Changes in 2021

The calculation of sick leave payments is regulated by Federal Law No. 255 “On Insurance” dated December 29, 2006, as amended on May 1, 2021. Let's look at the main changes for 2021:

- The time to establish the base will be 2021 and 2021.

- The salary limit from which calculations can be made is 1,473,000 rubles.

- The minimum wage since the beginning of 2018 is 9,489 rubles.

- The number of days is 730 (for standard cases).

- The number of days when calculating maternity leave is 731 days.

During the first 3 days of incapacity for work, benefits must be paid by the employer. In subsequent days, funds are credited from the Social Security Fund. The benefit will be determined based on the salary for 2 years. That is, this is 2021 and 2021. For each of these years a certain limit is set:

- For 2021, this is 718 thousand rubles.

- For 2021, this is 755 thousand rubles.

That is, if an employee earned more than 755,000 rubles in 2021, the amount above the limit will not be taken into account in calculations. To determine the benefit, you need to establish a daily salary. In 2018, the maximum amount of this earnings will be 2021.81 rubles. This amount can be found using these calculations:

(718 thousand + 755 rubles): 730 days.

Another significant innovation is a change in the size of the minimum wage. Now it is 9,489 instead of 7,800 rubles in 2021. The minimum wage is the basis for calculation in the following cases:

- No income for 2 years.

- The salary is equal to or lower than the minimum wage.

- The experience is less than six months.

In 2021, the smallest daily payment amount is 311.97 rubles. The employee's actual salary may be less than this amount. The amount taken into account for the calculation is exactly 311.97 rubles.

When calculating, you need to take into account the employee’s length of service:

- Employees with 8 years or more of experience receive 100% of the benefit.

- 80% of the payments are received by employees with 5-8 years of experience.

- 60% of the payments are received by employees with 5 years of experience or less.

The relevant rules are stipulated in paragraph 1 of Article 7 of Federal Law No. 255 of December 29, 2006.

IMPORTANT! If regions have regional coefficients, they must be taken into account when determining the amount of benefits.

Additional features

The benefit amount is determined based on these three factors:

- Insurance experience.

- Salary.

- Official employment.

IMPORTANT! The benefit is paid only when the employee is officially employed. Otherwise, insurance premiums are not deducted from his salary. Consequently, no amount is accumulated for disability payments.

ATTENTION! Dismissed specialists can receive benefits if they fall ill within a month from the date of termination of the employment agreement. If the enterprise was closed, you need to contact local insurance structures for payments.

When can you receive payments?

In the new year, payments are due in the following cases:

- Illness and injury.

- Caring for children or incapacitated close relatives.

- If people are subject to quarantine.

- Rehabilitation period.

- Prosthetics.

- Pregnancy.

FOR YOUR INFORMATION! Only those employees who have provided an officially issued certificate of incapacity for work will be able to receive the benefit.

The nuances of payments after dismissal

In this case, receiving benefits requires fulfilling certain conditions:

- No later than 6 months after dismissal, a sick leave certificate with a work book is sent to the old place of work.

- The new place of work has not yet been finalized.

- No more than a month passed from the date of dismissal before the sick leave began.

- Only sick leave for the employee himself is paid. Caring for family members is not associated with compensation under such circumstances.

- You need to contact the employees of one of the FSS branches.

The procedure for determining payments for sick leave in case of illness

The benefit is accrued within 10 days from the date of provision of the certificate of incapacity for work. Payment is made on the date of the next salary. The benefit is accrued not only for working days, but also for weekends/holidays. You can receive benefits for six months (based on Articles 12 and 15 of Federal Law No. 255).

The first step is to calculate your salary per day. Daily payment refers to payments from which contributions to the Social Insurance Fund are calculated. That is, you need to set wages for 2021 and 2021, and then divide this amount by the number of days (730 days).

