A report in the EDV-1 is an inventory of individual (personalized) accounting documents transferred to the territorial bodies of the Pension Fund of the Russian Federation as part of individual information about insured persons.

Form EDV-1 was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2021 No. 507P “On approval of the form SZV-STAZH, ODV-1, SZV-KORR, SZV-ISH of the procedure for filling them out and the format of information and on the recognition as invalid by the Resolution of the Board of the Pension Fund of the Russian Federation dated 01/11/2017 No. 3P.”

Description of the EDV-1 form in the Pension Fund of Russia

EDV-1, in essence, is an inventory of documents submitted and additional information about the policyholder submitting data on length of service to the Pension Fund. Otherwise, a statistical report for the Pension Fund.

The data included in EFA-1 consists of:

- a list of documents submitted to the Pension Fund;

- a table reflecting summary data on calculations of contributions for the reporting period, broken down by type of contribution;

- decoding of special working conditions that give employees the right to early retirement, and the number of such employees.

The EDV-1 report, as well as the SZV-STAZH, contains the minimum necessary information about the employer submitting it (registration number of the policyholder in the Pension Fund of the Russian Federation, TIN, KPP, name), as well as data on the period of the report and the type of information presented in it .

Sections that are always filled

Sections 1, 2 and 3 are completed regardless of which main report the inventory is attached to.

Section 1 reflects information about the reporting organization or individual entrepreneur:

- registration number in the Pension Fund of Russia: has 12 characters and is assigned when registering a company with the Pension Fund of Russia;

- TIN and checkpoint;

- name of the insured.

Section 2 is intended to indicate the period for which reports are submitted. It must indicate the year. And a coded designation of the time period for which the report is provided:

- quarter;

- half year;

- year;

- another time interval for which reporting was to be submitted.

Currently, the SZV-STAZH report is submitted once a year, so the reporting period code in EFA-1 for this report is always 0. A complete list of reporting period codes for previous years can be found by referring to the appendix to the procedure for filling out personalized accounting forms.

Section 3 is intended to indicate the number of persons for whom information is filed in the main report. Opposite the name of the corresponding form indicated in column 1, we reflect the number of insured persons in column 2. Only one line is filled in in this tabular part.

Current EFA-1 form and deadlines

In 2021, with SZV-STAZH for 2021, EDV-1 must be submitted in the form that was approved by Resolution of the Pension Fund of the Russian Federation of December 6, 2018 No. 507p. Let us remind you that the new form of SZV-STAZH was approved by the same resolution.

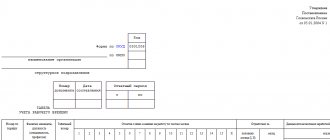

The following is a free EFA-1, current in 2021 for the 2021 report:

Since EDV-1 is submitted only together with SZV forms, the deadlines and procedure for submitting them are the same. For example, ODV-1 with SZV-STAZH for 2019 must be submitted no later than 03/01/2020 and only through TKS channels, if the number of insured persons in SZV-STAZH exceeded 24 people. If the number of people included in the SZV-STAZH for 2021 was 24 or less, then the SZV-STAZH and the accompanying EFA-1 report can be generated and submitted on paper.

How to prepare and submit the SZV-STAZH for 2021 on time is described in detail on our website in the article “SZV-STAZH for 2021: a new form and sample for filling out in 2020.”

DOWNLOAD

How to fill out section 4 of EFA-1, example

Representatives of the Pension Fund of Russia sent a request to the institution to provide information for 2001. Previously, information was not provided for this period. The number of employees in 2001 was 15 people.

Filled-in form

How to fill out EDV-1

Let's look at the process step by step:

STEP 1. Fill out the header of the form (Section 1) with information about the policyholder. The section is clearly structured; each identifier has its own row of cells. STEP 2. We enter data about the report itself in Section 2: period code, year, form type: original, corrective or canceling. STEP 3. We indicate information about the document with which we are submitting EFA-1. To do this, in the table located in Section 3:

- select the required line (for annual SZV-STAGE this is line 1);

- in the selected line we indicate the number of people for whom the main report was prepared.

STEP 4. Section 4 in EFA-1 is filled out only when submitting data using the SZV-ISH and SZV-KORR forms. For SZV-STAZH, skip this section (leave it blank). STEP 5. Determine whether Section 5 needs to be filled out and fill it out if so. It is intended for entering information about employees who have the right to early retirement. If there are such employees in SZV-STAZH, the table in Section 5 must also reflect the data and add the information required by the Pension Fund of the Russian Federation, which is not included in SZV-STAZH.

NOTE!

Section 5 in EDV-1 is now filled out if the SZV-STAZH indicates employees entitled to early retirement who are employed in the types of work provided for in Part 1 of Art. 30 and art. 31 of the Law of December 28, 2013 No. 400-FZ. Until 2021, information was entered into EFA-1 only for the work specified in paragraphs. 1-18 hours 1 tbsp. 30 of Law No. 400-FZ. The fact is that the list of occupations giving the right to early retirement has been supplemented with teaching, medical and creative activities.

