Payroll calculation is a labor-intensive and painstaking procedure. Despite the widespread automation of this process, an accountant is not immune from errors. Failures in the operation of computer equipment also occur, which can result in incorrect calculations and overpayment of wages to employees.

Having discovered an error, the accountant often makes an automatic deduction from the next month's accruals based on settlements with the employee, making the appropriate entries in accounting. Is such a “simple” way out of the situation legal? In what cases does an organization have no right to withhold excess wages paid? Is an accountant responsible for errors in payroll calculations? Let's find out in the article.

Is it possible to pay wages to a non-resident through a cash register ?

Procedure for deducting overpayment

First, you need to determine whether it is possible to withhold overpaid money from the employee. You can withhold money from an employee in the following situations (137 Labor Code of the Russian Federation):

- The employee did not work out the funds previously issued to the employee or did not return them. An example is failure to provide a report on a business trip or for accountable money. Or the employee was paid an advance, which he did not work off. In some cases, it is also possible to withhold vacation pay, for example, when the employee’s vacation was provided in advance and the employee resigns. It is important to remember that vacation pay cannot be withheld if an employee quits due to layoffs or conscription into the army;

- The employee was overpaid due to an accounting error. Or, due to an accounting error, the employee received a large amount of vacation pay or benefits.

Refund due to inaccuracy in calculations

To withhold overpaid wages on this basis, it is important to understand that wages mean remuneration for work, since the above prohibition does not apply to other payments.

Information on how to distinguish payments included in wages from other types of remuneration can be found in the article “What are the types of bonuses and employee benefits? ”

Inaccuracy in calculations is grounds for the return of overpaid wages if the person who calculated it made an error. For example, when adding the amounts of bonus (200 rubles) and salary (10,000 rubles), instead of 200, 2,000 was entered into the calculation (i.e., an extra zero was indicated), etc.

Accountant mistakes

Let's consider which errors can be considered countable and which cannot:

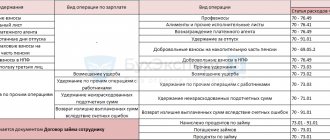

| Counting errors | Countless mistakes |

| Incorrect initial data was entered into the accounting program, for example, salary, date of employment, date of dismissal, percentage for calculating bonuses, etc.; The accounting program crashed, resulting in wages being calculated incorrectly; When calculating wages, large indicators were taken into account regarding the volume of work performed | During one pay period, the salary was transferred twice; The employee’s salary was transferred to the card, and he received it at the cash desk; The employee was provided with a personal income tax deduction without justification; When calculating the average salary, excluded payments were taken into account; An incorrect algorithm was entered into the program to calculate benefits or sick leave; When calculating benefits, the employee's insurance length was incorrectly calculated; The salary was transferred to an employee who quit last month; At the direction of the labor inspectorate, the employee’s salary was accrued, and then the court declared the order illegal |

When can overpaid and overpaid wages be returned?

In Part 4 of Art. 137 of the Labor Code of the Russian Federation contains an exhaustive list of situations when overpaid wages to an employee can be recovered. This:

- counting error;

- the employee’s fault for failure to comply with labor standards or idle time;

- unlawful actions of an employee.

The definition of the concept of “calculation error” is not contained in the current legislation, but you can rely on the explanation given by Rostrud in letter dated October 1, 2012 No. 1286-6-1: this is an arithmetic error, that is, made during arithmetic calculations.

A technical glitch in a payroll program may or may not be considered a counting error. The judicial position on this issue is contradictory:

- According to the appeal ruling of the Sverdlovsk Regional Court dated April 21, 2016 in case No. 33-7642/2016, technical errors are not countable.

- The ruling of the Samara Regional Court dated January 18, 2012 No. 33-302/2012 states that an arithmetic error occurs during manual counting, and a technical error (software failure) occurs during automated counting. In both cases this is a counting error.

If we are talking about the guilty actions of an employee, it is necessary to draw up documents confirming this fact: record it in a simple act, report to the police about the fact of theft of funds by an accountant who accrued an extra salary to himself.

Procedure for reimbursement of overpayment

Depending on the situation in which the overpayment arose, the algorithm for its compensation will vary:

- The employee received a payment in an amount greater than what was due due to his own fraud (for example, the submitted documents contained deliberately false data) or the overpayment arose due to the fact that the employee did not report the advance payment or did not work it out. In this case, you first need to determine whether the employee agrees to the deduction, and also find out whether more than one month has passed from the date the overpayment was established. If the employee does not agree to withhold the overpayment, the employer only has the right to go to court. If the employee gives his consent, then the overpayment must be withheld from his salary. In this case, it is necessary to observe the rule of 20% withholding, that is, no more than 20% can be withheld from wages at a time (138 Labor Code of the Russian Federation).

- The overpayment occurred as a result of an accounting error. In this case, it is necessary to find out whether the accounting error is counting. If this is the case, then the overpayment is withheld from the employee’s salary, but not more than 20% of the salary at a time. If the error is uncountable, then the employer can withhold the overpayment only if the employee does it himself.

