Home / Disputes with insurance companies / How to determine the depreciation group for Internet equipment

Not all types of fixed assets can be found in the Classification and OKOF. For those types of fixed assets that are not listed in these directories, the useful life is established by the taxpayer in accordance with the technical specifications or recommendations of the manufacturers (clause 6 of Article 258 of the Tax Code of Russia).

How to determine the depreciation group using the OKOF code

Let's say right away that a structured cable network is not mentioned in the Tax Classification. According to OKOF, such objects are included in buildings and structures and are their integral part. If it is necessary to isolate a structured cable network as an independent object (for example, during its subsequent installation), the useful life is established by the organization independently on the basis of technical conditions or recommendations of manufacturers (clause 6 of Article 258 of the Tax Code of the Russian Federation). In practice, a structured cabling network usually belongs to the 6th depreciation group. For such a group, the useful life is set at over 10 years to 15 years inclusive.

Answer

In accordance with the All-Russian Classification of Fixed Assets (OKOF), communications inside buildings are included in buildings. That is, there is no need to account for them as separate fixed assets. In this case, information about these communications must be reflected in the technical passport of the facility. If we are talking about external sewer networks and electrical cable lines, then they should be taken into account as separate inventory items.

The instructions for the use of the Unified Chart of Accounts recommend using the classification of fixed assets established by OKOF (clause 45 of the Instructions for the use of the Unified Chart of Accounts, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n). For example, in accordance with the All-Russian Classification of Fixed Assets (OKOF), a cable power transmission line (OKOF code - 12 4527341) is included in the tenth depreciation group, with a useful life of over thirty years. Sewerage (OKOF code - 12 4527372) is included in the seventh depreciation group, with a useful life of over 15 to 20 years.

These OKOF codes correspond to the account code of the Unified Chart of Accounts 101 03 “Structures”

Thus, external engineering networks, including external sewerage networks, electrical cable lines, are independent objects and structures.

Restore capital investments in accounting using account 0.401.10.180 (as the amount of surplus discovered at the end of the year). Make accounting corrections using an additional accounting entry and document it with a primary accounting document - a certificate (f. 0504833):

Debit 0.101.xx.310 Credit 0.401.10.180 - surplus fixed assets identified during inventory were capitalized. The cost of surpluses identified during the inventory is recognized as non-operating income (Clause 20, Article 250 of the Tax Code of the Russian Federation). More on this in recommendation 6.

As a general rule, communications to a building do not need to be included in fixed assets. It is explained this way.

Similar conclusions were made in the letter of the Ministry of Finance of Russia dated September 4, 2012 No. 02-06-10/3529.

It should be noted that the classification of material assets as fixed assets is within the competence of the institution. Therefore, the institution must make the final decision on the inclusion (or non-inclusion) of communications in fixed assets independently.

Distribute the costs of paying for the maintenance of communications among the articles (subarticles) of KOSGU in the following order:

if services are provided under a contract for the provision of utility services and their cost is included in the utility tariff - under subarticle KOSGU 223 “Utilities”;

if services are provided within the framework of a contract for the provision of work, services - under subarticle KOSGU 225 “Work, services for property maintenance.”

2. DECISION, CLASSIFIER OF THE RUSSIA STATE STANDARD OF 12/26/1994 No. 359, OK 013-94

Buildings include communications inside buildings necessary for their operation, such as:

heating system, including boiler installation for heating (if the latter is located in the building itself);

internal water supply, gas and sewerage networks with all devices;

internal network of power and lighting electrical wiring with all lighting fixtures; internal telephone and signaling networks; ventilation devices for general sanitary purposes;

lifts and elevators.

Built-in boiler installations (boiler rooms, heating points), including their accessories, also belong to buildings. Fixed assets of free-standing boiler houses are classified in the appropriate sections: “Buildings (except residential)”, “Machinery and equipment”, etc.

Water, gas and heat-conducting devices, as well as sewerage devices, are included in buildings, starting from the inlet valve or tee near the buildings or from the nearest inspection well, depending on the location of the connection of the supply pipeline.

Electrical lighting wiring and internal telephone and alarm networks are included in buildings, starting from the entrance box or cable terminations (including the box and couplings), or bushings (including the bushings themselves).

