The standard functionality of UT 11, in addition to the capabilities of conventional cost calculation, allows for additional detailing. For many companies, due to the specifics of their work, such additional features will be useful.

First, let's look at where separate accounting is included and what types of analytics there are.

In the settings for financial results and controlling, there is a separate group of settings: Separate cost accounting.

Pay in order!

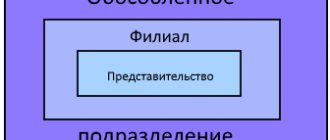

There are three types of separate divisions:

- Branch.

- Representation.

- Others.

The characteristics that unite all three types are territorial isolation and the presence of jobs created for more than a month. This is the general definition of an OP given by the Tax Code of the Russian Federation in Article 11. The Tax Code does not define the concepts of “branch” and “representative office”. Their definition will have to be sought in civil legislation.

Article 55 of the Civil Code of the Russian Federation indicates that the representative office represents the interests of the legal entity and also protects them. A branch has broader rights: it carries out all or part of the functions of a legal entity, including those of a representative office. Simply put, if an organization opens an office where a client can seek advice, conclude an agreement, write a complaint, place an order, then this is a representative office; if this office supplies the client with goods under a concluded agreement, then this is already a branch.

Other divisions fall into the “other” category. It is important to correctly determine what type of OP is opening. This matters not only from a legal point of view, but also from the point of view of the Tax Code.

Should - don't: don't guess with a daisy

If you are in doubt whether you need to open the OP or not, most likely the answer is yes, it is necessary. Please note that neither the Tax Code nor the Civil Code contain any restrictions on the number of employees of a separate division, as well as the absence of an order for its creation in internal documents.

There are difficult situations when it is really difficult to understand whether an OP occurs or not:

- We hire an employee in another city to provide services or perform work on the territory of clients (customers). Let's say a company provides cleaning services in another city and hires cleaners. In this case, there is no separate division, because there are no stationary jobs. A similar approach is applied to the situation when a worker (electrician, finisher) goes to the customer’s site. Depending on the position and type of occupation, the employee is drawn up with both a regular employment contract and an agreement on home-based or remote work.

- Construction work is underway. Here you need to consider each specific situation individually.

- Road works are being carried out. In this case, the Federal Tax Service believes that there is no need to create an OP. The work is being carried out “in the field”; there is no talk of any permanent location.

- Storage space is rented or purchased. This is one of the frequent subjects of controversy. There are permanent employees at the warehouse: storekeeper, watchman, loaders, which means that you will definitely need to register an OP.

- Premises in the same building. The company rents an office in a business center and decides to open a cafe on another floor. On the one hand, both premises are located in the same building and, naturally, belong to the same tax office, so it is logical to assume that there is no need to open an OP. The judges confirm this point of view, since they consider one of the signs of territorial isolation to be assigned to a tax inspectorate different from the parent enterprise. On the other hand, tax authorities do not always agree with arbitration practice. Their position is that even if in fact the legal address of the organization and the cafe differ slightly, for example, in the number of the premises, then formally such a difference is already a reason for registering the separate entity. The conclusion is drawn from the definition of OP in Article 11 of the Tax Code, the concepts established by Article 55 of the Civil Code of the Russian Federation and the determination of the location of a legal entity (according to paragraph 2 of Article 54 of the Civil Code, this is the place of state registration). You will either have to contact the Federal Tax Service for clarification, or act at your own peril and risk.

- The employee works in coworking mode. A popular way to work outside the home. Freelancers usually resort to it. The point is to engage in some kind of activity in a room where fellow “free artists” gather, perhaps in the process exchanging opinions, achievements and experiences, or simply working in a calm environment. Let’s imagine that a space is rented for an employee under a coworking agreement, is this equivalent to renting an office, is it necessary to organize an OP? In reality, this option involves a short-term rental, usually for a few hours a day, and the employer has no control over such a workplace. This means that it cannot be recognized as stationary and the creation of a separate unit is not required.

Note! Homeworkers and remote workers clearly do not have workplaces controlled by the employer.

Example No. 1: the construction site where the workers are sent is equipped with cabins owned by the organization, the workers are given tools by the employer, and he also controls the progress of the work - there is an OP.

Example No. 2: workers come to the construction site every day from home, safety at the site is monitored not by the employer (subcontractor), but by the general contractor, who also controls the progress of construction. Based on the definition of jobs (Article 209 of the Labor Code), there are none in this case, since construction is not under the control of the employer.

It should be noted that in most cases, tax authorities, regardless of the circumstances, believe that a construction site requires the creation of a separate division.

