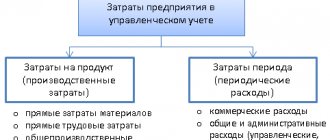

Why divide costs into direct and indirect?

When calculating income taxes, direct and indirect expenses reduce the tax base, but at different times.

Therefore, it is necessary to divide expenses into direct and indirect in order not to make a mistake with the moment of recognizing expenses as expenses. That is, correctly determine the tax base and calculate the tax.

The tax base can be reduced by the amount of direct expenses only after the sale of products in the production costs of which they are taken into account. That is, their amount for the current month must be distributed between work in progress and products manufactured during the month (work performed, services provided).

You can write off only that part of direct expenses that falls on finished, shipped and sold products (Articles 318, 319 of the Tax Code of the Russian Federation).

Indirect expenses are written off to reduce the tax base in the month in which they were incurred, that is, without reference to sales.

Therefore, sometimes there is a temptation to expand the list of indirect expenses as much as possible and reduce the list of direct ones - in order to pay less income tax.

However, it is better not to do this, but try to divide your expenses into direct and indirect so that you don’t have to pay more later. https://youtu.be/https://www.youtube.com/watch?v=s12lbu8yE9Y

Accounting and distribution of indirect costs

Problems often arise with the distribution of indirect costs among manufactured products. But this issue requires accuracy and timeliness, because indirect costs also participate in the formation of the cost of the product and, therefore, must be included in its selling price.

Usually, to determine the share of indirect costs that make up the cost of a particular product, the absorption coefficient is calculated. It shows how much of the indirect costs the product absorbs.

This coefficient is calculated in proportion to the selected (and fixed in the Accounting Policy) distribution base. Most often, either direct labor costs or all direct costs as a whole are chosen as such a basis.

In this case, the distribution base is the sum of direct costs, and the absorption coefficient is calculated as the percentage of the share of these costs going towards the production of a particular product to the total direct costs.

There are other options for allocating indirect costs. For example, with the Direct Costing method, they are not recorded as part of the cost price, but are immediately deducted from profit.

How to safely separate expenses into direct and indirect

Tax authorities will not find fault if in tax accounting you take into account as direct expenses the costs that are included in the cost of products (works, services) in accounting.

The list of costs included in the cost of production in accounting may only include direct costs. That is, those expenses that are directly necessary for the production of products. These include the costs of raw materials and supplies, wages of production personnel, depreciation of production equipment, etc.

Just keep in mind that the accounting list of direct costs should be based on the normal, and not the truncated cost of finished goods. The formation of truncated cost is based on the distribution of costs into variables that depend on the volume of products produced, and constants that do not depend on it. It turns out that indirect costs include those associated with the production of several types of products, including the costs of maintaining and operating equipment. The inspectorate will not allow this approach (see, for example, letter of the Ministry of Finance dated January 13, 2014 No. 03-03-06/1/218).

Methodology for analyzing indirect costs

Analysis of indirect costs is carried out in order to find reserves for reducing them without deteriorating the quality characteristics of the product.

Most often, analytical activities are carried out in the following several stages:

- Comparison of indirect costs per ruble of products in dynamics and with planned indicators;

- Research into the factors and causes that initiated these changes;

- Deviations from the estimated indicators are calculated and their changes in dynamics are studied for each expenditure item;

- The causes and validity of savings/overspending are examined, a positive or negative assessment is given to these phenomena, conclusions are drawn, and recommendations are formulated.

Direct and indirect costs for Tax Code

However, do not forget that the Tax Code of the Russian Federation also gives its recommendations for tax accounting.

The list of recommended direct expenses is directly established in paragraph 1 of Article 318 of the Tax Code of the Russian Federation:

- costs of raw materials or materials used in the production of goods, components, semi-finished products;

- expenses for remuneration of personnel involved in the production process and insurance premiums for it;

- depreciation amounts of fixed assets used in production.

Costs that are not directly related to production or, according to technical regulations, are not included in it, are classified as indirect.