What to do if a specialist was employed by another organization in 2021 or 2021? A person needs to send a request to a former employer. The latter is required to provide a certificate of earnings. It is compiled according to form No. 182n.

The next step is to determine the daily allowance:

Daily salary * Percentage determined by insurance experience.

The specifics of the calculations are specified in Order of the Ministry of Health and Social Development No. 91 of February 6, 2007. The length of service includes these segments:

- Activities based on an employment agreement.

- Civil service.

- Other activities during which deductions were made.

Next you need to set the amount of the benefit itself:

Benefit * number of days of incapacity for work.

Personal income tax must be withheld from the resulting amount. The basis is paragraph 1 of Article 217 of the Tax Code of the Russian Federation. Contributions do not need to be deducted from benefits.

About medical and social examination

Medical and social examination is prescribed to patients who have been on sick leave for a long time or suffer from a persistent disorder of one of the body functions. The purpose of such an event is to establish the extent of existing violations. And, if necessary, assign a certain disability group.

After such a procedure, one of the following decisions is usually made:

- The sick leave certificate is closed until a new examination, and a certain disability group is assigned.

- Refusal to establish a specific group. The period of sick leave is increased until the ability to work is restored.

- Dismissal due to disability is illegal if there are no other reasons. The exception is situations with complete loss of ability to work. For such an employee, an acceptable absence from work is introduced for a maximum of 120 days. 5 months is the longest continuous vacation of the entire year.

Examples of calculations under various circumstances

The calculation procedure varies depending on the specific circumstances.

Earnings exceed the limit

The employee took 10 days leave. In 2021, the employee’s salary amounted to 690 thousand rubles, in 2021 – 815 thousand rubles. The amount for two years will be 1,505,000 rubles. Work experience is 7 years.

The salary limit in 2021 is 1,473,000 rubles. That is, the benefit will be set precisely from this limit. The average daily salary will be 2,017.81 rubles (1,473,000/730). The employee's work experience is 7 years. That is, the benefit is calculated at the rate of 80%. It is necessary to make these calculations: 2,017.81 * 80% = 1,614.25 rubles.

In the future, it is necessary to determine the benefit for the entire period: 1,614.25 * 10 days = 16,142.50 rubles. It is this amount that will be transferred on the date of the next salary payment.

Earnings equal to minimum wage

The specialist got a job at the organization on November 1, 2021. She provided a certificate of incapacity for work in February 2021. The disease lasted for 11 days. This was the specialist’s first job, and therefore she had no other salary.

The employee's insurance coverage is less than 6 months. Consequently, the benefit will be accrued at 60%. The calculation is made on the basis of the minimum wage, which is 9,489 rubles. First, the average daily salary is determined: 9,489 rubles * 24 months = 311.97 rubles.

The next step is to determine the daily allowance: 311.97 rubles * 60% = 187.18 rubles. The total benefit for the period of illness will be 2,058.98 rubles (187.18 rubles * 11 days).

IMPORTANT! The amount of payments for a full month with an experience of less than six months cannot be higher than the minimum wage on the basis of paragraph 6 of Article 7 of Federal Law No. 255.

Part-time work benefit

Some employees are working reduced hours. The latter benefits not only employees, but also employers. The latter, with the help of this tool, stop the decrease in revenue levels and prevent the formation of a shortage of funds. That is, a shorter working day promotes savings.

If an employee works part-time, the amount of benefits is established according to general rules. However, a number of significant nuances need to be taken into account. In particular, benefits are determined based on actual earnings. In this case, the number of hours worked does not need to be taken into account.

To establish the average daily payment, it is necessary to divide the salary for the last 2 years by 730 days. However, the average salary of a specialist cannot be lower than the minimum wage. Earnings cannot be reduced due to shortened hours. In the event that the salary is less than the minimum wage, calculations should be based on the minimum wage.

