflected loss from other activities | 99 | 91-9 |

At the end of the financial year, the accountant makes the following entries:

| Operation | Debit | Credit |

| Profit for the year from other types of company activities was written off | 91-1 | 91-9 |

| Reflected loss from other activities for the year | 91-9 | 91-2 |

In turn, count. 99 “Profit and Loss” remains unclosed. This BSCH closes on December 31st. The accountant generates the following entries:

- Dt 99 Kt 84—– reflects the net profit of the reporting year;

- Dt 84 Kt 99 - the company's uncovered loss is reflected.

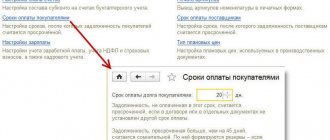

Vacation schedule and staffing

Every year, the employer is required to approve the vacation schedule for the next year. This must be done before December 17 of the current year (Article 123 of the Labor Code of the Russian Federation).

From 01/01/2016 it is planned to increase the minimum wage (minimum wage). Let us remind you that now it is 5,965 rubles. If the enterprise has employees whose salary is close to the minimum wage, the staffing table will need to be revised. According to Art. 133 and 133.1 of the Labor Code of the Russian Federation, the salary of employees cannot be lower than the federal and regional minimum wage.

In case of salary increases, it is necessary to draw up additional agreements to the employment contract.