What is account 25 used for in accounting?

The chart of accounts determines that account 25 general production expenses is intended to account for expenses associated with servicing the organization’s production processes.

Such company expenses include the cost of maintaining production equipment (for example, electricity), the cost of maintaining and servicing production premises, the salary of service personnel with mandatory deductions for it, etc.

The rules establish that service costs are collected in a separate account 25. During a certain period they are accumulated in account 25, and at the end of the period they are subject to distribution according to the accepted methodology at the enterprise.

As a result of this, these costs are included in a certain proportion in the cost of each type of finished product of the company according to the selected distribution base.

The need for such a process for an organization arises for the purposes of budgeting and management accounting, when calculating marginal income.

Attention! Maintenance costs can be distributed not only between main production facilities, but also included in auxiliary costs.

It is advisable to use the account if a business entity produces finished products (provides services, performs work) in a large assortment.

If the company is a small business or has a small range of products, then according to the accounting policy of the organization, account 25 may not be applied. In this case, these costs are reflected as part of the costs of main production.

Attention! In small enterprises, it is quite difficult to distinguish between basic, general production and general business expenses. Those costs that can immediately be attributed to the finished product without distribution are the main costs.

The costs of maintaining a workshop in which a wide range of products are produced are general production costs. The costs of managing a company (office maintenance, salaries of the director, his deputies, financial employees, etc.) are general shop expenses.

You might be interested in:

Account 10 in accounting: what it is used for, characteristics, subaccounts, postings

How are overhead costs distributed?

When choosing a methodology for distributing ODA, it is necessary to take into account the specifics of production and the norms enshrined in the tax policy of the organization. There is a general formula for the distribution of general and general production expenses:

K (OPR) = OPR/B

K is the required coefficient, OPR is the amount of total expenses, B is the base to which all taken into account expenses are distributed.

Calculation using this formula gives a clear idea of how many rubles of ODA fall on 1 ruble of the distribution base. In this case, the choice of base should take into account the relationship between overhead costs and the final cost of a good, service or product of production.

What is included in the account

To understand what is reflected in account 25, you need to know what costs are included in general production costs.

These include:

- Costs for maintenance and servicing of industrial premises - rent, depreciation, costs for heating, lighting, air conditioning, ventilation of industrial premises, etc.

- Maintenance costs for production equipment - electricity, fuel, spare parts, etc.

- The cost of paying general shop personnel is the salary of engineering and technical junior service personnel.

- Deductions accrued on the salaries of general production personnel.

- Insurance costs, both compulsory and voluntary.

- Third-party services that are included in overhead costs.

- Other expenses included by the company in overhead costs in accordance with the characteristics of the activities performed.

Attention! The enterprise, for the most part, independently decides which expenses can be classified as general production expenses. However, the company's management must remember that when taxing profits, it is quite problematic to take into account indirect expenses as expenses taken into account for tax accounting. Therefore, many business entities try to include the maximum list of expenses in direct costs.

Incorrect reflection of services

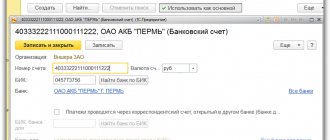

20 the account is not closed when the Subconto column in the reflection of the sale of services in the document Sales of goods and services on the Services tab is not filled in. To check whether the Subconto column is filled, you need to look at the records of the accumulation register Sales of services and check whether the Nomenclature group column is filled.

When closing expense accounts 20, 23, 25, 26, the following message may be displayed: “The item group for the issue is incorrectly specified.” The same item group cannot be used in the documents “Sales of goods and services” on the Services tab in the Subconto column and in the documents “Act on the provision of production services” and “Production report for the shift”

In order to check the correctness of the specified nomenclature groups for product output, it is necessary to compare the entries in the accumulation register “Product output at planned prices (accounting)” in the Nomenclature group column, as well as in the accumulation register “Sales of services in the Nomenclature group column”.

Account characteristics

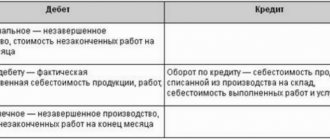

The chart of accounts gives the answer which account 25 is active or passive. Since it is designed to record company expenses, it collects information about the company's assets. Therefore the account is active.

The peculiarity of this account is that it does not have balances at the beginning and end of the period, as it relates to collection and distribution accounts.

They tend to write off the accumulated turnover at the end by distributing it among other accounting accounts. That is, every month the amounts are written off, and from the beginning of the period information about the costs incurred is again accumulated.

