The structure of all government institutions has its own divisions, departments, that is, structural units. And most of them have separate divisions - branches and representative offices, including in other cities. And sometimes employers need to transfer employees from one department to another, from the head office to a branch, etc. In some cases, for example, when staffing is reduced, the employer is obliged to offer the employee a vacant position from those available both directly in the organization and in the branch. In the article we will look at how to transfer an employee to another structural unit, including a separate one and located in a different area.

Save your job

The obligation to retain the employee’s previous job depends on the duration of the transfer.

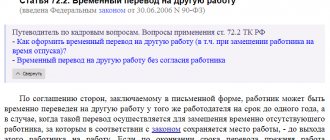

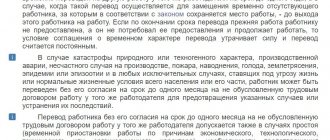

Temporary transfer. During a temporary transfer, the employee retains his previous job. If, at the end of the transfer period, he did not demand a return to his workplace and continues to work, then the condition of the agreement on the temporary nature of the transfer loses force and the transfer is considered permanent (Part 1 of Article 72.2 of the Labor Code of the Russian Federation).

Constant translation. In the case of a permanent transfer, the employer is not obliged to maintain the employee’s previous job.

What deadlines must be met?

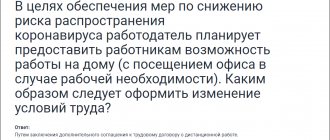

If reasons arise for carrying out preventive measures or eliminating consequences, it is allowed to transfer the employee to other work, the nature of which may not fully correspond to the provisions of the employment contract .

It is understood that the activity is carried out by the same owner, and obtaining an affirmative answer, that is, consent, is not necessary. No more than 1 month - this period is established by law for transfers dictated by production needs.

If, for the same reasons, it is necessary to carry out tasks that are also not taken into account in the contract, but are necessary to preserve the property of the enterprise, prevent material damage, or replace an employee who is not working for any reason, then the transfer is provided for by law without the consent of the employee, but for a maximum period of up to 1 months _

It is understood that what is happening at the enterprise is of an emergency nature, and the owner of the company is the same.

Compensate for moving expenses

If a move to another area is due to a transfer to a new place of work, the employer is obliged to bear the following expenses (Articles 165 and 169 of the Labor Code of the Russian Federation):

- relocation of the employee and his family members;

— transportation of property (except for cases when the employer provides the employee with means of transportation);

- settling into a new place of residence.

A commercial company independently determines the amount of compensation and the procedure for its payment (Part 2 of Article 169 of the Labor Code of the Russian Federation).

Note.

Family members include only spouses, parents (adoptive parents) and children (adopted) (Article 2 of the Family Code of the Russian Federation).

Salary during temporary work

For the temporary performance of other official duties at the will of only the employer, the employee must be guaranteed to receive a salary established by law. It is paid according to the following rules:

- if the salary for a temporary position of an employee is higher than his average previous earnings, it should remain that way. They consider it as their previous earnings plus additional payment;

- if the salary at a temporary job is less than what was previously earned, it is paid based on the previous average salary. The manager, at his own discretion, can also make additional payments, motivating employees to work in temporary jobs.

Documentation of translation

The transfer of an employee to another permanent job requires documentation.

Note. What forms of documents to use

According to Article 21 of the Federal Law of November 6, 2011 N 402-FZ “On Accounting,” companies are not required to use the forms of primary accounting documents that are contained in albums of unified forms approved by the State Statistics Committee of Russia. At the same time, Law No. 402-FZ does not limit the right to use those unified forms that have already become familiar.

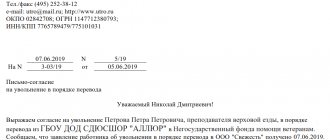

Offer to an employee to transfer to work in another location

If the head of the company considers it appropriate to change the place of work and residence of a certain employee, he must offer the employee a transfer to work in another location.

The need to obtain the employee’s written consent to the transfer is established by Part 1 of Article 72.1 of the Labor Code. The solution to this issue cannot be unilateral, since it affects the terms of the employment contract determined by the parties.

To obtain such consent, you must first prepare a written proposal to the employee for transfer and relocation to a new place of work.

It is allowed to compose this proposal in any form.

The procedure for transferring between branches of one enterprise or from head office to branch and back

1. General provisions

Branch of the organization in accordance with clause 3 of Art. 55 of the Civil Code of the Russian Federation is not an independent legal entity.