Structures also include: complete functional devices for the transmission of energy and information, such as power lines,* heating plants, pipelines for various purposes, radio relay lines, cable communication lines, specialized structures of communication systems, as well as a number of similar objects with all associated complexes of engineering structures.

3. DECREE OF THE GOVERNMENT OF THE RF DATED 01.01.2002 No. 1

Classification of fixed assets included in depreciation groups

Seventh group

(property with a useful life of over 15 years up to 20 years inclusive)*

Facilities and transmission devices

| Unified Chart of Accounts | All-Russian classifier of fixed assets | ||

| Name | Name | ||

| Living spaces | Dwellings | ||

| Non-residential premises | Buildings (except residential) | ||

| cars and equipment | cars and equipment | ||

| Vehicles | Means of transport | ||

| Industrial and household equipment | Industrial and household equipment | ||

| Library fund | |||

| Other fixed assets | Working, productive and breeding livestock (except for young animals and livestock for slaughter) | ||

| Perennial plantings | |||

| Material fixed assets not included in other groups | |||

5. LETTER OF THE RUSSIAN MINISTRY OF FINANCE DATED 09/04/2012 No. 02-06-10/3529

On accounting as part of the main means of communications inside the building necessary for its operation

On accounting as part of the main means of communications inside the building necessary for its operation

The Department of Budget Policy and Methodology of the Ministry of Finance of the Russian Federation (hereinafter referred to as the Department) has reviewed the letter within its competence and reports.

Reflect the surplus in the month in which the inventory was completed (an inventory commission report was drawn up) (clause 5.5 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49).

The procedure for recording surpluses identified during the inventory in accounting depends on the type of institution.

In accounting for budgetary institutions:

Reflect the surplus identified during the inventory by posting:

Debit 0.101.34.310 (0.101.24.310, 0.102.30.320, 0.103.13.330, 0.105.21.340, 0.201.34.510, 0.201.35.510...) Credit 0.401.10.180

— surpluses (fixed assets, intangible assets, non-produced assets, inventories, cash, monetary documents) identified during the inventory have been capitalized.*

This procedure is established by paragraphs , , , , , Instruction No. 174n, Instructions to the Unified Chart of Accounts No. 157n (accounts 101.00, 102.00, 103.00, 105.00, 201.35, Article 271 and paragraph 2 of Article 273 of the Tax Code of the Russian Federation.*

Reason for correction

Fill out corrections with a primary accounting document - a certificate (f. 0504833) based on documents that were not posted in the required reporting period (for example, an act of provision of services, an additional agreement, etc.). Please indicate in the certificate:

justification for making corrections;

the name of the accounting register being corrected (transaction journal), its number (if any), the period for which it was compiled.

At the same time, in order to avoid disagreements with inspectors, agree on options for correcting errors of previous years with the founder and enshrine them in the accounting policy (clause 6 of the Instructions to the Unified Chart of Accounts No. 157n). In this case, they will be mandatory for use by both the institution and the inspectors.

Errors discovered after reporting must be corrected on the day they were discovered (clause 18 of the Instructions to the Unified Chart of Accounts No. 157n).

KBK correction

If an institution needs to correct (clarify) the budget classification codes (KOSGU, type of expenses) for which cash transactions were reflected on the personal account, then this can only be done within the current financial year. Correction of such errors for the past year is not provided for by law. This conclusion follows from the provisions of paragraph 2.5.3 of the Procedure, approved by order of the Treasury of Russia dated October 10, 2008 No. 8n.

Attention: an error in reporting is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided.

The impact of accounting errors on tax calculations

Errors in accounting and reporting can affect the calculation of taxes paid by an institution. For information on how to make corrections to tax reporting, see

How to determine the depreciation period of property for tax accounting. Depreciation group for premises electrical supply systems. For what main means should the new classifier be used?

Question:

In continuation of our topic “Electrical supply of premises”, which depreciation group should be assigned to?

