How to compile them? Basic principles

When conducting accounting, specialists will use three types of accounts: active, passive and active-passive . Active enterprises must reflect cash, inventory, fixed assets and non-current assets, inventory balances, etc. Passive legal entities reflect all their obligations to the state, business partners, employees, and creditors.

Active-passive accounts are also designed to display business transactions, but differ in that they can simultaneously contain both a credit and a debit balance. An example is the debt (prepayment) that a particular supplier has to a company in parallel with the debt (goods received without payment) that the same company has to the same supplier.

When preparing accounting entries, you need to remember the following nuances:

- active accounts can only have a debit balance, while passive accounts can only have a credit balance;

- the increase in passive accounts occurs only by credit, and active accounts - by debit;

- the balance on active-passive accounts can be reflected simultaneously in both liabilities and assets of the balance sheet;

- when compiling a balance sheet, the balances of passive accounts are displayed on the right side, and the balances of active accounts on the left;

- to reduce an active account, you need to make entries on its credit, and to reduce a passive account, you need to make debit entries.

Posting is a way of expressing the correspondence of accounts, the basis for which is a completed business transaction. When compiling them, it is recommended to adhere to the following scheme:

- It is necessary to determine which accounts and accounting objects are affected by the transaction being processed (its economic content is taken into account).

- It is necessary to establish which accounts will be involved in the posting (passive or active).

- The account to be credited or debited must be determined. To do this, the sources of origin of the operation and all related factors are taken into account.

When making simple entries, two accounts are affected, for example, when money is received at the company's cash desk from the current account, the following entry is made: Kt 51 Dt 50. When making complex entries, several accounting accounts are involved.

You can clearly see the procedure for making transactions in the following video:

Double entry principle

Reflection of business transactions on accounting accounts by specialists is carried out using the double entry method.

The essence of this method is as follows: for each operation, the accountant makes a corresponding entry simultaneously on the debit of one account and on the credit of another account .

What kind of document is this and what regulations is it regulated by?

- The main law establishing the need to prepare invoices (IF), as well as maintaining special accounting documentation, is the Tax Code of the Russian Federation, namely Part 3 of Article 169.

- The rules for maintaining accounting registers are reflected in Article 10 of the Federal Law of December 6, 2011 N 402-FZ (as amended on December 31, 2017) “On Accounting.” By accounting registers we mean the necessary accounting documentation; in the case of invoices, these will be:

- SF accounting log;

- sales book;

- Book of purchases.

- The rules for filling out the documentation used in calculating value added tax are reflected in the Decree of the Government of the Russian Federation of December 26, 2011 N 1137 (as amended on August 19, 2017).

Read more about why an invoice is needed for both sellers and buyers here.

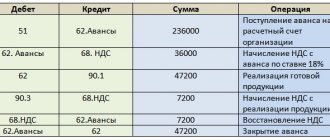

Posting examples

Currently, a large number of methodological manuals are regularly published for accountants, which indicate the most common entries for a particular type of activity.

Using existing examples, specialists will be able to avoid the most common mistakes when compiling correspondence accounts and posting them to the appropriate accounting registers.

By salary

When preparing entries for operations, the essence of which is to carry out settlements with employees, specialists must make the following account correspondence:

| Debit | Contents of a business transaction | Credit |

| 20, 23, 26, 92 | Salary accrued | 70 |

| 70 | Salary issued from cash register | 50 |

| 68 | Mandatory taxes charged | 70 |

| 51 | Escrow payment (unpaid) | 50 |

| 50 | Received money in the cash register to pay salaries | 51 |

Renting premises

When renting out space or a building, entries are made by both the owner of the fixed asset and the tenant. They prepare correspondence accounts for any action related to the leased property.

The main ones are shown in the table:

| Debit | Contents of a business transaction | Credit |

| 01 (sub-account “Assets leased out”) | Leased premises | 01 |

| 20 | Depreciation has been calculated on the transferred premises | 02 |

| 50, 51 | Rent received | 62 |

| 90 (sub-account 2) | Depreciation and other rental expenses written off | 20 |

| 001 | The tenant received the premises | |

| 76 | Rent transferred | 51 |

| 44, 29, 26, 25, 23, 20 | Rent arrears | 76 |

Wholesale and retail trade

When carrying out business activities related to the sale of goods, finished products, works or services, legal entities make many transactions.

