Payment

In practice, to speed up payments by counterparties for shipped goods, various discount systems and

Purpose of account 62 The account is intended to record information about transactions with counterparties purchasing from

Legislation: The procedure for carrying forward losses from previous years The Tax Code provides for the possibility of reducing the tax base by

The procedure for conducting a special assessment of working conditions is set out in the methodology for conducting SOUT, which is approved by order

Payment for housing to an employee When companies-employers invite specialists with

Recent court verdicts show that disputes between UTII payers and tax authorities about the size of retail space,

The standard functionality of UT 11, in addition to the capabilities of conventional cost calculation, allows for additional cost calculations.

Correcting the ERSV report—a right or an obligation? Each employer must submit a calculation to the inspectorate

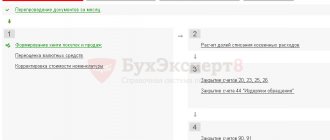

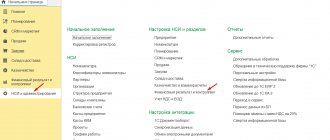

Until the release of "1C:ERP Enterprise Management" version 2.4.2 (hereinafter 1C:ERP), in which the 1C company

Formation of profit The process of summing up profits and losses received from operations is called formation of profit.