Answer:

The power supply system can be classified, for example, into depreciation group 6 (“Power Supply Complex” OKOF 220.41.20.20.711). If the technical characteristics of the property do not allow it to be classified in this group, then the useful life of this property can be determined based on the manufacturer’s recommendations and (or) technical specifications. Usually this is the warranty period or service life, which is stated in the equipment (product) passport. If the manufacturer’s technical specifications and recommendations are not available, contact the Russian Ministry of Economic Development with a request.

Rationale

Structured cabling network: shock-absorbing group

In addition, in such situations, it is allowed to calculate depreciation according to uniform standards approved by Resolution of the Council of Ministers of the USSR of October 22, 1990 No. 1072. However, the legality of using these standards will most likely have to be defended in court. In arbitration practice there are examples of court decisions confirming the validity of this approach (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated January 11, 2009 No. VAS-14074/08, the resolution of the Federal Antimonopoly Service of the West Siberian District dated May 5, 2012 No. A27-10607 /2011, Far Eastern District dated May 19, 2010 No. A16-1033/2009 and dated December 29, 2009 No. F03-5980/2009, Northwestern District dated September 15, 2008 No. A21-8224/2007).

How to correctly determine the depreciation group

OS Group Service life, years Where it belongs Printer II 2-3 Electronic computers Personal computer, laptop II 2-3 MFP printing III 3-5 Photocopying equipment Music center, plasma TV IV 5-7 Television and radio equipment Office furniture IV 5-7 Furniture for printing, trade, consumer services Passenger car III 3-5 Passenger cars Truck III 3-5 Trucks with a carrying capacity of up to 0.5 tons

Please note => How to pay for school without commission

Requirements for depreciation groups

330.28.22.18.270 Equipment for loading blast furnaces, machines and mechanisms for wet coke quenching; machines and mechanisms of coke ovens 330.28.23.13.140 Ticket printing machines, equipment and devices specialized for automation of technological processes 330.28.29 Other general purpose machines and equipment, not included in other groups, internal combustion engines, except engines for vehicles; AC electric motors with a power of 0.25 kW and above (except for special power and large-sized ones); special power electric motors; except for fixed assets included in other groups

Equipment depreciation and calculation rules

This category includes fixed assets with a useful life from 7 to 10 years (inclusive). Among them are the following: construction complexes for breeding animals, devices for delivering goods (with the exception of conveyors), different types of combines (for collecting grain, corn, potatoes, beets), equipment for cutting and processing metals, structures for gas supply, buses length from 16.5 to 24 meters, large and high-class passenger cars, trailers, semi-trailers, trucks (lifting weight from 5 tons).

How much to depreciate a cable network in accounting?

The useful life of fixed assets in accounting is determined by the organization independently at the time the object is accepted for accounting (clause 20 of PBU 6/01). This period may be set depending on expected physical wear and tear or period of use. When establishing the useful life, you can also refer to the tax classification. This means that the useful life of the cable communication network can also be set in the range from 121 to 180 months.

Depreciation groups of fixed assets and what applies to them

At the same time, it should be noted that the new OKOF directory from 2020 will apply only to those fixed assets that the company will put into operation from January 1 next year. Simply put, there is no need to re-determine the depreciation group of an asset purchased earlier, even if, according to OKOF-2020 with decoding and group, the useful life of such an object would have to change.

Please note => Making changes to the address of a legal entity, clarification of the address

How to determine the depreciation period of property for tax accounting

How to determine the useful life of an OS

From January 1, 2021, when determining deadlines, focus on the new OKOF OK 013-2014 (SNS 2008), approved by order of Rosstandart dated December 12, 2014 No. 2018-st. OKOF, approved by Decree of the State Standard of Russia dated December 26, 1994 No. 359, has become invalid.

Classification is required for tax accounting. For accounting purposes, the organization itself decides what period to set for fixed assets in accounting. We advise you to set the same deadline in accounting as in tax accounting.

New OKOF classifier from 2021

All fixed assets from the Classification of fixed assets included in depreciation groups (approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1) are divided by codes from the All-Russian Classifier of Fixed Assets. Therefore, the transition to new OKOFs from 2021 has changed the depreciation period of some assets in tax accounting. In this case, you need to be guided exclusively by the new OKOF codes from 2020 . Changes to the current Classification of fixed assets for tax depreciation purposes were made by Decree of the Government of the Russian Federation dated July 7, 2020 No. 640.