For example, the salary of management personnel and insurance premiums for it (see letter of the Ministry of Finance dated September 20, 2011 No. 03-03-06/1/578). This is the remuneration of the director, accounting, personnel, economic, and financial services.

But only those expenses that cannot be classified as direct can be recognized as indirect. Thus, tax authorities will not accept as indirect expenses the costs of:

- payment for the services of subcontractors or processors of customer-supplied raw materials;

- rent and utility payments for industrial premises.

These costs are related to production and therefore should be classified as direct.

Don't forget to secure lists of direct and indirect expenses in the company's accounting policies.

Read in the berator “Practical Encyclopedia of an Accountant”

How to fill out Appendix No. 2 to sheet 02 of the income tax return

How to reflect indirect expenses in your income tax return

Indirect costs are reflected in line 040 of the second appendix to the second sheet of the Declaration. Moreover, the values are reflected from the beginning of the period in an increasing manner. Individual expenses that make up the total amount for term 040 are detailed and shown additionally:

- 041 – mandatory fees to the budget and taxes accrued for the period;

- 042 – depreciation bonuses for non-current assets belonging to groups 1-2 and 8-10;

- 043 – depreciation bonuses for fixed assets from depreciation groups 3-7;

- 045 – costs of social support for disabled people;

- 047 – amount of expenses for the acquisition of land plots.

Depreciation

Any organization has office equipment, computers, furniture, and transport intended for management needs. They are not used in production. Depreciation on such fixed assets can be safely considered an indirect expense.

This is not the case with premises - often both production and non-production are located in the same building. Depreciation cannot be divided. Therefore, it will have to be classified as direct or indirect based on calculations, for example, depending on how many percent of the area is occupied by production premises and how much by non-production premises.

If the production area occupies less than half, then the depreciation amounts for the entire premises can be considered indirect costs (see the definition of the Supreme Arbitration Court of August 16, 2012 No. VAS-9792/12).

Indirect costs in construction

Such a specific branch of the economy as construction has a number of features. The duration of the production cycle, significant material consumption, the complexity of performing certain types of work - these are just some of them.

Typically, direct costs in construction firms include the following:

- Basic materials;

- Salaries of key employees directly involved in construction;

- Mandatory contributions to the budget from the payroll fund for such employees;

- Depreciation and repair of equipment involved in construction;

- Price of subcontractor services;

- Lease payments;

- Leasing payments;

- Maintenance of machinery and equipment;

- The cost of marriage.

Other expenses incurred by construction companies, in accordance with Art. 318. The Tax Code of the Russian Federation are considered indirect.

1C Accounting - accounting of business transactions in detail!

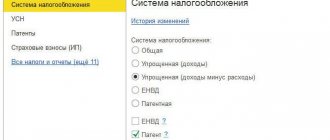

subscribe to blog updates via e-mail Hello dear readers of the blog-buh blog. In publications about the closure of the month, we are gradually approaching the most frequently asked and popular questions. I mean questions devoted to closing costly accounts (20, 23, 25, 26) and related issues of program settings. But we will start by calculating the share of write-off of indirect expenses and the corresponding regulatory operation of closing the month in the software product 1C Enterprise Accounting, edition 3.0 . This operation is intended to carry out preliminary calculations that precede the closure of expense accounts. It determines the amounts that reduce the tax base. I will also immediately note that this regulatory operation does not always directly generate postings, but only if certain types of expenses occur:

- Advertising expenses;

- Entertainment expenses;

- Voluntary insurance under long-term life insurance contracts for employees;

- Voluntary personal insurance;

- Voluntary personal insurance in case of death or disability;

- Expenses to reimburse employees for paying interest on loans;

- Expenses associated with various types of activities, taxable and not subject to UTII;

- Fare.

Of course, within the framework of this publication I will not be able to analyze examples within each of the listed types of expense. But I will try to most fully outline the essence of the regulatory operation under consideration using the most typical cases as an example.

