Don't have time to keep personnel records?

We'll take it on from 833 rubles per month

Find out more

Accounting for wages at an enterprise begins with documents that are the basis for calculating wages: staffing schedules, employment contracts, hiring orders, work orders, production accounting books, time sheets, incentive orders, etc.

Organizations can use unified forms of primary documents or use independently developed forms. The forms of documents used must be fixed in the accounting policies of the enterprise.

Organization of payroll accounting at the enterprise

In order to organize labor and wage accounting at an enterprise, the accounting policy specifies what forms of primary documents will be used for this purpose.

At the same time, with the entry into force of the accounting law of December 6, 2011 No. 402-FZ, the use of unified forms ceased to be mandatory. But many accountants, when organizing payroll accounting at an enterprise, give preference to the forms of primary documents approved by Goskomstat Resolution No. 1 of January 5, 2004. The primary documentation for accounting for the movement of personnel are orders (on hiring, dismissal, transfers, provision of paid leave, etc.). d.). For each hired employee, a personal card is created and a personal account is opened.

Data on accrued and paid salaries, amounts of deductions and deductions are entered into a personal account, which is opened, as a rule, for a year. Data is transferred to personal cards from time sheets, sick leave sheets, orders for piece work, orders (on making deductions or calculating bonuses), etc.

You can learn about the procedure for organizing primary accounting at an enterprise from the article “Procedure for organizing primary accounting”.

Payment of personal income tax to the budget

Payment of personal income tax to the budget is carried out no later than the day following the day of payment of wages to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Payment of personal income tax to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Please pay attention to filling out the fields:

- Transaction type - Tax payment .

- Tax - personal income tax when performing the duties of a tax agent .

- Type of liability - Tax .

- for - July 2018 , the month of accrual of income (salaries).

Learn more about reflecting personal income tax payments to the budget

Postings according to the document

The document generates the posting:

- Dt 68.01 Kt 51 - payment of personal income tax to the budget for May.

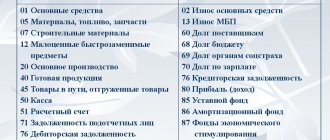

Accounting for settlements with personnel for wages - account for accounting

To record calculations for remuneration of personnel, accounting account 70 is used - it summarizes the relevant information for each employee of the enterprise.

The debit of the account shows the amount of paid wages, as well as the amount of deductions (for taxes (account 68), for executive documents (account 76), shortages (account 73) and damage to valuables (account 94), etc.) . If an employee does not receive his accrued salary on time, then this amount is reflected in the debit of the account. 70 in correspondence with account. 76.

The loan displays:

- the amounts of accrued wages in correspondence with the accounts in which the corresponding costs are collected;

- amounts of accrued vacation pay in correspondence with the account. 96;

- accrued dividends to the company's employees in correspondence with the account. 84.

Enterprises must organize analytical accounting according to accounting 70 for each employee.

Find out how to take into account labor costs in kind in ConsultantPlus . If you do not have access to the K+ system, get a trial online access for free.

About the accounting register, which summarizes information about settlements with employees for wages, read in the article Features of the balance sheet for account 70 .

Key aspects

Salary is the employee’s remuneration, calculated based on the volume of work performed, qualifications, length of service and workload (Article 129 of the Labor Code of the Russian Federation).

The volume of payments is determined in accordance with the norms of current legislation, as well as taking into account the payment system established at the enterprise. Staff remuneration is a significant share of the costs of any economic entity. That is why it is so important to organize complete and reliable accounting of labor and wages at the enterprise. Systematic analysis of information will allow assessing cost effectiveness, as well as identifying reserves (financial and labor).

It should be borne in mind that wage costs directly affect the cost of production. Moreover, the cost calculation includes not only the earnings of workers in the main production, but also payments in favor of support staff.

An economic entity has the right to independently develop a payment system, taking into account the type of activity, specificity, complexity and harmfulness (danger) of production. At this stage, you should be guided by key principles:

- Legality. The conditions for calculating remuneration cannot violate the current requirements and norms of labor legislation.

- Justice. Payment must be equivalent to the work performed.

- Results-oriented. Provide a system of incentives and/or bonuses for employees for achieving specific results.

- Timeliness and frequency. Earnings must be paid systematically, without delay, in full.

It should also be noted that wages must be economically justified. Otherwise, there can be no question of the effectiveness of these costs.

Accounting: salaries to be issued

Accounting for wages and deductions from them should also clearly reflect the amount payable to employees. In this regard, accrued on the debit of the account. 70 wages will be reduced.

Personal income tax is necessarily withheld from the salaries of all employees - for this purpose, Dt 70 Kt 68 is posted.

Payment of wages (without personal income tax and deductions on writs of execution, etc.) is made through the cash register or by transferring funds to the employee’s card account. When issuing a salary account. 70 corresponds with account. 50 (51).

You can find out how salaries are transferred to a card in the article “Procedure for transferring salaries to a bank card”.

What it looks like in the chart of accounts

It's time to look into the settings of the chart of accounts for the 70th account. I present to your attention the settings for account 70 from the 1C Accounting 7.7 program and the option for setting up account 70 in the 1C Accounting 8.2 program.

Your task, as we already know how to do, is to write what the characteristics of the account tell you and what it means. Then, find differences in the characteristics and assume what this will affect in transactions, SALT and Balance Sheet.

