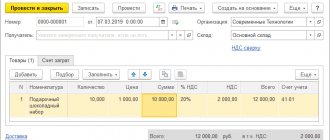

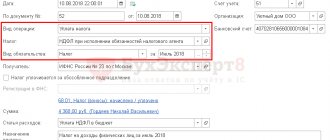

Payment

The economic activities of organizations are based on the use of property owned by it, which is reflected in accounting. From 1.01.19

Let's look at return on equity. In foreign sources, the return on equity ratio is designated as ROE

Employer reporting Alexey Borisov Leading expert on labor relations Current as of September 3, 2020

Income tax (lines 2410–2400) Lines 2410–2400 of the Report reflect calculations for tax on

OS in accounting and tax accounting To put a fixed asset on the balance sheet, you must comply

GPC agreement: advance payment for the performer and personal income tax (Chernykh S. Remuneration under a civil law agreement for

Don't have time to keep personnel records? We'll take it on from 833 rubles per month

Order of the Ministry of Finance No. 90 dated 06/08/2015 established changes to the BCC for 2021 in

Accounting entries depend on who records them: the issuer or the holder. Let's consider accounting

The procedure for taxing individuals who own vehicles with the appropriate tax is the same as for