It is difficult to overestimate the commercial role of advertising, and therefore the economic efficiency of the funds spent on it.

However, this expense item turns out to be the most controversial from a taxation point of view (income tax base). Not every phenomenon considered by ordinary people to be advertising is such from a legal point of view. In addition, you need to take into account an important criterion for the legality of accounting for expenses for tax purposes - the normalization of expenses.

Let's consider how the concept of the norm for advertising expenses is reflected in accounting and tax accounting.

Question: The LLC plans to enter into an agreement with a legal entity-executor to carry out work on the production and application of advertising banners on the external sides of urban ground transport (trams) to advertise manufactured products in order to increase their sales. In response to a request to the tax authority about the existing maximum amount for accounting expenses for this type of advertising expenses, the LLC received a response that the maximum amount is 1% of sales revenue, since trams are not a means of stable territorial placement. However, LLC believes that this type of advertising expenses is taken into account in the amount actually incurred. Is the LLC's position justified? View answer

Types of standardized expenses used

When an enterprise incurs expenses related to normalization, accounting is carried out especially carefully. The accuracy of the calculations prevents underestimation of income taxes. A number of expenses are found in almost all businesses.

| Type of expenses | Consumption rate size |

| Pension and personal insurance of employees | 12% of the wage fund |

| Employee health insurance | 6% of the wage fund |

| Replacement of defective periodicals | 7% of the circulation cost |

| Loss of printed products | 10% of the circulation cost |

| Certain types of advertising | 1% of revenue |

| Representation needs | 4% of the wage fund |

| Provisions for doubtful debts | Art. 266 Tax Code of the Russian Federation |

Certain types of expenses are taken into account in a special manner:

- Paid for notarization of documents, taken into account in the amount of tariffs established by law.

- Spent on R&D in the form of other expenses depending on wages and amounts allocated for the formation of funds from the sales amount.

- Sent for the maintenance of transport in the amount of standards established by the Government.

- Arising in the form of losses from natural loss within the limits determined by the Government.

The standards established by the Tax Code of the Russian Federation, departmental acts or Government resolutions are regularly reviewed. Before applying standards, their relevance is determined.

Recognition of expenses in tax accounting: general principles

To begin with, let us recall the basic rule for recognizing expenses in tax accounting, regardless of their type: expenses must be documented and economically justified. This double requirement assumes that the accounting department and management can justify any amount written off from the company’s current account as necessary for the company’s activities. In addition, for such amounts there must be at least closing primary documents - acts and invoices.

One important conclusion follows from this rule: not all expenses incurred by the company can be taken into account in reducing the amount of the tax base. The country's main tax document interprets a very specific cost structure as economically justified.

Normalization of thermal energy consumption

Thermal energy consumption is used for the production and management needs of the enterprise. The amount of energy supplied is determined by the technical requirements of the equipment of boiler houses and servicing utility networks. The cost of consumption is determined by the volume of supply and tariffs of the energy producer, fixed by contractual terms.

When concluding a contract, the planned need of the enterprise is calculated, the amount of supply is determined by actual consumption. In the accounting of an enterprise, energy losses may occur during transportation and storage. Losses are taken into account in the amount of natural loss norms determined by government decree (clause 7 of article 254 of the Tax Code of the Russian Federation).

Direct and indirect expenses in tax accounting

The distribution of expenses into direct and indirect is relevant for companies using the accrual method of income tax (Article 318 of the Tax Code of the Russian Federation). In this case, indirect expenses are taken into account in the tax base upon their occurrence and in the presence of relevant documents. Direct costs are reflected only as goods, works or services in the production of which they participated are sold.

The organization determines the specific distribution of costs for these two items independently. And in this regard, tax legislation leaves payers with certain options for action, because often writing off expenses at a time without the need to distribute them proportionally to sales (that is, when expenses are classified as indirect) is more profitable for the company. However, the general principles of cost distribution are still spelled out in the code, and they should be followed.

Thus, direct expenses in tax accounting are primarily material expenses. These include expenses for the purchase of raw materials and components for production purposes, as well as containers and packaging, and any additional materials in preparation of goods for transfer to the final buyer. Inventory and tools, which due to the specific nature of their use and low cost are not considered fixed assets, work clothes, payment for utilities, as well as the rental of production premises themselves are also included in material expenses. However, this is not their entire list. This subtype of costs includes any expenses arising in the implementation of the main activities of the company.

The next subtype of direct expenses is personnel costs. This article includes both the amounts accrued and paid to employees, and the insurance premiums paid by the employer for them.

