Payment of penalties by payment order in 2020-2021

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

You can calculate penalties using our calculator .

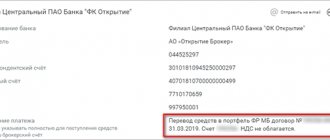

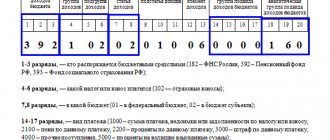

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

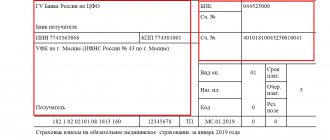

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: since 2015, we no longer fill out field 110 “Payment Type” .

Previously, when paying penalties, the penalty code PE was entered in it. Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK.

IMPORTANT! The KBK lists are approved by the Russian Ministry of Finance. They were approved by different orders for 2021 and 2020. See here for details.

What details are included in the invoice?

Since there is no unified form of the document, the mandatory details for it are not established. Typically the invoice contains the following information.

- Date of document generation.

- Serial number. Accounts are numbered from the beginning of each calendar year.

- The validity period of the document, if it is not specified in the contract. This detail is especially relevant for an offer invoice, because payment after the deadline may not lead to the conclusion of an agreement and the money will have to be returned. If the invoice for payment is issued under a valid agreement, then a delay in payment may lead to the accrual of a penalty, penalty or fine.

- Names and addresses of the recipient and payer. They must comply with the contract, but in some cases exceptions are allowed. For example, the address may change due to a move, or the name may change as a result of reorganization.

- TIN, KPP, bank details of the recipient of funds. If the details differ from those specified in the contract, this must be reflected separately in the invoice, writing: “Attention! Bank details have changed."

- Name of goods, works or services. If you need to issue an invoice for payment on the basis of an agreement, in this column, instead of a list of goods or services, you can indicate: “payment for goods (services) under the Agreement...”

- Total amount to be paid. It is usually indicated in words to avoid numerical errors.

- Amount of VAT or lack thereof.

- Job title of the person who prepared the invoice and signature with transcript.

Now it is becoming a rule of good manners to also indicate the company’s website and e-mail.

Free tax consultation

The document can be signed by the head of the organization or an authorized employee on the basis of a power of attorney. Also, the account may have two signatures, if this is provided for by the internal document flow rules.

When should an invoice be submitted? This point is not provided for by law. Typically, an invoice is generated simultaneously with shipping documents or after signing a certificate of completion of work or provision of services. Sometimes the deadline for issuing an invoice for payment may be stipulated in the contract.

To issue an invoice, you do not need to use special programs; you can download a free Word or Excel template and prepare your own form with the necessary details of the seller or service provider. An xls file is better suited for these purposes; it can use formulas for the necessary calculations. Since there is no mandatory single form, you can make your template unique and recognizable.

To further simplify the procedure for sending an invoice, use a specialized online service. The document from the service does not have to be downloaded and printed; you can send it to the counterparty using a link in any convenient way. The online invoicing program allows you to automatically generate invoices with and without VAT, fill in the buyer’s and seller’s details using the TIN, and the name of the bank using the BIC, check the correctness of the specified data (TIN and current account number), correctly indicate the amount in words, allow you to sign and seal. Below you can see a sample of a document created in the service.

Issue an invoice online Completely free and without registration

Basis of payment - 2nd feature of the penalty payment

The 2nd difference in the payment for penalties is the basis of the payment (field 106). For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

All three of the above cases are discussed in detail in the Ready-made solution from ConsultantPlus. Samples of filling out payment forms are provided for each of them. You can view them by getting trial access to K+ for free.

Read more about payment details in this article.

Why and when is it used

When concluding any contract, each of the participants expects the counterparty to fulfill its contractual obligations properly and on time. But sometimes one of the parties to the contract avoids fulfilling its obligations, for example, the contractor delays the completion of the order or the buyer is in no hurry to pay for the delivered goods. In order to induce the customer or contractor to fulfill the conditions, an addition to the contract is drawn up, a penalty agreement is drawn up by agreement of the parties and provides for measures of financial liability for violation of the stipulated conditions.

The meaning of including a penalty clause in a contract is to create the threat of a property disadvantage for the debtor in the event of non-fulfillment or improper performance of the obligation. By law, an agreement on a penalty must be made in writing, regardless of the form of the underlying obligation.

Feature 3 – field 107 “Tax period”

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2020 - penalties for August 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

Read about filling out field 107 in your personal income tax payment form here.

Normative base

“Review of judicial practice of the Supreme Court of the Russian Federation No. 2 (2019)”, approved.

By the Presidium of the Supreme Court of the Russian Federation 07/17/2019 According to Art. 330 of the Civil Code of the Russian Federation, a penalty is an amount determined by law or contract that the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular in case of delay in fulfillment. This is a sanction, a type of liability for violation of obligations, it is included in the contract as a separate part. If the penalties were not specified immediately and the parties agreed on them later, a separate contract for penalties is not drawn up; sanctions are specified in an additional agreement.

How to indicate the number and date of the document - grounds for paying penalties

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

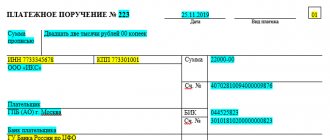

A sample payment order for the payment of penalties in 2020-2021 can be viewed and downloaded on our website:

Invoice agreement

This is an invoice for payment and an agreement in one document, it immediately states the necessary conditions of cooperation. It is often concluded when the supply is small. It’s easier and faster to create a register on one sheet of paper than to print a full-fledged agreement and waste time on approving it.

Article 441 of the Civil Code states that before concluding an agreement it is permissible to provide an offer.