What if it’s just a room where goods or materials are delivered, unloaded, and picked up, if necessary, by visiting drivers and forwarders? Despite the fact that employees are not constantly in the warehouse, it is considered that there are jobs, and the time spent on them does not matter.

By the way! A similar approach is valid in a situation where an organization has rented or purchased an office, but the employee uses it occasionally.

After the company has decided to create an OP, it is necessary to prepare documents regulating its activities and register it with the Federal Tax Service.

Vesting and registration

I’ll make a reservation that if we are talking about the third type of units (others), then you just need to submit an application in form C-09-3-1. The decision to create a representative office or branch is made by a meeting of participants (Clause 1, Article 5 of Federal Law No. 14-FZ “On Limited Liability Companies”) with at least 2/3 votes, unless otherwise specified in the company’s charter. At the meeting, the position is adopted, a leader is elected, and the director of the organization issues an order.

The provision must include the following points:

- Location and name.

- Functions, rights and responsibilities.

- Functions of the manager, powers (it is worth indicating to whom the manager directly reports - the meeting of participants, the director, the general director, another official).

- Property information.

- The presence or absence of your own account, balance.

- Where payroll is calculated, at the head office or in a division.

You can also specify other points: internal reporting, rules for moving inventory, cash flow, etc.

Note! The registration period is one month from the date of creation (clause 1 of Order of the Ministry of Finance No. 114n dated November 5, 2009). A branch or representative office is reflected in the Unified State Register of Legal Entities after state registration.

For late registration of a company's division, fines may apply: 200 rubles – clause 1 of Art. 126 of the Tax Code of the Russian Federation for failure to submit information on time and 10% of income received (minimum 40,000 rubles) - clause 2 of Article 126 of the Tax Code of the Russian Federation for activities without registration with the tax authority.

In 2021, a bill was considered to increase liability for failure to submit (late submission) to the Federal Tax Service of information on opening an OP and increasing it to the level specified in paragraph 2 of Art. 126 of the Tax Code, but in November 2021 it was rejected during consideration by the State Duma.

Accounting in a branch included in the autonomous balance sheet

Unlike the previous type of division, in this case, when a branch is assigned to an autonomous balance sheet, its accounting is carried out separately from the accounting of the parent organization. What does the phrase “autonomous, separate” balance mean? As the Ministry of Finance of the Russian Federation notes (see letter No. 04-05-06/27 dated March 29, 2004), this concept is excluded from PBU No. 4/99.

Meanwhile, for the purposes of applying the norms of Ch. 30 of the Tax Code of the Russian Federation, it should be considered that this is a specific list of indicators that the organization has established for its branch. Taking them into account, the division forms its own autonomous balance sheet and reflects the actual property and financial position.

| Features of the operation of a branch included in the autonomous balance sheet | ||

| The branch has its own accounting service (with a staff member of the chief accountant), which conducts accounting and prepares reports independently from the parent structure | The working chart of accounts is formed in relation to the specifics of the branch's activities. As established, not used: sch. 80, 84, 75 and other accounts that are relevant and applied in the parent organization | The branch's accounting department deals with: compilation, systematization, processing, storage of primary documents; taking into account all business transactions, existing obligations and transferred property, which in one way or another relate to the activities of the organization |

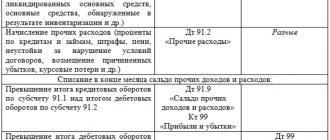

Mutual settlements between a legal entity and its structural unit included in the autonomous balance sheet are displayed using an account. 79 (plus subaccounts 97-1 “Calculations for allocated property” or 79-2 “Calculations for current business operations” and other subaccounts). And so on for each branch.

The generated internal reporting is submitted by the division's accounting department to the head office. The received documentation is then used in the preparation of quarterly and annual reporting for the entire organization. As is customary, the count data is analyzed. 79, the balances of the DT of the organization’s subaccounts are compared with the CT of the branch’s subaccounts, and then the CT of the organization and the DT of its division. There shouldn't be any discrepancies.

After this, the “head” accounting department clears out the balances, but in accounting. does not conduct reporting. Accordingly, indicators on the activities of the branch for a specific reporting period are added to the relevant data for the organization. For your information, a similar scheme of actions is used when generating different forms of reporting. For example, when preparing a report on losses and profits or on the movement of funds.

Property Relocation: Accounting

When moving inventory, fixed assets and money between the head office and other departments, the method of accounting depends on whether the OP has a dedicated balance sheet.

Important! All divisions maintain accounting records in accordance with the accounting policies of the “head”.

There is no separate balance

In this case, when moving, for example, equipment (OS), an internal transfer should be carried out in analytics.

Example No. 3: transfers to division “A-1” a lathe with an initial cost of 150,000 and depreciation accrued at the time of transfer in the amount of 54,000:

- D 01 "A-1" K 01 "A" - 150000, movement carried out.