If the production process involves the use of certain fixed assets, then in the company’s accounting it will be possible to distinguish another subtype of direct expenses within the framework of production and sales - depreciation expenses.

Tax accounting for other expenses that do not fall under any of the items related to direct costs means that the expenses are considered indirect. An important condition: they should not be considered non-operating expenses.

Cost accounting when using a car

Operating transport requires incurring operating costs and costs associated with equipment repairs. Expenses are taken into account for transport owned by the organization, received under a rental or leasing agreement, subject to the acceptance of the equipment into operation or off-balance sheet accounting. In the accounting of individual entrepreneurs, personal vehicles are used, the expenses for which are taken into account in expenses provided that they are used to generate income.

| Type of consumption | How is it determined |

| Fuel | The standards are established by order of the Ministry of Transport. Consumption is determined depending on seasonality, city scale and increasing factors taking into account the year of manufacture |

| fuels and lubricants | The standards are determined by the Ministry of Transport and the enterprise depending on the intensity of operation. |

Advertising expenses – standardized and non-standardized in 2017

Advertising expenses, regulated and non-standardized - this, according to Art. 3 of Law No. 38-FZ of March 13, 2006, the costs of an enterprise for distribution in any form and in any way, through any media to unknown persons in order to attract attention to the object and for the sake of promoting it in market conditions. During taxation, such costs can be normalized, that is, taken into account according to approved standards, or not normalized, that is, charged as expenses in the full actual amount.

Accounting for business travel expenses

The relationships of enterprises with partners in other regions require negotiations, personal discussion of contracts and other reasons for business trips. When performing an official task, the enterprise incurs costs, some of which are regulated. The costs take into account:

- Cost of travel to the place of execution of the official assignment.

- Payment for hotel accommodation, registration of additional documents.

- Per diem and field expenses. Payments to employees are not standardized and are taken into account for tax purposes in full (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation).

When calculating daily allowances, the provisions of clause 3 of Art. 217 Tax Code of the Russian Federation. Amounts accrued over 700 rubles per day for business trips within the country do not apply to compensation payments, are considered the employee’s income and are subject to taxes.

Production and sales costs

This type of costs is characterized by the fact that the organization incurs them to ensure its own activities. Such operations are inextricably linked with conducting business in the main areas. The company carries out these expenses on a voluntary basis, that is, it independently and voluntarily bears the costs in order to ensure the viability of the company and make a profit.

Production costs are defined by a list in Article 253 of the Tax Code of the Russian Federation; a detailed description of expenditure transactions is presented in Art. 254 - 264 Tax Code of the Russian Federation. Thus, the main types of costs in this category include expenses for:

- Remuneration of key personnel (official salaries, rates, allowances, additional payments, bonuses and other payments).

- Insurance premiums accrued for the remuneration of key personnel within the framework of current legislation (Chapter 34 of the Tax Code of the Russian Federation, Law No. 125-FZ).

- Material expenses (in tax accounting these are expenses for the purchase of raw materials, materials, equipment, fuels and lubricants for production).

- Depreciation charges (amounts of accrued depreciation on fixed assets used in production).

It is worth noting that this list ends with the item “other costs,” which means that the list enshrined in the Tax Code of the Russian Federation is not closed. Consequently, tax accounting for other expenses allows the company to reflect any expense transaction as part of production expenses, provided that the company can justify it.

Rationing of interest on loans and credits

Interest on debt obligations of ordinary transactions is taken into account in full. Expense rationing is provided for controlled transactions and agreements between related parties. Expenses include the actual interest rate under the contract or the key rate of the Central Bank of the Russian Federation if the standard value is exceeded. The accounting procedure is defined in Art. 269 of the Tax Code of the Russian Federation.

If an enterprise has controlled or uncontrolled transactions, the procedure for writing off expenses is determined independently. Accounting for expenses in taxation depends on the accounting method. With the cash method, inclusion in the composition is made at the time of payment, with accrual - on the last day of the reporting period.

Priority product display services

Often, conflicts with tax authorities arise among manufacturers who pay retail chains for merchandising services.

