Which accounts to use for settlements under the GPC agreement

Sometimes certain types of work (services) are performed for a company by an individual under civil law contracts (GPC).

In this case, the accountant needs to carry out the necessary operations in accounting: to reflect and pay remuneration, calculate insurance premiums, withhold personal income tax, etc. Which accounts should be used for this?

To reflect settlements under the GPC agreement, account 76 “Settlements with various debtors and creditors” is used. This account must be used regardless of whether the work under the GPC contract is performed by an employee of the same company or by a third party who is not in an employment relationship with the employer (customer). In this case, it is incorrect to use account 70 “Settlements with personnel for remuneration” to reflect calculations, since it is not intended to account for this type of transaction.

Which entries should be used in accounting under a GPC agreement? Corresponding accounts are determined depending on the purpose for which the work was performed (service provided): for the needs of the main or auxiliary production, for solving general business problems, etc.

Postings for accrual of remuneration:

The following materials will introduce you to the postings for various business transactions:

- “Transactions on the accrual and payment of UTII”;

- “Wage entries in budget accounting”;

- "Accounting entries for deposits and interest."

How to correctly conclude a GPC agreement with an individual is also described on our website. And ConsultantPlus experts have prepared instructions with which you can check it for tax risks:

To see the recommendations, get a free trial access to K+ and go to the Ready Solution.

Accounting

The contractor's revenue from the implementation of work under construction contracts is classified as income from ordinary activities (clause 5 of PBU 9/99).

The procedure for accounting for revenue under a construction contract depends on the duration of the work.

On this basis, construction contracts are divided into:

- short-term (if the work is performed within one reporting year);

- long-term (if the period of work takes more than 12 months or if the start and completion of work occur in different reporting years).

This conclusion follows from paragraph 1 of PBU 2/2008.

In this case, regardless of the duration of the work:

- revenue from the sale of construction work is included by the contractor in income from ordinary activities (clause 5 of PBU 9/99, clause 7 of PBU 2/2008);

- advances received from the customer are not included in income and are reflected in accounts payable (paragraph 4, 5, paragraph 3, paragraph 12 of PBU 9/99, paragraph 7 of PBU 2/2008).

In accounting, recognize sales revenue in accordance with the requirements of paragraph 12 of PBU 9/99.

The main criterion for recognizing revenue in accounting is the customer's acceptance of the results of the work performed. Document the delivery and acceptance of work with documents signed by both parties (Articles 720, 753 of the Civil Code of the Russian Federation). The date of preparation of such documents is the date of reflection of income in the contractor’s accounting (subparagraph “d”, paragraph 12 of PBU 9/99, part 1 of article 9 of the Law of December 6, 2011 No. 402-FZ).

Posting in accounting for payment of accrued remuneration

Each of the entries indicated in the previous section forms in the accounting the customer’s obligation to the contractor to pay remuneration for work performed under the GPC agreement (services provided). It arises after the customer accepts the work (service) from the contractor and signs the acceptance certificate. The act will serve as the basis for accounting entries. Then the customer needs to pay the contractor and also reflect this operation in accounting.

To reflect settlements under GPC agreements, the following posting is used:

The basis for such an entry in accounting (in addition to the agreement and act) will be a bank statement if the money is transferred in non-cash form, or a cash order when paying the contractor money from the cash register.

This material will introduce you to the postings for accounting cash transactions.

You can find out how a customer can calculate income tax, pay personal income tax and insurance premiums when paying for services to an individual in ConsultantPlus by getting trial access to the system for free.

Documentation of acceptance and transfer of work

Acceptance and transfer of work under a construction contract is formalized by an act signed by the customer and the contractor. This procedure applies regardless of the duration of the work under the contract. This follows from the provisions of paragraph 4 of Article 753 of the Civil Code of the Russian Federation.

To formalize the acceptance and transfer of work, an organization can use unified document forms approved by Decree of the State Statistics Committee of Russia dated November 11, 1999 No. 100. These include:

- act of acceptance of work performed (form No. KS-2) (drawn up on the basis of data from the log book of work performed according to form No. KS-6a);

- certificate of the cost of work performed and expenses (form No. KS-3);

- acceptance certificate for a completed construction project (form No. KS-11).

Moreover, such documents must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. In addition, they must be approved by the head of the organization (Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

In the act of acceptance of completed work (for example, according to form No. KS-2), provide a list of work performed by the contractor during the reporting period, indicating their cost. An act of acceptance of completed work (for example, in form No. KS-2) can be drawn up in two cases:

- upon acceptance by the customer of a stage of work, if stage-by-stage acceptance is provided for by the terms of the contract;

- to determine the cost of work performed by the contractor for a certain period of time for the purpose of making interim payments, if such payments are provided for by the terms of the contract.

In the first case, signing an act of acceptance of completed work (for example, in form No. KS-2) indicates acceptance of the completed stage of work in accordance with the contract. The risk of accidental death or damage to the result of the work passes to the customer (clause 3 of Article 753 of the Civil Code of the Russian Federation).

In the second case, the agreement of the parties should provide that the drawing up of an acceptance certificate for the work performed (for example, in form No. KS-2) does not indicate the customer’s acceptance of the results of the work performed with the transfer to him of the risks of accidental loss or damage to the results of the work. And also that acts are drawn up only for settlements between the parties. In this case, such documents are of an interim nature (clause 18 of the information letter of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 No. 51). The acts serve as the basis for determining the amount of the next advance payment and filling out a certificate of the cost of work performed (for example, according to form No. KS-3), which is presented to the customer for payment.