Its managers may be empowered to resolve personnel issues (hire, dismiss, transfer of employees) within their branch.

At the same time, the employer in relation to the employee hired by the branch is the parent organization, and the employment contract with the employee must indicate as a mandatory condition the place of work and structural unit (Part 2 of Article 57 of the Labor Code of the Russian Federation), at a branch of the organization.

In turn, part 1 of Art. 72.1 of the Labor Code of the Russian Federation defines transfer to another job as a permanent or temporary change in the labor function and (or) structural unit in which the employee works (if the latter was specified in the employment contract), while continuing to work for the same employer, as well as transfer to work in another locality together with the employer.

The transfer of an employee from one branch to another branch, or from a branch to the head office within one legal entity, is a transfer to another permanent job in the same organization and is possible only with the written consent of the employee .

The procedure for transferring employees between branches of one legal entity, or from the parent organization to the branch and back, is not regulated by law.

2. Registration and transfer of personnel documents.

Registration of personnel documents (i.e. additional agreement, transfer order) must be carried out by the personnel department of the head office of a legal entity , since the director of the branch does not have the authority to transfer an employee to another branch.

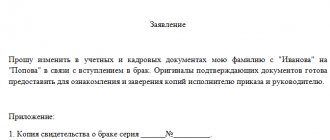

Stage 1. Filling out an application for transfer of an employee to another branch.

The application is written to the “Head of all branches”, i.e. the Director of a legal entity, or acting on his behalf under a power of attorney to sign personnel documents.

Responsible – the employee who is being transferred.

The application must be written in full accordance with the decision of the Personnel Selection Committee.

2. Stage. Submission of the application to the Head Office.

The application and other documents, if accepted by you at the Company, are submitted to the Head Office for signature by the Manager. Whether the application should also be endorsed by the heads of the branches between which the employee is being transferred is better determined in the internal documents (enter here if you are using it as a model). At this stage, the transfer is carried out by email/using an electronic document management system by HR employees.

Responsible persons are personnel service employees.

3. Stage. Drawing up an additional agreement to the employment contract.

The additional agreement is drawn up in four copies. (One remains with the issuing branch, the second with the Head Office, the third with the receiving branch, and the fourth with the employee).

The procedure for preparing an additional agreement to an employment contract:

3.1. An employee of the personnel department of the sending unit, after receiving the endorsed application and (additional documents on the transfer if necessary) about the transfer, sends copies of the documents to the OK employee of the receiving unit.

3.2. An employee of the personnel department of the receiving unit, after receiving the application, endorses it, thereby confirming the presence of a vacancy in the units specified in the application and sends the documents in response, attaching an excerpt from the staffing table, or information in free form with the following content:

3.2.1. Full payment parameters by position

3.2.2. SOUT data for this position

3.2.3. Employee work schedule

3.2.4. Other necessary information that is necessary to prepare an additional agreement to the employment contract (information about the availability of special benefits and compensation, working conditions in the far north, etc.).

3.3. An employee of the personnel department of the transferring department prepares an additional agreement to the employment contract and familiarizes the employee with it.

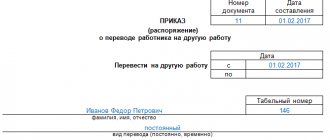

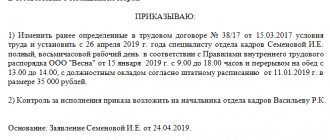

4. Stage. Registration and issuance of transfer order..

In 1C of the giving unit, an entry is made about the dismissal of the employee. A certificate is generated using the link from the order in 1C about dismissal “How did the employee use the vacation?” indicating the number of unused vacation days with mandatory reflection of working periods. This certificate is checked, printed and prepared for transmission to the receiving OK.

The order is registered (assigned a number) by the personnel department of the head office of the legal entity at the request of the personnel service employee of the issuing unit. It is drawn up according to the unified form T-5 in triplicate. (One remains with the issuing branch, the second - in the affairs of the OK Head Office, the third - with the receiving branch).

The person in charge is the HR employee of the issuing unit. Responsible for proper familiarization of the employee, signing a set of documents from the employee (additional agreement, order) is the issuing department.

5. Stage. Making appropriate entries in the Book of Movement of Labor Books.

In the book of accounting for the movement of work books, opposite the entry on the acceptance of the Labor Committee, the entry “the work book has been transferred to the personnel department of the branch/separate unit in the city .....” is placed, the details of the transfer order are not issued.

