Payment

What is considered a sale Goods are considered sold if the ownership of them has transferred from the seller

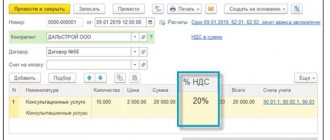

From 2021, the key VAT rate will be 20% (subparagraph “c” of paragraph 3 of article

When submitting reports in the SZV-M form, specific deadlines are established, violation of which entails

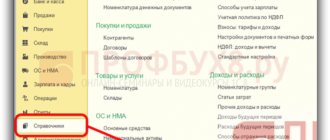

When operating under the general taxation system, companies are required to pay many taxes, including

Account 16 “Deviation in the cost of material assets” is used by organizations that reflect the cost of inventories according to

Which accounts should be used for settlements under a civil and gas agreement? Sometimes for a company certain types of work

Hello! In this article we will talk about the features of paying land tax by an individual entrepreneur. Today

List of objects of taxation with contributions The list of objects of taxation with insurance premiums includes funds that

The provisions of the Tax Code of the Russian Federation impose an obligation on tax agents to submit quarterly reports in the form

What is a foreign currency current account, how does it differ from a ruble account? Top 10 banks for