- D 02 “A” D 02 “A-1” – 54000, depreciation on the transferred machine was transferred.

The same should be done with other inventory items. When a division does not have a separate balance sheet, cash is handled by the central accounting department, and settlements with suppliers and contractors are carried out through it. In this case, normal postings are performed.

Example No. 4: Organization “B” transfers to division “B-2” materials intended for the repair of the premises in which the OP is located, costing 20,000 rubles. To transport them, “B” hires a transport company (TC), its services cost 3,000 rubles:

- D 10.8 materials in the warehouse in “B-2” K 10.8 materials in the warehouse “B” - 20,000, materials were transferred to OP “B-2”.

- D 23 (23, 25, 20, 44) K 76 – 3000, reflects the costs of transporting materials for repairs.

- D 76 K 51 – 3000, paid for TK services.

There is a separate balance

In this case, account 79 “Intra-business settlements” is used to move property and funds.

When transferring fixed assets in the accounting of the head office, it is necessary to make the following entries (we use the data from example No. 3):

- D 79-1 “A-1” K 01 “A” - 150000, the transfer of equipment is reflected.

- D 02 “A” D 79-1 “A-1” – 54000, depreciation on the machine was transferred.

Postings when transferring inventory items and paying the costs of their delivery (we use the data from example No. 4): D 79-1 “B-2” K 10-8 – 20000, materials for repairs were transferred. Further postings depend on whether the department has a current account.

No invoice (services ordered and paid for by central accounting):

- D 23 (...) K 76 – 3000, transportation costs.

- D 76 K 51 – 3000, payment to the transport company.

There is no invoice (the order for services is made by the OP, and payment is made by the parent organization):

- D 79-2 K 76 - the unit transferred the debt to the TC to the “head”. In accounting for the separation itself, the postings will be as follows: D 23 (...) K 76 - 3000, transportation costs, D 76 K 79-2 - the TC debt was transferred to the head office.

- D 76 K 51 – paid for TC services

No invoice (OP independently ordered and paid for the services):

- For division “B-2”: D 23 (...) K 76 - 3000, transportation costs are reflected, D 76 K 51 - payment to TC is transferred.

- The OP can first receive funds for expenses, then in postings “B-2” there will be posting D 51 K 79-2 - funds have been received from the central accounting department for settlements. In this case, wiring D 79-2 K 51 will be reflected in the “head” control unit.

In most cases, the wiring looks like a mirror image, as you've probably noticed. Costs incurred are transferred to the central office by posting D 79-2 K 20, 25, 23, 44. Reverse posting, respectively, is from the head accounting department.

You can read more about taxation in a separate division here.

Solutions

Three options were proposed as solutions to the problem of choosing an accounting system:

a) organize the maintenance of records of a separate unit in the same information base in which NAZ records are kept with the development of additions to implement the accounting features in the sanatorium;

b) organize the accounting of a separate division using the previous link “1C: Enterprise Accounting”, “1C: Public catering”, “1C: Salary and Personnel Management” with modifications to the configurations to implement the requirements of the accounting policy of PJSC “;

c) organize the maintenance of records of a separate division in a separate information base, but based on a configuration similar to the configuration of the NAZ accounting system.

The NAZ accounting department immediately rejected the first option, since the already complex structure of regulatory and reference information of an aircraft production enterprise would be replenished with food products, dishes, medical equipment, and the production of aircraft would coexist with the production of borscht.

For the remaining options, an assessment of labor costs for improvements and further support was carried out. Due to the desire of PJSC “to improve its accounting system, constant updating and addition of accounting and tax accounting registers, as well as due to increased activity in the field of regulated reporting on the part of legislators, it was decided to implement the third option as it is less expensive to develop and further accompanied.

How do separate divisions affect the taxation system?

One of the most unpleasant restrictions for companies using a simplified taxation system is the inability to open branches (subparagraph 1, paragraph 3, Article 346.12 of the Tax Code does not talk about other types of divisions, including representative offices).

If you create such an OP in the middle of the year, then the simplifier is obliged to start using the general system. However, some organizations, on the contrary, turn this point to their advantage. For example, a company is offered a lucrative contract using the simplified tax system, but the client is ready to work with it only if VAT is available. Then a branch is opened, the company loses the right to use the simplified tax system and switches to OSNO.

Important! The creation of a separate division must be realistic. It must not only exist on paper, but also have a staff, a current manager, an actual address and conduct activities.

It should be noted that if the Federal Tax Service finds signs of formality of the action, then there is a high chance of recognizing the maneuver as deception. For the purpose of obtaining tax benefits, including. You will have to recalculate taxes, pay penalties, resubmit reports, and the client will not be happy.