Let me remind you that the site already has a number of articles that are devoted to the issue of closing a month in the 1C BUKH 3.0 program:

- Part 2: “Closing accounts 20, 23, 25, 26” transactions: detailed analysis of “Closing the month” in 1C ACCOUNTING 3.0

- Part 1: “Closing accounts 20, 23, 25, 26” transactions: detailed analysis of “Closing the month” in 1C ACCOUNTING 3.0;

- “Adjustment of item cost”;

- “Revaluation of foreign currency funds”;

- “Calculation of trade margin”;

- “Recognition of expenses for the acquisition of OS for the simplified tax system”;

- “Write-off of additional expenses for the simplified tax system”;

- “Calculation of shares of write-off of indirect expenses”;

- “Calculation of transport tax”;

- “Calculation of land tax”;

- “Calculation of property tax”;

- “Write-off of deferred expenses”;

- “Repayment of the cost of workwear and special equipment”;

- Accounting for depreciation of fixed assets;

- Exclusion of work in progress from the composition of material costs for the simplified tax system;

- Methods of depreciation of fixed assets in 1C Accounting.

Registration of entertainment expenses in 1C Accounting 3.0

Let's look at the calculation of the share of write-off of indirect expenses using the example of entertainment expenses. When calculating income tax, entertainment expenses are taken into account in the amount of no more than 4% of labor costs . However, in accounting, these expenses are reflected in the amount of actual costs. Actually, in the first part of the article we will talk about how to reflect entertainment expenses in accounting using 1C Accounting. But first, a little about what hospitality expenses are. These are expenses that are associated with holding official receptions : breakfasts, lunches, buffet service, delivery to the reception site, costs of translation services and other expenses within the framework of similar events.

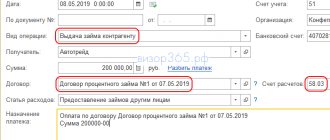

Reflection of entertainment expenses in 1C Account can be done using the document “Receipt of goods and services”. We fill out all the fields of this document in the same way as in the usual reflection of received goods and services. In our case, services will arrive, but this is also not so important. What is important for us is which cost item will be selected when setting up a cost account. You must select the cost item “Entertainment expenses”, which has ” in the “type of expense ” field.

If a posting is generated for exactly this cost item, the program will consider this to be entertainment expenses.

Rationing of entertainment expenses at the end of the month

| Now let's see what transactions will be generated by the routine month-closing operation “Calculation of shares of write-off of indirect expenses” . But first, let’s calculate what amount and what percentage of entertainment expenses should be taken into account when calculating income tax. To do this, remember that the law takes into account 4% of labor costs. To find out what kind of labor costs our organization has, we will create the SALT in account 70. |

We formulate for the period from January to November 2014, since hospitality expenses were reflected in November.

In the generated report, we are interested in the total amount of the loan, this is the labor costs. 4% of this amount is 39,600 . This means that we can expect that this exact amount of entertainment expenses will be taken into account. This is 0.396 of the total amount of entertainment expenses (39,600 / 100,000). Let's remember these two numbers. Now let’s close the month for November 2014 and look at the entries made by the operation “Calculation of shares of write-off of indirect expenses” . And postings will be made in two registers. Firstly, this is the information register “Share of write-off of indirect expenses” , in which the calculated share/rate of expense accounting is indicated: 0.396 = 39,600 / 100,000. This share will be indicated in the field that corresponds to entertainment expenses, i.e. For each option of normalized consumption there is its own field.

Secondly, a posting will be generated in the information register “Calculation of standardization of expenses” . Here we will see the amount that we calculated a little earlier - 39,600 . I will also explain the meaning of each field:

- Expenses for the year – the total amount of entertainment expenses since the beginning of the year;

- Expenses year - the amount of entertainment expenses, recalculated according to the norm (also from the beginning of the year);

- Expenses per month - the amount of entertainment expenses recalculated according to the norm (for the current month);

- Differences year - the difference between the total amount of entertainment expenses and the amount according to the norm (for the year);

- Monthly difference – The difference between the total amount of entertainment expenses and the standard amount (for the current month);

- Base amount – the base in this case is the cost of paying employees since the beginning of the year.