Daily earnings, determined based on the minimum wage, must be reduced in proportion to the actual length of the working day. However, the considered rule can only be used when a shortened working day is introduced no later than the day the disability is recorded. Some employers try to cheat. They introduce a shortened day when the employee is already on sick leave. This is done to save money. However, such a measure is not legal. The employee can challenge it.

Calculation example

The secretary of the organization works 4 hours a day on a regular five-day week. The disease was discovered in January. The sheet was issued for 5 days. Let's look at a worker's earnings over the past two years:

- 50 thousand rubles in 2021

- 65 thousand rubles in 2021

The specialist's insurance experience is 6 years. First, the employer needs to determine the average daily salary. To do this, the following calculations are made: (50 thousand rubles + 65 thousand rubles) / 730 days = 157.53 rubles.

The average daily salary, determined on the basis of the minimum wage, is 311.97 rubles. That is, the salary obtained as a result of calculations is less than the minimum. For this reason, further calculations must be performed on the basis of the minimum wage (311.97 rubles). Daily earnings must be changed to the shortened schedule coefficient: 311.97 / 8 hours * 4 hours = 155.98 rubles.

The last step is to establish benefits based on length of service: 155.98 rubles * 80% * 5 days = 632.92 rubles. The 80% coefficient is the result of six years of work experience.

Preparing for work

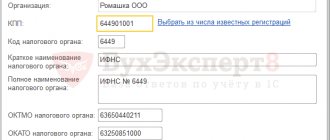

Step 1. Register in the system

To work with electronic sick leave certificates, an organization will need to create a personal account in the Unified Integrated Information System “Sotsstrakh” of the FSS at cabinets.fss.ru (hereinafter referred to as the UIIS “Sotsstrakh”).

You can log in through your legal entity account on the State Services portal. If your organization does not have a confirmed account on State Services, create one in the Unified Identification and Authentication System (USIA):

- On esia.gosuslugi.ru go to the “Organizations” tab.

- Create a verified account using a qualified electronic signature issued in the name of an executive or a person authorized to act without a power of attorney.

- Fill out the card with the details.

If you have an accounting service, read about how to receive sick leave for employees in the article.

After registering in your UIIS “Sotsstrakh” personal account, fill out information about your company and read the instructions.

Each participant in the system has its own personal account functions:

- Hospitals will upload electronic forms into the system, signing them with a qualified electronic signature.

- The accountant will see employee sick leave, receive the necessary information for calculating benefits and fill out the employer section.

- The insured will be able to check whether the sick leave certificate has been filled out correctly and whether the benefits have been accrued correctly.

- Federal Law No. 86-FZ provides that a doctor will be able to issue an electronic sick leave for temporary disability, pregnancy or maternity if these two conditions are met:

- The medical institution and the employer of the insured person are registered in a special automated system of electronic forms.

- The patient agreed in writing to issue a certificate of incapacity for work in electronic form.

A list of data required for conducting a medical and social examination of the insured and calculating benefits, as well as the deadlines for their submission, have been approved (Resolution of the Government of the Russian Federation dated December 16, 2017 No. 1567).

Step 2: Redistribute responsibilities

Appoint an accountant responsible for working with electronic sick leave, obtain an electronic signature for it and provide access to the Social Insurance Unified Information System. If necessary, teach new work rules to those accountants who previously worked only with paper sick leave.

Many services are developing new capabilities for working with electronic sick leave. To work with electronic sick leave, you can also use a free program that the Social Insurance Fund offers to download in the employer’s personal account.

In Externa you can download, fill out and send electronic sick leave to the Social Insurance Fund. Regions with direct payments can create a register based on ELN data and send it to the Social Insurance Fund.

Register

Step 3: Tell employees about the changes

Once the company has connected to the system, tell employees that they have the right to file sick leave electronically. You can issue an order against signature or send it by email.

The employee himself decides in what form he wants to draw up the document: paper or electronic. But electronic sick leave has advantages, convey them to your employees:

- It is easier to complete; there is no need to additionally certify it with seals at the registry office.

