OS in accounting and tax accounting

To put a fixed asset on the balance sheet, several conditions must be met:

- Will work for the company and will not be resold.

- Use time for at least twelve months

- It will bring real income to the organization

According to legal requirements and accounting rules, low-value property worth up to forty thousand can be immediately written off. For example, a personal computer for 25,000 rubles can be classified as inventories and written off as expenses on the first day of its use, then depreciation is not charged. If an enterprise has accepted fixed assets for accounting, then it is necessary to calculate depreciation at least once a month. Organizations working on the simplified tax system can independently provide for the frequency of depreciation in their accounting policies.

There are three ways to write off the cost of a fixed asset:

- linear;

- reducing balance method

- method of writing off value by the sum of the numbers of years of useful use;

The costs that affect the initial cost of a property differ in some cases. In tax accounting, it is possible to use linear and non-linear depreciation methods.

Upon completion of modernization in accounting, it is necessary to increase the useful life of the object. There are no restrictions on its increase. In tax accounting, this period does not need to be changed, and its increase is possible within the limits established for its depreciation group.

Postings when applying PBU 18/02 (income is not recognized in the accounting system)

| No. | Contents of operation | Debit account | Credit account | Amount, rub. |

| 1 | OS received for free use is accepted for accounting | 001 | 150 000,00 | |

| 2 | A permanent tax liability (PNO) has been formed - monthly (60,000.00 / 6 * 20%) | 99 | 68.04 | 2 000,00 |

| 3 | Upon expiration of the free use period, the OS was deregistered | 001 | 150 000,00 |

Receipt of equipment free of charge

The gratuitous receipt of fixed assets occurs quite rarely and, in general, such property can be obtained from the founder of the organization. In this regard, there are a number of features. The first option is that the fixed asset can go to the organization under a gift agreement. According to which one party transfers ownership to the other free of charge under an agreement.

Donating equipment between two commercial organizations is strictly prohibited, unless the gift exceeds the value of three thousand rubles. Receive equipment worth over 3,000 rubles as a gift. is possible only from individuals, non-profit organizations, state and municipal authorities.

This prohibition does not apply to the gratuitous transfer of property between the founder (commercial organization) and the established organization.

It is better to conclude an agreement in writing as agreed by the parties, regardless of the amount. The second way in which a fixed asset can end up in an organization is through a donation. If a legal entity has accepted such property, then it is obliged to keep separate records of all transactions related to its use

Registration of gratuitously received property rights

Register property rights received free of charge in the interests of the recipient of such rights. After all, most likely, the recipient will have expenses associated with the maintenance and use of property received for free use.

And from the point of view of the Tax Code of the Russian Federation (TC RF), a taxpayer can reflect in tax expenses only costs associated with actually existing property.

In accordance with Article 689 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), in such cases a gratuitous use agreement (loan agreement) is drawn up. Under a gratuitous user agreement, one party gives the property for free temporary use to the other party. The party that later received the property for free use undertakes to return this property. Either in the same condition in which the property was received, taking into account wear and tear, or in the condition stipulated by the agreement for gratuitous use (

The procedure for accounting for VAT when transferring free of charge

The gratuitous transfer of equipment or goods into ownership is considered a sale, and therefore is subject to VAT taxation. Thus, the party who makes the gift must pay this tax. This means that the recipient does not deduct the amount of VAT from the cost of the fixed asset transferred to it free of charge.

Postings for VAT:

- The amount of “input” VAT on delivery services Dt 19 Kt 60 is taken into account.

- The amount of “input” VAT on delivery services Dt 68 Kt 19 was presented for deduction.

Money instead of property

The problem of double taxation disappears if the company receives free money, not property, and then uses it to purchase what it needs.

For a long time now, tax authorities have not made any claims regarding the write-off of property acquired with gratuitous money as expenses (even if the company did not include them in income on the basis of clause 11 of Article 251 of the Tax Code; also see letter of the Ministry of Finance dated March 22, 2010 No. 03 -03-06/1/166). In addition, funds are impersonal, and in most cases it is impossible to accurately determine the source of the company’s receipt of the amount of money it paid for a particular acquisition. For funds, there is no one-year restriction on the transfer to third parties of property received free of charge; compliance with this rule in other cases is necessary to use the benefits under paragraph 11 of Article 251 of the Tax Code. Replacing property with money saves the transferring party from charging VAT, which, by the way, the tax authorities would not allow the recipient to deduct.

This is the simplest and most reliable way. But, alas, it is not always possible to transfer money instead of property. For example, often the founders, not having free funds to support their business, give the company what they themselves have - used office equipment, cars, furniture, etc. In addition, the organization does not always receive free property from the founder or friendly persons. This could be, for example, inseparable improvements to a fixed asset item being returned from lease.

