The economic activities of organizations are based on the use of property owned by it, which is reflected in accounting. From January 1, 2019, the movable property of an organization, according to amendments to the Tax Code of the Russian Federation (Article 374-1), is not subject to property tax, and since accounting data is the basis for calculating NU indicators, the criteria defining movable and immovable property acquire special significance. Postings for property accounting, forming the main balance sheet indicators, are also one of the most important in accounting.

How can an organization distinguish movable property from immovable property ?

Definition of the term "accounting"

Accounting is an orderly system for collecting, registering and summarizing information in monetary terms about the property, obligations of an organization and their movement through continuous, continuous and documentary accounting of all business transactions.

Accounting in accordance with the law on accounting can be carried out by: the chief accountant hired by the enterprise under an employment contract, the general director in the absence of an accountant, an accountant who is not the chief accountant, or a third-party organization (accounting support).

Formation of accounting entries for accounting of the organization’s property

The legislation determines that the company's property exists separately from the property of the owners and other companies. Maintaining accounting records of property is regulated by the Civil Code, Tax Code, the Law “On Accounting”, and PBU.

There are several types of organization property:

- fixed assets, including real estate, equipment, transport;

- intangible property, which consists of intangible objects that bring profit to the company (computer programs, inventions);

- cash and non-cash finances of the company in any currency;

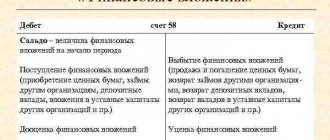

- cash investments in the authorized capital of other companies, in securities;

- inventories for production (goods, raw materials, finished products, etc.);

- accounts receivable, that is, financial assets representing debt from counterparties.

Accounting for an organization's property is based on a strict principle: the organization's property in monetary terms and the sources of its formation are equivalent. The increase in sources is recorded in credit accounts. Account debits reflect expenses.

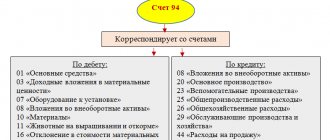

The main method of accounting policy is double entry using two corresponding accounts that have their own number and characteristics. The organization's property is recorded using the accounts "Cash", "Fixed Assets" and others. Accounts receivable are recorded in settlement accounts.

| Dt | CT | Name |

| 91/2 | 68/subaccount | accrual and inclusion in expenses |

| 44, 26 | 68/subaccount | allocation to general business expenses |

Liquidity ratios and purposes of their calculation

The purpose of calculating liquidity ratios is to assess the ability of a company's assets to quickly turn into cash. High values and growth of these indicators are assessed positively and indicate solvency.

Kt.l. = AO/OK

, Where

Kt.l. – current liquidity ratio (shows the company’s ability to pay current obligations using only current assets),

JSC – current assets,

OK – short-term liabilities.

Kb.l. = (Z.k. + Vf.k. + Dsr)/FROM

, Where

Kb.l. – quick liquidity ratio (demonstrates the ability to pay off current liabilities with highly liquid assets),

Zd.k. – debts of debtors for a period of up to a year,

Vf.k. – short-term financial investments,

Dsr - cash,

OT – current obligations.

Ka.l = (Dsr + Vf.k.)/OT

, Where

Ka.l. – absolute liquidity ratio (shows the ability to pay current expenses with assets with absolute liquidity),

Dsr - cash,

Vf.k. – short-term financial investments.

Property as an accounting object

Any business, no matter what field of activity it is in, needs resources. For example, to build a house you need a plot of land, building materials, a team of specialists who will directly carry out all the work on its construction, designers and management personnel, and, finally, finances.

Managers of an economic entity organize the production process (performing work or providing a service) by combining material, labor and financial resources. In turn, accounting work in this case consists of collecting, processing, documenting information, as well as presenting the results obtained to the management team of an economic entity or its owners.

One of the objects subject to accounting by the accounting service is property.

The property of an economic entity is a set of assets that are in its ownership. Thus, well-organized financial accounting guarantees the reliability of the data contained in it and reporting indicators regarding the property of a business entity.

Can not understand anything?

Try asking your teachers for help

The objects of accounting are the organization's property, their obligations and business transactions carried out by organizations in the course of their activities.

What indicators determine the solvency of an enterprise

During the analysis, indicators that determine the solvency of a business entity are necessarily calculated.

One of the most important coefficients is the value of total solvency (COP), which is calculated as follows:

Co.p. = A/O, where

A are the assets of the company, and O are its liabilities.

This indicator is compared with the standard (should not be less than 1) and studied over time (growth is assessed positively).

Example. In OJSC Sfera, balance sheet assets amount to 357,068 thousand rubles, and liabilities – 173,865 thousand rubles. The total solvency ratio is calculated as follows: 357,068/173,865 = 2.05. The standard is far exceeded, which characterizes the company as a reliable partner.

The indicator of long-term solvency (Kl.p.) allows you to draw conclusions about the solvency of the company in the long term and even identify signs of possible bankruptcy long before the crisis. It is calculated like this:

Kd.p. = Kz/Ks, where

Кз – borrowed capital;

Kc – equity capital.

The higher the ratio, the lower the estimated long-term solvency of the research object. The prevalence of borrowed funds is fraught with financial risks.

