Payment

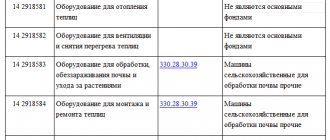

After almost two years of adjustments, the draft FSBU 6/2020 “Fixed Assets” was released. Project

Do you want to renovate your office space? Have moved or decided to update employees' workplaces,

UTII is used by many small enterprises whose activities comply with this taxation regime. This tax combines

Are you planning to open a catering establishment? Form of ownership (IP or LLC) and taxation system for

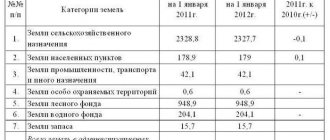

The institution was given a land plot with the right of permanent (indefinite) use. How to take this area into account: for

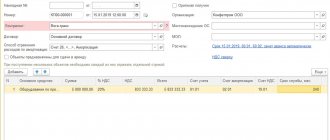

The modernization of fixed assets in 1C 8.3 means a change in their original properties. Usually,

At the end of the tax period, individual entrepreneurs, as a rule, submit declarations to the tax office. IN

How to work as a tutor? Do I need to open an individual entrepreneur and pay taxes? What documents should I fill out? How to use

Many large companies have separate divisions. In the process of activity, various situations arise when branches,

Payers of income tax are required to periodically report by submitting a corresponding tax return to the Federal Tax Service, in