Payment

Organizations offering insurance services are required to maintain accounting records. Their activities are controlled by the insurance market department, the existing

Depreciation of leased property in accounting Leasing is a transaction involving 3 parties: the lessee

In the first (electronic) issues of the magazine, we already introduced the reader to the procedure for accrual and payment

RusTender OKVED 2 - All-Russian Classifier of Types of Economic Activities Find OKVED2 codes online or

Explanations to the Balance Sheet and the Financial Results Statement If annual dividends for the reporting period

Tutorial 1C: Accounting 8 In the last lesson, you and I learned how to receive goods and materials, additional. expenses

07/09/2019 0 61 6 min. Having worked at one enterprise for more than six months, a person automatically

olegas 2 years ago / 250 Views A competent selection of stocks for investment involves

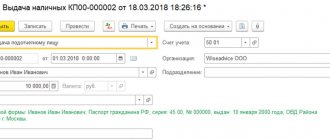

Accountants very often encounter the need to create advance reports when making cash payments to employees.

Each business representative, choosing a tax regime at the beginning of his entrepreneurial journey, or changing it