When filling out these forms, follow the recommendations contained in Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

The cost indicated in the certificate of acceptance of work performed (for example, in form No. KS-2) may differ from the cost indicated in the certificate of cost of work performed (for example, in form No. KS-3). In particular, in the certificate, in addition to the cost of the work performed, reflected in the act, data on the cost of equipment payable by the customer, data about which is not included in the act, can be entered.

Document the acceptance by the customer of the completed construction facility with an acceptance certificate for the completed construction facility (for example, according to form No. KS-11).

In what account should personal income tax be reflected on payments to the contractor?

When paying remuneration, the source of payments is obliged to withhold personal income tax from the amount accrued to the individual (subclause 6, clause 1, article 208 of the Tax Code of the Russian Federation). The customer does not have to perform the duties of a tax agent for personal income tax only if the GPC agreement is concluded with an individual entrepreneur, a private notary or a lawyer. These categories of performers pay the tax themselves (clause 2 of Article 227 of the Tax Code of the Russian Federation).

Operations for calculating tax and transferring it to the budget are carried out according to the following scheme:

The responsibilities of the tax agent when making payments under the GPC agreement are not limited to withholding tax, transferring it and reflecting payments in Form 6-NDFL. At the end of the year, you need to issue a 2-NDFL certificate or inform the tax authorities and the recipient of the income about the impossibility of withholding tax if the remuneration is issued in kind (clause 5 of Article 226 of the Tax Code of the Russian Federation).

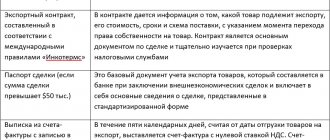

Civil relations

Under a work contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its result to the customer, and the customer undertakes to accept the result of the work and pay for it (Clause 1, Article 702 of the Civil Code of the Russian Federation).

If the contract does not provide for advance payment for the work performed or its individual stages, the customer is obliged to pay the contractor the agreed price after the final delivery of the work results, provided that the work is completed properly and on time or with the customer’s consent ahead of schedule (clause 1 of Article 711 of the Civil Code RF).

The contractor has the right to demand payment of an advance or deposit only in cases and in the amount specified in the law or the contract (clause 2 of Article 711 of the Civil Code of the Russian Federation).

How to show insurance premiums under an agreement with an individual in accounting

Insurance premiums are charged on the remuneration amounts under the GPC agreement: for compulsory pension and medical insurance. Contributions to the Social Insurance Fund for compulsory social insurance in case of temporary disability and in connection with maternity do not need to be accrued (subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation).

Contributions for accident insurance are accrued only if this is provided for in the GPC agreement (paragraph 4, paragraph 1, article 5, paragraph 1, article 20.1 of the law “On compulsory social insurance ...” dated July 24, 1998 No. 125- Federal Law).

The accrual and payment of insurance premiums are reflected by entries in the accounting accounts in the following order:

On account 69, you need to organize analytical accounting for the types of insurance premiums paid (sub-account “Settlements with the Pension Fund”, sub-account “Settlements with the Federal Compulsory Medical Insurance Fund”, etc.).

How to reflect payments under GPC agreements in the DAM is described in this publication.

Accounting for construction contracts

5, 6, 6.1 PBU 10/99). These expenses are recognized when the conditions provided for in clause 16 of PBU 10/99 are met; in this case, these conditions are met on the date of signing the acceptance certificate for the work performed.

Insurance premiums accrued on the amount of remuneration to the contractor (as discussed in the section “Insurance Premiums”) also relate to expenses for ordinary activities and are recognized on the date of their accrual (clauses 5, 16 of PBU 10/99).

Accounting records for reflecting the transactions under consideration are made in the manner established by the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown below in the table of entries.

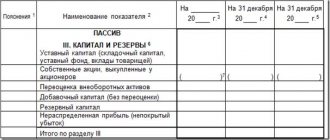

Results

Postings under a GPC agreement with an individual affect different accounting accounts.

The accrual of remuneration is reflected in account 76 “Settlements with various debtors and creditors”. The customer makes the payment by debiting account 76 in correspondence with the cash accounts. Insurance premiums are charged on the amount of remuneration and reflected in account 69 “Calculations for social insurance and security”. The deduction and transfer of personal income tax from the remuneration received is carried out using account 68 “Calculations for taxes and fees”. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for long-term contracts

The accounting procedure for long-term contracts differs from that described above. The subcontractor's expenses and revenue are recognized as the work is completed. At the same time, it is important to determine a reliable financial result for a specific date. It can be different: both profits and losses are reflected in accounting. Often, the revenue recognized at the reporting date is determined in proportion to the share of the cost of completed work in the total revenue from the subcontract.

Determination of the degree of completion of work must be enshrined in the accounting policies of the subcontractor. There are two options here:

- determination by share in the total volume of work under a specific subcontract;

- determination by the share of actual expenses in the total amount of expenses according to the approved estimate.

The list of transactions under a standard long-term agreement includes:

- Receiving an advance – Dt51 Kt62.

- Payment of VAT – Dt62 Kt68.

- Accounting for costs of work - Dt20 Kt60, 70 or 10.

- Accounting for tax imposed on services and materials from third-party suppliers – Dt19 Kt60.

- Determination of revenue based on the readiness of work or actual expenses - Dt46 Kt90.

- The amount of expenses is Dt90 Kt20.

- Presentation of the cost of work for payment – Dt62 Kt46.

- Implementation upon signing by the customer of the acceptance certificate - Dt62 Kt90.

- VAT accrual on revenue – Dt90 Kt68.

- Write-off of expenses – Dt90 Kt20.

Also, in debit 68 of the account, the VAT paid on advances is offset and the tax presented by contractors and suppliers is accepted for deduction.