Accountants very often encounter the need to create advance reports when making cash payments to employees. This document is necessary to confirm the amount spent or monetary documents issued to the employee previously.

Let's give a simple example. The employee was sent on a business trip and given a certain amount to buy a ticket. Upon his return, he provides this ticket to the accountant in order to confirm how much money he actually spent. Then the accountant makes an advance report based on it.

Many more examples can be given. This includes the purchase of materials, goods (stationery, household equipment, etc.), payment for fuels and lubricants, daily allowances, postage and much more.

In this article we will look at the step-by-step instructions for creating an expense report in 1C 8.3 and provide a sample of how to fill it out.

Issuance of funds on account

The procedure for issuing DS for reporting is regulated by the Regulations on the procedure for conducting cash transactions dated 10/12/2011 No. 373-P.

The basis for extradition is the application of the accountable person. The application must have the manager’s handwritten signature indicating the amount and period for which cash is issued, his signature and date.

In 1C 3.0, the issuance of a DS/report to an employee is carried out:

- By means of a “Cash expenditure order” with the type of business operation “Issue to an accountable person”;

Fig.1 Issuance of money/report using a cash receipt order - The document “Payment order” with the type of operation “Transfer to an accountable person”;

Issuance of money against the document Payment order - “Issuance of monetary documents” to an accountable person. For example, a fuel card, travel pass, etc. can serve as a monetary document. Despite the fact that a monetary document is a material object, such documents are recorded in total terms.

In all documents issuing DS for reporting with the corresponding types of transactions, there is a mandatory “Recipient” field, in which you must select from the “Individuals” directory the employee to whom the funds are issued (transferred).

Regardless of the method of issuing funds for reporting - in cash from the cash register or by bank transfer to an employee's account (to a card), the essence of the business transaction does not change. In 1C Accounting, accounting for DS issued for reporting is kept on account 71: DS account 71 (for debit) corresponds with account 50 or 51 (for credit), depending on how the money was issued.

Account cash warrant

Access to the document in the section “Bank and cash desk” - “Cash desk” - “Cash documents”:

Let’s create a new document for cash withdrawal with the transaction type “Issue to an accountable person.”

The result of posting the document will be a posting reflecting the issuance of funds to the employee from the organization’s cash desk:

How to prepare an advance report

Since DS are issued on the basis of an employee’s application, we can conclude that the organization has the right not to accept an advance report from an employee who has not previously been given funds on account (or was issued, but for other purposes). In this case, information about the costs incurred by the employee is not reflected in the system.

You can create a new document “Advance report” from the “Bank and cash desk” subsystem, then the “Advance reports” command.

The header of the document must indicate to whom and from which company the funds for which the employee is reporting were issued.

Fig. 3 Preparation of an employee’s advance report

The document also contains a number of optional fields used to print advance reports by the employee (printed form AO-1) or, if the advance report contains goods purchased by the employee, to print a receipt order (printed form M-4).

If you need to change or supplement printed forms, contact our specialists; we will provide 1C modification services as soon as possible.

Using an expense report, you can reflect a whole range of employee expenses:

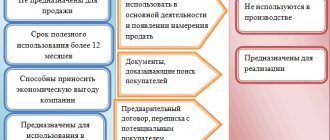

- Acquisition of inventory items (tabular section “Goods”). In this part, the functionality of the Advance Report duplicates the capabilities of the “Receipt of Goods and Services” document;

- Register the receipt of returnable packaging (tab “Returnable packaging”);

- Reflect the payment of DS to the supplier against future receipts or for previously delivered goods/rendered). The key difference between this operation and the operation of reflecting the purchase of goods and materials is that when displaying the operation on the “Goods” tab, the accountant must indicate specific values purchased by the employee by selecting them from the “Nomenclature” directory, whereas when reflecting the expenditure of funds on the “Payment” tab It is enough to indicate the amount and recipient of the funds. You can also indicate in free form the details of the incoming document and the content of the transaction. This data will be used when filling out the printed form of the Advance Report (AO-1).

- Reflect other expenses (tab “Other”). On the tab, you can reflect other expenses by specifying expense accounts manually.

The “Advances” tab stands out, where it is necessary to list the documents with which funds were issued to the employee for reporting.

According to current legislation, an employee who has received funds on account is required to report on the use of these funds no later than 3 business days from the end of the period for issuing these funds. If the deadline for the issuance of funds is not clearly defined (it can be indicated either in an order for the organization (common to all employees) or specified by the manager in an application for the issuance of funds), then three days are counted from the moment the funds are issued.

The amount of money issued and the amount spent by the accountable person may not match:

- In case of overexpenditure (if the overexpenditure is reflected in the Advance Report document, then the company has recognized the fact of overexpenditure), a credit balance is formed on account 71 for the amount of the overexpenditure, which can be closed by issuing funds to the employee.

- If the employee has a balance of funds, he can formalize their use with a new advance report or return the balance of unspent funds.

If working with expense reports raises any questions for you, please contact our 1C:Enterprise program support specialists. We will be happy to help you!