Report on detection of a counting error and notification of a dismissed employee

In order to record the legal fact of a counting error, it is recommended to draw up a commission act. Such a commission must include a chief accountant, as well as a payroll accountant.

The document indicates when, who and where the inaccuracy was identified. It is necessary to indicate the reason for its commission, as well as the exact amount of the salary. The paper is drawn up in two copies. It must be signed by all members of the commission.

One copy must be given to the former employee with notification of the need to return the excess wages received. The document requires you to indicate the exact amount and date by which the debt must be repaid.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Conditions for withholding overpayments

In order to withhold an overpayment from an employee’s salary, the following conditions must be met:

- The employee agrees to the retention;

- At least one month must pass from the date that was set for the return of the advance or for repaying the debt.

Both conditions must be met simultaneously. If at least one of them is not fulfilled, the money can only be recovered in court. You will also need to go to court if the employee provided false information, or if some information affecting the salary was hidden.

Postings

If you discover an overcharged and overpaid amount, you should remember that part of this amount is income tax. Thus, the excess payment is “split” into two independent amounts and reflected in different entries.

First, the overpayment as a whole is reversed, using the same entries by which it was accrued: Dt20, 23, 26 Kt70 - reversal for the amount of the overpayment (payments to the Funds for overpayment are similarly reversed).

Then personal income tax is reversed: Dt70 Kt68/NDFL – reversal from the overpayment amount (13%).

The remaining amount overpaid to the employee is reflected in account 73 with the opening of the corresponding sub-account: Dt 73 Kt 70.

The employee voluntarily pays off the debt by depositing funds into the cash register or by deducting from the salary. It is also possible to deposit funds into the company's current account: Dt50,51,70 Kt73.

If for some reason the debt cannot be collected, then the following entries are made:

- Dt76 Kt 73;

- Dt 91/2 Kt 76.

How to return an overpayment of wages due to the fault of an accountant

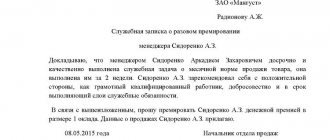

Once an error is discovered, the manager must be notified about it. To do this, a memo is written indicating that a counting error was made when calculating wages (benefits or vacation pay). After this, the employee can be asked to contribute money voluntarily, or withhold it from their salary. An order must be issued to withhold funds. Confirming his consent to withhold money from his salary, the employee puts his signature on the order. This will constitute the employee’s written consent to withhold the overpayment (

Documenting

The head of the organization must issue an order on the recovery of overpaid wages (letter of Rostrud dated August 9, 2007 No. 3044-6-0). The order must be issued no later than one month from the date of expiration of the period established for the employee to return the overpayment. If such a period was not set for the employee, the order must be issued no later than a month after the discovery of the excessive payment of wages. Withholding is possible only if the employee does not dispute the fact and amount of the overpayment. This conclusion follows from Article 137 of the Labor Code of the Russian Federation. In addition, to avoid disputes with the labor inspectorate, draw up a memorandum justifying the reason for withholding the overpayment.

Adjustment of accounting, personal income tax and insurance premiums

If an error occurs in the payment of wages, you will need to recalculate personal income tax, contributions, and also correct accounting records. The postings will be as follows:

| Business transaction | Wiring | |

| D | TO | |

| An advance was paid to the employee | 70 | 51 |

| The overpaid amount was reversed | 20 | 70 |

| The employee is paid a salary | 20 | 70 |

| Insurance premiums paid on wages | 20 | 69 |

| Basic salary paid minus withholding amounts | 70 | 51 |

| Personal income tax withheld | 70 | 68 |

SAMPLE REPORT

SAMPLE ORDER

Recalculation of benefits

In exactly the same way, you will need to recalculate benefits in the field of the same name and you will receive a ready-made result for recalculation or additional accrual of benefits for periods already recorded in accounting.

When it is necessary to adjust an order for parental leave, the recalculation is carried out by the machine in automatic mode, unless, of course, corrections have been made to the current order. But like any other action, you have the right to do this yourself, using the salary functionality and further recalculations.

The situation is different when the period has not yet closed and there is no need to generate a separate document relating to another reporting period. Everything is simple here and you work with the functionality of calculating earnings. For one subordinate it is not difficult to carry out manipulations, but what to do when there are many of them and corrections are required for each. Here the fill button at the top of the form will come to your aid. The machine offers you the following actions:

- refill the information while saving the entered information manually;

- completely refill the form;

- supplement information on subordinates that was not entered previously.

However, when making adjustments to the earnings of one subordinate, it is better to do this by indicating the accrual position for the required subordinate. The context menu will open and you will need to select an employee for the recalculation command.

The team for additional accruals and recalculations is formed in a given special mode for calculating earnings. The button works in relation to periods already posted and closed in accounting. Here it is possible to carry out interpayments with a subordinate, and the developers implemented it in the interests of paying income without waiting for the end of the settlement period.