The responsibility of any organization is to submit tax and accounting reports to the tax authorities, as well as timely and full payment of taxes and fees to the budget. Tax authorities check the data provided by the organization and carry out tax control. In cases where untimely and/or incomplete fulfillment of the taxpayer’s obligations is detected, the tax inspectorate may send tax demands for the fulfillment of these obligations. Let's consider the requirements for payment of taxes and requirements for the provision of documents.

What is a requirement to pay a tax, fee, penalty or fine?

According to the Tax Code of the Russian Federation, the taxpayer has an obligation to pay taxes and fees on time and in full. The timing of transferring payments to the budget depends on the type of tax or fee, the nuances of local or regional legislation, and the category of taxpayer.

Individuals pay taxes according to Federal Tax Service notifications sent by Russian Post or received through the “Taxpayer Personal Account” service on the Federal Tax Service website. For the convenience of citizens, such notifications contain not only the size of the tax base and rate, but also the deadline by which the tax must be transferred. For example, for 2021, a citizen must pay personal property taxes by December 1, 2018. According to paragraph 2 of Art. 52 of the Tax Code of the Russian Federation, a letter from the inspection must arrive no later than 30 days before the payment is due.

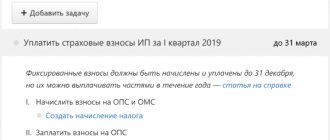

Personal property entrepreneurs pay taxes according to the rules established for ordinary citizens. But for business taxes, they independently calculate the amounts payable in accordance with the chosen tax regime. The payment deadlines for each tax and special regime are established by the Tax Code. For example, if an individual entrepreneur works for the OSN, then he needs to submit his annual income tax return for the past year by April 30 of the next year. During the same period, he must pay personal income tax on business activities.

Legal entities also report on taxes and fees independently: they submit reports to the tax authority and pay taxes and fees. In addition, for some taxes, the company must transfer advances within a specified period and, taking them into account, then calculate the amount of the annual tax payment.

Thus, timely payment of taxes and fees is the direct responsibility of each taxpayer and is enshrined in clause 2 of Art. 44 and paragraph 1 of Art. 45 of the Tax Code of the Russian Federation. Violation of the deadlines for transferring taxes and fees to the budget or their incomplete payment is the basis for the tax authorities to send a tax payment request to the payer.

According to Art. 69 of the Tax Code of the Russian Federation, the requirement to pay tax is a notification to the payer of the unpaid amount of tax and the obligation to pay it within the prescribed period. Inspectors send a tax payment request if a citizen or organization has arrears identified as a result of an audit. For more information about the mandatory compliance with the audit conditions, read the material “The tax office has no right to demand payment of tax outside of an audit .

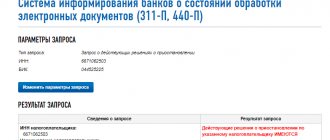

From what date the updated payment request form is applied (approved by order of the Federal Tax Service of Russia dated February 13, 2017 No. ММВ-7-8 / [email protected] ), find out from the publication.

The tax payment request contains the following information:

- amount of tax debt;

- the amount of penalties accrued at the time of sending the request for tax payment;

- debt repayment period and tax collection measures - in case the taxpayer ignores the requirement.

For individuals, tax authorities also provide information about the initial tax payment deadline. In addition, in the request for payment of tax, inspectors must provide references to legislative acts regulating the payment of overdue tax. For organizations and entrepreneurs, the requirement to pay tax also contains the KBK and OKTMO for each type of unpaid tax.

New requirements for payments from 2021

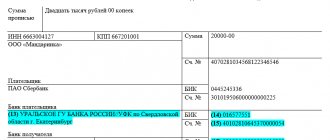

Starting from the new year, several details in the tax bill will change at once (letter of the Federal Tax Service No. KCH-4-8/16504 dated 10/08/2020):

- in field 13 “Recipient's bank” after the name of the bank, the name of the corresponding Treasury account should be indicated (through the sign “//”);

- new values will be indicated in field 14 “BIC”;

- in the previously unfilled field 15 “Account No.” the recipient’s bank account number is entered;

- in field 17 “Account No.” indicate the recipient’s new accounts.

In the attachment to the Federal Tax Service letter No. KCH-4-8/16504 you can find new details of all territorial bodies of the Federal Treasury, indicating the fields of the payment order in which they are entered. Until May 1, 2021, a so-called “transition period” is established, during which taxpayers are still allowed to use both new and old accounts, but it is better to indicate current details as early as January 1, 2021.

What is the deadline for sending a tax demand for tax payment?

The deadlines for sending requests for payment of taxes and fees are regulated by Art. 70 Tax Code of the Russian Federation. Tax authorities have the right to send a demand for tax payment from the moment the arrears are identified. The maximum period during which inspectors are required to notify you of debt to the budget is 3 months.

What is the procedure for preparing and submitting a tax payment request? Tax officials discovered arrears - they record this fact in an internal document of the Federal Tax Service. Based on this document, a tax payment request is drawn up within 3 months and submitted to the taxpayer. If a debt to the budget was discovered as a result of a tax audit, then you will receive a request to pay the tax within 20 business days from the date the decision on the audit materials comes into force.

Moreover, even if the tax authorities missed the deadline for sending a demand for tax payment, they still have the right to collect the arrears.