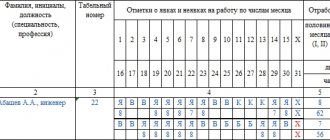

| Count | Where to get information and how to indicate |

| Serial number | Indicate the serial number of the entry in ascending order without gaps or repetitions. Assign a number for each structural unit. If data on the names of professions is reflected in several lines, assign a serial number only to the first entry. |

| Name of the structural unit according to the staffing table | Indicate all names of structural divisions for the reporting year according to the staffing table |

| Name of profession, position according to staffing table | Indicate in separate lines for each department all the names of professions for the reporting year according to the staffing table |

| Number of jobs according to staffing table | Indicate the number of jobs in the structural unit for a specific profession for the reporting year according to the staffing table. If the staffing table changes, indicate the largest number of jobs according to the staffing table. |

| Number of actual employees | The number of insured people actually working under special working conditions must match the number of those for whom you pay insurance premiums at additional rates for compulsory pension insurance. Indicate the number of employees who worked in the reporting year and for whom they filled out columns 9, 10, 12 of Table 3 SZV-STAZH. Fill in the field for each profession in the structural unit |

| The nature of the work actually performed and additional working conditions | Describe the work and working conditions in accordance with the Unified Tariff and Qualification Directory of Work and Professions of Workers. For example, working as a crane operator for transporting hot sinter and pellets. |

| Name of primary documents confirming employment under special working conditions | Indicate the internal document of the organization. For example, certification of workplaces for working conditions or a special assessment of working conditions, technological regulations. |

| Code of special working conditions/length of service according to the Classifier | Take the code from the Classifier. Indicate only if during the period of work in conditions with the right to early retirement you paid insurance premiums at an additional rate. By Classifier we mean the All-Russian Classifier of Information on Social Protection of the Population OK 003-2017 (OKIZN OK 003-2017), which came into force on January 1, 2017, replacing OKIZN OK 003-99. An exception is periods with the codes “DECREE”, “VRNETRUD”, “WATCH”, “DLOTPUSK”. |

| Position code of lists No. 1 and 2, “small” list | Take the code from the lists or approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10. |

A correctly completed Section 5 in EFA-1 for 2021 will look like this:

Below the table, indicate the total number of jobs in special working conditions according to the staffing schedule during the year. It should be equal to the sum of jobs that are indicated in column 4 of the table for each structural unit and profession.

Also indicate the total number of employees who actually worked under special conditions in the reporting year.

It should be equal to the sum of workers who are included in column 5 of the table for each structural unit and profession. STEP 6. We certify the report with the signature of an authorized person and seal (if available).

You can view and freely fill out EFA-1 for 2021 with completed Section 5 using the direct link below: EXAMPLE OF COMPLETING EFA-1 2020

What does it look like

The form consists of five sections, each of which contains tables and fields to fill out. Most often, only sections 1–4 are completed. There are three types of statements:

- original - submitted with the original documents;

- corrective - submitted when changes are made to section 5;

- canceling - submitted if necessary to cancel the information in section 5.

| Document included with EDV-1 | Situation |

| SZV-STAZH |

|

| SZV-ISH |

|

| SZV-KORR |

|

Let's sum it up

The EFA-1 report for 2021 must be submitted together with the SZV-STAZH report within the same deadlines, following the same procedure.

Relevant in 2021 is the form approved by Resolution of the Pension Fund of Russia Board dated December 6, 2018 No. 507p.

In the EDV-1 form submitted along with the SZV-STAZH, Section 4 is never completed.

Section 5 should be completed only if the policyholder has employees entitled to early retirement and information about this is already included in columns 9, 10 or 12 of the SZV-STAZH form.

Read also

12.02.2020

What kind of document

The new reporting form was approved by the Pension Fund back in 2018. A separate Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p regulates not only the form, but also the rules for filling it out, and in what case the EDV-1 is filled out. This specialized form of reporting documentation is drawn up by policyholders when preparing reports for certain types, containing individual information about insured working citizens. The new report is applied and contains information directly about the policyholder.

Section 1 “Details of the policyholder submitting the documents”

The position “Registration number in the Pension Fund of the Russian Federation” indicates the registration number of the policyholder assigned to him upon registration as an insured under compulsory pension insurance.

In the “TIN” position, the TIN (individual taxpayer number) is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at its location on the territory of the Russian Federation.

For an individual, the TIN is indicated in accordance with the certificate of registration with the tax authority of the individual at the place of residence on the territory of the Russian Federation.

When the payer fills out the TIN, which consists of ten characters, in the area of twelve cells reserved for recording the TIN indicator, a dash should be placed in the last two cells.

In the position “KPP” (code of the reason for registration at the location of the organization), the KPP is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at the location in the territory of the Russian Federation.

The checkpoint at the location of the separate subdivision is indicated in accordance with the notification of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at the location of the separate subdivision on the territory of the Russian Federation.

In the position “Name (short)” the short name of the organization is indicated in accordance with the constituent documents (the name in Latin transcription is allowed) or the name of a branch of a foreign organization operating on the territory of the Russian Federation, a separate division.