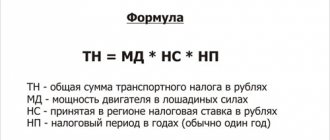

The procedure for taxing individuals who own vehicles with the appropriate tax, the same as for organizations, is established by the provisions of the Tax Code and the laws of the constituent entities of the Russian Federation. When establishing a tax, the legislative (representative) bodies of the constituent entities of the Russian Federation determine the tax rate within the limits specified by the Tax Code, the procedure and terms for its payment.

Transport tax must be paid if are registered , namely:

- cars,

- motorcycles,

- scooters,

- buses,

- other self-propelled machines and mechanisms on pneumatic and caterpillar tracks,

- aircraft,

- helicopters,

- motor ships,

- yachts,

- sailing ships,

- boats,

- snowmobiles,

- motor sleigh,

- motor boats,

- jet skis,

- non-self-propelled (towed vessels),

- other* water and air vehicles registered in accordance with the established procedure in accordance with the legislation of the Russian Federation.