If you find yourself in the network: tax and accounting SCS

Regina Latypova,

Deputy Director of the Legal Consulting Department of the Telecom-Service IT Group of Companies

Almost every organization has “I don’t know what.”

This something “entangles” the organization in a network and often confuses the accountant when he makes a decision on the accounting procedure for this object.

We are talking about cable systems that support all kinds of information systems: computer, telephone and television networks, fire and security alarm systems, or more precisely about SCS or structured cabling systems.

According to materials from Wikipedia (ru.wikipedia.org), a structured cabling system (SCS) is the basis of an enterprise’s information infrastructure, which makes it possible to combine many information services for various purposes into a single system: local computer and telephone networks, security systems, video surveillance, etc. d.

SCS is a hierarchical cable system of a building or group of buildings, divided into structural subsystems. It consists of a set of copper and optical cables, cross-panels, patch cords, cable connectors, modular sockets, data sockets and auxiliary equipment. All of the above elements are integrated into a single system and operated according to certain rules.

Simply put, SCS provides the information space of the office.

It is safe to say that the SCS satisfies all four criteria for classifying the SCS as an object of fixed assets. In accordance with clause 4 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n (hereinafter referred to as PBU 6/01), the asset is accepted by the organization for accounting as fixed assets, if the following conditions are simultaneously met:

a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

b) the object is intended to be used for a long time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

c) the organization does not intend the subsequent resale of this object;

d) the object is capable of bringing economic benefits to the organization in the future.

Acceptance of SCS for accounting

Let's consider how an object is accepted for accounting.

In accordance with clause 7 of PBU 6/01, fixed assets are accepted for accounting at their original cost.

The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for acquisition, construction and production, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The actual costs of the acquisition, construction and production of fixed assets are the amounts paid in accordance with the contract to the supplier, as well as the amounts paid for delivering the object and bringing it into a condition suitable for use; amounts paid to organizations for carrying out work under construction contracts and other contracts; amounts paid to organizations for information and consulting services related to the acquisition of fixed assets, etc.

Let us recall that SCS consists of a set of copper and optical cables, cross-panels, connecting cords, cable connectors, modular sockets, information sockets and auxiliary equipment mounted into a single system.

Typical SCS installation work includes:

- installation of cable channels (ducts, trays, corrugated pipes, pipes, etc.);

- punching holes in walls;

- laying cables in cable channels;

- installation of sockets;

- assembly and installation of the mounting cabinet;

- installation and filling of patch panels and organizers.

By their nature, the listed works are construction work (“All-Russian Classifier of Products by Type of Economic Activities” OK 034-2007 (CPES 2002), approved by Order of Rostechregulirovanie dated November 22, 2007 No. 329-st).

These works can be carried out by a contractor on the basis of a contract concluded with him or by the organization’s own resources. Let's consider both options.

Contract installation of SCS

The contract for the installation of SCS may be a contract providing for the performance of work from the customer’s materials or from the contractor’s materials. In practice, there are also mixed contracts that provide for the supply of materials and equipment (elements of SCS), as well as their installation.

If the contract involves the use of customer materials, the materials must be transferred to the contractor for installation. This operation is formalized by an act of transfer of customer-supplied materials in any form, since the form of the act is not contained in the albums of unified forms of primary accounting documentation.

Accounting for materials transferred to the contractor is kept in subaccount 10-7 “Materials transferred for external processing.”

Subsequently, upon acceptance of the work, the cost of materials, as well as the cost of work under the contract, form the initial cost of the SCS.

If the contract provides for the use of contractor materials, the cost of the work includes the cost of materials.

The delivery and acceptance of work is certified by a Certificate of Acceptance of Completed Work, drawn up in form No. KS-2 (approved by Resolution of the State Statistics Committee of November 11, 1999 No. 100). Form No. KS-2 is used for acceptance of completed contract construction and installation work. Based on the data from the Certificate of Acceptance of Work Completed, a Certificate of Cost of Work Completed and Expenses is filled out (Form No. KS-3).