An important component of such services is the special display of goods, forcing the buyer to pay special attention to the products of this particular supplier. For example, newspapers and magazines of a particular publisher are located in the central display window of a kiosk, food products of a particular brand occupy the first rows on the shelves of a supermarket, etc., etc. Payment for such actions, as a rule, arouses increased interest among inspectors. The fact is that Ministry of Finance specialists prohibit sellers from taking into account the cost of priority display in expenses, since it is not directly related to the supply agreement. And only if a separate agreement for the provision of marketing services is concluded between the supplier and the retailer, officials recognize the justification of the costs. But even in this situation, they are allowed to write off not the full amount, but only a part of it, which does not exceed 1 percent of the revenue. From the point of view of officials, services for special display of goods are nothing more than advertising, and advertising costs in general need to be rationed. This opinion is expressed, in particular, in the letter of the Ministry of Finance of Russia dated December 13, 2011 No. 03-03-06/1/818 (more about this in the material “When concluding a separate contract for the provision of services, the costs of priority display of goods can be taken into account when taxing profits ").

However, the officials' conclusions are not confirmed by arbitration practice. The judges attribute the special display not to advertising, but to marketing services. The main argument is GOST R 51304-99 “Retail trade services. General requirements" (currently replaced by GOST R 51304-2009). According to paragraph 4.2 of this document, display of goods is one of the main stages in the process of providing trade services. And paragraph 5.6 states that the displays are provided for by the requirement of aesthetics of trade services. For this reason, display has nothing to do with advertising and, therefore, the corresponding costs are not standardized. This is stated, in particular, in the resolution of the Federal Antimonopoly Service of the North Caucasus District dated March 29, 2013 A32-5215/2012.

Several years ago, one Moscow company proved in court that it is possible to fully take into account in the costs not only the cost of the display itself, but also the fee for training staff in the basics of display. The judges agreed that these services are also not advertising, but relate to marketing (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 13, 2009 No. KA-A40/6444-09).

But despite positive arbitration practices, taxpayers should exercise caution. Before abandoning cost rationing, you should make sure that marketing services (including displays) are covered by a separate contract. In addition, it is better to issue an internal document (for example, a director’s order), which will clearly state that the display of goods is not for advertising purposes, but for the implementation of marketing policy. These measures will allow the supplier to protect itself from claims from tax authorities.

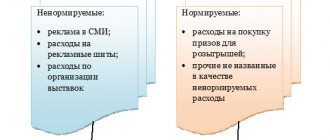

Rationing of advertising events of the enterprise

Costs of advertising the company's activities and attracting customers are written off in full or within normal limits, depending on the type of advertising. Non-standardized types of advertising include:

- Advertising events in the form of information alerts through the media and communication systems.

- Outdoor illuminated advertising, installation of billboards and stands.

- Providing exhibitions, showrooms, printing advertising products, participation in exhibitions and similar forms.

Types of advertising not specified in clause 4 of Art. 264 of the Tax Code of the Russian Federation and spent on the purchase of prizes during promotional events must be taken into account as part of the standardized costs. The limit amount is set at 1% of the amount received from sales in the reporting or tax period.

Cost calculation example

The "Visit" company held an advertising campaign to promote its products in the form of an exhibition. The total cost of expenses was 250,000 rubles. During the event, prizes were awarded for a competition on knowledge of the history of product creation in the amount of 10,000 rubles. Revenue in the accounting period amounted to 150,000 rubles. In the accounting of the enterprise "Visit" the following operations are performed:

- We determined the amount of non-standardized costs: 250,000 – 10,000 = 240,000 rubles;

- We calculated the allowable rate of expenses: 150,000 x 1% = 1,500 rubles.

- Conclusion: the amount of expenses accepted for accounting was 241,500 rubles.

Key cost grouping

All types of costs that an economic entity incurs in the course of its activities can be divided into two large groups. The first group should include all expenses that are associated with sales or production. That is, these are costs that are aimed at carrying out the main activity.

The second group is costs that are not directly related to sales or production. They are most often called non-operating transactions.

However, the provisions of the Tax Code of the Russian Federation provide for additional fragmentation of expenses of the first group. Thus, all costs associated with sales and production are divided into direct and indirect expenses.

For clarity, let’s define in a block diagram what the current classification of expenses in tax accounting looks like:

Now let's look at each of the groups in more detail.