METHOD 2

Category “Questions and Answers”

Question No. 1. We were given equipment free of charge, where should we take it?

Equipment is classified as fixed assets; it must be accepted for accounting and tax accounting at its original cost in accordance with the accounting of donated equipment.

Question No. 2. The founder donated property to the company free of charge, is it necessary to pay income tax?

No, such income is not taken into account, provided that the founder has at least fifty percent of the authorized capital.

Repaying an employee loan

Our company provides assistance in preparing 3-NDFL tax returns on personal income. Our managers will be happy to help you resolve your issues!

Repayment of obligations under a loan agreement can be carried out both in cash and non-cash forms. As a rule, repayment of an intra-company loan based on an employee’s application is carried out through deductions from his salary.

Let's consider the procedure for taxation of transactions related to the repayment of a loan issued to an employee of the organization.

Income tax

The amount of the loan issued to the employee and the amount received from him to repay such borrowing are not taken into account when determining income and expenses for profit tax purposes (clause 10, clause 1, article 251, clause 12, article 270 of the Tax Code of the Russian Federation).

If the employee was issued an interest-bearing loan, then for the purpose of calculating income tax, interest on the loans provided is classified as non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation). Their accounting depends on the method of recognition of income and expenses for calculating the taxable base.

Value added tax

Operations for the provision of loans in cash and the provision of financial services for the provision of loans in cash are not subject to VAT (clause 15, clause 3, article 149 of the Tax Code of the Russian Federation). At the same time, when an employer issues an interest-bearing loan to an employee, the enterprise needs to keep separate VAT records on the basis of clause 4 of Article 149 and clause 4 of Article 170 of the Tax Code of the Russian Federation.

Personal income tax

Loans for employees are issued by organizations, as a rule, at reduced interest rates. Preferential use of borrowed funds is considered in this case as the borrower’s income in the form of material benefits received from savings on interest in accordance with paragraph 1 of paragraph 1 of Article 212 of the Tax Code of the Russian Federation. Thus, the borrower becomes a personal income tax payer on this basis.

The tax base for calculating personal income tax is defined as the excess of the amount of interest calculated on the basis of three-quarters of the current refinancing rate established by the Central Bank of the Russian Federation on the date of receipt of the loan over the amount of interest under the terms of the agreement. In accordance with paragraph 2 of Article 224 of the Tax Code of the Russian Federation, this income is subject to personal income tax at a rate of 35%.

Based on paragraph 3 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation, the date of receipt of income is the date of payment by the taxpayer of interest on borrowed (credit) funds received. According to the Ministry of Finance of Russia, when issuing an interest-free loan, the actual date of receipt of income in the form of material benefits should be considered the corresponding dates of repayment of borrowed funds (letters dated 04/23/2008 N 03-04-06-01/103, dated 04/11/2008 N 03-04- 06-01/83, dated 04.02.2008 N 03-04-07-01/21).

We note that from January 1, 2008, the date of actual receipt of income is recognized as the day the employee paid interest for the use of borrowed funds (clause 3, clause 1, Article 223 of the Tax Code of the Russian Federation), and material benefits received from savings on interest for use are excluded from the list of income borrowed (credit) funds for new construction or acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them if the taxpayer (borrower) has the right to receive a property tax deduction in accordance with paragraph 2 of paragraph 1 Article 220 of the Tax Code of the Russian Federation.

According to the clarifications of the Ministry of Finance in letter dated 04/16/2008 N 03-04-06-01/93, before the taxpayer confirms the right to receive a property tax deduction, income in the form of material benefits received from savings on interest for the use of borrowed (credit) funds is taxed according to rate 35%. Subsequently, after confirmation of this right in the manner prescribed by clause 3 of Article 220 of the Tax Code of the Russian Federation, the previously paid tax amount is recalculated. In a letter dated April 14, 2008 N 03-04-06-01/85, the Ministry of Finance of Russia indicated that when the taxpayer confirms the right to a property tax deduction, income in the form of material benefits received from savings on interest for the use of borrowed (credit) funds is exempt from taxation in full, including when the amount of the loan received exceeds the maximum amount of property tax deduction (excluding interest) provided for in paragraph 2 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation.

To exclude material benefits from an employee’s taxable income, the following documents are required:

- loan agreement, the intended purpose of which is new construction or purchase of housing;

- notification confirming the taxpayer's right to a tax deduction issued by the tax authority

Since the beginning of 2008, the responsibility for determining the tax base when an individual receives income in the form of material benefits from savings on interest, calculation, withholding and transfer of tax has been assigned to the tax agent (clause 2 of Article 212 of the Tax Code of the Russian Federation). The lending company must enter this income into the tax card for accounting income and personal income tax in Form 1-NDFL and reflect it in the individual’s income certificate in Form 2-NDFL.