Thus, the amount of expenses for the purchase of materials, installation of SCS, transportation and other expenses form the initial cost of the fixed asset item.

In accordance with the Chart of Accounts for accounting the financial and economic activities of organizations and instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (hereinafter referred to as the Chart of Accounts), to summarize information about the organization’s expenses into objects that will subsequently be accepted for accounting account 08 “Investments in non-current assets” is intended for accounting as fixed assets.

Let us remind you that in accordance with paragraph 1, paragraph 6, Article 171, paragraph 1, paragraph 5, Article 172 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), the amounts of value added tax presented to the organization by contractors for the installation of SCS and suppliers materials are accepted for deduction in full after the relevant work and materials have been registered.

Carrying out work on installation of SCS on our own

When performing work on your own, the initial cost of the structure consists of materials, as well as wages and “salary” taxes (unified social tax, contributions to the Pension Fund of the Russian Federation) of workers employed in this area of work.

Write-off of materials for production is carried out on the basis of the invoice requirement in form No. M-11 (approved by Resolution of the State Statistics Committee of October 30, 1997 No. 71a “On approval of unified forms of primary accounting documentation for accounting of labor and its payment, fixed assets and intangible assets, low-value materials and wearable items, work in capital construction"). Based on the invoice requirement, the cost of materials transferred for installation is written off from the credit of account 10 “Materials” to the debit of account 08 “Investments in non-current assets”.

Also, the debit of account 08 “Investments in non-current assets” includes the amount of costs for wages, unified social tax, contributions to the Pension Fund of the Russian Federation in correspondence with the credit of accounts 70 “Settlements with personnel for wages”, 69 “Settlements for social insurance and security”. The corresponding entries are made on the basis of the payroll and accounting certificates.

It should be noted that the performance of construction and installation work for one’s own consumption is subject to taxation by value added tax, in accordance with paragraph 3 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation.

In accordance with paragraph 2 of Article 159 of the Tax Code of the Russian Federation, the tax base in the case under consideration is determined as the cost of work performed, calculated on the basis of all actual expenses of the taxpayer for their implementation.

The moment of determining the tax base, in accordance with clause 10 of Article 167 of the Tax Code of the Russian Federation, is the last date of each tax period.

Moreover, from January 1, 2009, the amounts of VAT calculated by the organization are accepted for deduction at the time of calculating the tax base and are not related to the fact of paying the tax, as was previously the case (paragraph 3, paragraph 6, Article 171, paragraph 2, paragraph 5 Article 172 of the Tax Code of the Russian Federation as amended by Federal Law No. 224-FZ of November 26, 2008).

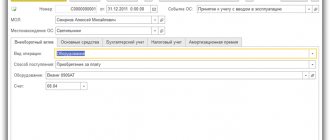

Generated initial cost of fixed assets

The generated initial cost of fixed assets, accepted for operation and registered in the prescribed manner, is written off from account 08 “Investments in non-current assets” to the debit of account 01 “Fixed Assets” on the basis of the Certificate of acceptance and transfer of fixed assets (except for buildings, structures) (Form No. OS-1, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7 “On approval of unified forms of primary accounting documentation for accounting of fixed assets”).

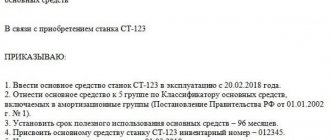

In accordance with Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 “On the classification of fixed assets included in depreciation groups,” SCS is included in the third depreciation group - property with a useful life of more than 3 years up to 5 years inclusive (“Cable communications and equipment terminal and intermediate wire communications").

Repair, modernization, reconstruction and retrofitting of SCS

During the operation of the SCS, its individual elements may wear out and become unusable. In addition, the organization may need to improve or retrofit SCS.

In accordance with clause 26 of PBU 6/01, restoration of a fixed asset facility can be carried out through repair, modernization and reconstruction.

The difference between repairs and other methods of restoring fixed assets is that all types of repairs (current and major repairs) are classified as current costs, while reconstruction and modernization are classified as capital.

At the same time, reconstruction and modernization itself may not be associated with the restoration of a fixed asset at all, but rather be an action aimed at improving the SCS. The retrofitting of SCS meets the same goal.