Basic moments:

- The form may be signed unilaterally. The main thing is to write down a clause that if the customer pays, the contract is considered concluded, and the customer agrees with all the specified conditions.

- Done in two copies for each party. Both have the same legal force.

Mandatory details

You must specify:

- name and details of the compiling organization;

- name of the document (the name is obvious);

- his number;

- date of compilation;

- supplier,

- recipient,

- list of goods, works or services and cost;

- VAT (rate and amount) or information why it is not subject to VAT.

If penalties are due

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office in 2021.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties to the Social Insurance Fund in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document”, enter 0 (clauses 5, 6 of Appendix 4 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). And if penalties are paid at the request of the fund and according to the inspection report, their details are given in the purpose of payment.

Formulation

If difficulties arise with the wording, it is recommended to use the following example of penalties for violation of the terms of the contract:

“The work contractor undertakes, on his own and at his own expense, to restore the damaged barn of the Customer of the work by December 27, 2020. In case of violation of the specified restoration period, the Work Performer shall pay the Work Customer compensation in the amount of 100 rubles for each day of delay.”

An additional agreement to the employment contract on penalties is not drawn up; this is illegal. The conditions included in the employment contract are listed in Art. 57 Labor Code of the Russian Federation. They include the employee’s data, date and place of imprisonment, working hours, payment terms, address of the workplace and the employee’s duties, date of commencement of duties, etc. Additional conditions are included by agreement of the parties if they do not worsen the situation of the working citizen. In accordance with Chapter 39 of the Labor Code of the Russian Federation, the financial liability of a working citizen is regulated. Under any circumstances, the employee only compensates for direct actual damage; fines are not specified in the employment contract or additional agreement to it.

From Chapter 23 of the Civil Code of the Russian Federation it follows how to prescribe penalties in the contract:

- as a percentage of the fee for the day or other period of delay;

- as a specific amount for the period of delay;

- as a percentage or share of a certain amount for the period of delay (rate of the Central Bank of the Russian Federation or other indicator).

In accordance with Art. 333 of the Civil Code of the Russian Federation, the court may reduce the amount of payment if it clearly does not correspond to the seriousness of the violation, much more than the average in the market.

Results

A payment order for the payment of penalties is issued similarly to a payment order for the payment of taxes (the same status of the payer, the same details of the recipient and the same income administrator are indicated).

Payment of penalties by type of taxes and fees is made according to separate BCCs, in categories 14–17 of which the income subtype code is indicated - 2100. In a special order, separate fields of the payment slip for the transfer of penalties (“Basis of payment” and “Tax period” are filled in) ).

Sources: Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Invoice offer

An invoice, in simple terms, is a commercial proposal with which a potential client agrees and pays or refuses. It is advisable to formalize the refusal in writing. There is no unified form for an offer; when drawing up, a budget organization most often uses an independently developed form.

An invoice is an offer if it contains the following details:

- destination,

- essential terms of the agreement;

- the intention of the sender (offeror) to consider himself as having entered into a contract.

For it to have legal force, the recipient must and sufficiently pay (accept) it, as stated in Art. 438 Civil Code of the Russian Federation.

Let's look at what offers there are:

- Irrevocable - concluded with everyone, not limited in terms of time.

- Free - most often done for certain organizations that show interest in a product or service.

- Firm - done individually for a specific organization, where the terms during which acceptance is possible are clearly stated.

- Public - an offer that is made publicly.

Features of accruals

If the debtor pays the penalty, this will not free him from the need to cover the main “body” of the debt. The loan money is distributed in the following order:

- Costs to the creditor due to the debtor's debt.

- Accrued penalties and fines.

- The main “body” of debt.

If a person wants to reduce the fine in court, he must immediately go to court without paying a penalty. If payments have already been made, it is unlikely that the funds will be returned.

Examples of statutory penalties

| Legislative act | Example of a violation | Penalty amount |

| Charter of road transport and urban ground electric transport (Federal Law No. 259-FZ) | Delay in cargo delivery | A fine of 9% of the cost of payment for carriage under the contract, unless a different rate is established in the contract (for each day of delay) |

| Charter of railway transport of the Russian Federation (Federal Law No. 18-FZ) | Late baggage delivery | Penalty in the amount of 3% of the baggage transportation fee (for each day of delay) |

| Code of Inland Water Transport of the Russian Federation | Failure to meet cargo delivery deadlines | Penalty in the amount of 9% of the transportation amount, but not more than 50% of the transportation amount (for each day of violation) |

| Air Code of the Russian Federation | Delay in cargo delivery | A fine of 25% of the minimum wage, but not more than 50% of the transportation amount (for each hour of delay) |

| Federal Law “On Freight Forwarding Activities” (No. 87-FZ) | Violation of deadlines for fulfilling obligations under the contract | Penalty in the amount of 3% (not more than 80% of the amount of remuneration to the forwarder) - for each day |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

document

- Miscellaneous: samples (Full list of documents)

- Search for the phrase "Miscellaneous" throughout the site

- “Claim for payment of the debt and penalties due to late payment under the contract (general form).”doc

- Documents downloaded

Entered into the database

Corrections have been made to

- Treaties

- All documents

- Holidays and weekends calendar for 2019

- Small business registration is useful

- How to draw up a contract yourself

- OKVED code table

On our website, everyone can find a contract or a sample document of interest for free; the database of contracts is updated regularly. Our database contains more than 5,000 contracts and documents of various types. If you notice an inaccuracy in any agreement, or the impossibility of the “download” function of any agreement, please contact us using the contact information. Have a good time!

Today and forever

— download the document in a convenient format! A unique opportunity to download any document in DOC and PDF absolutely free of charge. Only we have many documents in such formats. After downloading the file, click “Thank you”, this helps us form a rating of all documents in the database.