Payment

What does an individual entrepreneur pay without employees? An individual entrepreneur (IP) is an individual who has passed the state

A power of attorney for submitting reports to the Federal Tax Service is a document establishing the powers of a representative of a legal entity to

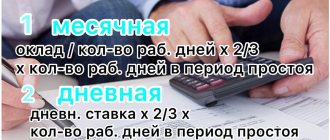

The legal regulation of the labor period is carried out at the level of legislative acts, contractual regulation of working conditions and

What is account 25 used for in accounting? The chart of accounts determines that the account

It is difficult to overestimate the commercial role of advertising, and therefore the economic efficiency of the funds spent on it.

The FSS periodically conducts scheduled and unscheduled on-site inspections of policyholders. The department monitors the accuracy of accrual and

Value added tax is an indirect type of fee. VAT in Russia is charged on every

Legislation on land tax The main document regulating land tax issues is the Tax Code of the Russian Federation,

Home — Documents Organizations registered this year and wishing to start their business

The responsibility of any organization is to provide tax and accounting reports to the tax authorities, as well as