The person in charge is the HR employee of the issuing unit.

The employee of the issuing OC must ensure the transfer of the work book by hand / courier service, ensuring its safety

6. Stage. Transfer of documents to the receiving branch.

After all documents are completed, they are transferred for further management and storage to the branch where the employee will work. So, the original documents are sent to the branch:

- employment contract and all additional agreements to it, including on transfer,

- employment history,

- employee’s personal card in form T-2,

- order to transfer to another job,

- certificate of the number of days of unused vacation indicating the periods, certified by the OK employee’s signature and seal

- personal file (if maintained).

- other documents relevant for work activity: outstanding donor certificates, documents establishing disability, etc.

The personnel department of the issuing unit is obliged to ensure the personal transfer of documents according to the act , or the sending of documents by courier delivery service, with mandatory tracking of the package of documents and insurance in case of loss.

In this case, two copies of the act are signed by an employee of the personnel department of the issuing unit and attached to the set of documents. After receiving the documents and checking their completeness, the HR department of the receiving unit is obliged to ensure the transfer/forwarding of the original act with its signature.

7. Stage. Registering an employee in the 1C program and processing documents in the receiving department

In 1C, the receiving OK makes a posting about the reception of the employee. Unused vacations are entered as a balance according to the certificate received in accordance with the Methodological Recommendations for working with the 1C program.

Responsible – employee of the personnel department of the receiving unit.

8. Stage. Making an entry about the transfer in the work book.

Information about transfer to another permanent job must be entered in the employee’s work book (Part 4 of Article 66 of the Labor Code of the Russian Federation). Such an entry must be made in the employee’s work book by the HR department of the branch/OP where the transfer was made.

An entry about a transfer to another permanent job is entered into the work book as follows: in column 1 the serial number of the entry is entered; Column 2 indicates the date of the employee’s transfer; in column 3 an entry is made about the employee’s transfer to another job, indicating the position, structural unit, name of the separate structural unit; in column 4, reference is made to the order (instruction) on the transfer of the employee to another job.

9. Stage. Entry of the transfer into the personal card by the receiving branch.

In accordance with clause 12 of the Rules, the employer is obliged to familiarize the owner with the entry made in the work book about transfer to another permanent job against signature in his personal card, where the entry made in the work book is repeated. After entering information about the employee’s transfer to another permanent job into Section III “Hiring, transfers to another job” of form No. T-2, the employer familiarizes them with the information to the employee against signature in column 6 “Personal signature of the owner of the work record book.”

Responsible – employee of the personnel department of the receiving unit.

10. Stage. Making an entry in the TC accounting book and inserts for them.

An entry about the acceptance of the work book is made in the Work Book Record Book, where the date of acceptance is the date of transfer, and the details of the transfer order are indicated.

Responsible – employee of the personnel department of the receiving unit.

Please contact us if you have any questions or need clarification.

You can request the development of documents and procedures for your organization via the feedback form

Additional agreement to the employment contract

Changes in the terms of the employment contract determined by the parties must be recorded in an additional agreement. It is also appropriate in its text to define the procedure for compensating expenses for moving an employee and his family, transporting property, settling into a new place, as well as other conditions that the parties deem necessary to determine.

In the case of the development of a systematic branch network, it is more convenient to develop a provision on compensation of expenses for employees, where to establish uniform standards for reimbursement of expenses for moving employees to new places of work. If one or two employees move to another location, the conditions for reimbursement of expenses need only be included in an additional agreement to the employment contract.

Personal income tax

Employee expenses for relocation and arrangement are not subject to personal income tax. Paragraph 3 of Article 217 of the Tax Code exempts from payment of personal income tax on all types of compensation payments established by the current legislation of the Russian Federation (within the limits established in accordance with the legislation of the Russian Federation), including those related to the performance of labor duties (including moving to work in another area).

Consequently, amounts reimbursed by the organization for the cost of travel of the employee and his family members to the place of work, made in connection with his move to work in another area, are not subject to personal income tax in the amount established by the employment contract. This is confirmed by letters from the Ministry of Finance of Russia dated May 26, 2008 N 03-04-06-01/140 and dated May 30, 2007 N 03-04-06-01/165.

The concept of a structural unit.

First, let's figure out what a structural unit of an organization is. Neither labor nor civil legislation provides an “official” definition. In the generally accepted sense, a structural unit of an organization is its officially designated part that performs certain tasks established by the organization.