Registered property

Since 2011, an organization receiving a real estate property, the ownership of which is subject to state registration, takes it into account at the time of actual receipt, regardless of the fact of state registration of property rights. The corresponding changes were made to the regulatory legal acts on accounting by order of the Ministry of Finance of Russia dated December 24, 2010 No. 186n. According to them, rules establishing the dependence of the registration of real estate on the availability of documents confirming state registration of ownership of such an object are excluded from the Regulations and Guidelines for the accounting of fixed assets.

Transfer of gifts to individuals

So, donation between a commercial organization and an individual who is not an individual entrepreneur is not prohibited by current legislation (clause 4, clause 1, article 575 of the Civil Code of the Russian Federation). Transfer of a gift worth up to 3,000 rubles. can be committed orally (clause 1 of article 574 of the Civil Code of the Russian Federation).

The cost of gifts received by an individual from organizations or individual entrepreneurs does not exceed 4,000 rubles. per year, not subject to personal income tax (clause 28, article 217 of the Tax Code of the Russian Federation). For a certain category of citizens (for example, for veterans and disabled people of the Great Patriotic War), the cost of gifts, which is not subject to personal income tax, is 10,000 rubles. per year (clause 33 of article 217 of the Tax Code of the Russian Federation).

To receive a tax deduction provided for in paragraphs 28 and 33 of Article 2021 of the Tax Code of the Russian Federation, the transfer of a gift must be confirmed with documents (letter of the Ministry of Finance of Russia dated August 12, 2014 No. 03-04-06/40051). In this case, for personal income tax purposes it does not matter:

- whether the gift is money, a gift certificate or other property;

- whether the recipient is an employee of the organization or not.

It’s a different matter if the gift is an employee’s incentive for conscientious performance of job duties. In this case, the gift is an incentive payment (bonus), which is part of the remuneration (Part 1 of Article 129, Article 131, Article 191 of the Labor Code of the Russian Federation).

A gift within the framework of an employment relationship is subject to personal income tax in full without applying a deduction as income in cash or in kind (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation, clauses 1, 3, 4 of article 210 of the Tax Code of the Russian Federation, p. 2 Article 211 of the Tax Code of the Russian Federation).

An organization does not have an object for taxation of insurance premiums if gifts to employees are transferred under a gift agreement in writing, the value of the gift does not matter (clause 4 of Article 420 of the Tax Code of the Russian Federation, letter of the Ministry of Labor of Russia dated September 22, 2015 No. 17-3/B -473, letter of the Ministry of Finance of Russia dated January 20, 2017 No. 03-15-06/2437).

If the transfer of gifts is carried out within the framework of labor relations, is part of the remuneration system (remuneration for specific labor results) and is of an incentive nature, then the cost of gifts to employees of the organization is subject to insurance contributions (Definitions of the Supreme Court of the Russian Federation dated March 6, 2017 No. 307-KG17-54 in case No. A44-1285/2016, dated 08/27/2014 in case No. 307-ES14-377, A44-3041/2013).

Let's look at how 1C: Accounting 8 (rev. 3.0) reflects the transfer of gifts to individuals.

Example 1

| Modern Technologies LLC applies OSNO, the provisions of PBU 18/02, and pays VAT. In March 2021, the management of Modern Technologies LLC decided, in honor of International Women’s Day, to present gifts to its employees and employees of the partner organization (10 gifts in total) at an official event. The decision was formalized by order of the head. The cost of each gift is RUB 1,200.00. (including VAT 20% - RUB 200.00). |

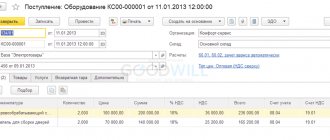

The receipt of goods (materials), which are subsequently used to be transferred to individuals as gifts, is reflected in the standard accounting system document Receipt (act, invoice) with the transaction type Goods (invoice) (Purchases section). Let's say an organization purchased 50 ready-made gift sets. After posting the document, the following entries are entered into the accounting register:

Debit 41.01 Credit 60.01 - for the amount of purchased gifts (50,000 rubles). Debit 19.03 Credit 60.01 - for the amount of VAT (10,000 rubles).

For those accounts where tax accounting is supported (in this case, these are accounts 41 and 60; tax accounting is not supported for account 19), the corresponding amounts are entered into special resources of the accounting register for tax accounting purposes (Amount Dt NU and Amount Kt NU).

To register an invoice received from a supplier, fill in the Invoice No. and from fields, then click on the Register button. In this case, the document Invoice received is automatically created, and a hyperlink to the created invoice appears in the form of the basis document. In the form of the document Invoice received by default, the flag Reflect VAT deduction in the purchase book by the date of receipt is selected, which allows you to include the tax amount in VAT tax deductions immediately after gifts are accepted for accounting. If the flag is not set, then the deduction is reflected in the regulatory document Formation of purchase ledger entries.