It should be noted that issues of determining the nature of the work performed are not regulated by accounting legislation. In addition, each case of modernization, reconstruction, and retrofitting of SCS is quite unique. Therefore, in order to correctly qualify the operations performed, it is advisable to obtain the opinion of technical specialists responsible for the operation of the SCS. Such specialists may be employees of the organization itself or contractors who carried out the installation work.

Let's consider accounting options depending on what work has been performed on the SCS.

SCS repair

Repairs are the current costs of the organization; the costs of carrying them out do not increase the initial cost of the fixed asset.

In accordance with clause 67 of the Guidelines for the accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines), expenses associated with the repair of fixed assets are reflected on the basis of the corresponding primary accounting documents for accounting for vacation transactions material assets (form No. M-11), payroll (payroll), debt to contractors for repair work performed (work acceptance certificate) and other expenses.

The corresponding transactions are reflected in the reporting period in which the repairs were made. Transactions are reflected in the debit of production cost accounts in correspondence with the credit of settlement accounts.

We also note that in order to evenly include upcoming expenses for the repair of fixed assets in the production costs of the reporting period, the organization can create a reserve for expenses for the repair of fixed assets (clause 69 of the Methodological Instructions).

In tax accounting, in accordance with Article 260, paragraph 5 of Article 272 of the Tax Code of the Russian Federation, expenses for the repair of fixed assets made by the taxpayer are considered as other expenses and are recognized for tax purposes in the reporting (tax) period in which they were incurred carried out in the amount of actual costs.

To ensure equal inclusion of expenses for repairs of fixed assets over two or more tax periods, taxpayers have the right to create reserves for upcoming repairs of fixed assets in accordance with the procedure established by Article 324 of the Tax Code of the Russian Federation.

Thus, tax accounting for the costs of repairing fixed assets is similar to accounting.

Read about modernization and reconstruction, as well as partial liquidation of SCS in the next issue of Telecom-Partner magazine No. 12 (151) for December 2009.

Depreciation groups of fixed assets: how to determine in 2020

An organization acquiring used fixed assets (including in the form of a contribution to the authorized (share) capital or by way of succession during the reorganization of legal entities), in order to apply the linear method of calculating depreciation for these objects, has the right to determine the depreciation rate for this property taking into account the useful life reduced by the number of years (months) of operation of this property by the previous owners. In this case, the useful life of these fixed assets can be defined as their useful life established by the previous owner of these fixed assets, reduced by the number of years (months) of operation of this property by the previous owner. If the period of actual use of this fixed asset by the previous owners turns out to be equal to its useful life, determined by the classification of fixed assets approved by the Government of the Russian Federation in accordance with this chapter, or exceeds this period, the taxpayer has the right to independently determine the useful life of this fixed asset, taking into account the requirements safety precautions and other factors.

Please note => How to identify a federal state

How to determine the group and period of use of a fixed asset according to OKOF

Here is the algorithm to determine the depreciation group and service life:

Step 1.

Find in the OK 013-2014 (SNA 2008) classifier the code to which your fixed asset belongs. The code is indicated in the first column of the OKOF table. To quickly and easily find the OKOF code, use the service.

To quickly find the code, you can use direct and reverse keys approved by Rosstandart order No. 458 dated April 21, 2021. Check them to see which group the fixed asset belongs to according to the new classifier. In the direct key, the first and second columns of the table indicate the codes and names of fixed assets according to the old classifier, and the third and fourth columns - according to the new classifier.

Further actions depend on the result. The options may be the following:

go to Step 2 (for options 1 and 2) >>>

If you have one of these two options, proceed to Step 2 (for options 3 and 4) >>>

Step 2 (for options 1 and 2).

Find the fixed asset code according to OKOF in the first column of the Classification of fixed assets.

Step 2 (for options 3 and 4).

If you were unable to find the property in the Classification, then determine its useful life based on the manufacturer’s recommendations and (or) technical specifications. Usually this is the warranty period or service life specified in the equipment (product) passport.