To reflect transactions in this area in accounting, the following entries must be made:

| Debit | Contents of a business transaction | Credit |

| Money transferred: | ||

| 62 | refund of advance payment to buyers | 51, 50 |

| 61 | suppliers | 51, 50 |

| 45 | Products shipped to customers | 41/1 |

| 41/1,41/2 | Received goods from suppliers | 60 |

| VAT reflected | ||

| 19 | on goods received | 60 |

| 41/2 | in retail | 60 |

| 90/03 | by goods shipped | 68 |

| 90/03 | in retail | 68/02 |

| 62 | Implementation reflected | 90/01.1 |

| 92.R | retail | 90/01.1 |

| 91/02.1 | The cost of shipped products is reflected | 45 |

| 91/02.1 | in retail | 41/1 |

Assignment agreement

When drawing up this agreement, the accountant of any commercial organization carrying out economic activities in the status of a legal entity must draw up correspondence accounts.

For such operations the following transactions are used:

| Debit | Contents of a business transaction | Credit |

| 58 | The cost of all rights acquired by the company under the assignment agreement previously signed between the parties is reflected. | 76 |

| 76 | The debt that arises to the assignor is repaid in full or in part | 51, 50 |

| 50, 51 | The debt was received from the debtor to the current account or to the company's cash desk | 76 |

| 76 | The amount of all repaid debts is taken into account as part of income | 91/1 |

| 91/2 | Accounting for acquired rights of claim as expenses | 58 |

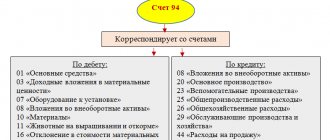

Cash transactions

Business entities must document cash transactions in accordance with the CCP in force on the territory of the Russian Federation.

To compile correspondence, the accountant uses the following accounts:

- 50 – cash register;

- 51 – current account;

- 70 – payroll calculations;

- 73 – other calculations;

- 62 – settlements with customers;

- 75 – replenishment of the authorized capital;

- 71 – settlements with accountable persons;

- 91 – reflection of exchange rate differences;

- 94 – reflection of shortages;

- 76 – other payments.

| Debit | Contents of a business transaction | Credit |

| 71 | Money issued to accountable persons | 50 |

| 50 | Unused imprest amounts were returned to the cash desk | 71 |

| 70 | Salary issued | 50 |

| 50 | Received money from current account | 51 |

| 50 | Buyers paid for the goods | 62 |

| 50 | The founders replenished the authorized capital | 75 |

| 94 | Shortage written off | 50 |

| 91 | Exchange rate differences reflected | 50 |

How inventory is accounted for at an enterprise - see this article. You can find all the necessary information about business transactions in accounting here.

Provision of services

When providing services, business entities draw up acceptance certificates. If a legal entity is a value added tax payer, it is obliged to issue an invoice according to which VAT is deducted.

The following entries are made in accounting:

| Debit | Contents of a business transaction | Credit |

| 26 | Service provided to the client (excluding VAT) | 76, 60 |

| 19 | VAT is reflected | 76, 60 |

| 50, 51 | Payment for services received | 60, 76 |

| 68 | VAT amount submitted for deduction | 19 |

| 90 | Expenses are written off to cost of sales | 26 |

With fixed assets

If a business entity has fixed assets on its balance sheet that it uses in carrying out business activities, it must draw up correspondence accounts as follows:

| Debit | Contents of a business transaction | Credit |

| 01 | Fixed assets received from suppliers were added to the balance sheet | 60 |

| 60 | Invoices paid | 51 |

| 07 | Related expenses reflected | 60, 76 |

| 07,19/1 | All taxes and fees reflected | 68 |

| 91/2 62 | Fixed assets sold | 01 91/1 |

| 51 | Funds transferred from buyer | 62 |

| 91/2 | VAT charged | 68 |

| 02 | Accrued depreciation written off | 01 |

Closing of the year

At the end of each reporting year, the accountant is required to make special entries that will allow some accounts to be closed. This procedure is called balance sheet reformation , it represents the zeroing of some accounting accounts.

It is mandatory for specialists to close accounts 90, 91, 99 and prepare the following correspondence:

| Debit | Contents of a business transaction | Credit |

| 90/9 90/1 | Account No. 90 is closed | 90/2, 90/4, 90/8 90/9 |

| 84 | Received loss | 99 |

| 99 | Profit received at the end of the year | 84 |

| 91/9 99 | Account No. 91 is closed | 91 91/9 |

Taxes and state duties

Each business entity, when conducting business, is faced with the need to accrue and transfer taxes, mandatory payments and fees to the budget. Also, legal entities have to pay a state fee when preparing documents or receiving any services from government agencies.