Starting from version 3.0.65 in 1C:Accounting 8, you can reflect the gratuitous transfer of goods (materials, products) using the Gratuitous Transfer document (Sales section), which allows you to:

- indicate either a specific recipient (for example, when transferring a bonus product to a buyer) or not indicate it at all (for example, when distributing materials for advertising purposes to an indefinite number of people);

- automatically reflect the cost of the transferred property in expenses. The cost account and VAT account are indicated by default as 91.02 “Other expenses” with the analytics Expenses for the transfer of goods (work, services) free of charge and for one’s own needs (profits not accepted for tax purposes);

- charge VAT, which goes into the sales book and into the VAT return. If an organization maintains separate VAT accounting and enters a rate Without VAT, then the data can be reflected in Section 7 of the VAT return;

- reflect the reversal of paid expenses in the book of income and expenses of organizations and individual entrepreneurs using the simplified tax system (KUDiR);

- print documents (Demand-waybill (M-11), Invoice, Consignment note (TORG-12), Universal transfer document (UDD)).

Let's create a document Gratuitous transfer according to the conditions of Example 1 (Fig. 1).

Rice. 1. Document “Free transfer”, tab “Products”

Despite the fact that gifts are transferred to certain individuals specified in the manager’s order, the Recipient field is not required to be filled in. When selling goods free of charge to individuals, there is no need to issue invoices to each of them, since individuals do not deduct VAT.

To reflect accrued VAT in the sales book, it is enough to draw up an accounting statement or a consolidated invoice (letter of the Ministry of Finance of Russia dated 02/08/2016 No. 03-07-09/6171).

On the Products tab, you should specify information about the products transferred for advertising purposes. As the market value of goods in the program, the sales price for the last document is automatically filled in. If the sale price is not determined, then the purchase price is filled in. In Example 1, this is 1,000 rubles.

Since the cost of gifts and the amount of accrued VAT are not taken into account in income tax expenses, on the Cost Account tab you should leave the cost account and VAT account set by default by the program in the appropriate fields (Fig. 2).

Rice. 2. Accounts for expenses when transferring gifts

After posting the Gratuitous Transfer document, the following accounting entries are generated:

Debit 91.02 Credit 41.01 - for the cost of gifts (10,000 rubles). Debit 91.02 Credit 68.02 - for the amount of accrued VAT (2,000 rubles).

For tax accounting purposes for income tax, amounts are entered into special resources of the accounting register:

The amount of Kt NU 41.01 is for the cost of gifts (10,000 rubles). Amount Dt PR 91.02 - for the amounts of permanent differences (10,000 rubles and 2,000 rubles).

If the organization decides to issue a consolidated invoice, then simply click on the Issue invoice button. In the automatically created invoice, dashes are placed in the lines “Consignee and his address”, “Buyer”, “Address”, “TIN/KPP of the buyer” in accordance with the recommendations of the Ministry of Finance of Russia set out in letter dated 02/08/2016 No. 03-07- 09/6171.

A consolidated invoice issued for the gratuitous transfer of goods will be registered in the sales book with the transaction type code “10”, which corresponds to the value “Shipment (transfer) of goods (performance of work, provision of services), property rights on a gratuitous basis” according to the Appendix to Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected]

In the month of transfer of gifts, after processing the Closing of the month and performing the regulatory operation Calculation of deferred tax according to PBU 18, a constant tax expense will be recognized:

Debit 99.02.3 Credit 68.04.2 - in the amount of 2,400 rubles. (RUB 12,000 x 20%).

In the income statement, the cost of the gift transferred and the amount of accrued VAT will be automatically reflected in line 2350 “Other expenses”.

| 1C:ITS For information on how to reflect an individual’s income in the amount of the cost of a gift in 1C solutions, see the reference book “Personnel records and settlements with personnel in 1C programs” in the “Personnel and remuneration” section. |

Constitutional and legal interpretation

As the Constitutional Court of the Russian Federation has repeatedly pointed out, the principle of equal tax burden is established by Articles 8 (Part 2), 19 and 57 of the Constitution of the Russian Federation. In the field of tax relations, it means that it is not allowed to establish additional or higher tax rates depending on the form of ownership, the organizational and legal form of entrepreneurial activity, the location of the taxpayer and other discriminatory grounds

(Resolution of the Constitutional Court of the Russian Federation dated March 21, 1997 No. 5-P “In the case of verifying the constitutionality of the provisions of paragraph two of paragraph 2 of Article 18 and Article 20 of the Law of the Russian Federation of December 27, 1991 “On the Fundamentals of the Tax System in the Russian Federation””).