The debit reflects expenses incurred by the company for general production purposes. The loan reflects the distribution of accumulated expenses for the month according to the methodology chosen by the enterprise.

Attention! A calculation coefficient is often used that reflects how many indirect costs are per ruble of direct costs (materials, salaries of key personnel).

Sometimes the number of workers employed in the production of a certain type of product, the area of production premises, and machine-hours of operation of capital equipment are used as the basis for distribution.

You might be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

When choosing a method for distributing cost write-offs, management must first of all be guided by the specifics of the activity being performed.

This must be approached with full responsibility, since costs written off as cost will subsequently affect the financial result of the activity.

Attention! The chosen method of distribution must be fixed in the company's accounting policy. So the account does not have beginning and ending balances, information about it is not reflected in the balance sheet.

1.2.1 Cost accounting for a construction contractor.

The object of accounting under a construction contract with a contractor in accordance with clause 3 of PBU 2/94 is the costs incurred when performing certain types of work on objects built under one project or contract. Upon concluding a construction contract, the contractor undertakes to perform specific construction and installation work or build a specific facility within a certain period of time, and the customer will create the conditions necessary for the performance of these works, accept and pay for them. The fact of delivery and acceptance of contract work means that the customer has received a finished result from the contractor, which can be evaluated and paid for.

Subaccounts

The chart of accounts establishes that it is recommended to open two sub-accounts for this account:

- 25 subaccount 1 – “Maintenance and operation of equipment”, which summarizes the costs of operating the organization’s equipment;

- 25 subaccount 2 – “General shop expenses”, which is supposed to summarize the costs of managing and servicing the main production facilities.

However, since account 25 can accumulate expenses of various natures, to analyze them it will be more convenient to open a separate sub-account for each type:

- Salaries of general production workers;

- Contributions to social funds;

- Raw materials and materials;

- fuels and lubricants;

- Depreciation of fixed assets;

- Depreciation of intangible assets;

- Public utilities;

- Etc.

Attention! With this type of accounting, a “Closing” subaccount must be opened. Its essence is that during the closing procedure, first the costs of all subaccounts are written off to it, and then distribution from it to the accounts of other productions begins.

The order of divisions is not established

If the operations of closing cost accounts are determined manually (Accounting policy, tab Release of products, services), then this sequence must be specified. To do this, you need to create a document “Setting the order of departments for closing cost accounts.” If such a document has already been created, it may contain irrelevant data. In order to correct this error, you need to create a new document with the current date, automatically filling out the document using the “fill” button

Examples of typical postings

Let's look at what typical operations are made with a score of 25.

| Debit | Credit | Operation description |

| 25 | 60, 76 | Receipt of services from the supplier is reflected |

| 25 | Materials and fuels were written off | |

| 25 | Accrued depreciation of fixed assets for general production purposes | |

| 25 | 05 | Depreciation of intangible assets accrued |

| 25 | Salaries accrued to general production employees | |

| 25 | Social contributions are accrued for employee salaries | |

| 25 | 97 | Future expenses were written off |

| 20 | 25 | At the end of the period, accumulated expenses are written off to main production |

| 23 | 25 | The expenses for auxiliary production were written off |

| 29 | 25 | Expenses for service facilities were written off |

Basic business operations

- Depreciation calculation

Dt 25 Kr 02 – for equipment intended for industrial activities;Dt 25 Kr 05 – for intangible assets

- Transfer of purchased inventory and household equipment for maintenance and repair of equipment

- Carrying out calculations for wages of industrial departments with the exception of administrative personnel

Dt 25 Kr 70 – employee wages;Dt 25 Kr 69 – calculation of mandatory contributions to social funds from the amounts of accrued wages

- Write-off of overhead costs for inclusion in the cost of manufactured products, depending on the type of activity performed

Dt 20 Kr 25 – main production;Dt 23 Kr 25 – auxiliary production;

Dt 29 Kr 25 – service production.

Lyudmila Poberezhnykh, 2017-01-03

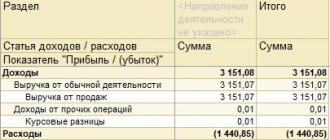

Introductory information

Very often, when working with 1C, we are faced with the problem of closing the 20th, 23rd, 25th and 26th accounts.

Judging by the number of relevant questions on the Online Accounting forum, the identified problem has not lost its relevance for a long time. I have read a lot on this topic, but sometimes I still fall into a stupor when I see an ownerless remnant that should not exist. In order to somehow systematize the information on this issue, I decided to summarize everything that I had read and studied “at random” in the program itself. Submit tax reports for free directly from 1C