Answers are available only to subscribers!

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

Accounting for labor and wages among simplifiers

Salary accounting for the OSN and simplified tax system is carried out in the same way, with the exception that not all simplifiers will be able to reduce their income by the amount of labor costs. This right is retained only for those simplifiers who have chosen the object of simplified taxation “income minus expenses”.

ConsultantPlus experts explained in detail how to take into account labor costs under the simplified tax system. Study the material by getting trial access to the K+ system for free.

Reflection in reporting 6-NDFL

Calculation of personal income tax amounts is carried out by tax agents on the date of actual receipt of income on an accrual basis from the beginning of the tax period (clause 3 of Article 226 of the Tax Code of the Russian Federation). The date of actual receipt of income in the form of wages is the last day of the month indicated in the Salary Payroll document PDF (Clause 2 of Article 223 of the Tax Code of the Russian Federation). It will be reflected on page 100 of Section 2 of form 6-NDFL.

Payroll for July 2021: PDF

- Accrued - 35,000 rubles.

- Deduction for children - 1,400 rubles.

- Personal income tax - 4,368 rubles.

In Form 6-NDFL, payment of wages is reflected in:

Section 1 “Generalized indicators”:

- page 070 - 4,368 , amount of tax withheld.

Section 2 “Dates and amounts of income actually received and withheld personal income tax”: PDF

- page 100 - 07/31/2018 , date of actual receipt of income;

- page 110 - 08/10/2018 , tax withholding date;

- page 120 - 08/13/2018 , tax payment deadline;

- pp. 130 - 35,000 , the amount of income actually received;

- pp. 140 - 4,368 , amount of tax withheld.

Small business difficulties

Small and medium-sized enterprises are playing an increasingly important role in the domestic economy. Of course, conditions in our country are far from ideal, especially when compared with other countries. There is a whole list of reasons that hinder the development of such enterprises in our country.

According to experts, one of the reasons is excessive control over their activities by various government bodies. The lack of government support at the proper level also affects the fact that the development of small businesses is not progressing at the pace we would like.

Difficulties associated with providing loans and other benefits for those running small or medium-sized businesses in the Russian Federation also contributed. If in other countries a preferential tax system has been developed for such enterprises or the payment of taxes is completely abolished at first, then in our country at the moment small entrepreneurs can only dream about this.

But despite all the difficulties, small businesses are still developing, and there is hope that sooner or later the state will take measures aimed at eliminating the above and other problems. And since similar enterprises exist and there are more and more of them every day, the relevant question is how accounting is organized in small businesses and whether there are problems with it.

How to organize such accounting?

First of all, it must be said that it is extremely important that the accounting department checks the correctness of all records relating to the movement of inventory items at least once a week. This makes it much easier to identify discrepancies and shortcomings.

In order to significantly facilitate control over inventory items available in warehouses, many companies resort to accounting automation. By resorting to automation, many unwanted problems, such as those related to delivery, can be eliminated. This saves a lot of time, plus you can find out the real balance of inventory items at any time.

There are programs that will help you control the expiration dates of stored products. And with a large volume of inventory, it is quite problematic to cope with this without automation. There are a lot of applications that can help you establish such control. Everyone can choose the best option for themselves, depending on their goals.

How to control the use of working time?

For employers, the question of how effectively their staff uses working time becomes more and more relevant every year. After all, not everyone works on a piecework basis. And there is no guarantee that the employee at the rate uses the time for which he is paid for its intended purpose. Of course, controlling this is quite problematic. Most often, the basis for conclusions is the results of the work.

But those employees whose work is related to computers can be controlled using programs specially developed for this. Such applications perform monitoring, as a result of which the employer will be able to understand whether a person is really busy with something or is simply wasting time on things that are not related to his immediate responsibilities.

Some applications allow you to see whether an employee has visited job sites. Thus, you can prevent the loss of a valuable employee by increasing his salary or creating more favorable conditions.

Also, for such control, some employers install turnstiles with sensors in different places. But it must be remembered that such measures cause irritability among staff, so it is necessary to comply with the measures.

Materials from the warehouse and their accounting

Enterprises whose activities are impossible without storing certain valuables (materials and materials) should know that it is very important to organize proper accounting of materials in the warehouse and in the accounting department. Since the warehouse is not a unit independent of the enterprise, control over the resources stored in it is carried out simultaneously by a warehouse employee (storekeeper) and an accountant.

Control over the quantity of inventory items must be maintained on an ongoing basis. First of all, this procedure reduces the risk of theft - you can notice the shortage in time and identify the culprit. Thanks to such accounting, it is always clear how much inventory is currently in the warehouse. This allows you to order the necessary materials in time before they run out. And this, in turn, will avoid downtime.

As soon as the inventory items arrive at the warehouse, those responsible for controlling this process must check whether they correspond to the data specified in the invoice.

If no discrepancies are found, you can issue a receipt order, a copy of which must be provided to the accounting department. The same procedure must be followed in the case when inventory items are transferred from a warehouse. Only the order in this case will be expendable. In addition to issuing orders, the warehouse must also maintain special commodity cards, which also display all movements of inventory items, as well as their balance.

The accountant must control all movements of inventory items using orders, primary documents, and information from warehouse cards.