IMPORTANT! If the amount of arrears is less than 500 rubles, then inspectors have the right to make a demand for tax payment within a year (Clause 1, Article 70 of the Tax Code of the Russian Federation).

An organization, entrepreneur or individual can receive a tax payment request in several ways:

- personally against signature;

- by registered mail;

- in electronic form via TKS (the procedure was approved by order of the Federal Tax Service of Russia dated February 27, 2017 No. ММВ-7-8/ [email protected] );

- in the taxpayer’s personal account (the procedure was approved by order of the Federal Tax Service of Russia dated June 30, 2015 No. ММВ-7-17/ [email protected] ).

NOTE! Cases of fraud have become more frequent - letters are sent to the company by e-mail about the presence of debts on taxes and fees. Attached to the letter is a virus file, the launch of which leads to disruptions in the operation of the computer. The Federal Tax Service never sends tax payment requests by email!

If tax authorities send a tax payment request by mail, it will be delivered to the address specified in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. This must be taken into account if the actual and legal addresses of the taxpayer do not match, since according to the law such a letter is considered received on the 6th business day from the date of sending. This means that starting from the 7th day after sending the tax payment request, the tax authorities expect you to take action to repay the arrears.

Inspectors will send an individual a tax payment request to the registration address indicated in the passport.

If the tax authorities have sent you a request to pay tax under the TKS, then you must send a receipt confirming receipt of the document within 6 days from the date the tax authorities sent the request. If the inspectors do not receive a receipt from you within 6 days, they have the right to block the company’s current account. To prevent this from happening, we recommend that you regularly check the reporting program you use to government agencies.

If during the time that has passed since the request for tax payment was sent, the taxpayer’s debt has changed, the tax authorities will send an updated request.

When must the requirement to pay tax be fulfilled?

What should you do when receiving a tax claim? If you do not agree with it, then within 1 year you can appeal it to a higher authority. But during this time, tax authorities may have time to collect the money forcibly, so you need to object to the demand, if necessary, as early as possible.

The tax payment request specifies the date by which the tax debt, penalty or fine must be repaid. As a rule, this period is 10 calendar days. If you pay the required amount during this time, then the tax payment requirement is considered fulfilled.

What happens if the company does not repay the debt within the specified period? In this case, the tax authorities have 2 months to make a decision on collecting the arrears in an indisputable manner and blocking the organization’s current accounts. By Russian Post, in person or via TKS, the taxpayer is given a decision on collection - the decision is considered received on the 6th business day. Then the tax authorities send a collection to the bank to transfer the required amount to the budget.

Read about the maximum amount of arrears that the Federal Tax Service can recover without involving the judiciary here .

If the tax authorities missed the 2-month deadline, then they will no longer be able to collect the money in an indisputable manner. Now they have another 4 months to go to court and receive the amount owed by the court.

When tax arrears can be written off from a deposit account, find out from the publication.

Thus, an organization should settle its relationship with the budget as quickly as possible after receiving a tax payment request, otherwise the tax authorities will receive the money themselves or through the court.

For individuals, the procedure for fulfilling the tax payment requirement has some differences - the citizen must repay the debt to the budget within the period specified in the requirement. Otherwise, the tax authorities go to court with an application to collect the arrears.

Enforcement methods

Tax legislation provides for several ways to ensure compliance with requirements for the payment of taxes, penalties and fees:

- secured by property;

- under the responsibility of the guarantor;

- fines;

- seizure of property;

- freezing transactions on a bank account.

A collateral agreement is drawn up between the payer-debtor or his representative and the tax authority.

In this case, the amount of the collateral may exceed the amount of the debt, but it cannot be less than it.

If the payer fails to comply with the request, the tax authority may sell the debtor’s property at market value, withholding from the proceeds the funds necessary for repayment, and then returning the difference from the sale to the payer. This measure applies not only to organizations - legal entities and individual entrepreneurs, but also to individuals.

The guarantor can fulfill the obligations of the payer against whom the claim is made in full and not in part. Moreover, this practice is most often used in relation to organizations for which another organization acts as a guarantor, the activities of which are closely related to the activities of the debtor. The return of funds paid upon request is negotiated in this case individually between the guarantor and the debtor.

The tax authority has the right to freeze the movement of funds in the debtor’s bank account only on the basis of a relevant decision.

In this case, the bank cannot refuse to execute the decision. The debtor's funds are frozen, and then the funds necessary to repay the debt are transferred to the state budget.

Seizure of property, as one of the extreme measures to fulfill a claim, is applied on the basis of a decision of both the tax authority and the court. Seized property may be returned to the debtor if he promptly fulfills the requirement applied to him. Otherwise, the property will be sold at market value to pay off the debt to the state budget.

Penalties are added to the principal amount of the debt and are indicated in the request, which is sent to the payer-debtor. The obligation to pay penalties is mandatory, since even if a tax, fee or fine is paid off, if the penalties are not paid, they will continue to accumulate.

A change in the obligation to pay tax, as well as its application to the payer, occurs only on the basis of the current tax legislation, which includes not only the Tax Code, but also other regulations that regulate taxation issues, the application of a particular tax, including including regional and local laws and regulations.

Payment obligations arise for the taxpayer when the established tax subject to payment is applied to him.