Hello! In this article we will talk about the features of paying land tax by an individual entrepreneur.

Today you will learn:

- In what cases does an individual entrepreneur need to pay land tax;

- When land tax is not taken into account;

- How to calculate tax payable;

- Should an individual entrepreneur pay land tax using the simplified tax system?

Land tax

The generally accepted taxation system also includes a tax on land use. If you are the owner of a plot, you are required to pay contributions to the treasury for it. This applies to individuals and legal entities.

Land tax is regulated by three main legal acts:

- Law No. 141 of 2004;

- Law No. 382 of 2014 (everything related to changes in accrual);

- Tax Code, in particular Chapter 31.

There are two main tax rates that are adopted at the state level. They are the maximum possible for each region. Local authorities can reduce this rate, thereby reducing the tax burden in a particular region of the country.

Basic tax rates:

- 0.3% – for agricultural land in urban areas, construction of housing and communications, maintaining your own garden or vegetable garden, personal breeding of domestic animals; lands used for customs, security or defense purposes;

- 1.5% – for all other types of land plots not included in the above list.

Within one region, the land tax rate can be differentiated, that is, different between individual taxpayers. This rule is set at the discretion of the local administration.

You can find out the rate that applies in your region of residence via the Internet or by contacting the authorities directly. If you want to find information online, you need to visit the official website of the tax service of the constituent entity of the Russian Federation.

To find an accepted bet, follow these steps:

- Specify region;

- Go to the “Electronic Services” section;

- Select the “Betting Information” link;

- Indicate the tax of interest, namely land tax;

- Select a period;

- On the map that appears, mark the location of your site;

- Click on the “Search” button;

- You will see a table with a regulatory act that sets the rate in the selected region;

- On the right in the table you will see a link to the document, click on it to access the information;

- In the file that opens you will find all the necessary information.

This might also be useful:

- simplified tax system for individual entrepreneurs in 2021

- Tax system: what to choose?

- UTII for individual entrepreneurs in 2021

- Calculation of income tax from salary

- General taxation system for individual entrepreneurs

- Unified agricultural tax for individual entrepreneurs and organizations

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Does the individual entrepreneur pay land tax?

In matters of payment of land tax, an individual entrepreneur is treated as an individual. If your activity, one way or another, involves the use of an allotment that brings in cash, then you must pay tax.

The mandatory contribution is paid in the following cases:

- If the land is privately owned;

- The allotment was transferred for indefinite use;

- With lifelong inheritance.

If you have title documents for the land you are using, then you are a taxpayer. Moreover, this type of collection is municipal, that is, all contributions are sent to the local budget, and not to the general treasury of the country.

Procedure for deductions

The procedure for paying land tax by an entrepreneur is no different from other payments provided for by current legislation.

Some business entities have a question about where to make the payment if the individual entrepreneur is registered in one place, but uses land in another locality: for example, the individual entrepreneur is registered in the city, and its production occupies land in the suburbs.

According to the law, land tax is transferred only to the budget of the municipality where the site is located, regardless of the place of registration of the individual entrepreneur.

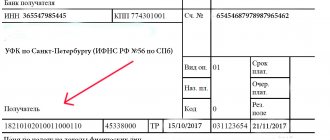

When making a payment, it is important to use the correct details, which are different in each region, and they also differ between municipalities.

Back to contents

About benefits

As noted earlier, land tenants are exempt from paying land tax. In addition, federal legislation contains certain benefits in the amount of tax payments for land for certain categories of citizens.

Please note that local legislation may provide for other categories of citizens, as well as business entities, for whom there is an exemption from land tax or a preferential regime for its calculation.

Thus, when paying land tax, an individual entrepreneur must be guided not only by the norms of federal tax legislation, but also by the regulatory documents of regional and local authorities. This is where the main difficulty lies. However, as practice shows, most entrepreneurs successfully cope with this problem.

Back to contents

Calculating taxes

Not all beginning entrepreneurs know whether they submit a land tax return. Currently, individual entrepreneurs are exempt from drawing up and filing a declaration.

Previously, it was necessary to submit reports to the tax service, but now individual notifications with the amount are sent to the entrepreneur’s address.

Such notifications are sent before October 31 of the year following the reporting year. That is, for taxes for 2021, the payment letter will arrive in October 2021. Payment deadlines end on December 1st after receiving a receipt from the tax office.

There are often cases when the tax authority does not send notifications. It is important to understand that this does not exempt you from paying the fee. For late repayment of debt, penalties will be charged from your account, regardless of whether the tax authority sent the notification on time or not.

Therefore, if a payment receipt has not appeared in your mailbox by October 15, we recommend visiting the tax authority to clarify the circumstances and receive a notification.

Depending on what dates in the month you purchased the plot, that month may or may not be included in the payment.

A full month will be taken into account if:

- The plot is registered from the 1st to the 15th of the month (for the buyer);

- The plot was sold from the 16th to the 31st (for the seller).

The month of purchase/sale will not be taken into account for tax purposes if:

- The plot was purchased from the 16th to the 31st (for the buyer);

- The plot was sold from the 1st to the 15th (for the seller).

The land tax payment process includes the following steps:

- The tax authority draws up a notice of payment with a receipt;

- The document is sent to the individual entrepreneur’s registration address;

- The entrepreneur pays the tax using the specified details at any bank that provides such a service.

Land tax is payable once a year. For individual entrepreneurs, advance payments are not provided - this means that the entire tax amount must be paid at once.

How to pay

It is easy to pay the tax on the simplified tax system in a year; today there is no need, as before, to find out tax rates and use complex formulas. For individual entrepreneurs, all calculations will be performed by the tax authority. After receiving a letter from the tax office, you can make payment as follows:

- through any branch of Sberbank;

- through the “Bank-Client” system;

- using the electronic service of the Federal Tax Service.

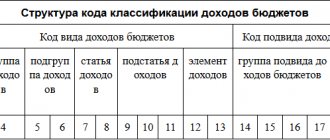

When filling out a payment order, you will need the following data: full name, tax identification number of the payer and name of the tax being paid. The budget classification code (BCC) is also required: the land tax of individual entrepreneurs will not pass without it. The BCC is specified on the official tax service portal.

Payment benefits

The state has created benefits for paying taxes on land plots for certain categories of citizens. Exemption from contributions is carried out on a full or partial basis.

The tax base for the following persons is reduced in the amount of 10,000 rubles:

- Disabled people of groups 1 and 2;

- Disabled since childhood;

- Heroes of the USSR or the Russian Federation;

- WWII veterans;

- Participants in man-made disasters and persons taking part in their liquidation (persons exposed to radiation).

For these categories, 10,000 rubles are deducted from the tax base. Also, each region can establish additional benefits. For example, in some areas there is a regulation establishing the area of the plot that is not subject to tax.

If the plot is larger than this area, then only a contribution is paid for the difference between the actual size and that established by law. For those whose plot is less than or equal to the area specified in the legal document, the tax is equal to zero.

If you are the owner of several plots in different regions, then you are entitled to benefits for each individual plot. If you own lands within one subject of the Russian Federation, then you can use only one of them for preferential tax purposes.

Responsibility

For failure to submit a land tax return on time, liability is provided under Art. 119 of the Tax Code of the Russian Federation. For each full or partial month of delay in the declaration, a fine of 5 percent of the tax not paid on time is collected.