Final settlements with accountable persons

The status of settlements with accountable persons can be analyzed using the standard accounting report “Account balance sheet” (section “Reports” - “Standard reports”). Example of a report on account 71.01. “Settlements with accountable persons” is given below:

When making payments to accountable persons, the following situations are possible:

- the amount of funds spent exceeds the issued accountable funds. In the balance sheet, such amounts will be reflected in the credit balance and represent the organization’s debt to the employee. In this case, the employee will be given funds to repay the outstanding debt. Operations for issuing accountable amounts are similar to those discussed above for the initial payment.

- after the advance report is provided, the confirmed expenses are less than the previously issued amount. In this case, the employee can either use the remaining funds for other purchases and submit a new expense report, or return the unused funds to the company.

The return of funds to the organization's cash desk is formalized by the document “Cash receipt order” with the type of operation “Return from an accountable person.” In our example, the receivables of employee A.P. Mogova is 1400 rubles, which demonstrates the debit balance in the balance sheet for subaccount 71.01.

Let’s make sure that after the return of funds, settlements with the accountable person are closed:

The materials in this article illustrate step-by-step operations for accounting for settlements with accountable persons to help novice users of the program work with these documents.

Return of unused funds to the company's cash desk

The return of the DS is carried out through the “Cash receipt order/Return from an accountable person”, or by transfer to the organization’s current account.

The peculiarities of the operation of returning unspent DS by the accountant to the organization’s current account (by bank transfer) include the fact that this operation is not regulated by current legislation, therefore it is advisable to exclude it from the fact of economic activity. As a last resort, you can try to determine the procedure for such payments in local acts, for example, issue an order on the procedure for the issuance and return of unspent funds by accountable persons by bank transfer.

Payment order

To transfer accountable amounts in non-cash form, create a document “Payment order” with the type of operation “Transfer to an accountable person”:

After filling out the document details, set the status to “Paid” and enter the document “Debit from the current account”:

which, after execution, generates a transaction for the transfer of funds to the employee from the organization’s bank account:

Results

By purchasing the 1C:Accounting program, you receive functionality sufficient for regular business activities for issuing and returning DS from the enterprise’s cash desk. Filling out an expense report in 1C Enterprise Accounting 3.0 is not difficult, but the process itself will require certain methodological knowledge.

Advance reports are drawn up as a separate document, which can be used to document both the receipt of goods or payment to a supplier for goods and services, as well as specific transactions, for example, payment of taxes or travel expenses.

Report on the acquisition of inventory items

Supporting documents for the report on the acquisition of goods and materials are invoices, invoices, cash register receipts, sales receipts, receipts for the receipt order, strict reporting documents. On the second page of the advance report, the accounting entries will be for the credit of account 71, only the correspondence for the debit is signed:

| Debit | Credit | Contents of operation |

| 10.1 | 71 | Purchase of raw materials and supplies |

| 10.3 | 71 | Purchase of fuels and lubricants |

| 10.5 | 71 | Purchasing spare parts |

| 41 | 71 | Purchasing goods |

Having completed his part, the accountable person signs and submits the report to the accountant, who must fill out a receipt at the bottom of the first page, indicating how many documents, on how many sheets and for what amount he accepted. Having signed and cut off the receipt, the accountant hands it over to the accountable person.

How to report for the use of daily allowances on a business trip

You may be interested in: Operating hours of Sberbank in Yekaterinburg. Addresses of Sberbank branches and ATMs in Yekaterinburg

Business travel is an integral part of business activity. Visits of employees to conclude contracts, accept goods, to separate departments require proper registration and recording. Business trips are issued on the basis of a written decision of the manager. A travel certificate is not necessary; you can confirm the number of days of stay with an order, travel tickets, or residence documents.

The amount of daily allowance is determined in the “Regulations on Business Travel”, which is an annex to the collective agreement. The Tax Code does not limit the upper limit of daily allowance, but we must remember that the amount of daily allowance exceeding 700 rubles. on business trips in Russia and 2500 rubles. on business trips abroad is subject to personal income tax, and since 2017, insurance premiums.

In the advance report for a business trip, the entries depend on what goals it pursued:

| Debit | Credit | Contents of operation |

| 20 | 71 | Travel expenses related to core production activities |

| 44 | 71 | Travel expenses related to the main activities of the trading enterprise |

| 28 | 71 | Travel expenses associated with accompanying defective products |

We prepare a report on accommodation on a business trip

Accommodation on a business trip can be paid in two ways: according to actual expenses and in a fixed amount. The payment method is fixed in the Business Travel Regulations; if the second option is chosen, the amount for accommodation for one day is set. In the first case, you will have to provide hotel bills, cash register receipts or certificates that the establishment operates without a cash register. Postings for the advance report are similar to accounting for daily allowances.

Business trip report

Travel expenses on a business trip are confirmed by travel documents for all types of transport: plane, train, bus, ship or boat, except taxi. Costs for booking and baggage are included.

It is also allowed to reimburse expenses for an employee who goes on a business trip using personal transport. In this case, confirmation of expenses will be receipts from gas stations, a certificate of fuel consumption rate, PTS, a certificate of the distance to the destination of the trip and back. If all documents are accepted and the advance report is approved, the transactions are similar to those given for recording daily allowances.