Rationing of entertainment expenses

Enterprises bear the costs of negotiations with partners or potential partners, reception, delivery of persons and their accommodation. The list of allowable expenses is established in clause 2 of Art. 264 Tax Code of the Russian Federation. Detailed accounting must be provided to support expenses.

| Accounting transaction | Documenting |

| Approval of the list of costs used to represent the interests of the company | Appendix to the order on accounting policies |

| Issuance of an order | For each reception or negotiation, an order is drawn up separately |

| Approval of the list of costs | An estimate is being drawn up |

| Conclusion of an agreement with a supplier of works and services | The document contains a detailed description of the services or work provided. |

| Confirmation of contract execution | A deed, invoice and other forms are drawn up |

| Submitting the report for approval to the manager | The report on the event includes the purpose, time, location, program, composition of persons, cost item by item |

| Calculation of standardized costs | Produced in accordance with the wage fund |

The size of the norm is limited to 4% of the payroll. Write-off of expenses is carried out during the tax period for calculating profit - a calendar year in proportion to the norm.

Example of calculating the cost rate

The Krona enterprise has prepared a conference meeting with partners to negotiate the terms of contracts. The cost of expenses amounted to 20,000 (including VAT 3050.85) rubles for the event. The company submits quarterly income tax reports. The wage fund for the 1st quarter of 2016 amounted to 200,000 rubles. In the accounting of the Krona enterprise:

- We determined the size of the expense norm: 200,000 x 4% = 8,000 rubles;

- We calculated the amount not taken into account in expenses: 20,000 – 8,000 = 12,000 rubles;

- We determined the amount of VAT to apply the deduction: 8,000 x 18/118 = 1,220.34 rubles.

- Conclusion: the expenses of the 1st quarter of 2021 include the amount of 8,000 rubles, the VAT deduction for the 1st quarter is 1,220.34 rubles.

Advertising expenses that are not standardized

Non-standardized advertising expenses are those that relate to advertising in all cases and cannot be regarded as otherwise. The Law “On Advertising” and the Tax Code of the Russian Federation (paragraphs 2–4, clause 4, article 264) provide a closed list of such expenses.

- Costs of advertising activities for which the media are used:

- advertisements in print media;

- radio broadcasts;

- TV shows;

- Internet;

- other communication means.

Media advertising costs can be interpreted quite broadly; they include such indicators as:

- cost of airtime;

- payment for the creation and placement of an advertising video;

- advertising agent salary, etc.

NOTE! The created advertising product, if it exists and operates for a certain time, becomes an intangible asset, which means it will have an initial book value and be subject to depreciation during its entire period of use.

- Costs for outdoor advertising , which include: advertising stands;

- shields;

- banners;

- stretch marks;

- light panels and displays;

- balloons, aerostats, etc.

ATTENTION! These expenses fully include not only expenses on the advertising information itself, but also on its media. If the media belongs to the company, then it is its asset, the value of which is depreciated.

- trade fairs;

IMPORTANT INFORMATION! As part of these events, expenses for entry fees, issuance of permits, production of brochures and catalogs, design of shop windows and demonstration rooms are not standardized, while costs associated with participation, but optional, for example, distribution of souvenirs, tastings, distribution of advertising publications, etc. ., are subject to rationing.

For advertising expenses to be recognized as normal

The tax office closely monitors the inclusion or exclusion of expenses in the income tax base. To avoid tax disputes, the requirements for justifying non-standardized advertising expenses should be strictly observed:

- expenses should be made specifically for advertising, that is, the activity should be strictly informational and not have specific addressees;

- You must have primary documents confirming the advertising use of information.

FOR EXAMPLE. Here are a few controversial points regarding the classification of expenses as non-standardized:

- The company has created its own website and advertises its products on it. The costs of creating a website are considered advertising in full. But the costs of creating and operating an online store, even if it contains advertising information, are classified as “other sales-related.”

- A furniture company is taking part in a sales exhibition and has equipped a demonstration bedroom for this purpose. In addition to furniture owned by the company, the design also included other items to create coziness (tablecloth, bed linen, vase, etc.). The costs of their purchase and delivery can be classified as non-standardized advertising expenses.

- A confectionery manufacturer organizes a tasting. Girls in branded suits with the company logo treat visitors to cookies and hand out advertising leaflets. The costs of printing leaflets are not standardized, but the costs of branded clothing and tasting samples are not.

- The company conducted training on competent advertising of its products, rules for presenting samples to the client, etc. The costs of the training are not advertising expenses.

Tax accounting of non-operating expenses

The principles for classifying costs as non-operating are prescribed in Article 265 of the Tax Code. Such expenses are not directly related to the production or sale of goods, works or services.

Non-operating expenses include various fees charged by the bank for servicing a current account, legal costs, negative exchange rate differences, interest on loans and borrowings, losses from previous years identified in the reporting period, as well as some other costs that are only indirectly related to the business activities of the company .