Also use the advice of the Russian Ministry of Finance from letter dated December 27, 2021 No. 02-07-08/78243. For new accounting objects that, before January 1, 2021, were listed in the old OKOF, but were no longer listed in the new one, the organization can determine the useful life independently. That is, taking into account the manufacturer's recommendations.

Important.

For objects that were put into operation before January 1, 2017, the useful life cannot be changed. The new Classification applies only to fixed assets that the organization began to operate after December 31, 2021. Therefore, if the old and new Classifications indicate different useful lives for the same objects, then depreciate fixed assets put into operation before January 1, 2021 at the same rates. This follows from letters of the Ministry of Finance of Russia dated November 8, 2021 No. 03-03-RZ/65124 and dated October 6, 2021 No. 03-05-05-01/58129.

Determine the useful life of used fixed assets in a special manner (see How to calculate depreciation of used fixed assets in tax accounting).

Situation: how to determine the useful life of a fixed asset in tax accounting: as any period provided for by a depreciation group, or as the maximum for a depreciation group

When determining the useful life period of a fixed asset, you can choose any period corresponding to the time interval that is provided for a particular depreciation group by the Classification.

There are no restrictions in the Tax Code. On the contrary, the organization has the opportunity to independently determine the useful life (clause 1 of Article 258 of the Tax Code of the Russian Federation). The validity of such a conclusion is confirmed by arbitration practice (see, for example, Resolution of the Federal Antimonopoly Service of the West Siberian District dated September 3, 2010 No. A27-24526/2009).

For example, the fourth depreciation group includes fixed assets with a useful life of more than five years up to seven years inclusive. The organization established that the woodworking machine it purchased belongs to the fourth group (code 330.28.49.12.119). When putting a machine into operation, the organization has the right to set any useful life for it in the range from 61 to 84 months inclusive.

Situation: how to determine the useful life of a fixed asset in tax accounting if it is not provided for in the Classification, and there are no technical conditions and recommendations from the manufacturer

In this case, contact the Russian Ministry of Economic Development with a request.

As a general rule, an organization should set the useful life of a fixed asset as follows:

1. First you need to look at the Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1. In this document, fixed assets are combined into 10 depreciation groups depending on their useful life and are arranged in ascending order of this period (clause 3 of Article 258 of the Tax Code of the Russian Federation). Find the name of the fixed asset in the Classification and see which group it belongs to. Each group has its own time limits;

2. if you did not find a suitable name for a fixed asset in the Classification, then establish its useful life based on the manufacturer’s recommendations and (or) technical specifications. Usually this is the warranty period or service life, which is stated in the equipment (product) passport.

Such rules are established by paragraphs and Article 258 of the Tax Code of the Russian Federation.

If the fixed asset is not mentioned in the Classification, and there is no technical documentation for it, you can determine the depreciation group and useful life by submitting a request to the Ministry of Economic Development of Russia. Such recommendations are in letters from the Ministry of Finance

GOVERNMENT OF THE NOVOSIBIRSK REGION

RESOLUTION

On approval of the list of property related to electric grid facilities and structures that are their integral technological part

In accordance with Article 8.11 of the Law of the Novosibirsk Region dated October 16, 2003 N 142-OZ “On taxes and features of taxation of certain categories of taxpayers in the Novosibirsk Region” Government of the Novosibirsk Region

st atation:

1. Approve the attached list of property related to electric grid facilities and structures that are their integral technological part.

2. I reserve control over the implementation of the resolution.

3. This resolution applies to legal relations that arose from January 1, 2013.

Governor of the region V.A. Yurchenko

How to determine the depreciation group according to OKOF

- The length of time during which equipment or property can properly serve to achieve the goals of the company, which is determined separately or jointly with the interests of the taxation system. It directly distributes the property complex into depreciation groups, according to the classifier of the type and type of fixed asset.

- Tax legislation includes ten groups of depreciable property . This approach forms the percentages and amount of deductions for the reconstruction and improvement of assets of the depreciation type of property:

- from 1 year to 2 years;

- two or three years;

- from three to five years;

- from five to seven years;

- the fifth from seven to ten years;

- ten - fifteen years;

- fifteen - twenty years;

- from 25 to 30 years;

- tenth – more than 30 years.