GPC agreement: advance payment for the performer and personal income tax (Chernykh S

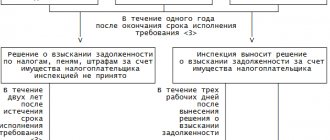

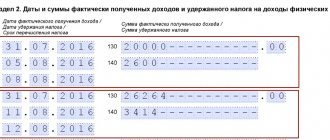

Remuneration under a civil contract for work performed or service provided relates to the income of an individual subject to personal income tax. And if the contractor is not an individual entrepreneur, the responsibility for calculating it, withholding it when paying income and paying it to the budget lies with the customer as a tax agent. The question is whether tax should be withheld already when paying the advance under the contract. And if so, what if the work or services are never completed or provided? The tax agent is obliged to withhold the calculated personal income tax directly from the amount of the taxpayer’s income upon their actual payment (clause 4 of Article 226 of the Tax Code). In this case, the date of actual receipt of income in cash is defined as the day of its payment, including its transfer to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code). A special procedure for determining the date of actual receipt is provided for income in the form of wages. It is recognized as the last day of the month for which this income was accrued (clause 2 of Article 223 of the Tax Code). In this regard, in particular, personal income tax is not withheld from the advance payment of wages. The calculation and withholding of tax in this case is carried out directly on the last day of the month for which wages are accrued (Letters of the Ministry of Finance of Russia dated April 18, 2013 N 03-04-06/13294, dated August 9, 2012 N 03-04-06 /8-232, dated July 16, 2008 N 03-04-06-01/209, etc.). However, remuneration for work performed or service provided is not wages, and the relationship between the contractor and the customer is regulated not by the Labor Code, but by the provisions of civil law.

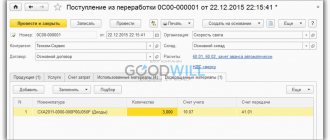

Remuneration paid based on performance results

Insurance contributions to the Pension Fund of the Russian Federation and the Compulsory Medical Insurance Fund are calculated for the remuneration paid after the delivery of the results of work under the contract.