- It cannot be spoiled, forgotten, or lost. If the insured person loses his sick leave number, he will be able to restore it in his personal account using the SNILS number and the State Services password.

- An electronic sick leave does not need to be carefully stored and transferred to an accountant, like its paper counterpart. It is enough to provide the sheet number by phone or by mail. This is especially true for companies with branches, different offices or separately located accounting departments.

Tatyana Ogorodnikova, accountant at Agency Bonus :

— The FSS itself sent us a letter inviting us to become a participant in the system and entered into an agreement with us on information interaction. We plan to notify employees about the possibility of filing sick leave electronically in mailings on behalf of department directors. From the introduction of electronic certificates of incapacity for work, we definitely expect only positive changes in work: for example, we will no longer have to send an employee to the doctor to reissue the document due to an error. This has happened before.

Features of calculating benefits for accounting

Payments under the BiR are established on the basis of Federal Law No. 255 of December 29, 2006 and Government Resolution No. 375 of June 15, 2007. The duration of the holiday according to the BiR is equal to these values:

- 140 days at normal course.

- 156 days for complications.

- 194 days for twins or triplets.

To receive money, the employee must provide the employer with a certificate of incapacity for work and a statement. Applications must be submitted at 30 weeks of pregnancy. If a woman is expecting twins or triplets, the application must be submitted at 28 weeks. The manager must assign and determine the amount of benefits within 10 days. The benefit is transferred in a single payment.

ATTENTION! Adoptive parents of babies under 3 months can also receive payments. The benefit is calculated on the basis of adoption papers.

Calculation example

A woman goes on vacation. The salary of a specialist is 33,000 rubles. Over the course of two years, she once went on sick leave for a month. The payment for this period amounted to 21 thousand rubles. The calculations will be as follows: (33,000 * 23 + 21,000) / 731 – 30 = 1,112.70 rubles.

The standard billing period is 730 days. However, when determining pure maternity days, it is equal to 731 days.

The specialist is expecting one child. Pregnancy does not involve complications, and therefore the duration of the vacation is 140 days. Therefore, these calculations are performed: 1,112.70 * 140 = 155,778 rubles.

This is exactly the size of maternity benefits.

Limit amounts of payments for BiR in 2021

The maximum volume is set based on the volume of the base for determining social security contributions. Let's consider the maximum payment volumes:

- 282,106 rubles - with a vacation of 140 days.

- 314,347 rubles - with a vacation of 156 days.

- 390,919 rubles - with a vacation of 194 days.

The salary limit when determining maternity leave is 61,375 rubles.

Determination of payments for accounting when working part-time

A woman who has been working part-time for more than two years has the right to request compensation from each organization in which she worked. There are these options for receiving payments:

- If a woman’s place of work has not changed in 2 years, she receives benefits from two organizations at once. That is, she needs to issue two certificates of incapacity for work.

- If one of the employee’s places of work changes, benefits can only be requested from one company of your choice. The woman must confirm that she does not receive payments from other organizations.

FOR YOUR INFORMATION! Part-time work involves working in two companies. One place of work will be the main one, and the second will be an additional one.

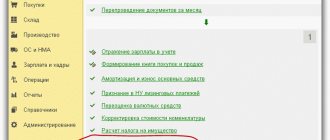

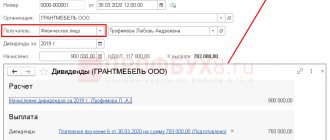

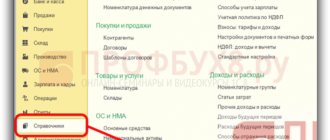

Accrual of sick leave in 1C 8.3

When auto-filling the “Payroll” document in 1C 8.3 for the period in which our employee was on sick leave, the program will insert this amount into the appropriate column. Also, the amount of time worked will decrease during the period of illness.

On the payslip, accrued sick leave amounts at the expense of the employer are displayed on separate lines.