You can also generate a calculation certificate for this routine operation. However, it is very strange that this certificate does not contain information about the base - about labor costs, based on which the standard for accounting for entertainment expenses was calculated. But the developers of 1C certainly know better.

| After normalization has been carried out during the month-closing operations, it is necessary to close 20 accounts. In this sense, we are most interested in account 26, in which entertainment expenses were reflected. In our example 26, the account is closed to account 90.08.01 “Administrative expenses for activities with the main taxation system”, since the direct costing method was chosen in the accounting policy - the method of distributing indirect expenses. |

However, in Tax Accounting 26, the account is closed only within the calculated norm in the amount of 39,600 (see screenshot).

Other cases of cost rationing

In this article, we examined in detail only 1 cost option, which is subject to rationing. Therefore, now I will give a brief description of all possible expenses, whose accounting standards can be calculated in the regulatory operation “Calculation of shares of write-off of indirect expenses”:

- Hospitality expenses - 4% of payroll

- Advertising costs – 1% of revenue

- Voluntary insurance under long-term life insurance contracts for employees - 12% of the payroll

- Voluntary personal insurance - 6% of payroll

- Voluntary personal insurance in case of death or loss of ability to work - RUB 15,000. for each insured employee

- Expenses for reimbursing employees' expenses for paying interest on loans - 3% of the payroll

- Expenses associated with various types of activities, taxable and not subject to UTII - in proportion to income received

- Transport costs - in proportion to goods sold

That's all for today! If you liked this article, you can use the social media buttons to save it to yourself! Also, don’t forget to leave your questions and comments in the comments ! Let me remind you once again that this was material from the “Closing of the Month” section, all articles of which are located here. To learn about new publications in time, you can subscribe to blog updates via e-mail.

Expenses when there is no income

Situation: how to take into account direct and indirect expenses when calculating income tax using the accrual method if there is no income from sales in the reporting period. Is the organization not a newly created one?

If there is no income in the reporting period, the organization can only recognize indirect expenses.

The explanation is simple - you can recognize direct expenses only as goods, works or services are sold, the cost of which includes the costs. Direct expenses that relate to the balance of unsold products cannot be taken into account when calculating income tax.

As for indirect expenses, they are in no way tied to the revenue received. They can be taken into account in the current period. And expenses in tax accounting are recognized only as expenses that meet the following criteria:

- are aimed at generating income and are economically justified;

- documented.

These are the requirements of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Moreover, if a specific expense does not bring direct income to the organization, this does not mean that it is unreasonable. It is enough that it is necessary for the activity that will result in the income generated. Therefore, indirect expenses of an organization can be recognized even in the case when income has not yet been received in the reporting period. Such conclusions are expressed in letters of the Ministry of Finance of Russia dated August 25, 2010 No. 03-03-06/1/565, dated May 21, 2010 No. 03-03-06/1/341, dated December 8, 2006 No. 03 -03-04/1/821.

Accounting for indirect expenses in the absence of income

Lack of income is caused by two reasons:

- The first is: the company conducts its activities correctly, but it has no buyers or sales do not generate revenue. Taxation for such industries can only be disastrous and significantly worsen financial affairs.

- The second reason: the organization is performing the work, but payment will occur after some time.

For example, construction companies. Profit from building an object and renting it out will occur only after significant costs and a long period of time.

If profit is calculated on a cash basis, then when taxes are deducted, the company goes into the red.

Sometimes tax inspectors do not collect tax because the company has no income.

Leading experts in the country argue that it is prohibited to levy taxes on a company that does not have any profit. This doesn't always happen.

conclusions

We think that the presented article has become another proof that the success of its future activities depends on the correct planning of income and expenses of an enterprise. It should also be taken into account that the amount of tax payments depends on the efficiency of dividing costs into direct and indirect categories of expenses . Therefore, planning the expenditure part of the project is the most important stage in drawing up a business plan.