Main tasks of accounting

The main task of accounting is the generation of complete and reliable information (accounting statements) about the activities of the organization and its property status, necessary for internal users of financial statements - managers, founders, participants and owners of the organization's property, as well as external - investors, creditors and other users of financial statements , on the basis of which it becomes possible:

- prevention of negative results of the organization’s economic activities;

- identification of internal reserves to ensure the financial stability of the organization;

- monitoring compliance with legislation when the organization carries out business operations;

- control of the feasibility of business operations;

- control of the availability and movement of property and liabilities;

- control over the use of material, labor and financial resources;

- monitoring compliance of activities with approved norms, standards and estimates.

Analysis of the structure and dynamics of assets

When conducting such an analysis of property, economists pay attention to the following points:

- what types of resources (own or borrowed) take the lead in the formation of the company's assets: a significant share of equity capital indicates the stability of the company, but if the structure is dominated by liabilities (especially short-term), the financial stability of the organization is in big question;

- trends in changes in own property (an increase indicates an increase in financial stability);

- trends in changes in attracted assets (an increase in their share indicates an increase in financial dependence on creditors);

- changes in the size of profits and reserves (a decrease in profits, and, even more so, the formation of losses means the ineffective functioning of the company and its instability in financial terms);

- the composition of the liabilities of the passive part of the property (the validity of the amount of borrowed funds is studied, since within reasonable limits they can have a positive impact on the development of the company, but their excessive growth can reduce its liquidity and deprive it of independence);

- trends in changes in long-term liabilities (their growth is assessed as generally positive);

- trends in changes in short-term liabilities (studied by creditors: employees, budget funds, lenders, suppliers, etc.);

- the difference between two types of debts: accounts payable and accounts receivable (the prevalence of accounts payable is assessed positively, while a significant share of debts from debtors indicates that capital, which could be used to develop production, is not used effectively).

Property rental: postings

The rental price of premises often consists of fixed and variable costs. The price per square meter rented is constant, utility payments are a variable part. Rental costs at the end of the month are included in expenses. The choice of accounts depends on the purpose of the area.

| Dt | CT | Wiring | Sum |

| 26 | 60.01 | Rental payment taken into account | 42 500 |

| 60.01 | 51 | Money transfer | 42 500 |

| 19 | 60.01 | VAT presented | 6483 |

| 68 | 19 | VAT is accepted for deduction | 6483 |

Tax legislation recommends keeping separate records for this type of income indicating the date; name of the property, its quantity, book value, sales costs and final cost of the object.

| Dt | CT | Name | Sum | Base |

| 62 | 91 | Sales of goods | 7500 | Agreement Invoice |

| 91 | 68 | VAT charged | 1144 | Invoice |

| 91 | 10 | Write-off of sold paper | 5000 | Invoice |

| 91 | 99 | Profit from sale | 1356 | Invoice |

Assessment of financial stability (coefficients of autonomy, dependence, agility)

Financial stability is usually assessed using the following indicators:

Autonomy ratio = equity/assets

The specific value depends on the industry of the company. Its normal limits are 0.5 - 0.7.

The indicator demonstrates the share of the company's own funds in the property and, accordingly, the degree of its independence from external sources.

Dependency ratio = liabilities/assets

The ratio shows the share of borrowed sources in the composition of all assets and indicates the level of dependence on external creditors. Its optimal value is 0.5. Exceeding the threshold of 0.8 is already regarded as a risk.

Agility ratio = working capital/equity capital

The indicator indicates the degree of involvement in the turnover of current assets. The preferred option is a value in the range of 0.2-0.5.

Basic elements of accounting method

- documentation - written evidence of a completed business transaction, giving legal force to accounting data;

— valuation – a way of expressing funds and their sources in monetary terms;

accounting accounts - a method of grouping the current reflection of property, liabilities and transactions;

- double entry - interconnected reflection of business transactions on accounting accounts, when each operation is simultaneously recorded as a debit to one account and a credit to another account for the same amount;

— inventory – checking the availability of property listed on the organization’s balance sheet, carried out by counting, describing, weighing, mutual reconciliation, evaluation of identified funds, and comparing the obtained data with accounting data;

- calculation - calculating the cost of a unit of products, work, services in monetary terms, that is, calculating the cost;

- balance sheet - is a source of information and is a method of economic grouping of an organization’s property by composition, location and sources of formation, expressed in monetary value and compiled as of a certain date;

— accounting statements – a set of accounting indicators reflected in the form of certain tables and characterizing the movement of property, liabilities and financial position of organizations for the reporting period.

Difference between equity and debt capital

It is more convenient to consider these differences in the table.

| Comparison sign | Type of company property | |

| Own | Borrowed | |

| The right to make management decisions and to participate in planning the company’s development strategy | Suggests this moment | Does not imply such powers |

| Impact on financial risk | Increasing your own assets minimizes the risk of financial instability | An increase in borrowed funds in the property structure significantly increases financial risks |

| Queue to pay part of the profit in the form of income | Residual priority principle | Get your income first |

| Place in line for reimbursement of contributions in the event of bankruptcy of an organization | Residual principle | First of all |

| Terms of return of invested funds | Not clearly stated | Unambiguously stated in agreements and contracts when providing loans |

| Objects of financing (most) | Long term facilities | Short term objects |

| Impact on the amount of income tax | Does not affect the amount of tax in any way | Reduces tax by accounting for interest on loans as expenses |

| Sources of formation | Internal and external | External only |

| The mutual influence of the income of the owner of capital and the profitability of the company | Direct communication | No connection |