In accounting, they are required to reflect every business transaction related to taxes, fees and duties:

| Debit | Contents of a business transaction | Credit |

| 68 | Transfer of state duty | 51 |

| 99 | Profit tax calculation | 68 |

| 70 | Personal income tax withheld | 68 |

| 68 | Transfer of taxes to the budget | 51 |

| 91/2 | Transport tax charged | 68 |

| 90/3, 91/2 | VAT charged on sale | 68, 76 |

| 68 | VAT paid | 51 |

Loans issued

When accounting for loans, which have recently begun to be actively issued to both full-time employees and business partners, the following entries are made:

| Debit | Contents of a business transaction | Credit |

| 58 | Short-term or long-term loans are issued | 51 |

| 51 | Interest received on current account | 58 |

| 50 | Interest received at the company's cash desk | 58 |

| 58 | Interest accrued | 91 |

| 51 | Loan repayment is reflected in accounting | 58 |

Acquiring

In recent years, Russian companies have increasingly begun to use acquiring in their work, which allows them to accept bank cards from buyers (when paying for goods, works or services sold). When carrying out this type of calculation, accountants may encounter various problems that relate to the process of preparing entries.

Using standard invoice correspondence, they will be able to minimize the risk of making errors, which often cause penalties:

| Debit | Contents of a business transaction | Credit |

| 62 | Sales of goods | 90/1 |

| 90/3 | The amount of VAT is taken into account | 68/3 |

| 57 | Settlements with the buyer are closed (documents are transferred to the acquiring bank) | 62 |

| 57 | The revenue received from the buyer who paid for the goods with a payment card is reflected. | 90/1 |

| 51 | Received money from the acquiring bank | 57 |

| 91 | Related expenses written off | 57 |

| 96 | Purchase returns | 62 |

| 20/1 | The bank received an application from the buyer | 57 |

| 57 | Funds transferred | 51 |

| 57 | The commission charged by the bank is adjusted | 91 |

Analysis of shipment and sales of products

Analysis of shipment and sales is carried out to estimate sales volumes, and also provides information about the balance of goods in the warehouse. Data is generated monthly, quarterly and annually. The information obtained helps to assess the financial condition of the company, identify sales dynamics, and also see the real unsold balance, which, if the goods are perishable, can lead to losses.

Also, accounting for the shipment and sale of finished products allows you to see the volumes of goods sold and the dynamics of payment. At manufacturing enterprises, this is the main source of revenue generation.

Source of rules for reflecting sales in accounting

The principles that should be followed when registering sales transactions are set out in PBU 9/99 (approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n). This document, as a basic rule, establishes the division of all income arising from a legal entity:

- for ordinary ones, received regularly from the main activities;

- others, which are not derived from core activities and, as a rule, have a small share of total sales, even if they occur regularly.

A legal entity independently (based on the characteristics of its activities that affect the classification of income as ordinary or other) makes a decision on how to divide its income into these two types (clause 4 of PBU 9/99), fixing this in its accounting policies.

Among the income classified as ordinary, PBU 9/99 (clause 5) specifies as the main income those arising from sales of products, goods, works and services. Their value should be determined without VAT and excise taxes (clause 3 of PBU 9/99).

The moment for recognizing sales revenue occurs when the following conditions are simultaneously met (clause 12 of PBU 9/99):

- has the right to receive it;

- you can determine a specific amount;

- the proceeds are recognized as providing benefits to its recipient;

- there has been a transfer of ownership of the item of sale;

- you can determine the amount of expenses incurred during the sale.

Check whether you correctly reflect the sale of goods in accounting and tax accounting using the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Legal entities that use the opportunity to simplify accounting and accounting have the right to recognize income from sales as payment is received (i.e., without reference to the fact of transfer of ownership).

With a long cycle of creating an item for sale, it is allowed to recognize income not at the end of this cycle, but as individual parts are ready (clause 13 of PBU 9/99).

Accounting accounts

Now we come to the first important question, what are “ accounting accounts ”? An organization always owns property and liabilities. Property, more often called an asset, can be completely different, from land plots to a trademark and reputation. In the same way, the obligations, or liabilities, of a company are different. To take into account all the diversity, we have accounting accounts.

Accounts can be divided into three groups:

- To account for property or assets - 10, 41, 43, 50, 51, etc.

- To account for obligations or liabilities - 60, 70, 68, etc.

- To account for financial results - 90, 91, 99, etc.

Typically, accounts have “telling” names, which makes them easier to understand: for example, “02 - Depreciation of fixed assets”, “60 - Settlements with suppliers and contractors”.

Results

Income from the sale of goods refers to those received from the activity for which the legal entity was created, i.e., to ordinary income for accounting purposes.

The financial result from such sales is reflected in account 90, the credit of which shows the income in its full amount, including taxes, and the debit shows the amount of these same taxes, the book value of goods and sales expenses. For retail, which sets the accounting value of the goods equal to the sales price, this value at the time of sale is adjusted to the actual value by taking into account in account 90 the markup related to it, expressed as a negative value. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.