In order to correctly determine the amount of direct and indirect costs for starting and developing a business, and to calculate their optimal ratio, we advise you to focus on already developed business plans in your field. Using a ready-made business plan will allow you to avoid many mistakes, and will also simply save your energy and time. You can also trust professionals in this field and order a comprehensive development of a business plan in a turnkey format, taking into account the individual characteristics of your business.

Fare

Transport costs are considered both indirect and direct costs.

If we are talking about delivering goods to the buyer, that is, to wholesale warehouses, stores or directly to the home, then this refers to indirect.

If we talk about the transportation of materials used at the production stage, then according to the article, this is a direct expense.

To reduce the tax, you can distribute the costs spent on the delivery of goods within production evenly across all expenses - attributing them to both sold and non-sold goods.

Indirect costs when calculating product costs

Indirect costs, along with direct ones, form the cost of the product. But difficulties often arise with assigning them to a specific product. Unlike direct costs, they cannot be directly related to the production of a specific assortment unit. And therefore they need to be distributed accordingly.

This distribution is carried out differently at each enterprise. For this purpose, the most suitable distribution base is selected.

The following indicators are usually used as such a basis:

- Direct labor costs;

- All direct costs in general;

- Output;

- Expenses for equipment maintenance (for highly automated production);

- Number of machine hours, etc.

How to justify indirect expenses?

If indirect taxes are significant or represent a significant amount, it attracts the attention of the tax authorities.

The tax office will require, within five calendar days, to provide documents and extracts confirming the validity of indirect costs.

https://youtu.be/https://www.youtube.com/watch?v=3X26dMzqNFY

The more detailed and convincing the report is, the less likely it is that the budget will need to be recalculated..

Accounting for the cost of purchasing licenses

As practice shows, the taxpayer has the right to include the costs of purchasing licenses as indirect expenses. For example, the taxpayer included the full cost of a license for retail trade in alcoholic beverages, which is valid for five years, as non-operating expenses. The inspectorate considered that the cost of paying the fee and the cost of paying the state duty should reduce the accounting profit evenly over the period of validity of the license. The court found that in the taxpayer's accounting policy, the costs of acquiring a license are indirect. According to paragraph 2 of Art. 318 of the Tax Code of the Russian Federation, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period. The date of non-operating and other expenses is the date of accrual of taxes (fees) for expenses in the form of amounts of taxes (advance payments for taxes), fees and other obligatory payments (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation). Moreover, in accordance with paragraph 1 of Art. 272 of the Tax Code of the Russian Federation, expenses accepted for tax purposes are recognized as such in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other forms of payment and are determined taking into account Art. Art. 318 - 320 Tax Code of the Russian Federation. In this regard, the court found justified the one-time attribution of the disputed expenses to the cost of production (Resolution of the Federal Antimonopoly Service of the Moscow District dated December 20, 2011 in case No. A41-2253/11). A similar approach to resolving the issue under consideration can be seen in another court verdict. The tax inspectorate excluded from expenses that reduce the amount of sales revenue the costs of obtaining a license valid for five years and the costs of issuing a certificate of conformity issued for three years. At the same time, the inspection came to the conclusion that the taxpayer included certification costs as a lump sum as a violation of Art. 264 Tax Code of the Russian Federation. However, the court noted that according to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, the costs of acquiring licenses and the costs of product certification are indirect costs subject to in accordance with clause 2 of Art. 318 of the Tax Code of the Russian Federation is included in full as expenses of the current (reporting, tax) period. The position of the court is given in the Resolution of the Federal Antimonopoly Service of the Central District dated February 15, 2012 in case No. A35-1939/2010.

List of direct expenses

Direct costs include:

- Costs for replenishment of materials.

- Costs of wages for personnel engaged in primary production.

- A group of other costs in the form of depreciation of equipment, advertising of goods, payment of commissions to sales agents and the purchase of packaging materials.

Accounting for expenses is carried out by accumulating them in account 20. The peculiarity of the service sector is that direct costs are taken into account immediately in full without reference to the level of sales.