As for UTII, some questions arise here too. An organization has opened a new store, is it necessary to register if it is located in the same city as other existing retail outlets? The answer is in paragraph 2 of Art. 346.28 of the Tax Code of the Russian Federation: if the activity is carried out in different city districts, municipal areas, in intra-city territories and at the same time they are served by different branches of the Federal Tax Service, then you need to register with one of the inspectorates (the one that has jurisdiction over the first place of activity in the application).

If we are talking about different municipalities, then you need to submit an application in each (only once, and then proceed as described above). You will also have to submit a UTII-2 application if the organization starts a new type of activity on the imputation.

Income tax, property, transport

Separate divisions, the accounting and reporting of which are stipulated by the accounting policy, do not submit income tax returns. But the parent organization is obliged to pay part of the tax to the regional budget at the location of its separate entity and report on the breakdown of its remote structures.

Balance sheet divisions may own objects on which property tax is charged. Tax amounts should be paid and reported to the tax office of the OP. The transport tax declaration is submitted at the place of registration of the unit if the vehicles are located on its territory.

A new organization was opened instead of the OP

Some entrepreneurs resort to a way to organize a business in a new location without opening separate divisions. They simply register a new legal entity. The option is not creative and has a number of serious disadvantages:

- To transfer property or funds, you will have to enter into supply, purchase and sale, loan, etc. agreements. Unlike the option with the OP, when this happens on the basis of internal provisions.

- Each company will pay tax on transactions carried out (after all, most likely, the return transfer of money or goods and materials will be required). Moving between OPs does not affect taxation.

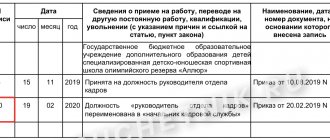

- If it is necessary to transfer some employees to a new company, this will have to be done through dismissal, with the payment of compensation in the old organization, and not all employees may agree to such manipulations. Transfer of personnel within the company occurs according to simpler rules.

- If the Federal Tax Service decides that a business has split up for the sole purpose of optimizing taxation (paying a single tax under the simplified tax system, instead of income tax and VAT, for example), then the organization will face significant fines. Tax Code in paragraph 3 of Art. 122 provides for a penalty of 40% of unpaid taxes. This is not to mention penalties and other costs. When we are talking about multi-million dollar amounts, the organization may face bankruptcy.

- Fragmentation of a business may also be associated with receiving any benefits and support. For example, a separately created company can take part in tenders as a small business entity, while the “old” company could not take part in them, because did not have this status.

- If a dependency is established between the existing and the created organization, then transactions carried out between them will become the object of close attention and assessment by the tax authorities.

The opening of a separate division is a sign of effectiveness and positive dynamics of business development. At the same time, you should not report opening an OP “just in case” if you are not sure of the need for this action. A whole month is given to submit documents. Sufficient time to study the legislation or contact a lawyer and make a final objective decision.

Cost details by manager

As an example, I will demonstrate the separation of cost by manager. First, you need to make adjustments to the department settings - enable separate accounting of goods.

Select the By division managers option.

Now let's process the purchase of goods. For clarity, we will create two documents from different suppliers with different purchase prices. Let's imagine that two managers purchase goods from different suppliers. In the documents, a division with separate accounting of goods must be selected!

Having generated a report on the movements of the receipt document, we can see the analytics of separate cost accounting - in the Financial Accounting Analytics dimension of the Cost of Goods register.

If we want to see the remaining goods by supplier, unfortunately, we will not be able to use regular warehouse reports. This information simply isn't there. The report Statement of batches of goods of the enterprise (in the section Financial results and controlling) will help us. But in the standard form, it displays details by batch (receipt documents).

We need to adjust its structure - in the list of grouped fields, change the receipt document to the supplier.

Now we can get the data in the required form.

Unfortunately, we will not be able to see in this report (and in others too) warehouse balances by manager, because this analytics relates only to cost and is not visible in warehouse reports. There is a way out - use an external report (I recently made such a report).

The next step is to prepare implementation documents separately for each manager. We will generate a report on the gross profit of the enterprise (of course, after completing the closing of the month).

Despite the same revenue value for the two managers, their gross profit and profitability are different. The reason is the difference in procurement costs.

This is how cost segregation by manager works.

Now let’s imagine a situation in which one of the managers tries to sell not only his own, but also “someone else’s” goods. In this case, the program will not issue any warning (although in earlier releases it did not allow this) and as a result, the total cost will be equal to the total cost of both purchases.

Here there may be a need to monitor situations when managers are selling “not their” products. My report on warehouse balances with additional analytics is suitable for this.