At the same time, there is a term “separate division”. To such divisions of Art. 55 of the Civil Code of the Russian Federation includes branches and representative offices. A representative office is a separate division of a legal entity, located outside its location, which represents the interests of the legal entity and protects them. A branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office.

Representative offices and branches are not legal entities. They are endowed with property by the legal entity that created them and act on the basis of the provisions approved by it.

By virtue of clause 16 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation” (hereinafter referred to as Resolution of the Armed Forces of the Russian Federation No. 2), branches and representative offices belong to the structural divisions of the organization. These are also other structures of the organization - its departments, services, workshops, sections, etc. Each structural unit has its own name and is reflected in the organization’s staffing table.

Accordingly, the organization has internal structural units (sections, departments) and there may be separate structural units (branches and representative offices), which can be located either in the same area with the employer or in another.

The Labor Code also mentions other separate divisions that are not branches and representative offices. And here we turn to tax legislation. So, according to Letter of the Ministry of Finance of the Russian Federation dated August 18, 2015 No. 03-02-07/1/47702 and clause 2 of Art. 11 of the Tax Code of the Russian Federation, a separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. The territorial isolation of a unit from an organization is determined by an address that differs from the address of this organization.

Insurance premiums

For the amount of reimbursement by the employer of expenses associated with the employee's move to a new place of work, in the amounts determined by the employment contract, the amounts of insurance contributions are not accrued:

- on the basis of Part 1 of Article 9 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”;

— subparagraph 2 of paragraph 1 of Article 20.2 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

Accounting

We will show the procedure for reflecting in accounting the reimbursement of expenses by an employer to an employee when moving from one region to another using an example.

Example.

The manager of the corporate management department of the Stavropol branch of Rassada LLC, S. T. Pulya, was transferred to work in the Vladimir branch as a senior manager with a salary of 50,000 rubles.

per month. The accounting department of Rassada LLC issued an advance to S. T. Pula for moving in the amount of 35,000 rubles. The additional agreement to the employment contract states that the company compensates the employee for documented expenses:

— travel for an employee and his family from Stavropol to Vladimir in a reserved seat carriage of the train;

— transportation of property;

- daily allowance for travel days.

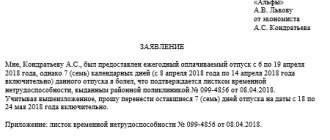

After the move, the employee contacted the director of the Vladimir branch with a statement in which he stated a request to compensate for the expenses incurred for the move. See below for a sample application.

Sample. Application for reimbursement of translation costs

To the director of the Vladimir branch of Rassada LLC

Matveev P.V.

From senior manager

Vladimir branch of Rassada LLC

Puli S.T.

Transfer at the initiative of the employee

If an employee himself has asked to be transferred to work in another organization, then the first link in the chain of approval of the transfer will be the employee’s application. Then the head of the organization where the employee works must inform in writing about the subordinate’s desire to the head of the organization to which the employee wants to move and obtain his consent. Further, the dismissal and hiring procedures are carried out according to general rules.

Attention: it is impossible to refuse to conclude an employment contract for an employee invited to work as a transfer from another organization. This prohibition is valid for one month from the date of dismissal from the previous place of work. This procedure is specified in Article 64 of the Labor Code of the Russian Federation.

Thus, if the new manager refuses employment to the transferred employee, this will be a violation of labor laws. For this, the labor inspectorate may fine the organization or its officials.

The fine is:

- for officials of the organization (manager) – from 1000 to 5000 rubles. (repeated violation entails a fine of 10,000 to 20,000 rubles or disqualification for a period of one to three years);

- for entrepreneurs – from 1000 to 5000 rubles. (repeated violation entails a fine of 10,000 to 20,000 rubles);

- for an organization – from 30,000 to 50,000 rubles. (repeated violation entails a fine of 50,000 to 70,000 rubles).

Such measures of liability are provided for in parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.

In addition, such a refusal could lead to problems for the former manager. An employee who has received a refusal has the right not only to appeal this refusal in court, but also to demand reinstatement at his previous place of work (Article 394 of the Labor Code of the Russian Federation). In this case, the organization must pay the reinstated employee the time of forced absence in the amount of average earnings. This is stated in paragraph 60 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2.

The court may also oblige the organization to compensate an illegally dismissed employee for moral damages. The amount of compensation for moral damage is determined by the court and indicated in its decision. In this case, judges must take into account the nature of the harm caused to the employee and the degree of guilt of the organization (clause 63 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2).

If the dismissal was declared illegal, the employee must be reinstated.